The Impact Of US Power On Elon Musk's Net Worth: A Tesla Case Study

Table of Contents

The Role of US Government Incentives in Tesla's Success and Musk's Wealth

The US government has played a pivotal role in fostering the growth of the electric vehicle (EV) market, directly benefiting Tesla and, consequently, Elon Musk's net worth. This support manifests in various forms, significantly impacting Tesla's profitability and market share.

Tax Credits and Subsidies

The US government offers substantial tax credits and subsidies to incentivize the adoption of electric vehicles and renewable energy technologies. These incentives have significantly reduced the cost of Tesla vehicles for consumers, boosting sales and increasing demand.

- Examples of specific tax credits: The federal tax credit for electric vehicles, state-level incentives varying by location, and credits for the installation of home charging stations.

- Estimated financial benefit to Tesla: While precise figures are difficult to obtain, analysts estimate that billions of dollars in tax credits have flowed to Tesla and its customers, directly contributing to its profitability and market valuation.

- Comparison to incentives in other major markets (China, Europe): While other countries offer EV incentives, the US has historically been among the most generous, providing a significant competitive advantage to Tesla. China's market, however, is rapidly evolving with its own substantial government support for domestic EV manufacturers.

Infrastructure Investment and Support

Government investment in charging infrastructure is another crucial factor. The expansion of the charging station network across the US has eased range anxiety, a major barrier to EV adoption, making Teslas more appealing to consumers.

- Examples of specific infrastructure investments: Federal and state funding for the construction of public charging stations, along with private investment spurred by government initiatives.

- Impact on Tesla sales: The readily available charging infrastructure has undeniably contributed to increased Tesla sales and market penetration in the US.

- Impact on battery technology advancements: Government funding for research and development in battery technology has indirectly benefited Tesla by lowering battery costs and improving performance. This has translated to greater efficiency and longer ranges for Tesla vehicles, enhancing their market appeal.

The Influence of the US Economy on Tesla's Performance and Musk's Net Worth

Tesla's performance and, therefore, Elon Musk's net worth are closely tied to the overall health of the US economy. Consumer spending patterns, economic cycles, and stock market fluctuations all play a critical role.

Consumer Spending and Market Demand

The correlation between US consumer spending and Tesla sales is strong. During economic booms, when consumer confidence and disposable income are high, Tesla sales tend to increase, boosting the company's stock price. Conversely, economic downturns usually lead to decreased sales and lower stock valuations.

- Statistics linking US consumer spending to Tesla sales: Analyzing quarterly Tesla sales data against concurrent consumer spending indices reveals a clear positive correlation.

- Impact of economic cycles on Tesla stock: Tesla's stock price tends to be more volatile than the broader market, reflecting its sensitivity to economic fluctuations and investor sentiment.

- Analysis of consumer preference for EVs: Growing consumer awareness of environmental concerns and government pushes towards sustainable transportation are fueling demand for EVs, benefiting Tesla.

US Stock Market Fluctuations and Tesla's Valuation

Tesla's stock price is highly susceptible to US stock market volatility. Investor sentiment, market trends, and the actions of institutional investors significantly influence Tesla's valuation and, ultimately, Elon Musk's net worth.

- Examples of major market events affecting Tesla's stock: Market corrections, interest rate hikes, and broader shifts in investor preference toward growth versus value stocks all impact Tesla's share price.

- Explanation of market capitalization and its influence on net worth: Elon Musk's net worth is largely determined by Tesla's market capitalization (the total value of all its outstanding shares).

- Analysis of major investor actions: Large institutional investors and hedge funds play a significant role in driving Tesla's stock price through their buying and selling activities.

The Impact of US Geopolitical Factors on Tesla and Musk's Net Worth

Geopolitical events and US trade policies also affect Tesla and, by extension, Elon Musk's net worth. These factors influence Tesla's global supply chain, production capabilities, and overall market competitiveness.

Trade Policy and International Relations

US trade policies directly impact Tesla's global supply chain. Trade wars or protectionist measures can disrupt the flow of raw materials or components, affecting production and profitability. Similarly, international relations can influence Tesla's ability to operate and expand in various markets.

- Examples of trade policies affecting Tesla: Tariffs on imported components or restrictions on exports to certain countries can impact Tesla's cost structure and market access.

- Impact of geopolitical events on Tesla's operations and supply chains: Geopolitical instability can lead to supply chain disruptions and increased operational risks, negatively impacting Tesla's financial performance.

Regulatory Environment and Competition

The US regulatory environment plays a crucial role in shaping Tesla's competitive landscape. Stringent environmental regulations, while potentially increasing costs, also give Tesla a competitive advantage, as the company is positioned as a leader in sustainable transportation.

- Specific examples of US regulations impacting Tesla: Emission standards, fuel efficiency requirements, and incentives for electric vehicle adoption all shape Tesla's business environment.

- Comparison to regulations in other countries: A comparative analysis of US regulations with those in other major markets reveals the unique competitive dynamics shaping Tesla's global success.

Conclusion

This case study demonstrates the profound impact of US power – encompassing government policies, economic conditions, and geopolitical factors – on Elon Musk's net worth, largely through its influence on Tesla's success. The interplay between US government incentives, consumer behavior, stock market fluctuations, and the international landscape significantly shapes Tesla's performance and, consequently, the wealth of its CEO. Understanding these intricate relationships is crucial for appreciating the complex dynamics that underpin the fortunes of major corporations and their leaders in the globalized economy. For more in-depth analysis of the impact of US power on Elon Musk's net worth, consider exploring further resources on government incentives for electric vehicles and the US stock market's influence on tech valuations. Further research into the evolving relationship between US policy and the electric vehicle market will continue to illuminate the factors affecting Elon Musk's net worth and the future trajectory of Tesla.

Featured Posts

-

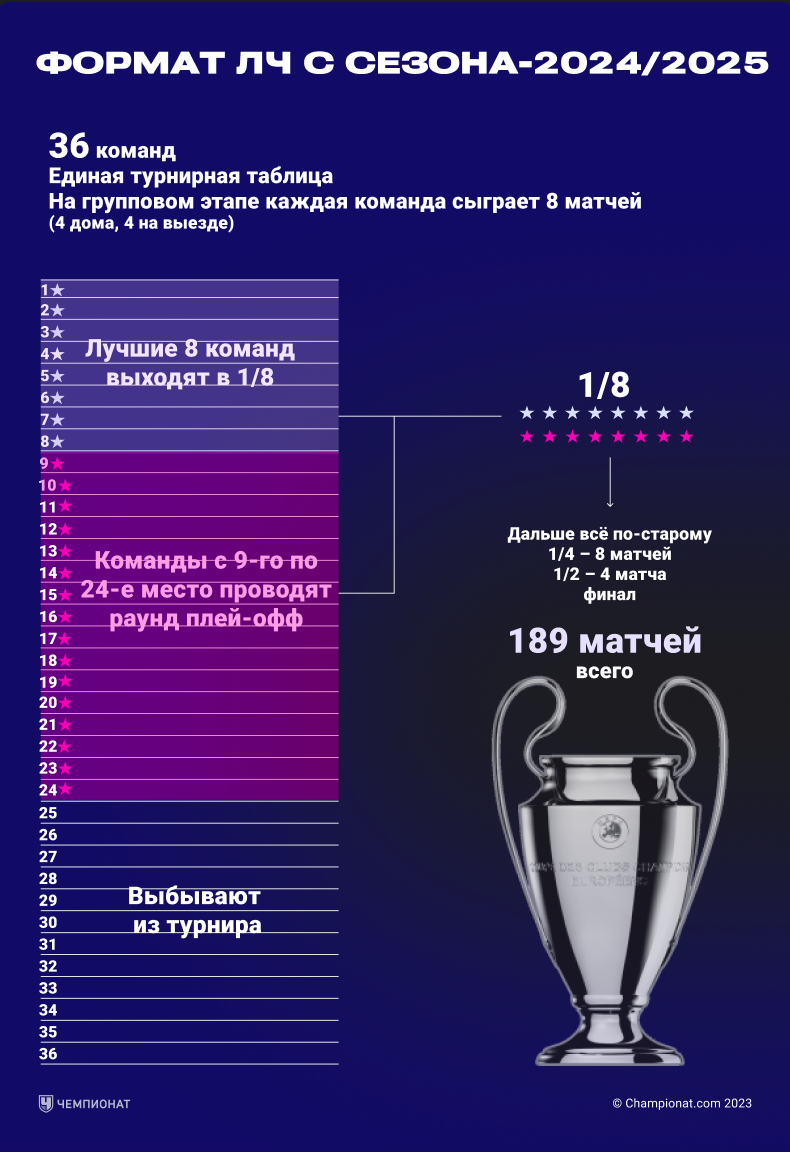

Raspisanie I Prognozy Polufinaly I Final Ligi Chempionov 2024 2025

May 09, 2025

Raspisanie I Prognozy Polufinaly I Final Ligi Chempionov 2024 2025

May 09, 2025 -

Violences Conjugales A Dijon Le Boxeur Bilel Latreche Devant La Justice En Aout

May 09, 2025

Violences Conjugales A Dijon Le Boxeur Bilel Latreche Devant La Justice En Aout

May 09, 2025 -

Handhaven Van De Relatie Brekelmans En India

May 09, 2025

Handhaven Van De Relatie Brekelmans En India

May 09, 2025 -

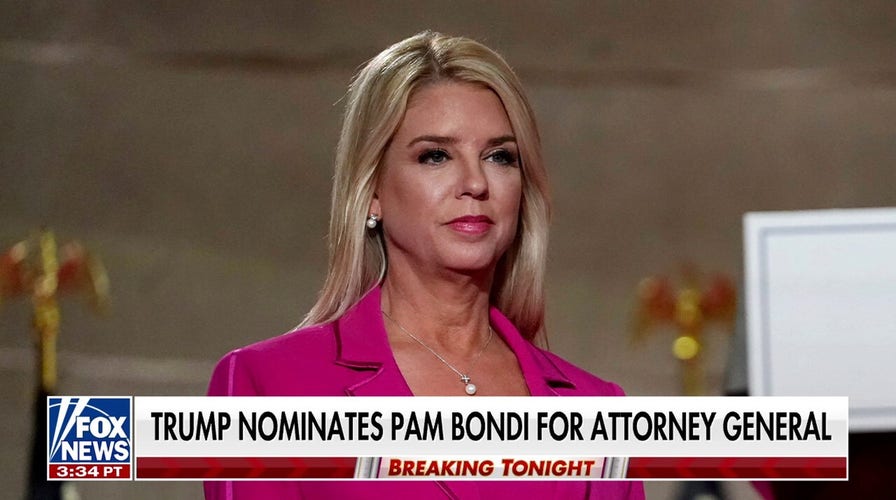

Bondi Under Fire Senate Democrats Allege Suppression Of Epstein Documents

May 09, 2025

Bondi Under Fire Senate Democrats Allege Suppression Of Epstein Documents

May 09, 2025 -

Wynne Evans Dropped From Go Compare Advert After Strictly Scandal

May 09, 2025

Wynne Evans Dropped From Go Compare Advert After Strictly Scandal

May 09, 2025