The Economic Impact Of Unrealistic Election Promises

Table of Contents

Inflated Spending Plans and Budget Deficits

Overly ambitious spending plans, often lacking concrete funding mechanisms, are a hallmark of unrealistic election promises. These promises, while potentially popular, can severely destabilize a nation's economy. The allure of immediate gratification often overshadows the long-term consequences of increased national debt and ballooning budget deficits.

For example, consider a government promising massive increases in social welfare programs without outlining how these increases will be financed. This can lead to:

- Increased borrowing costs for the government: To cover the shortfall, the government must borrow heavily, driving up interest rates and making it more expensive to fund other essential services. This increased debt burden also reduces a nation's credit rating, making future borrowing even more difficult and costly.

- Reduced government spending on essential services due to budgetary constraints: The need to service the increased debt can force cuts in crucial areas like education, healthcare, and infrastructure, hindering long-term economic growth. This creates a vicious cycle of debt and underinvestment.

- Potential for inflation as increased money supply chases limited goods and services: Government borrowing can lead to an expansion of the money supply, potentially causing inflation if the economy cannot produce enough goods and services to meet the increased demand. This erodes purchasing power and hurts citizens, especially those on fixed incomes.

- Negative impact on investor confidence: Uncontrolled government spending and growing debt can trigger a loss of confidence among both domestic and foreign investors, leading to capital flight and economic stagnation. This can also impact the exchange rate, making imports more expensive.

Unrealistic Tax Policies and Their Repercussions

Unrealistic tax policies, whether overly ambitious tax cuts or unrealistic tax increases, can significantly impact a nation's economic health. The consequences ripple through various sectors, affecting different income groups and exacerbating economic inequality.

For instance, promising drastic tax cuts without considering the revenue shortfall can lead to:

- Potential for revenue shortfalls if tax cuts are not offset by economic growth: The promised economic growth stimulated by tax cuts might not materialize, resulting in a significant reduction in government revenue. This can necessitate further cuts to public services or increases in other taxes.

- Negative effects on investment and economic activity due to increased tax burdens: Conversely, unrealistic tax increases can stifle investment and economic activity, hindering job creation and slowing economic growth. High taxes can make a country less competitive internationally.

- Impact on government revenue collection and social welfare programs: Significant tax cuts or increases can significantly impact government revenue, threatening the sustainability of crucial social welfare programs. This can lead to social unrest and political instability.

- Distortion of market mechanisms due to artificial tax incentives: Unrealistic tax policies can distort market mechanisms, leading to inefficient resource allocation and hindering the optimal functioning of the economy. This can favor specific sectors or industries, creating market imbalances.

The Impact of Unrealistic Infrastructure Promises

Grandiose infrastructure projects promised without feasible funding or comprehensive planning represent another form of unrealistic election promises. These often lead to significant economic problems. The initial excitement often gives way to cost overruns, delays, and ultimately, wasted resources.

For example, promising to build a nationwide high-speed rail system without a clear funding source can result in:

- Wasted resources due to poorly planned projects: Lack of proper planning and feasibility studies can lead to significant cost overruns and delays, wasting taxpayer money and hindering the project's completion. This can also lead to abandoned projects, creating "white elephants."

- Increased risk of corruption and mismanagement of funds: Large-scale infrastructure projects are susceptible to corruption and mismanagement, especially when adequate oversight and transparency are lacking. This further exacerbates the economic waste.

- Opportunity cost of diverting resources from other essential sectors: Committing significant resources to unrealistic infrastructure projects diverts funds from other crucial sectors like education, healthcare, or research and development, hindering overall economic development.

- Potential for environmental damage without proper environmental impact assessment: Insufficient environmental impact assessments can lead to significant environmental damage, resulting in long-term economic and social costs. This can also attract international condemnation.

Impact on Foreign Investment and International Relations

Unrealistic election promises can significantly damage a nation's reputation and deter foreign investment. The uncertainty created by broken promises or policies that are difficult to implement can scare away potential investors.

Specifically, this can lead to:

- Reduced foreign investment due to uncertainty and instability: Foreign investors are risk-averse. Unrealistic promises create uncertainty, making them hesitant to invest in a country perceived as unstable or unreliable.

- Damage to a country’s credibility and international standing: Breaking promises or implementing economically unsound policies can damage a country's international reputation and credibility, impacting its ability to engage in international trade and cooperation.

- Potential for trade wars or sanctions due to broken promises: If a country's actions contradict its international commitments, it may face trade wars or sanctions from other nations, negatively impacting its economy.

- Increased risk premium on sovereign debt: Uncertainty and instability increase the risk premium on a country's sovereign debt, making it more expensive to borrow money on international markets.

Conclusion: Understanding the Economic Impact of Unrealistic Election Promises

The economic impact of unrealistic election promises is multifaceted and far-reaching. From inflated spending plans leading to unsustainable debt levels and unrealistic tax policies distorting market mechanisms, to poorly planned infrastructure projects wasting resources and damaging international relations, the consequences are severe. Voters must critically evaluate campaign promises, understanding the potential economic ramifications before casting their ballot. Be informed about the economic realities, and vote for candidates with realistic and sustainable plans. Avoid the pitfalls of the economic impact of unrealistic election promises by choosing responsible leadership. Your vote directly impacts the economic future of your nation.

Featured Posts

-

Sherwood Ridge Primary Schools Policy On Anzac Day Participation For Religious Reasons

Apr 25, 2025

Sherwood Ridge Primary Schools Policy On Anzac Day Participation For Religious Reasons

Apr 25, 2025 -

Chinas Endurance Preparing For A Protracted Battle With The United States

Apr 25, 2025

Chinas Endurance Preparing For A Protracted Battle With The United States

Apr 25, 2025 -

Is This The Ultimate Jean Grey Casting For The Mcu

Apr 25, 2025

Is This The Ultimate Jean Grey Casting For The Mcu

Apr 25, 2025 -

Bob Fickel To Tackle His 40th Canberra Marathon

Apr 25, 2025

Bob Fickel To Tackle His 40th Canberra Marathon

Apr 25, 2025 -

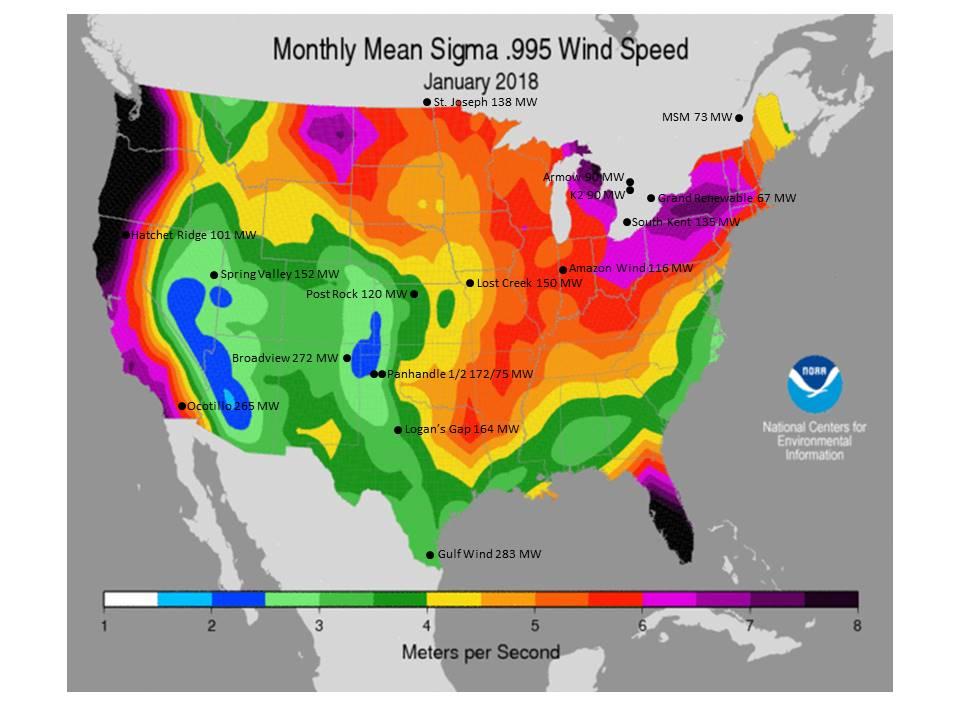

Wind In Oklahoma City Where Does It Fall On The Us Wind Speed Chart

Apr 25, 2025

Wind In Oklahoma City Where Does It Fall On The Us Wind Speed Chart

Apr 25, 2025