The Impact Of The Proposed Mississippi Income Tax Elimination On Hernando

Table of Contents

Economic Growth and Job Creation in Hernando

The proposed Mississippi income tax elimination could inject a powerful stimulus into the Hernando economy. Higher disposable income for residents translates to increased consumer spending, boosting local businesses and potentially attracting new investment.

Attracting New Businesses

The elimination of state income tax could act as a powerful magnet, attracting businesses seeking a more favorable tax environment. This could lead to a ripple effect of positive economic consequences:

- Lower operating costs for businesses: Businesses would see significant savings on payroll taxes, making Hernando a more competitive location.

- Increased investment in Hernando: With reduced tax burdens, businesses may be more inclined to invest in expansion projects and create new facilities within the city.

- Potential for new job creation and higher-paying positions: New businesses and expansions often bring higher-paying jobs, improving the overall economic well-being of Hernando residents.

Boosting Existing Businesses

Existing Hernando businesses stand to benefit significantly from increased consumer spending. The extra disposable income in the hands of residents could translate directly into higher sales and revenue for local businesses:

- Increased sales and revenue for local businesses: More money in residents' pockets means more money spent at local shops, restaurants, and service providers.

- Opportunity for business expansion and hiring: Increased revenue may allow businesses to expand operations, leading to more jobs and economic opportunities within Hernando.

- Enhanced competitiveness compared to areas with higher taxes: The elimination could give Hernando businesses a significant competitive edge over businesses in areas with higher income taxes.

Potential Challenges and Drawbacks

While the potential benefits are substantial, it's crucial to acknowledge the potential drawbacks of eliminating the Mississippi income tax. A thorough analysis requires considering the potential negative consequences.

Impact on Public Services

A significant concern is the impact on public services. The state income tax provides substantial funding for vital services in Hernando, including schools, infrastructure, and public safety. Its elimination could lead to:

- Potential cuts to education funding: Reduced tax revenue might force cuts to school budgets, potentially affecting class sizes, programs, and teacher salaries.

- Reduced resources for infrastructure maintenance and improvements: Funding for road repairs, water and sewer systems, and other infrastructure projects could be significantly reduced.

- Potential strain on public services due to reduced tax revenue: Across the board, essential services might face cuts or reduced quality due to decreased funding.

Shifting Tax Burden

The elimination of income tax might shift the tax burden onto other sources, such as sales tax and property tax. This could disproportionately affect lower-income residents:

- Increased reliance on sales tax revenue: Sales tax is a regressive tax, meaning it affects low-income individuals more heavily than higher-income individuals.

- Potential for higher property taxes: To compensate for lost income tax revenue, local governments might increase property taxes, further burdening homeowners.

- Potential for regressive impact on lower-income households: The shift in tax burden could exacerbate existing income inequalities within the Hernando community.

Comparing Hernando to Other Mississippi Communities

Understanding how Hernando’s situation compares to other Mississippi communities impacted by the proposed tax elimination is essential. This allows for a more comprehensive assessment of its potential consequences.

Regional Economic Competition

The proposed Mississippi tax reform will undoubtedly alter the regional economic landscape. Hernando’s competitive position relative to neighboring towns and cities will be significantly affected:

- How the tax change may alter the economic landscape of the region: Some areas might experience more significant growth than others, shifting regional economic power dynamics.

- Potential for attracting or losing businesses compared to neighboring towns: The tax change could influence business location decisions, potentially causing a shift in businesses from one area to another.

- Impact on population growth and migration: The economic shifts could impact population trends, with people potentially migrating to areas with more economic opportunities.

Long-Term Sustainability and Planning in Hernando

Looking beyond the immediate effects, long-term fiscal sustainability and proactive planning are crucial for Hernando. The elimination of the Mississippi income tax demands careful consideration of the long-term implications.

Fiscal Responsibility and Budgeting

Navigating the financial implications requires careful budgeting and resource allocation:

- Development of sustainable financial strategies: Hernando will need to develop new revenue streams and implement efficient budget management practices.

- Diversification of revenue streams: Relying solely on sales and property taxes could be risky. Exploring other revenue streams is crucial.

- Long-term financial planning to mitigate potential risks: Proactive financial planning is essential to mitigate potential long-term fiscal challenges.

Conclusion: Understanding the Mississippi Income Tax Elimination's Impact on Hernando

The proposed Mississippi income tax elimination presents both significant opportunities and considerable challenges for Hernando. While it holds the potential to stimulate economic growth and attract new businesses, it also carries risks, including potential cuts to public services and a shift in the tax burden. Understanding these potential ramifications is critical for residents, businesses, and local government officials. Careful planning and proactive strategies will be necessary to navigate this significant policy change and ensure a sustainable future for Hernando. Learn more about the proposed Mississippi income tax elimination and how it might affect your future in Hernando by actively participating in local government discussions and planning processes.

Featured Posts

-

Celebrity Tequila A Look At Its Potential Decline

May 19, 2025

Celebrity Tequila A Look At Its Potential Decline

May 19, 2025 -

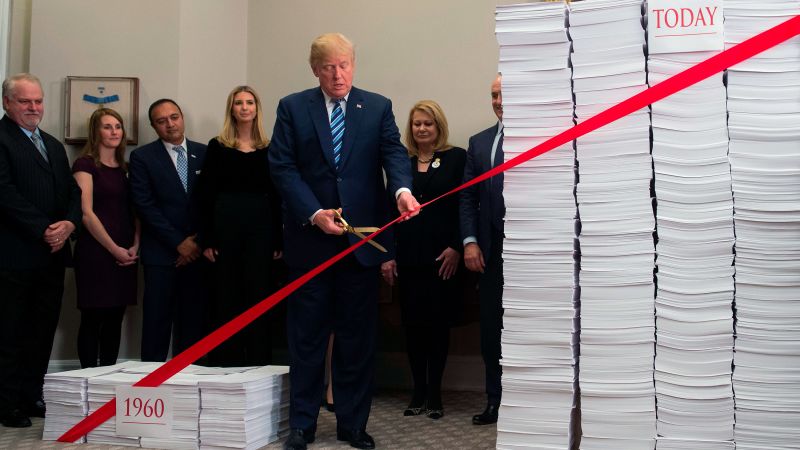

Trump Order Cripples Small Agency Leading To Library Staff And Service Reductions

May 19, 2025

Trump Order Cripples Small Agency Leading To Library Staff And Service Reductions

May 19, 2025 -

Kibris Ta Sehitlerimiz Fatih Erbakandan Oenemli Aciklama

May 19, 2025

Kibris Ta Sehitlerimiz Fatih Erbakandan Oenemli Aciklama

May 19, 2025 -

College Admissions Balancing Standards And Diversity In Higher Education

May 19, 2025

College Admissions Balancing Standards And Diversity In Higher Education

May 19, 2025 -

Rave Events Boosting Local Economies

May 19, 2025

Rave Events Boosting Local Economies

May 19, 2025