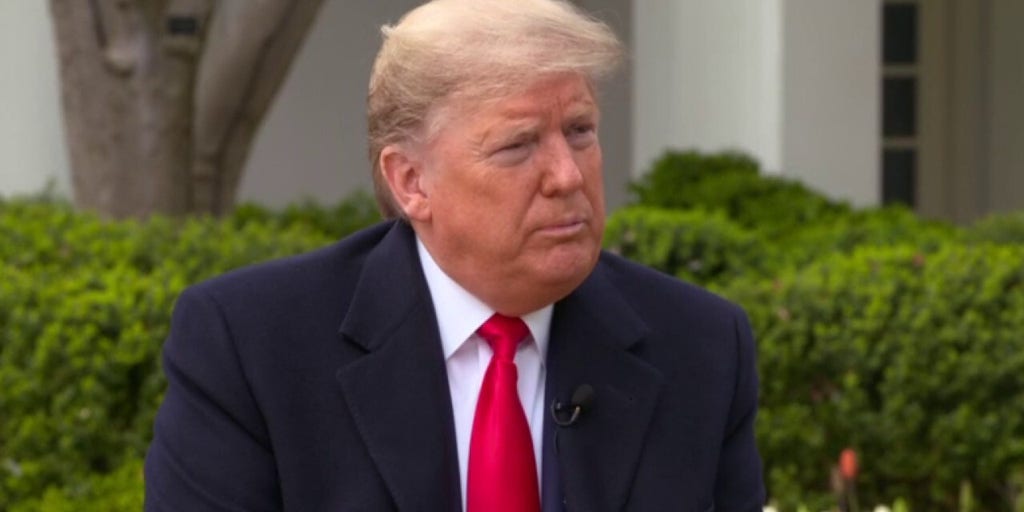

The Economic Fallout Of Trump's Trade Offensive: A Challenge To American Financial Primacy

Table of Contents

Escalation of Trade Wars and Their Global Impact

Trump's trade offensive was characterized by aggressive unilateral actions, primarily the imposition of tariffs on imported goods. This strategy, while aiming to protect American industries, triggered a series of retaliatory measures and significantly impacted both American businesses and consumers.

The Impact of Tariffs on American Businesses and Consumers

The increased prices for imported goods directly affected American consumers. Tariffs raised the cost of everyday items, reducing purchasing power and contributing to inflation. Specific industries felt the brunt of this impact:

-

Agriculture: Chinese retaliatory tariffs on soybeans devastated American farmers, leading to significant losses and farm closures.

-

Manufacturing: Increased costs of steel and aluminum, due to tariffs imposed by the Trump administration, impacted the auto manufacturing sector and other industries reliant on these materials.

-

Retail: Higher prices on imported goods forced retailers to raise prices or absorb losses, impacting profit margins and potentially leading to job losses.

-

Example: The increased cost of steel directly impacted US auto manufacturers, leading to higher production costs and reduced competitiveness in the global market.

-

Example: Tariffs on Chinese goods resulted in increased prices for consumers across various product categories, impacting household budgets.

Retaliatory Tariffs and Their Ripple Effects

Trump's trade offensive provoked retaliatory tariffs from key trading partners like China, the European Union, and Canada. These measures targeted American exports, disrupting global supply chains and further harming American businesses.

- Example: China imposed tariffs on American soybeans, impacting American farmers significantly.

- Example: The EU retaliated with tariffs on American products like motorcycles and bourbon.

The resulting disruption to established global supply chains led to increased uncertainty and added costs for businesses worldwide, further hindering economic growth. This unpredictability made international trade more complex and expensive, negatively affecting American competitiveness.

Damage to International Relations and Economic Alliances

Trump's protectionist trade policies significantly damaged America's relationships with its key trading partners and undermined established international economic institutions.

Strained Relationships with Key Trading Partners

The aggressive imposition of tariffs strained relationships with Canada, Mexico, China, and the European Union. These actions damaged trust and undermined the foundations of long-standing trade agreements:

-

NAFTA: The renegotiation of NAFTA into the USMCA, while ultimately avoiding a complete collapse of the agreement, created considerable uncertainty and tension between the US, Canada, and Mexico.

-

WTO: The Trump administration's frequent challenges to the World Trade Organization's authority weakened the institution's effectiveness in resolving trade disputes.

-

Example: The withdrawal from the Trans-Pacific Partnership (TPP) signaled a retreat from multilateral trade agreements and damaged America's standing in the Asia-Pacific region.

-

Example: Trade disputes with China escalated significantly, leading to a trade war that negatively impacted both economies.

Uncertainty and Investor Confidence

The unpredictable nature of Trump's trade policies fostered uncertainty in the global markets, impacting investor confidence.

- Example: The constant threat of new tariffs led businesses to delay investment decisions, hindering economic growth.

- Example: The uncertainty contributed to a decline in foreign direct investment in the US.

This uncertainty led to a flight of capital from the US in some sectors and reduced foreign investment, further impacting economic growth and potentially weakening the dollar's dominance. Stock markets also reacted negatively to periods of heightened trade tension.

Long-Term Implications for American Financial Primacy

Trump's trade offensive has raised serious questions about the long-term implications for American financial primacy.

Shifting Global Economic Power Dynamics

The trade disputes, coupled with the rise of China and other economic powers, have accelerated shifts in global economic power dynamics.

- Example: China's growing economic influence and its expanding trade relationships with other countries challenge America's traditional position as the global economic leader.

- Example: The increasing importance of regional trade blocs, such as the EU and the CPTPP, could potentially diminish the influence of the US in shaping global trade rules.

The potential decline in the US dollar's global dominance is a significant long-term implication of these shifts, impacting American economic influence worldwide.

Repairing Damage and Rebuilding Trust

Repairing the damage caused by Trump's trade offensive requires a significant effort to rebuild trust and foster greater predictability in American trade policy.

- Example: Re-engaging with international institutions like the WTO and negotiating new trade agreements based on mutual benefit are crucial steps in restoring America's economic leadership.

- Example: Adopting a more stable and transparent trade policy would help to restore investor confidence.

Conclusion

Trump's trade offensive has had significant and far-reaching economic consequences. The escalation of trade wars, the damage to international relations, and the uncertainty created have all contributed to challenges for American financial primacy. The resulting economic fallout necessitates a reassessment of US trade policy and a renewed commitment to fostering international cooperation. Understanding the lasting impact of Trump's trade offensive is crucial for navigating the future of American financial primacy. Further research into the long-term economic effects of protectionist trade policies is vital for informed policymaking.

Featured Posts

-

Bof A On Stock Market Valuations Why Investors Shouldnt Panic

Apr 22, 2025

Bof A On Stock Market Valuations Why Investors Shouldnt Panic

Apr 22, 2025 -

The Human Cost Of Trumps Economic Goals

Apr 22, 2025

The Human Cost Of Trumps Economic Goals

Apr 22, 2025 -

Fox News Faces Defamation Lawsuit From Ray Epps Regarding January 6th Reporting

Apr 22, 2025

Fox News Faces Defamation Lawsuit From Ray Epps Regarding January 6th Reporting

Apr 22, 2025 -

How Is A New Pope Chosen A Comprehensive Guide To Papal Conclaves

Apr 22, 2025

How Is A New Pope Chosen A Comprehensive Guide To Papal Conclaves

Apr 22, 2025 -

Access To Birth Control The Over The Counter Revolution After Roe

Apr 22, 2025

Access To Birth Control The Over The Counter Revolution After Roe

Apr 22, 2025