The Impact Of Reduced Chinese Steel Production On Iron Ore Prices

Table of Contents

China's Steel Production Slowdown: Causes and Consequences

The slowdown in China's steel production is a multifaceted issue with far-reaching consequences. Several key factors are at play:

Environmental Regulations and Carbon Emission Targets

China's commitment to environmental sustainability is driving significant changes in its steel industry. The government's stringent environmental regulations are forcing steel mills to curb production to meet increasingly strict pollution targets.

- Increased Scrutiny on Pollution Levels: Rigorous monitoring and enforcement of emission standards are leading to production cuts and plant closures for non-compliant facilities. This translates directly into reduced steel output.

- Implementation of Carbon Emission Trading Schemes: The introduction of carbon emission trading schemes adds significant costs for steel producers, impacting profitability and potentially leading to reduced production to manage costs.

- Government Policies Promoting Green Steel Production and Energy Efficiency: While aimed at long-term sustainability, the shift towards greener steel production methods involves significant upfront investment and can temporarily affect production capacity.

Weakening Domestic Demand

Internal demand for steel within China is also softening, contributing to the production slowdown. This weakening is attributed to several factors:

- Slowdown in the Construction Sector: A cooling real estate market and decreased infrastructure spending have significantly reduced demand for steel in the construction industry, a major consumer.

- Decreased Infrastructure Spending: Government efforts to control debt levels have resulted in reduced investment in large-scale infrastructure projects, impacting steel demand.

- Impact of the Real Estate Market Downturn: The ongoing crisis in China's real estate sector has profoundly impacted steel demand, as construction projects are delayed or canceled.

Global Economic Slowdown and Reduced Export Demand

The global economic slowdown is further exacerbating the situation. Reduced global demand for steel products is impacting Chinese exports.

- Lower Global Demand for Steel Products: A weaker global economy translates into decreased demand for various steel products, impacting Chinese exports and, consequently, domestic production.

- Increased Competition from Other Steel-Producing Nations: China faces increased competition from other steel-producing countries, further impacting its export market share.

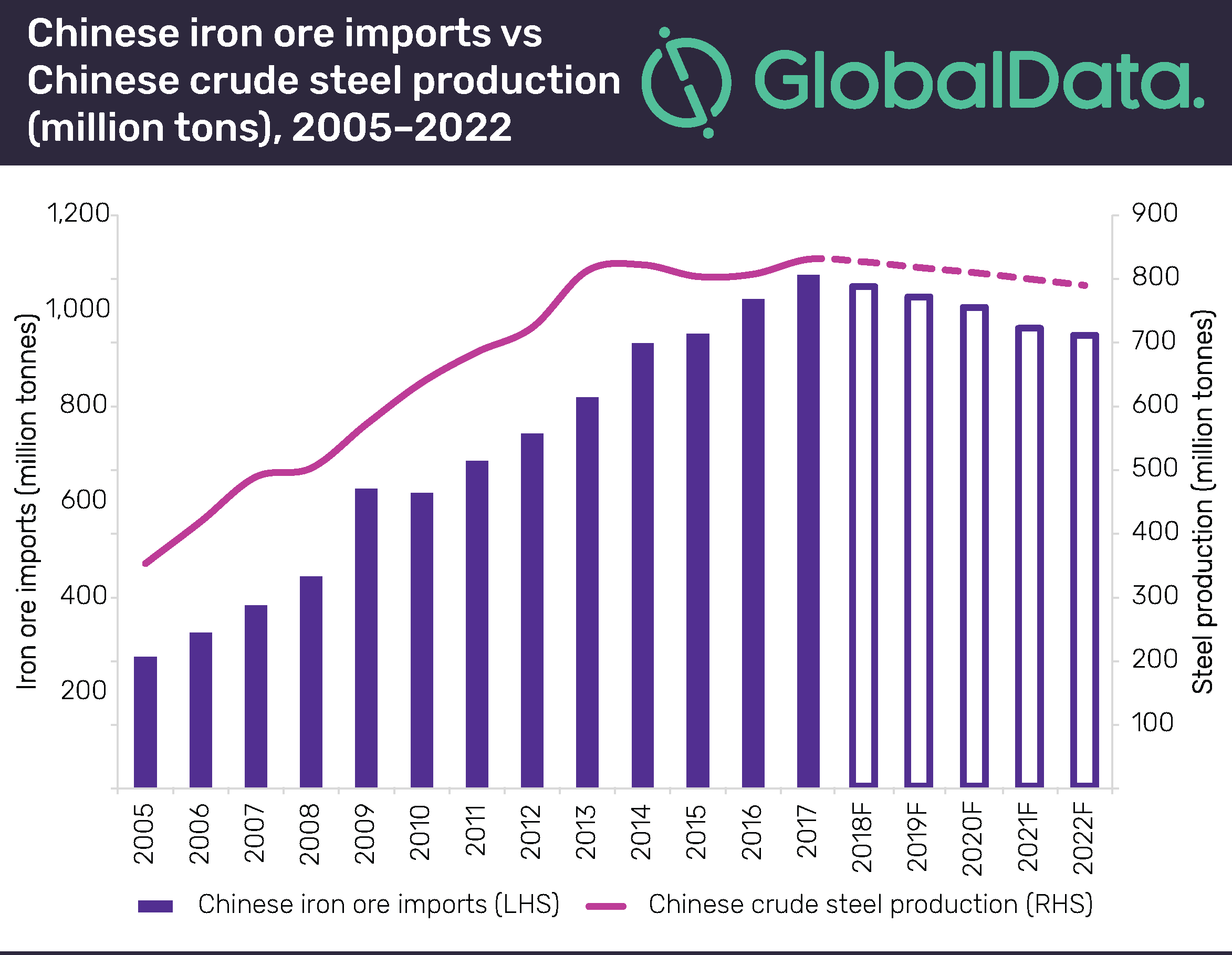

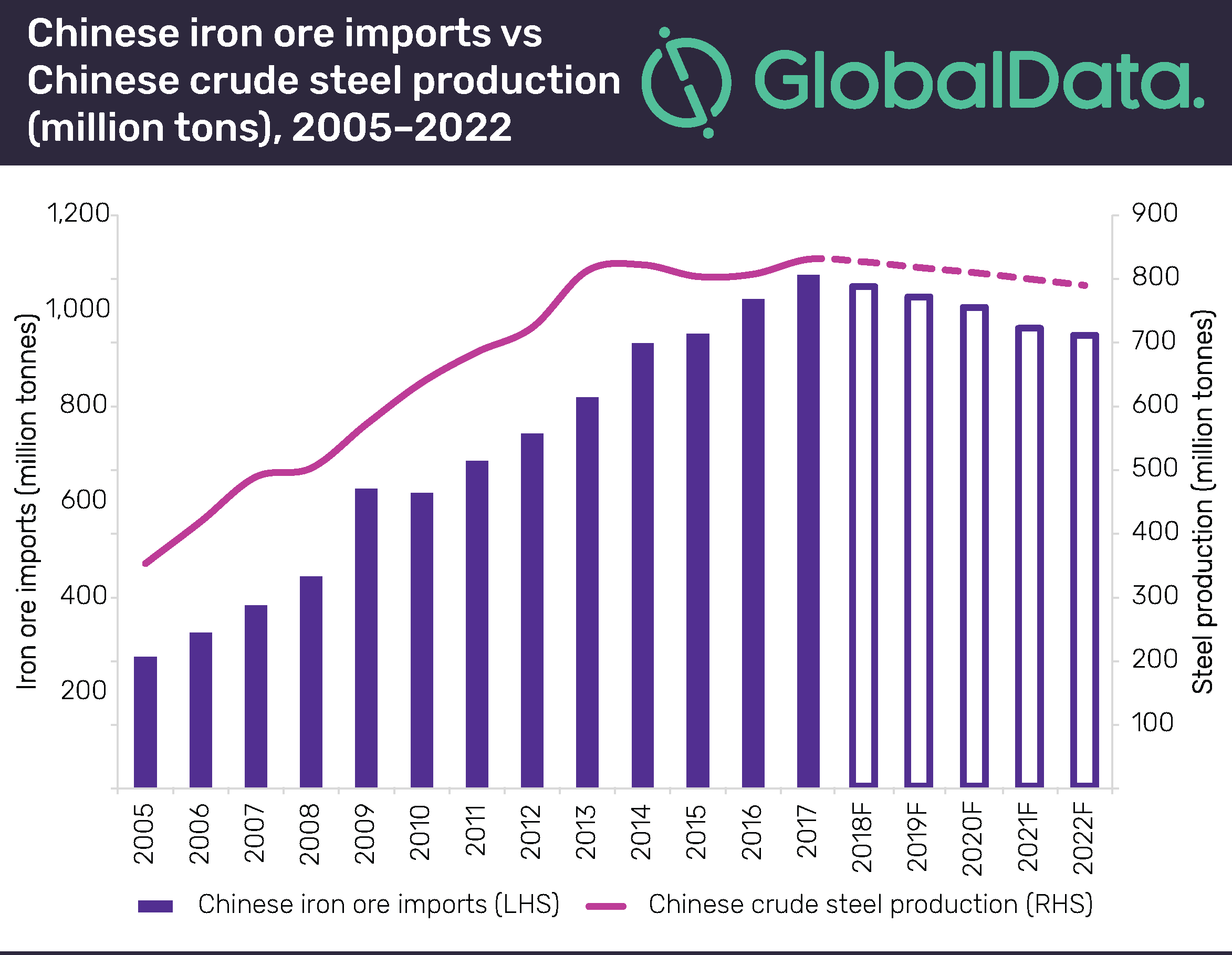

The Ripple Effect on Iron Ore Prices: Supply and Demand Dynamics

The reduced Chinese steel production has a direct and significant impact on iron ore prices, primarily through supply and demand dynamics.

Reduced Iron Ore Demand

Lower steel production inevitably leads to reduced demand for iron ore, the key raw material in steelmaking.

- Steel Mills Reducing Their Iron Ore Purchases: As steel mills produce less steel, their need for iron ore decreases proportionally, leading to lower purchase volumes.

- Inventory Levels Impacting Future Purchases: Existing iron ore inventories at steel mills also influence future purchase decisions, potentially delaying or reducing future orders.

- Impact on Iron Ore Spot and Futures Prices: The reduced demand directly translates into lower prices in both the spot and futures markets for iron ore.

Global Iron Ore Supply and its Influence

The global supply of iron ore also plays a role in determining prices.

- Major Iron Ore Producing Countries and Their Output: The production levels of major iron ore producers like Australia and Brazil significantly influence the overall supply and consequently, prices.

- Transportation Costs and Logistical Challenges: Transportation costs and potential disruptions to shipping routes can also impact the supply and availability of iron ore, affecting prices.

- Impact of Potential Disruptions to Supply Chains: Geopolitical events, natural disasters, or other unforeseen circumstances can disrupt supply chains, creating price volatility.

Speculation and Market Sentiment

Market sentiment and speculation significantly influence iron ore prices.

- Impact of Investor Sentiment and Market Forecasts: Investor confidence and market forecasts regarding future demand and supply play a crucial role in price fluctuations.

- Influence of Financial Instruments and Trading Activity: Trading activity in iron ore futures contracts and other financial instruments contributes to price volatility.

Predicting Future Trends: Forecasting Iron Ore Prices

Forecasting iron ore prices requires careful analysis of various market indicators.

Analyzing Current Market Indicators

Several key indicators are crucial for accurate price forecasting:

- Steel Production Data from China: Monitoring real-time steel production data from China provides insights into current and future iron ore demand.

- Global Steel Demand Forecasts: Global economic forecasts and steel demand projections help predict future iron ore consumption.

- Iron Ore Inventory Levels at Major Ports: Tracking inventory levels at major ports provides valuable information about supply and potential price pressures.

Potential Scenarios and Their Implications

Several scenarios can unfold, each with different implications for iron ore prices:

- Scenario 1: Continued Production Decline in China and its Consequences: A continued decline in Chinese steel production would likely lead to further price reductions for iron ore.

- Scenario 2: A Recovery in Chinese Steel Production and its Effects: A rebound in Chinese steel production would likely increase iron ore demand and prices.

- Scenario 3: Global Economic Recovery and its Impact on Demand: A global economic recovery could boost steel demand, positively influencing iron ore prices.

Conclusion: The Future of Iron Ore Prices and Chinese Steel Production

The relationship between reduced Chinese steel production and iron ore prices is complex and multifaceted. Environmental regulations, weakening domestic demand, and a global economic slowdown are key factors driving the decline in Chinese steel production, ultimately impacting iron ore prices. Monitoring key market indicators is crucial for predicting future price trends. Understanding the interplay of these factors is essential for navigating the volatile iron ore market. Stay updated on the latest developments influencing the impact of reduced Chinese steel production on iron ore prices by following our blog and subscribing to our newsletter.

Featured Posts

-

Trade Disputes And Their Ripple Effect Examining The Case Of Chinese Bubble Blasters

May 09, 2025

Trade Disputes And Their Ripple Effect Examining The Case Of Chinese Bubble Blasters

May 09, 2025 -

How Luis Enrique Reshaped Paris Saint Germain A Winning Formula

May 09, 2025

How Luis Enrique Reshaped Paris Saint Germain A Winning Formula

May 09, 2025 -

Blue Origins New Shepard Launch Delayed Technical Issue

May 09, 2025

Blue Origins New Shepard Launch Delayed Technical Issue

May 09, 2025 -

Jayson Tatums Ankle Examining The Injury And Its Implications For The Celtics

May 09, 2025

Jayson Tatums Ankle Examining The Injury And Its Implications For The Celtics

May 09, 2025 -

Nyt Strands Hints And Answers Wednesday March 12 Game 374

May 09, 2025

Nyt Strands Hints And Answers Wednesday March 12 Game 374

May 09, 2025