The Looming Geopolitical Conflict Over Rare Earth Minerals

Table of Contents

Uneven Distribution and Production Dominance

The geographical distribution of rare earth minerals is profoundly uneven. China currently dominates the global market, controlling an overwhelming majority of the world's rare earth mining and processing capacity. This concentration presents significant challenges to global supply chains and national security.

- China's Market Dominance: China accounts for over 60% of global rare earth production, a figure that has fluctuated over the years but consistently underscores their dominance. This allows them considerable leverage in the global market.

- Implications for Global Supply Chains: This reliance on a single major producer creates significant vulnerabilities. Any disruption to Chinese production, whether due to political instability, environmental regulations, or deliberate actions, can severely impact global supply chains and the industries that depend on these critical minerals.

- Market Share and Production Capacity: While other countries possess rare earth deposits, the infrastructure and processing capabilities to extract and refine these minerals at scale are significantly less developed than in China. This disparity creates a significant imbalance in global market share.

Strategic Importance of Rare Earth Minerals in Modern Technologies

Rare earth minerals are indispensable components in a vast array of modern technologies. Their unique magnetic, electronic, and catalytic properties make them critical for numerous applications.

- Renewable Energy Technologies: Neodymium magnets, made from rare earth elements, are crucial for wind turbine generators and electric vehicle motors. The increasing demand for renewable energy sources directly fuels the demand for these critical minerals.

- Defense Technology: Rare earth elements are vital components in advanced military technologies, including guided missiles, radar systems, and night vision equipment. This adds a layer of geopolitical complexity to their control and distribution.

- Consumer Electronics: Smartphones, laptops, and other consumer electronics rely heavily on rare earth elements for their functionality, including displays, speakers, and various electronic components.

Geopolitical Tensions and Diversification Efforts

The concentrated control of rare earth minerals is already generating significant geopolitical tensions. Countries are actively pursuing strategies to diversify their supply sources and mitigate the risks associated with dependence on a single supplier.

- Geopolitical Risks: The potential for trade wars, resource nationalism, and even military conflict related to rare earth mineral access is a serious concern. The concentration of power in one nation presents a significant vulnerability for other countries.

- Supply Chain Diversification: Many nations are investing heavily in mining projects outside China, supporting research and development of new extraction techniques, and exploring alternative materials to reduce their reliance on rare earth elements.

- International Cooperation: International collaborations and agreements are crucial to securing a stable and reliable supply of rare earth minerals. These efforts require concerted action to promote sustainable mining practices and transparent trade policies. Recycling initiatives also play a vital role in reducing reliance on newly mined resources.

Environmental Concerns and Sustainable Mining Practices

Rare earth mining poses significant environmental challenges, including water pollution, land degradation, and the release of radioactive materials. Sustainable and responsible mining practices are essential to mitigate these environmental impacts.

- Environmental Impact: The extraction and processing of rare earth minerals can be environmentally damaging, particularly if not undertaken responsibly. Water contamination and soil erosion are major concerns.

- Sustainable Mining: The development and implementation of cleaner, more efficient mining techniques, along with stricter environmental regulations and international standards, are crucial for minimizing the negative environmental effects.

- Responsible Sourcing: Consumers and businesses are increasingly demanding responsible sourcing of rare earth minerals, pushing companies to adopt more sustainable practices throughout their supply chains. This includes transparency and traceability of materials.

Conclusion: Navigating the Geopolitical Landscape of Rare Earth Minerals

The global demand for rare earth minerals is growing rapidly, driven by the expansion of renewable energy, advancements in consumer electronics, and the continued need for these materials in defense applications. The uneven distribution of these crucial resources, however, creates a precarious geopolitical landscape. China's dominance highlights the vulnerabilities inherent in relying on a single major producer, increasing the potential for future conflicts and supply chain disruptions. Diversification efforts, sustainable mining practices, international cooperation, and responsible sourcing are not just desirable goals; they are essential for navigating this complex challenge and securing a stable and reliable supply of rare earth minerals for the future. Learn more about responsible sourcing of rare earth minerals and advocate for policies that support sustainable supply chains and global cooperation to ensure rare earth mineral security for all nations.

Featured Posts

-

Get Cashback On Uber Kenya Rides Good News For Riders And Drivers

May 17, 2025

Get Cashback On Uber Kenya Rides Good News For Riders And Drivers

May 17, 2025 -

Affordable Finds That Actually Deliver

May 17, 2025

Affordable Finds That Actually Deliver

May 17, 2025 -

Trouvez Votre Trottinette Electrique A Moins De 200 E Sur Cdiscount

May 17, 2025

Trouvez Votre Trottinette Electrique A Moins De 200 E Sur Cdiscount

May 17, 2025 -

Tam Krwz Ky Dytng Layf Halyh Apdyts

May 17, 2025

Tam Krwz Ky Dytng Layf Halyh Apdyts

May 17, 2025 -

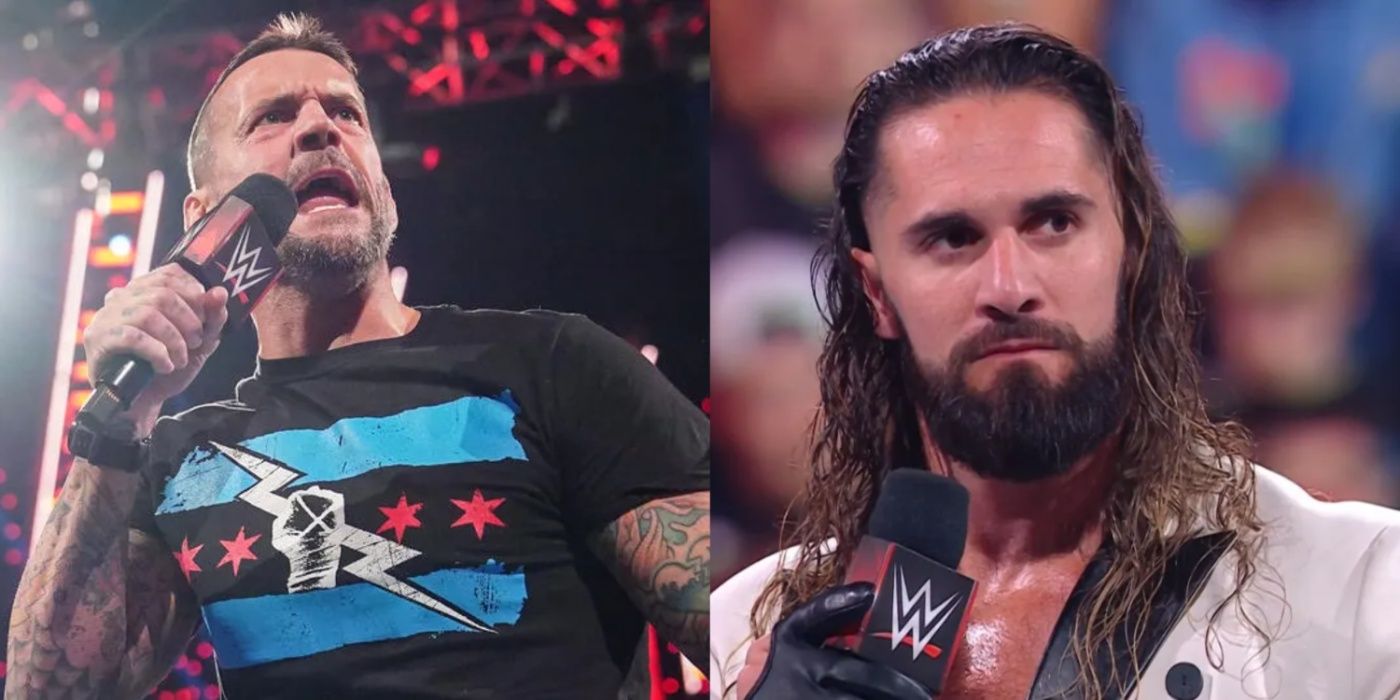

Jalen Brunson Misses Cm Punk Vs Seth Rollins Raws Big Match

May 17, 2025

Jalen Brunson Misses Cm Punk Vs Seth Rollins Raws Big Match

May 17, 2025