The Impact Of Reduced Consumer Spending On The Credit Card Industry

Table of Contents

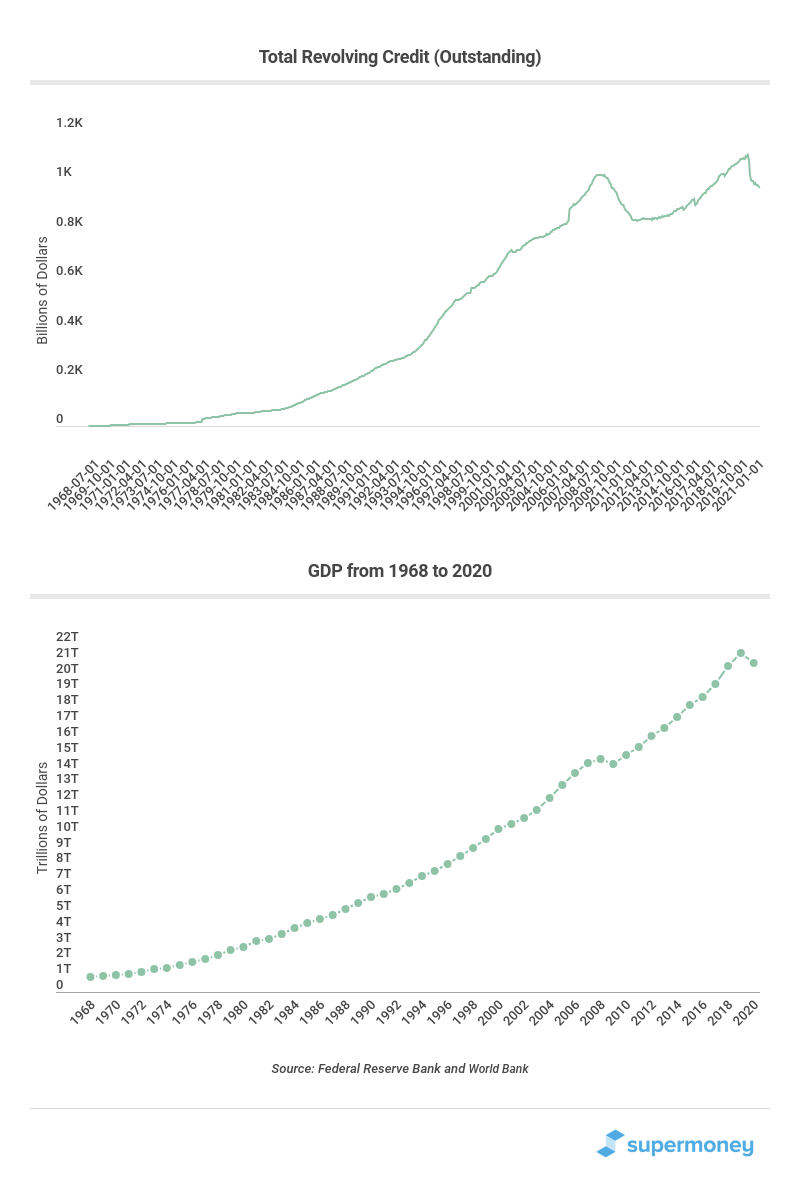

Decreased Transaction Volumes and Revenue for Credit Card Companies

Reduced consumer spending translates directly into lower transaction volumes for credit card companies. This has significant repercussions for their revenue streams. Keywords like transaction volume, credit card revenue, merchant fees, and interchange fees are central to understanding this impact.

- Lower Transaction Volumes: Fewer purchases mean fewer credit card transactions processed. This directly impacts the revenue generated through merchant fees (charged to businesses for processing credit card payments) and interchange fees (fees paid by merchants to card networks like Visa and Mastercard).

- Impact on Profitability: Credit card companies heavily rely on transaction volume for their profitability. A decline necessitates a re-evaluation of business models, potentially leading to cost-cutting measures, including reduced marketing budgets, staff layoffs, and a reevaluation of rewards programs.

- Ripple Effect on Businesses: Smaller businesses, often heavily reliant on credit card payments for their revenue, are disproportionately affected by reduced consumer spending. Their reduced income further contributes to the overall economic slowdown.

- Job Losses: Reduced profitability within the credit card industry may lead to job losses, affecting various roles from customer service representatives to data analysts and senior management.

Rising Credit Card Delinquency and Default Rates

As consumers face financial pressures due to reduced income or job losses, many struggle to meet their minimum credit card payments. This leads to a critical issue: rising credit card delinquency and default rates.

- Increased Delinquency: When consumers fall behind on their payments, even by a single missed payment, it negatively impacts their credit score and increases the delinquency rate for the credit card company.

- Defaults and Losses: Default occurs when a consumer is unable or unwilling to repay their credit card debt. This results in significant financial losses for credit card companies, impacting their bottom line and their ability to provide credit to other customers.

- Impact on Credit Scores: Increased defaults negatively affect consumers’ credit scores, making it harder to secure loans, mortgages, or even rent an apartment in the future. This creates a vicious cycle perpetuating financial hardship.

- Tighter Lending Standards: To mitigate the risks associated with rising default rates, credit card companies may implement tighter lending standards, potentially making it more difficult for consumers to obtain credit.

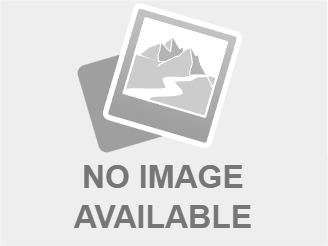

Shift in Consumer Spending Habits and Credit Card Usage

Reduced consumer spending isn’t just about less spending; it’s a shift in consumer behavior and spending habits. This shift has a direct impact on credit card usage.

- Budgeting and Prioritization: Consumers are increasingly adopting stricter budgeting strategies and prioritizing essential spending over non-essential purchases, reducing their reliance on credit cards.

- Rise of Debit Cards and Digital Payments: There's a noticeable shift towards debit card usage and alternative payment methods such as digital wallets (Apple Pay, Google Pay), mobile payment apps, and Buy Now Pay Later (BNPL) services.

- Adapting to Change: Credit card companies need to adapt to these changing preferences by offering more attractive rewards programs, competitive interest rates, and flexible payment options to retain customers and attract new ones.

- Financial Literacy: Increased focus on financial literacy and responsible credit card usage would be beneficial for both consumers and the credit card industry, promoting responsible borrowing and reducing the likelihood of defaults.

The Role of Interest Rates and Economic Policies

Interest rates and economic policies play a critical role in influencing consumer spending and the subsequent impact on the credit card industry.

- Rising Interest Rates: Higher interest rates make it more expensive for consumers to carry credit card debt, increasing the likelihood of delinquency and default. This further impacts the profitability of credit card companies.

- Economic Recession: During an economic recession, job losses and reduced income amplify the challenges faced by consumers, leading to a prolonged period of reduced consumer spending and increased strain on the credit card industry.

- Government Intervention: Government policies aimed at stimulating the economy, such as tax cuts or stimulus packages, can potentially offset the negative impacts of reduced consumer spending, supporting both consumers and the credit card industry.

- Inflationary Pressures: High inflation erodes purchasing power, leading to decreased consumer spending and heightened financial insecurity, potentially pushing more people towards relying on credit even as the cost of borrowing increases.

Conclusion

Reduced consumer spending poses a considerable challenge to the credit card industry, impacting revenue, escalating delinquency rates, and demanding a reassessment of business strategies. Credit card companies must adapt to evolving consumer behavior, potential economic downturns, and stricter regulatory environments. Understanding the complex implications of reduced consumer spending is vital for navigating these challenging times. Staying informed about consumer spending trends and credit card industry developments is key to mitigating risk and ensuring long-term sustainability. Don't underestimate the pervasive effects of reduced consumer spending on the credit card industry – proactive adaptation is crucial for survival and success.

Featured Posts

-

Chainalysis Acquisition Of Alterya A Strategic Move In Ai Powered Blockchain Security

Apr 24, 2025

Chainalysis Acquisition Of Alterya A Strategic Move In Ai Powered Blockchain Security

Apr 24, 2025 -

Ohio Derailments Aftermath Persistent Toxic Chemicals In Buildings

Apr 24, 2025

Ohio Derailments Aftermath Persistent Toxic Chemicals In Buildings

Apr 24, 2025 -

Wildfire Betting A Reflection Of Our Times The Los Angeles Case

Apr 24, 2025

Wildfire Betting A Reflection Of Our Times The Los Angeles Case

Apr 24, 2025 -

Liams Strange Behavior And Bridgets Stunning Discovery The Bold And The Beautiful April 16 Recap

Apr 24, 2025

Liams Strange Behavior And Bridgets Stunning Discovery The Bold And The Beautiful April 16 Recap

Apr 24, 2025 -

Tajni Film S Johnom Travoltom Reakcija Quentina Tarantina

Apr 24, 2025

Tajni Film S Johnom Travoltom Reakcija Quentina Tarantina

Apr 24, 2025

Latest Posts

-

Deutsche Bank Expands Defense Finance Capabilities A New Team Takes Shape

May 10, 2025

Deutsche Bank Expands Defense Finance Capabilities A New Team Takes Shape

May 10, 2025 -

Bangkok Post The Fight For Transgender Equality Continues

May 10, 2025

Bangkok Post The Fight For Transgender Equality Continues

May 10, 2025 -

Discussions On Transgender Equality Intensify Bangkok Post Reports

May 10, 2025

Discussions On Transgender Equality Intensify Bangkok Post Reports

May 10, 2025 -

Experiences Of Transgender Individuals Under Trumps Executive Orders

May 10, 2025

Experiences Of Transgender Individuals Under Trumps Executive Orders

May 10, 2025 -

Bangkok Post Reports On The Mounting Pressure For Transgender Rights

May 10, 2025

Bangkok Post Reports On The Mounting Pressure For Transgender Rights

May 10, 2025