The Painful Truth About Buy-and-Hold: Long-Term Investing Strategies

Table of Contents

The Allure of Buy-and-Hold: Understanding the Appeal

The buy-and-hold investment strategy, at its core, is remarkably simple: buy assets (like stocks or bonds) and hold them for an extended period, typically years or even decades, regardless of short-term market fluctuations. This simplicity is a major draw for many investors. The perceived ease of execution, requiring minimal time and effort, is highly attractive in our busy lives.

The strategy's appeal is further amplified by the power of compounding returns. Over the long term, consistent returns, even small ones, can accumulate significantly thanks to the snowball effect of compounding. This exponential growth is a key reason why buy-and-hold has become a cornerstone of many long-term investment plans.

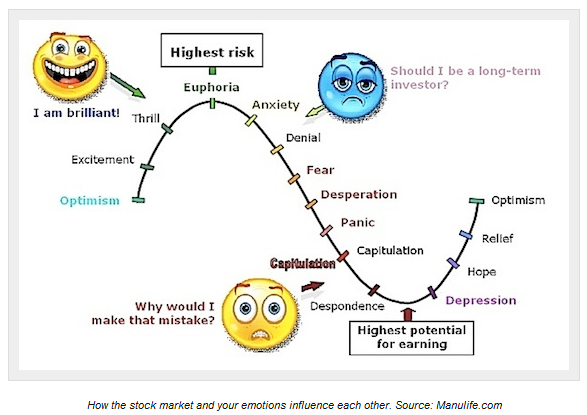

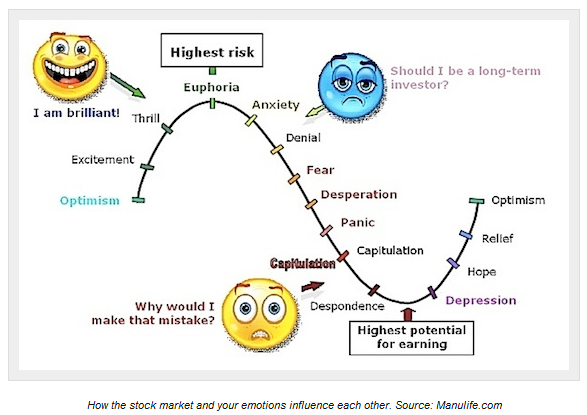

Finally, the emotional benefits are undeniable. A hands-off approach reduces the temptation to make impulsive, emotionally driven trading decisions based on short-term market noise. This disciplined approach can lead to better long-term results by avoiding panic selling during market downturns.

- Requires minimal time and effort: Perfect for busy professionals and those lacking extensive investment knowledge.

- Benefits from long-term market growth: Leverages the historical upward trend of major market indices over decades.

- Reduces emotional trading decisions: Protects against impulsive reactions to market volatility.

The Painful Realities: Hidden Risks of Buy-and-Hold

While buy-and-hold offers significant advantages, it's crucial to acknowledge the potential downsides. Ignoring the risks associated with this strategy can lead to substantial financial setbacks.

One of the most significant risks is the potential for substantial losses during prolonged bear markets or market crashes. While markets historically recover, the duration and depth of these downturns can be unpredictable, potentially eroding significant portions of your investment portfolio. Simply holding on during such periods without any strategy adjustment might lead to considerable financial pain.

Furthermore, a strict buy-and-hold approach can lead to missed opportunities. Markets are dynamic; some sectors or asset classes consistently outperform others over time. A buy-and-hold strategy neglects the possibility of rebalancing your portfolio or switching to better-performing assets, potentially limiting your overall returns.

- Vulnerability to market crashes and corrections: Significant losses are possible during prolonged market downturns.

- Potential for significant capital loss: Underperformance can lead to substantial losses if not properly managed.

- Missed opportunities to improve returns through active management: Ignoring market shifts can limit potential gains.

- Ignoring diversification may lead to higher risk: Concentrating investments in a single sector or asset class increases volatility.

Inflation's Silent Thief: Eroding Your Returns

Inflation silently erodes the purchasing power of your investments over time. While you might see positive nominal returns (the stated return on your investment), the real return (after adjusting for inflation) might be significantly lower, or even negative. This means your money may not buy as much in the future as it does today.

Understanding inflation-adjusted returns is critical for assessing the true success of a buy-and-hold strategy. A seemingly healthy return might be insufficient to maintain your purchasing power if inflation outpaces investment growth.

To mitigate the impact of inflation, consider incorporating inflation-protected securities (like TIPS) or assets that tend to perform well during inflationary periods (such as real estate or commodities) into your portfolio.

- Inflation reduces purchasing power over time: Your investment gains may not keep pace with rising prices.

- Nominal returns may not reflect real returns: Adjusting for inflation reveals the true growth of your investments.

- Consider inflation-protected securities or assets: Diversify your portfolio to hedge against inflation risk.

Beyond Buy-and-Hold: Alternative Long-Term Strategies

Buy-and-hold isn't the only path to long-term investment success. Several alternative strategies offer different approaches to wealth building:

- Value Investing: Focuses on identifying undervalued companies with strong fundamentals, aiming to purchase them at a discount to their intrinsic value.

- Growth Investing: Targets companies with high growth potential, often in emerging sectors or innovative industries.

- Dividend Investing: Concentrates on companies that pay consistent and growing dividends, providing a steady stream of income alongside potential capital appreciation.

Regardless of your chosen strategy, diversification and asset allocation are paramount. Spreading your investments across various asset classes (stocks, bonds, real estate, etc.) reduces risk and enhances the potential for long-term growth.

Developing a Personalized Long-Term Investment Plan

Your individual risk tolerance and financial goals are the cornerstones of any successful long-term investment strategy. A young investor with a long time horizon might tolerate higher risk for potentially greater returns, while someone nearing retirement might prioritize capital preservation and income generation.

Seeking professional financial advice is advisable, especially for those lacking the time or expertise to manage their investments effectively. A financial advisor can help create a personalized plan aligned with your circumstances and aspirations.

Regular portfolio reviews and adjustments are essential to maintain alignment with your goals and adapt to changing market conditions. This proactive approach ensures your strategy remains effective over the long term.

- Assess your risk tolerance: How much volatility are you comfortable with?

- Define your financial goals: Retirement, education, buying a home, etc.

- Seek professional advice if needed: A financial advisor can provide personalized guidance.

- Regularly review and adjust your portfolio: Stay aligned with your goals and adapt to changing market conditions.

Conclusion:

The "buy-and-hold" strategy, while seemingly simple, presents both opportunities and challenges. While the potential for long-term growth is undeniable, understanding the inherent risks of market volatility and inflation is crucial for successful long-term investing. Exploring alternative strategies and developing a personalized investment plan tailored to your individual risk tolerance and financial goals is vital. Don't blindly follow the buy-and-hold mantra; instead, adopt a nuanced approach to long-term investing that considers all aspects of your financial landscape. Remember to regularly review your investment strategy and consider seeking professional advice to optimize your approach to long-term investing and maximize your returns. Start planning your successful long-term investment strategy today!

Featured Posts

-

Apresentacao Oficial Ferrari 296 Speciale E Seu Motor Hibrido De 880 Cv

May 25, 2025

Apresentacao Oficial Ferrari 296 Speciale E Seu Motor Hibrido De 880 Cv

May 25, 2025 -

Thousands Of Miles Apart United In Dc Divided By Fate

May 25, 2025

Thousands Of Miles Apart United In Dc Divided By Fate

May 25, 2025 -

Major Losses Continue At Amsterdam Stock Exchange 11 Drop Since Wednesday

May 25, 2025

Major Losses Continue At Amsterdam Stock Exchange 11 Drop Since Wednesday

May 25, 2025 -

Euroleague Anatropes Sti Vathmologia Meta Ti Niki Tis Monako

May 25, 2025

Euroleague Anatropes Sti Vathmologia Meta Ti Niki Tis Monako

May 25, 2025 -

Southern Vacation Spot Responds To Negative Safety Assessment Following Shooting

May 25, 2025

Southern Vacation Spot Responds To Negative Safety Assessment Following Shooting

May 25, 2025