The Importance Of Net Asset Value (NAV) For Amundi Dow Jones Industrial Average UCITS ETF Investors

Table of Contents

How NAV Reflects the ETF's Underlying Assets

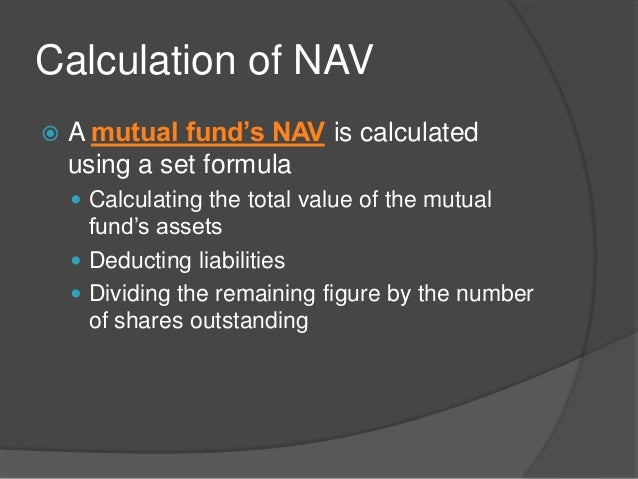

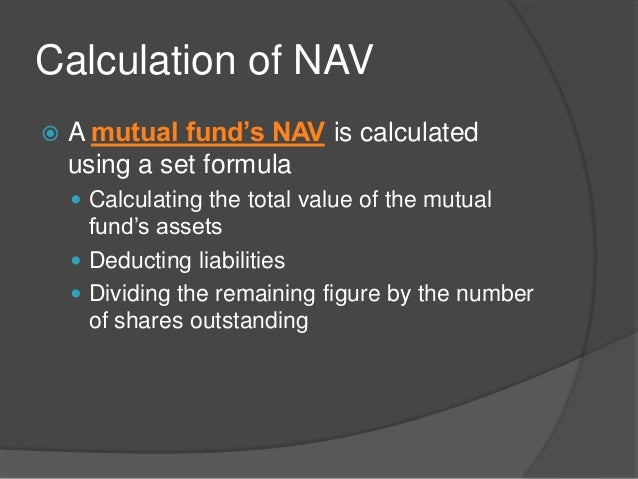

The Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF represents the total value of all its underlying assets, divided by the number of outstanding shares. This calculation directly reflects the performance of the 30 constituent stocks of the Dow Jones Industrial Average.

- Calculation: The NAV is calculated daily by summing the market value of each of the 30 component stocks, adding any accrued dividends, and subtracting any expenses. This total is then divided by the total number of outstanding ETF shares.

- Daily Fluctuations: The NAV fluctuates daily, mirroring the price movements of the underlying stocks. A rise in the price of the majority of the underlying stocks will generally result in a higher NAV, and vice versa.

- Influencing Factors: Several factors influence the daily NAV:

- Price movements of the underlying stocks: This is the most significant factor. A strong market day for the DJIA will typically lead to a higher NAV.

- Dividends received from underlying companies: Dividends paid by the component companies increase the ETF's assets and therefore contribute to the NAV.

- ETF expenses: Management fees and other operating expenses reduce the ETF's assets and thus slightly lower the NAV.

- Market Price vs. NAV: While the NAV represents the intrinsic value of the ETF, the market price may differ slightly due to supply and demand. Small discrepancies are normal, but significant deviations could indicate market inefficiencies.

Using NAV to Monitor Your Investment Performance

Tracking your investment's performance in the Amundi Dow Jones Industrial Average UCITS ETF is easily accomplished by monitoring the Net Asset Value (NAV).

- Calculating ROI: By comparing the current NAV to your initial purchase price (also expressed as NAV on the purchase date), you can determine your return on investment (ROI). A higher current NAV compared to your purchase price indicates a profit.

- Profit/Loss Calculation: The difference between the current NAV per share and your purchase price per share, multiplied by the number of shares owned, reveals your overall profit or loss.

- Tax Implications: NAV is also crucial for calculating capital gains for tax purposes. The difference between your selling price (based on the NAV at the time of sale) and your purchase price (based on the NAV at the time of purchase) determines your taxable capital gain or loss.

NAV and ETF Pricing Transparency

Regular publication of the Net Asset Value (NAV) is essential for ensuring transparency in the ETF market.

- Investor Protection: Transparent NAV reporting safeguards investors from potential manipulation or unfair pricing practices. It allows for independent verification of the ETF's value.

- Regulatory Compliance: UCITS (Undertakings for Collective Investment in Transferable Securities) ETFs are subject to strict regulations regarding NAV disclosure, ensuring accuracy and timely reporting. This adherence to regulations strengthens investor confidence.

NAV and Amundi Dow Jones Industrial Average UCITS ETF Specific Considerations

While the general principles of NAV apply to all ETFs, certain specific aspects apply to the Amundi Dow Jones Industrial Average UCITS ETF.

- Currency Considerations: If you are investing in a currency different from the base currency of the ETF, fluctuations in exchange rates will affect your returns when calculated in your local currency.

- Expense Ratios: Understanding the expense ratio of the Amundi Dow Jones Industrial Average UCITS ETF is critical. These expenses are deducted from the assets and directly impact the NAV.

- Reporting Schedules: Familiarize yourself with the reporting schedule for the ETF's NAV, which is usually daily. This information is readily available on the Amundi website. [Link to Amundi website] and [Link to ETF factsheet].

Conclusion: The Essential Role of Net Asset Value (NAV) in Your Investment Strategy

Understanding Net Asset Value (NAV) is paramount for successful investment in the Amundi Dow Jones Industrial Average UCITS ETF. Regularly monitoring the NAV allows you to accurately track your investment performance, calculate your ROI, and make informed investment decisions. By understanding how NAV fluctuates and its impact on your portfolio, you can effectively manage your risk and optimize your investment strategy. Stay informed about your Net Asset Value; accessing regular NAV updates and understanding the factors influencing it are key to successful investing. Visit the Amundi website for more information on the Amundi Dow Jones Industrial Average UCITS ETF and its Net Asset Value (NAV).

Featured Posts

-

Major Road Closed After Serious Accident Person Hospitalized

May 24, 2025

Major Road Closed After Serious Accident Person Hospitalized

May 24, 2025 -

Emergency Services Respond To M56 Car Crash And Casualty

May 24, 2025

Emergency Services Respond To M56 Car Crash And Casualty

May 24, 2025 -

Hvad Er Nytt I Fyrstu Rafutgafu Porsche Macan

May 24, 2025

Hvad Er Nytt I Fyrstu Rafutgafu Porsche Macan

May 24, 2025 -

Nemecke Hospodarstvo Prepustanie V Tisicoch Zasahuje Velke Spolocnosti

May 24, 2025

Nemecke Hospodarstvo Prepustanie V Tisicoch Zasahuje Velke Spolocnosti

May 24, 2025 -

Porsche Macan Rafbill Fyrsta Utgafan I Smaatridum

May 24, 2025

Porsche Macan Rafbill Fyrsta Utgafan I Smaatridum

May 24, 2025

Latest Posts

-

Iam Expat Fair Your One Stop Shop For Housing Finance And Family Fun

May 24, 2025

Iam Expat Fair Your One Stop Shop For Housing Finance And Family Fun

May 24, 2025 -

Find Housing Finance Solutions And Family Fun At The Iam Expat Fair

May 24, 2025

Find Housing Finance Solutions And Family Fun At The Iam Expat Fair

May 24, 2025 -

Iam Expat Fair Housing Finance Fun And Kids Activities

May 24, 2025

Iam Expat Fair Housing Finance Fun And Kids Activities

May 24, 2025 -

Understanding The Philips 2025 Annual General Meeting

May 24, 2025

Understanding The Philips 2025 Annual General Meeting

May 24, 2025 -

2025 Philips Annual General Meeting Shareholder Information And Updates

May 24, 2025

2025 Philips Annual General Meeting Shareholder Information And Updates

May 24, 2025