The Impact Of Rising Inflation And Unemployment On Economic Uncertainty

Table of Contents

The Mechanics of Inflation and Unemployment

Inflation, defined as a sustained increase in the general price level of goods and services in an economy over a period of time, can be caused by various factors. Demand-pull inflation occurs when aggregate demand outpaces aggregate supply, while cost-push inflation results from increases in production costs, such as wages or raw materials. Unemployment, conversely, refers to the state of being without work, but available and actively seeking employment. Types of unemployment include frictional (temporary unemployment between jobs), structural (mismatch between worker skills and available jobs), and cyclical (resulting from economic downturns).

The relationship between inflation and unemployment is complex, often depicted by the Phillips Curve, which suggests an inverse relationship: lower unemployment is associated with higher inflation, and vice versa. However, this relationship isn't always consistent. Stagflation, a period of simultaneous high inflation and high unemployment, demonstrates the limitations of the traditional Phillips Curve.

- Rising inflation erodes purchasing power: Higher prices mean consumers can buy fewer goods and services with the same amount of money, reducing their real income.

- High unemployment reduces consumer spending and overall economic activity: Job losses lead to decreased disposable income, resulting in lower consumer spending, which negatively impacts businesses and overall economic growth, potentially leading to economic instability.

- Impact on income inequality: Inflation and unemployment disproportionately affect lower-income households, exacerbating income inequality and social unrest. Those with less savings are hit hardest by rising prices and are more vulnerable to job losses.

Impact on Consumer Confidence and Spending

Economic uncertainty directly impacts consumer confidence, leading to decreased spending. When people feel insecure about their jobs or the future economy, they tend to postpone major purchases, save more, and reduce overall spending. This reduced consumer spending creates a negative feedback loop, impacting businesses' profitability and potentially leading to further job losses, reinforcing the cycle of economic uncertainty.

- Psychological impact on consumer decisions: Fear and uncertainty can lead to delayed purchases of both essential and non-essential goods.

- Inflation, unemployment, and delayed purchases: High inflation and unemployment create a climate of pessimism, prompting consumers to delay purchases of big-ticket items like cars and houses.

- Decrease in consumer durable goods purchases: Spending on durable goods, such as appliances and electronics, is highly sensitive to changes in consumer confidence, and declines sharply during periods of economic uncertainty.

Effects on Investment and Business Decisions

Economic uncertainty significantly affects investor confidence and investment decisions. Businesses facing rising input costs due to inflation and declining consumer demand due to unemployment are hesitant to invest in expansion, new technologies, or hiring. This hesitation can lead to business closures and further job losses, exacerbating economic instability.

- Challenges in forecasting future demand: Uncertainty makes it difficult for businesses to accurately predict future sales and demand, hindering their ability to make sound investment decisions.

- Impact on capital investment and technological advancements: Reduced investment means less funding for research and development, potentially slowing down technological advancements and long-term economic growth.

- Government intervention in stabilizing the economy: Governments often intervene through fiscal and monetary policies to stimulate economic activity and mitigate the impact of economic uncertainty.

The Role of Government Policies

Governments employ fiscal policies (like tax cuts or increased government spending) and monetary policies (like interest rate adjustments) to manage inflation and unemployment. However, the effectiveness of these policies varies, and unintended consequences are possible. For instance, while fiscal stimulus can boost demand, it can also fuel inflation if not managed carefully. Similarly, raising interest rates to curb inflation can slow economic growth and increase unemployment.

- Limitations of government intervention: Government policies are not always successful in mitigating economic uncertainty and may face delays and unforeseen challenges in implementation.

- Potential policy failures and their consequences: Incorrect policy decisions can worsen economic conditions, leading to deeper recessions or prolonged periods of high unemployment and inflation.

- International cooperation in addressing global economic challenges: Given the interconnectedness of the global economy, international cooperation is crucial in addressing global economic challenges and mitigating the impact of economic uncertainty.

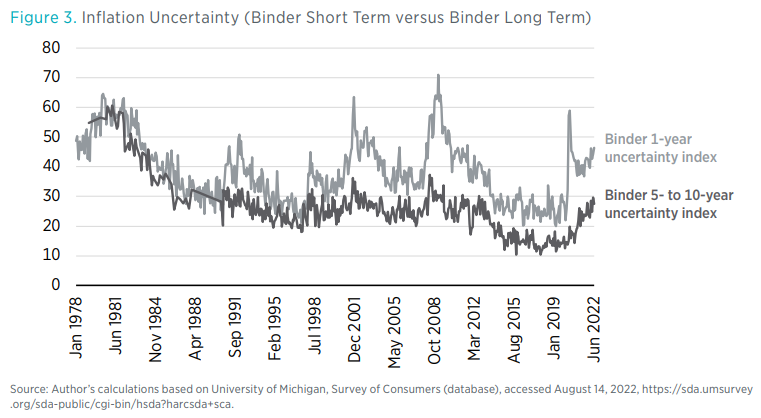

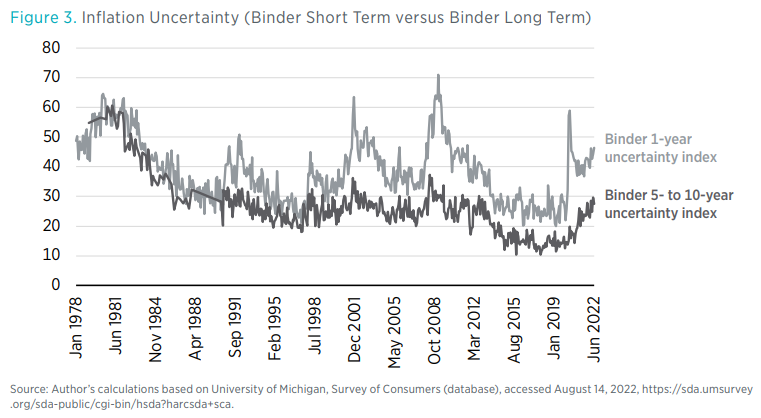

Forecasting Future Economic Trends

Accurately forecasting future economic conditions is extremely challenging, particularly in a climate of high inflation and unemployment. Multiple scenarios are possible, depending on the severity and duration of inflation and unemployment rates. A sustained period of high inflation and unemployment could lead to a recession, while effective policy interventions and a return of consumer confidence could lead to an economic recovery.

- Examples of past economic crises: Studying past economic crises, such as the Great Depression or the 2008 financial crisis, offers valuable insights into potential outcomes.

- Economic models and indicators: Utilizing economic models and key indicators like GDP growth, inflation rates, and unemployment figures helps to assess potential future trends.

- Impact on different sectors of the economy: Different sectors of the economy will be affected differently by rising inflation and unemployment. Some sectors might experience growth, while others might face significant challenges.

Conclusion

Rising inflation and unemployment have a profound and interconnected impact on economic uncertainty. The cascading effects on consumer confidence, investment decisions, and overall economic growth are significant. Understanding the mechanics of inflation and unemployment, their impact on various aspects of the economy, and the role of government policies is crucial for navigating this complex economic environment.

To mitigate the negative impacts of economic uncertainty, stay informed about current economic trends by following reputable economic news sources and consulting with financial advisors. Proactive personal financial planning, including diversification of investments and emergency fund preparation, is crucial for individuals. Businesses need to develop robust contingency plans and adapt their strategies to navigate the changing economic landscape. Continuously monitoring the interplay between rising inflation and unemployment is key to successfully managing the related economic uncertainty.

Featured Posts

-

Gisele Pelicots Memoir An Hbo Adaptation

May 30, 2025

Gisele Pelicots Memoir An Hbo Adaptation

May 30, 2025 -

Gaya Vs Performa Kawasaki W175 Dan Honda St 125 Dax Dibandingkan

May 30, 2025

Gaya Vs Performa Kawasaki W175 Dan Honda St 125 Dax Dibandingkan

May 30, 2025 -

Factors Driving The Rapid Expansion Of The Vaccine Packaging Market

May 30, 2025

Factors Driving The Rapid Expansion Of The Vaccine Packaging Market

May 30, 2025 -

Amman 24th Chinese Bridge Competition Concludes In Jordan

May 30, 2025

Amman 24th Chinese Bridge Competition Concludes In Jordan

May 30, 2025 -

Plires Programma Tileoptikon Metadoseon Gia To M Savvato 19 4

May 30, 2025

Plires Programma Tileoptikon Metadoseon Gia To M Savvato 19 4

May 30, 2025