The Political Tightrope: Trump's Tax Bill And GOP Unity.

Table of Contents

The Tax Bill's Divisive Provisions

The Trump administration's tax cuts, while lauded by some as a boon to the American economy, sparked significant internal disagreements within the Republican party. These divisions stemmed largely from the bill's perceived disproportionate benefits to the wealthy and its unclear impact on the middle class.

Tax Cuts for the Wealthy

Critics argued that the tax bill overwhelmingly favored high-income earners, exacerbating income inequality and widening the gap between the rich and the poor. This led to accusations of prioritizing the interests of the wealthy elite over the needs of average Americans.

- Significant reduction in the corporate tax rate: From 35% to 21%, benefiting large corporations and their shareholders, many of whom were already wealthy individuals.

- Increased standard deduction: While benefiting some middle-class families, the impact was less significant for the wealthy, who often itemize deductions.

- Estate tax cuts: Substantial reductions in estate taxes, primarily benefiting wealthy families transferring large inheritances.

These provisions fueled accusations of Republican hypocrisy and fueled intra-party conflict. Statements from Republican critics, though scarce, reflected concerns about the bill's impact on long-term economic stability and social equity. The term "GOP divisions" became commonplace in media coverage of the legislation.

Impact on the Middle Class

The bill's supporters claimed it would stimulate economic growth, leading to job creation and increased wages that would ultimately benefit the middle class. However, critics countered that the trickle-down effect was unreliable and that the tax cuts offered limited, if any, tangible benefits to most middle-class families.

- Temporary tax cuts: Some provisions, like the increased child tax credit, were temporary, limiting their long-term impact.

- Independent analyses: Several non-partisan studies revealed a limited positive impact on middle-class incomes, while others showed minimal change or even slight negative impacts for specific income brackets.

- Conflicting narratives: The conflicting narratives surrounding the bill's impact on the middle class significantly impacted the GOP's message and contributed to public distrust.

This disparity in the claimed and actual benefits for the middle class fuelled the political fallout and significantly contributed to Republican infighting over the bill's merits.

Intra-Party Conflicts and the Legislative Process

The passage of Trump's tax bill was fraught with internal conflict within the Republican party. The legislative process itself highlighted deep divisions between different factions.

Conservative vs. Moderate Factions

Tensions between conservative and moderate Republicans were readily apparent during the bill's passage. Conservatives pushed for deeper cuts and broader tax reforms, while moderates expressed concerns about the bill's fiscal responsibility and potential social impacts.

- Key figures: Senators like Rand Paul (conservative) and Susan Collins (moderate) represented opposing viewpoints, highlighting the intra-party conflict.

- Legislative amendments: Numerous amendments were proposed and debated, reflecting the ongoing battles between these factions.

- Voting patterns: Analysis of voting patterns revealed significant splits within the Republican party, demonstrating the deep-seated divisions.

The Role of Lobbying and Special Interests

Lobbying groups and special interests played a significant role in shaping the final version of the bill, contributing to internal party tensions. The influence of these groups fueled accusations of backroom deals and a lack of transparency.

- Key lobbying groups: Corporate lobbying groups exerted significant pressure, influencing provisions related to corporate tax rates and deductions.

- Influence on specific provisions: Evidence suggests that lobbying efforts directly impacted certain tax breaks and loopholes within the bill.

- Campaign contributions: The role of campaign contributions and financial ties between politicians and lobbying groups raised concerns about potential conflicts of interest.

Long-Term Consequences for the Republican Party

Trump's tax bill had significant long-term repercussions for the Republican party, impacting both its internal dynamics and its electoral prospects.

The 2018 Midterm Elections

The 2018 midterm elections provided a clear indication of the public's response to the tax bill. The significant Republican losses in the House of Representatives are widely seen as, at least partially, a direct result of voter dissatisfaction with the bill.

- Election results: Democrats won control of the House, fueled by dissatisfaction over the tax bill among many voters.

- Voter turnout: Increased voter turnout in key districts suggests that the tax bill played a role in mobilizing opposition voters.

- Polling data: Pre-election polling data consistently showed low approval ratings for the tax bill, reflecting public concerns.

The Legacy of the Tax Bill on GOP Unity

The tax bill's lasting impact on Republican unity remains a topic of debate. While the party managed to pass the legislation, the deep divisions exposed during the process continue to influence intra-party dynamics.

- Ongoing divisions: Evidence of persistent disagreements within the Republican party on economic policy is readily apparent in subsequent legislative battles.

- Future legislative challenges: The divisions created by the tax bill are likely to hinder future legislative efforts, particularly on issues with economic consequences.

- Impact on party platform: The tax bill's legacy continues to shape the Republican party's approach to tax reform and broader economic policy debates.

The Enduring Legacy of Trump's Tax Bill and GOP Unity

In conclusion, Trump's tax bill serves as a stark example of how ambitious legislative efforts can exacerbate existing divisions within a political party. The bill's divisive provisions, the intense intra-party conflicts surrounding its passage, and the subsequent electoral consequences all contributed to a significant and lasting impact on Republican unity. The long-term effects on the GOP's internal dynamics, future legislative success, and overall political trajectory are still unfolding. Understanding the full impact of Trump's tax bill on Republican unity requires further examination. Share your thoughts and insights on this pivotal moment in American politics.

Featured Posts

-

Core Inflation Heats Up The Bank Of Canadas Policy Predicament

May 22, 2025

Core Inflation Heats Up The Bank Of Canadas Policy Predicament

May 22, 2025 -

Nato Nun Gelecegi Tuerkiye Nin Belirleyici Rolue Ve Zirve Kararlari

May 22, 2025

Nato Nun Gelecegi Tuerkiye Nin Belirleyici Rolue Ve Zirve Kararlari

May 22, 2025 -

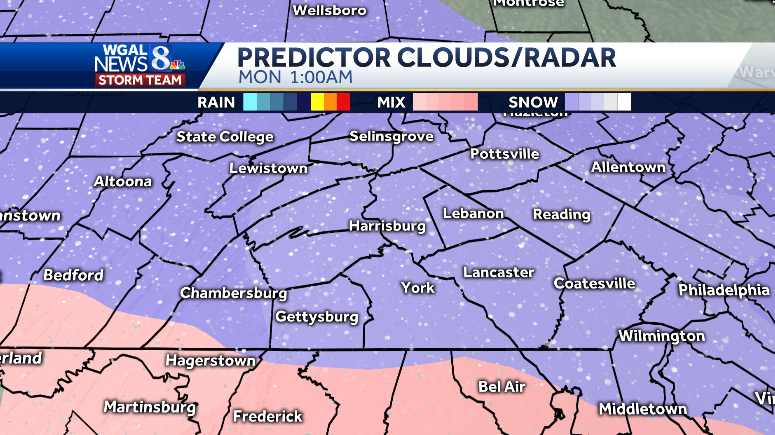

Severe Thunderstorm Watch South Central Pennsylvania

May 22, 2025

Severe Thunderstorm Watch South Central Pennsylvania

May 22, 2025 -

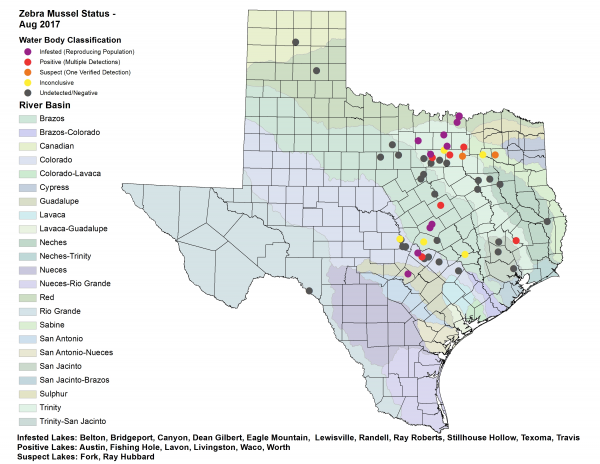

Zebra Mussel Infestation Casper Resident Finds Thousands On New Boat Lift

May 22, 2025

Zebra Mussel Infestation Casper Resident Finds Thousands On New Boat Lift

May 22, 2025 -

Nintendos Action Forces Ryujinx Switch Emulator To Cease Development

May 22, 2025

Nintendos Action Forces Ryujinx Switch Emulator To Cease Development

May 22, 2025

Latest Posts

-

Significant Fire Engulfs Used Car Dealership

May 22, 2025

Significant Fire Engulfs Used Car Dealership

May 22, 2025 -

Firefighters Respond To Major Car Dealership Fire

May 22, 2025

Firefighters Respond To Major Car Dealership Fire

May 22, 2025 -

Crews Battle Blaze At Used Car Dealership

May 22, 2025

Crews Battle Blaze At Used Car Dealership

May 22, 2025 -

Recent Susquehanna Valley Storm Damage Impacts And Long Term Effects

May 22, 2025

Recent Susquehanna Valley Storm Damage Impacts And Long Term Effects

May 22, 2025 -

Susquehanna Valley Storm Damage Resources And Support For Affected Residents

May 22, 2025

Susquehanna Valley Storm Damage Resources And Support For Affected Residents

May 22, 2025