The Most Profitable Dividend Strategy? Simplicity Itself

Table of Contents

Understanding the Power of Dividend Reinvestment

The cornerstone of our simple yet highly effective dividend strategy is dividend reinvestment. A Dividend Reinvestment Plan (DRIP) allows you to automatically reinvest your dividend payments into purchasing additional shares of the same company. This seemingly small act unleashes the incredible power of compounding.

Compounding, the snowball effect of earning returns on your returns, is where the magic truly happens. Imagine investing $1,000 annually in a company with a 5% dividend yield, reinvesting those dividends. Over 20 years, the impact of compounding can significantly increase your overall returns compared to simply receiving the dividends as cash.

- Reduced transaction fees: DRIPs often eliminate brokerage fees associated with buying additional shares.

- Automatic purchase of additional shares: Simplify your investment process with automated reinvestment.

- Accelerated wealth building: Witness your portfolio grow exponentially through the power of compounding.

- Tax advantages in some jurisdictions: Depending on your location, reinvesting dividends may offer tax benefits.

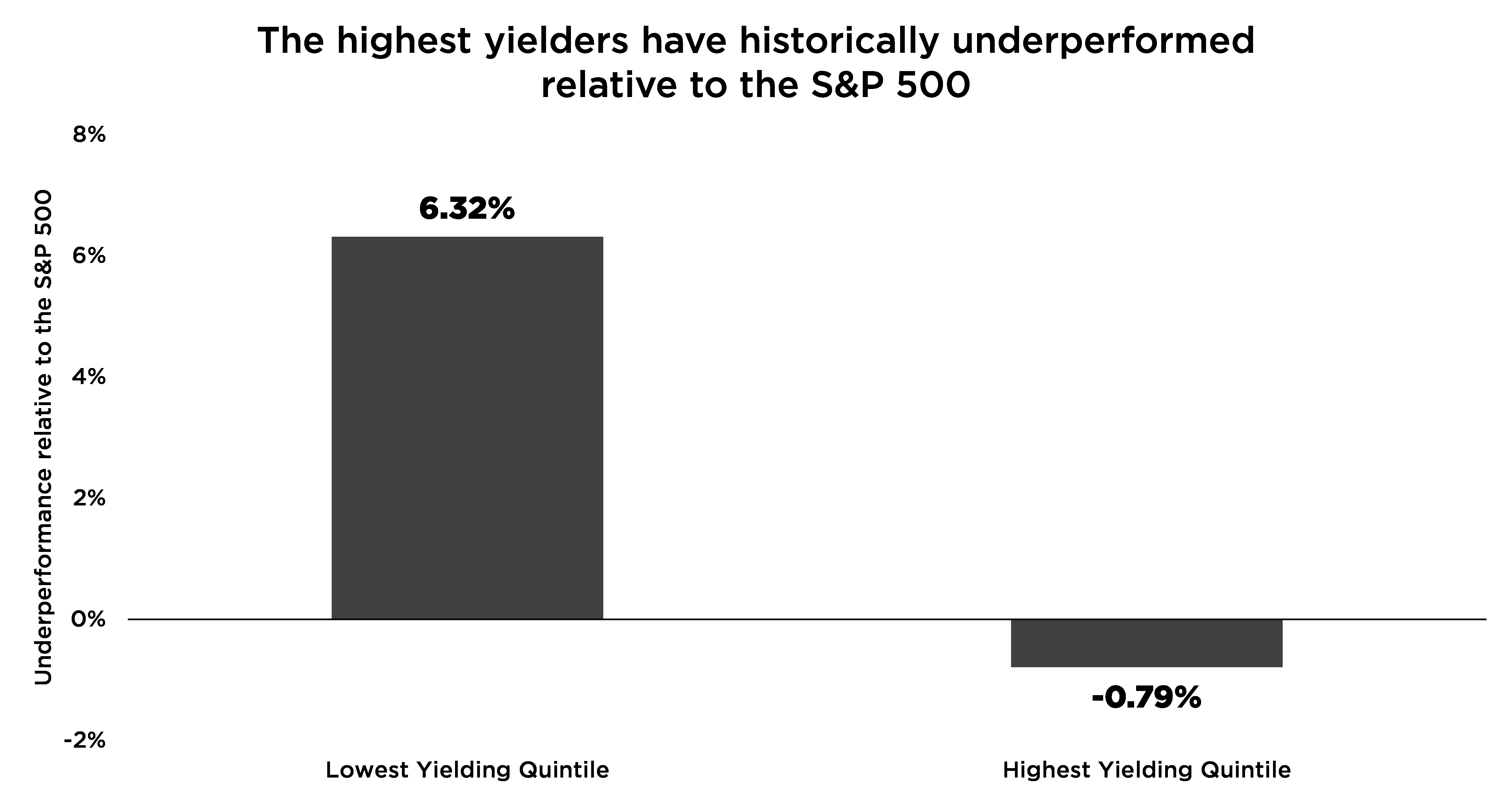

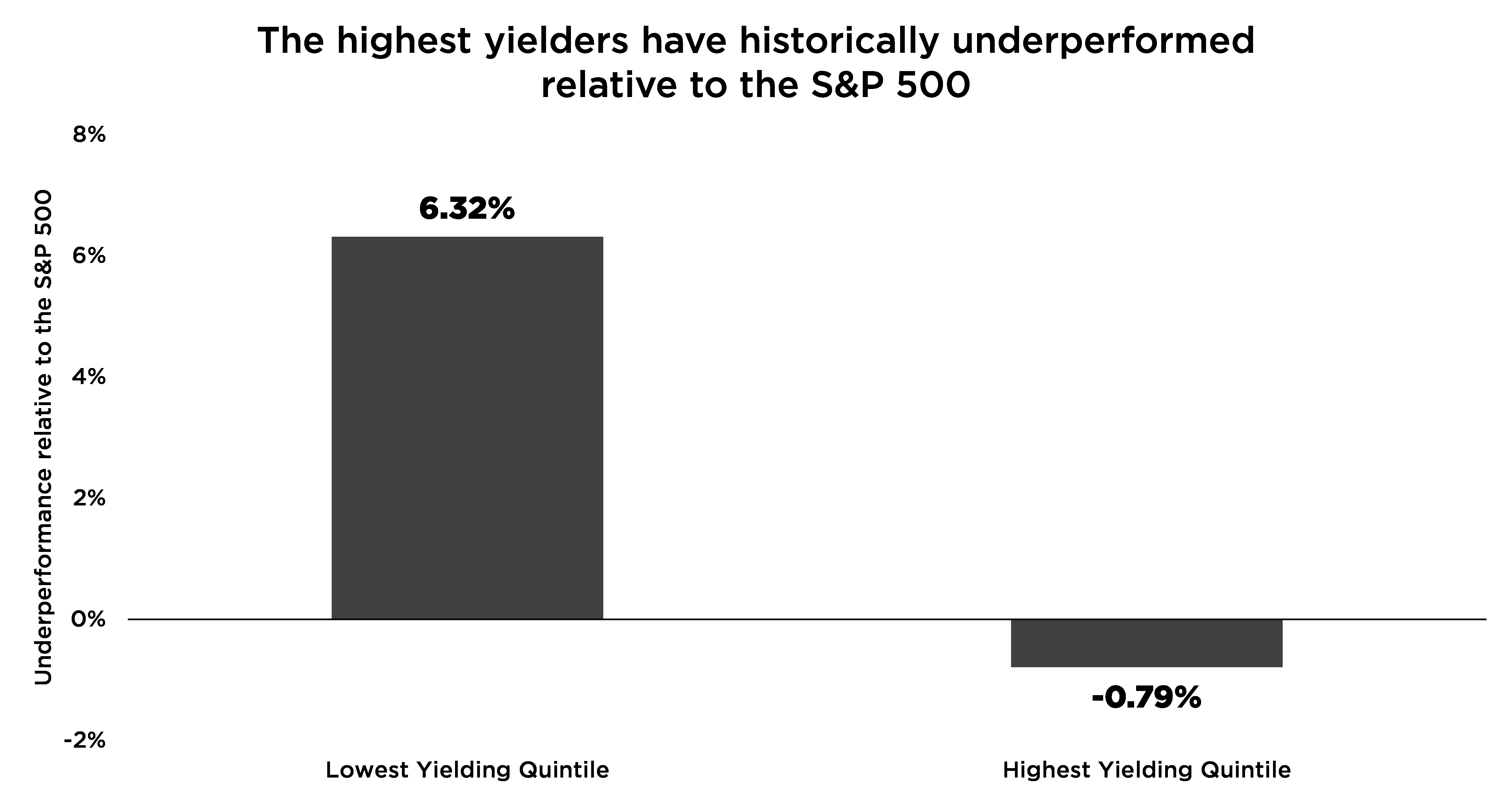

Selecting High-Yield Dividend Stocks – Wisely

While high-yield dividend stocks are tempting, remember that yield alone isn't the sole indicator of a sound investment. The most profitable dividend strategy involves careful due diligence. Focusing solely on high yields without considering the company's financial health can be risky.

Before investing, analyze the company's fundamentals:

- Payout ratio: This indicates the percentage of earnings paid out as dividends. A sustainable payout ratio is crucial for long-term dividend growth.

- Debt levels: High debt can threaten a company's ability to maintain dividend payments.

- Earnings growth: Consistent earnings growth suggests a company's ability to sustain and potentially increase its dividend payouts.

When selecting stocks, prioritize:

- Established, financially stable companies: Choose companies with a proven track record of consistent dividend payments.

- Companies with sustainable business models: Look for businesses with strong competitive advantages and resilient revenue streams.

- Diversification: Spread your investments across various sectors to mitigate risk.

The Importance of Long-Term Holding

Patience is a virtue in dividend investing. The most profitable dividend strategy embraces a long-term perspective. Market fluctuations are inevitable, and short-term volatility can significantly impact your returns.

A buy-and-hold strategy offers several advantages:

- Avoid emotional reactions to market volatility: Resist the urge to panic-sell during market downturns.

- Benefit from the power of compounding over the long term: Let your investments grow steadily over time.

- Reduce trading fees and taxes: Minimize transaction costs by holding your investments long-term.

- Minimize the risk of poor timing: Avoid making hasty decisions based on short-term market fluctuations.

Minimizing Fees and Taxes

High fees and taxes can significantly erode your investment returns. Optimizing these costs is crucial for maximizing profits.

Strategies to minimize fees and taxes include:

- Choose a low-cost brokerage account: Compare fees and commissions offered by different brokers.

- Utilize tax-advantaged accounts (if available): Explore options like retirement accounts to potentially reduce your tax burden.

- Understand tax implications of dividend income in your jurisdiction: Consult a tax professional for personalized advice.

- Consider tax-efficient investment strategies: Explore strategies to minimize your tax liability on dividend income.

Conclusion: Simplicity Leads to the Most Profitable Dividend Strategy

In conclusion, the most profitable dividend strategy doesn't require complexity. By focusing on dividend reinvestment (DRIPs), careful stock selection, long-term holding, and minimizing fees and taxes, you can build a robust and steadily growing portfolio. This simple, yet effective, approach allows you to leverage the power of compounding and achieve long-term financial success. Start building your portfolio today using this simple yet highly effective strategy! Consider further research and consult with a financial advisor to personalize your approach and ensure it aligns with your individual financial goals.

Featured Posts

-

Ufc 313 Mauricio Ruffys Ko Clinching Spinning Kick Training

May 11, 2025

Ufc 313 Mauricio Ruffys Ko Clinching Spinning Kick Training

May 11, 2025 -

The Great Gatsby Exploring The Real Life Figures That Inspired The Novel

May 11, 2025

The Great Gatsby Exploring The Real Life Figures That Inspired The Novel

May 11, 2025 -

Juan Sotos Hot Streak Did Michael Kays Question Spark A Rally

May 11, 2025

Juan Sotos Hot Streak Did Michael Kays Question Spark A Rally

May 11, 2025 -

To Netflix Jay Kelly Kloynei And Santler Se Mia Tainia Oskar

May 11, 2025

To Netflix Jay Kelly Kloynei And Santler Se Mia Tainia Oskar

May 11, 2025 -

Trumps Middle East Trip Kushners Unseen Influence

May 11, 2025

Trumps Middle East Trip Kushners Unseen Influence

May 11, 2025