The Impact Of Trump Tariffs On Fintech IPOs: A Deep Dive Into Affirm Holdings (AFRM)

Table of Contents

The Trump administration's trade policies sent shockwaves through the global economy. One area significantly impacted was the financial technology (Fintech) sector, particularly concerning Initial Public Offerings (IPOs). This article will explore the complex relationship between the Trump tariffs, macroeconomic conditions, and the success of Fintech IPOs, using Affirm Holdings (AFRM) as a compelling case study. We will analyze how these tariffs might have influenced AFRM's performance and consider alternative explanations for its trajectory in the market. We will examine the interplay between "Trump Tariffs," "Fintech IPOs," and "Affirm Holdings (AFRM)" to understand the broader implications for the future of Fintech investment.

2. Main Points:

2.1. Understanding the Trump Tariff Policies and Their Economic Ripple Effects

The Trump administration implemented a series of tariffs, primarily targeting China, aiming to protect American industries and rebalance trade. These tariffs, however, had far-reaching consequences. They increased the cost of imported goods, disrupted global supply chains, fueled inflation, and created significant uncertainty in the market. This uncertainty directly affected investor confidence and investment decisions, impacting sectors like Fintech which rely heavily on global supply chains and consumer spending.

- Impact on import costs for technology components used in Fintech: Many Fintech companies rely on imported components for their hardware and software. Tariffs increased the cost of these components, squeezing profit margins.

- Effect on consumer spending and its influence on Fintech businesses like Affirm: Increased prices due to tariffs reduced consumer disposable income, potentially impacting demand for buy-now-pay-later services offered by companies like Affirm.

- Changes in investor sentiment due to trade war uncertainty: The uncertainty surrounding the trade war made investors more risk-averse, potentially impacting the valuations and success of Fintech IPOs, including AFRM.

2.2. The Fintech Sector and IPO Market Dynamics Before and During the Tariff Period

The Fintech sector experienced explosive growth in the years leading up to the Trump tariffs. A wave of innovation and technological advancements spurred significant investor interest. However, the implementation of tariffs introduced a period of uncertainty.

- Comparison of IPO valuations and performance across different periods: A comparative analysis of Fintech IPO valuations and performance before, during, and after the tariff period can reveal potential correlations between trade policy and market outcomes.

- Discussion of factors influencing Fintech IPO success beyond tariffs (e.g., technological innovation, regulatory changes): It’s crucial to acknowledge that factors beyond tariffs influenced Fintech IPO success. Technological innovation, regulatory changes, and overall market sentiment played significant roles.

- Examine investor behavior towards Fintech IPOs during periods of tariff uncertainty: Investor behavior during the period of tariff uncertainty likely shifted towards more established, less volatile companies, potentially impacting the reception of newer Fintech IPOs.

2.3. Affirm Holdings (AFRM) as a Case Study: Navigating the Tariff Landscape

Affirm Holdings (AFRM) offers a buy-now-pay-later service, connecting consumers and merchants. Analyzing AFRM's performance during the Trump tariff period can offer insights into the impact of these policies on the Fintech sector.

- Impact of tariffs on Affirm's supply chain or operational costs: While Affirm's business model is less directly reliant on imported physical goods than some other tech companies, indirect impacts through increased costs for its merchants or customers are possible.

- Assessment of the impact of macroeconomic conditions (influenced by tariffs) on Affirm’s customer base and revenue: Changes in consumer spending and economic uncertainty directly impact the demand for Affirm's services.

- Examination of AFRM's stock performance around the period of tariff implementation: Analyzing AFRM's stock price fluctuations during this period can reveal potential correlations between its performance and the tariff policy's effects.

2.4. Alternative Explanations for Affirm's IPO Performance (Beyond Tariffs)

Attributing Affirm's IPO performance solely to Trump tariffs would be an oversimplification. Several other factors likely played a more significant role.

- The role of overall market sentiment and investor risk appetite: General market sentiment and investor risk tolerance significantly influence IPO success.

- Impact of technological advancements and competition within the Fintech sector: Competition and innovation within the Fintech sector are intense; Affirm's success or struggles depend on its ability to adapt and innovate.

- Influence of regulatory changes affecting Affirm's business model: Regulatory changes in the financial services industry can significantly impact the operations and profitability of companies like Affirm.

3. Conclusion: Trump Tariffs, Fintech IPOs, and the Future of Affirm (AFRM)

While the Trump tariffs undeniably created economic uncertainty, definitively proving their direct impact on Affirm Holdings (AFRM)'s IPO performance is complex. Other factors – such as overall market sentiment, technological advancements, and competition – likely played more significant roles. However, the experience of Affirm, and the Fintech sector as a whole, highlights the importance of understanding the ripple effects of global trade policies on investment decisions and market dynamics. Further research into the specific impacts of trade policies on the Fintech sector is needed. By monitoring Affirm Holdings (AFRM) and other key players, investors and analysts can gain valuable insights into the evolving relationship between global trade and Fintech's future. Understanding the long-term effects of "Trump Tariffs" on "Fintech IPOs," particularly concerning companies like "Affirm Holdings (AFRM)," remains crucial for navigating the complexities of the global financial landscape.

Featured Posts

-

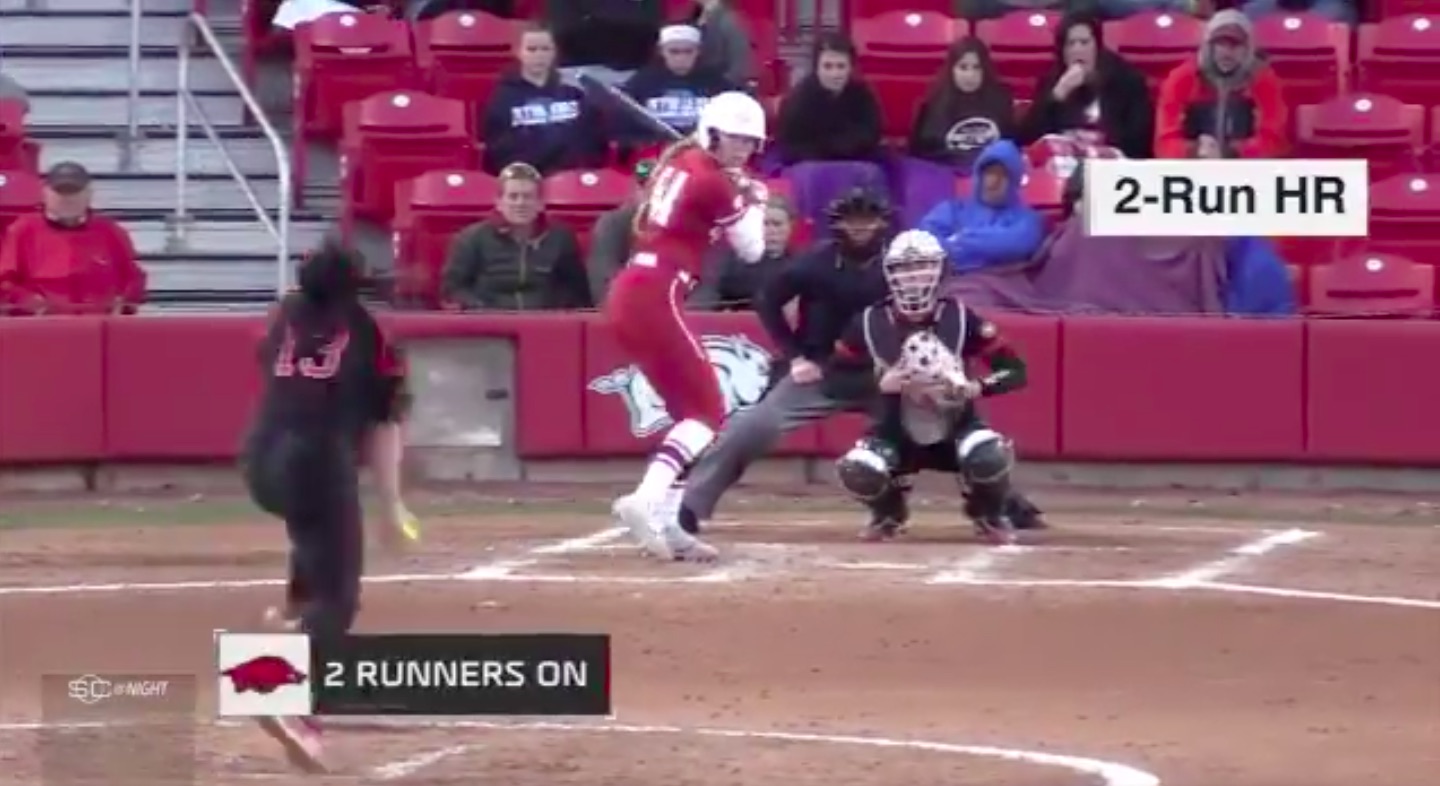

Arkansas Softball Players Historic Power A New Era In College Softball

May 14, 2025

Arkansas Softball Players Historic Power A New Era In College Softball

May 14, 2025 -

Complete Recap Suits La Premiere Event

May 14, 2025

Complete Recap Suits La Premiere Event

May 14, 2025 -

Que Visitar En Sevilla Este Miercoles 7 De Mayo De 2025

May 14, 2025

Que Visitar En Sevilla Este Miercoles 7 De Mayo De 2025

May 14, 2025 -

Official Dean Huijsen Makes Premier League Transfer Decision

May 14, 2025

Official Dean Huijsen Makes Premier League Transfer Decision

May 14, 2025 -

Eurovision 2024 Eden Golan Announces Israels Votes

May 14, 2025

Eurovision 2024 Eden Golan Announces Israels Votes

May 14, 2025