The Power Of Simplicity: A High-Yield Dividend Strategy

Table of Contents

Understanding the Fundamentals of High-Yield Dividend Investing

Defining High-Yield Dividends

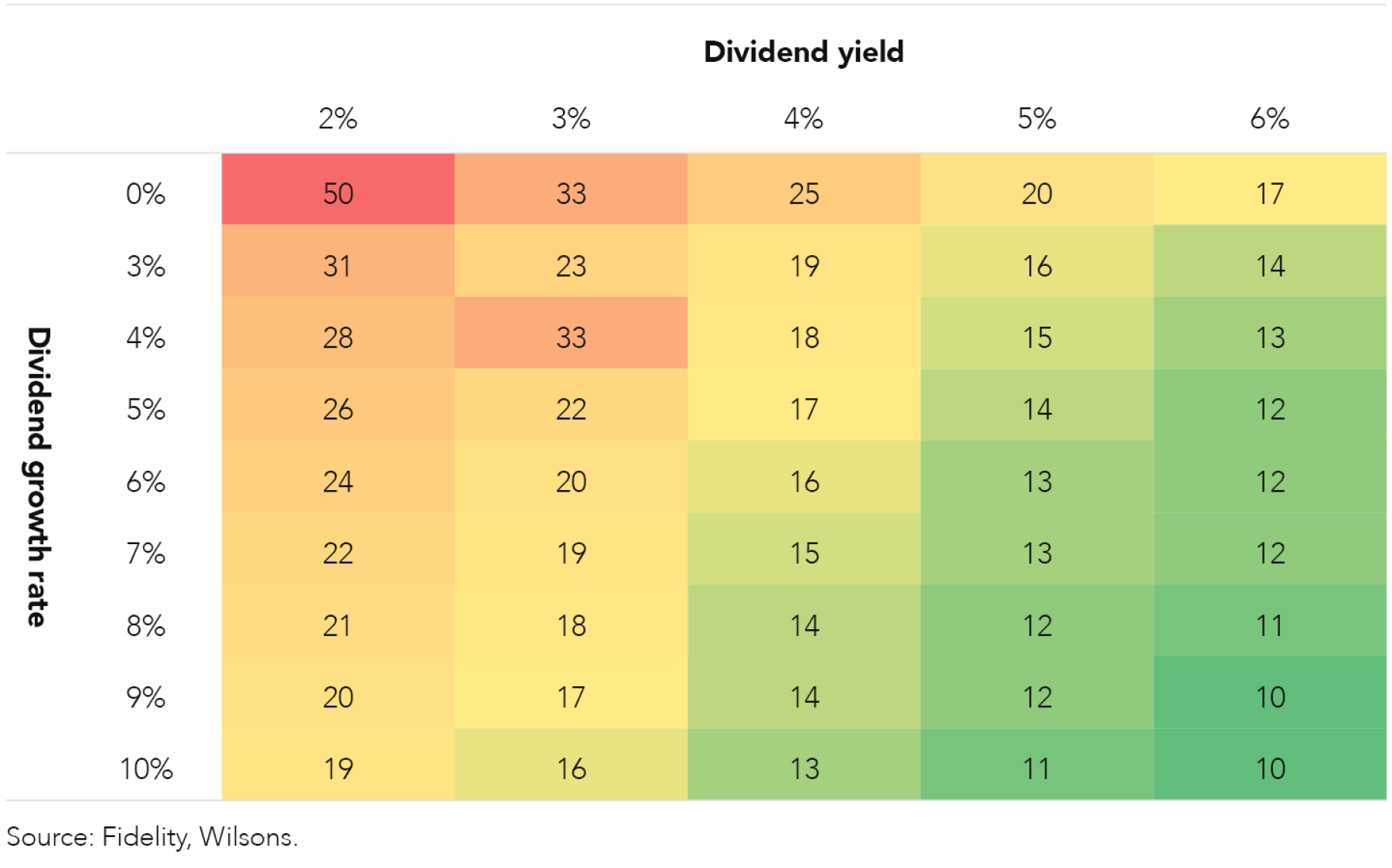

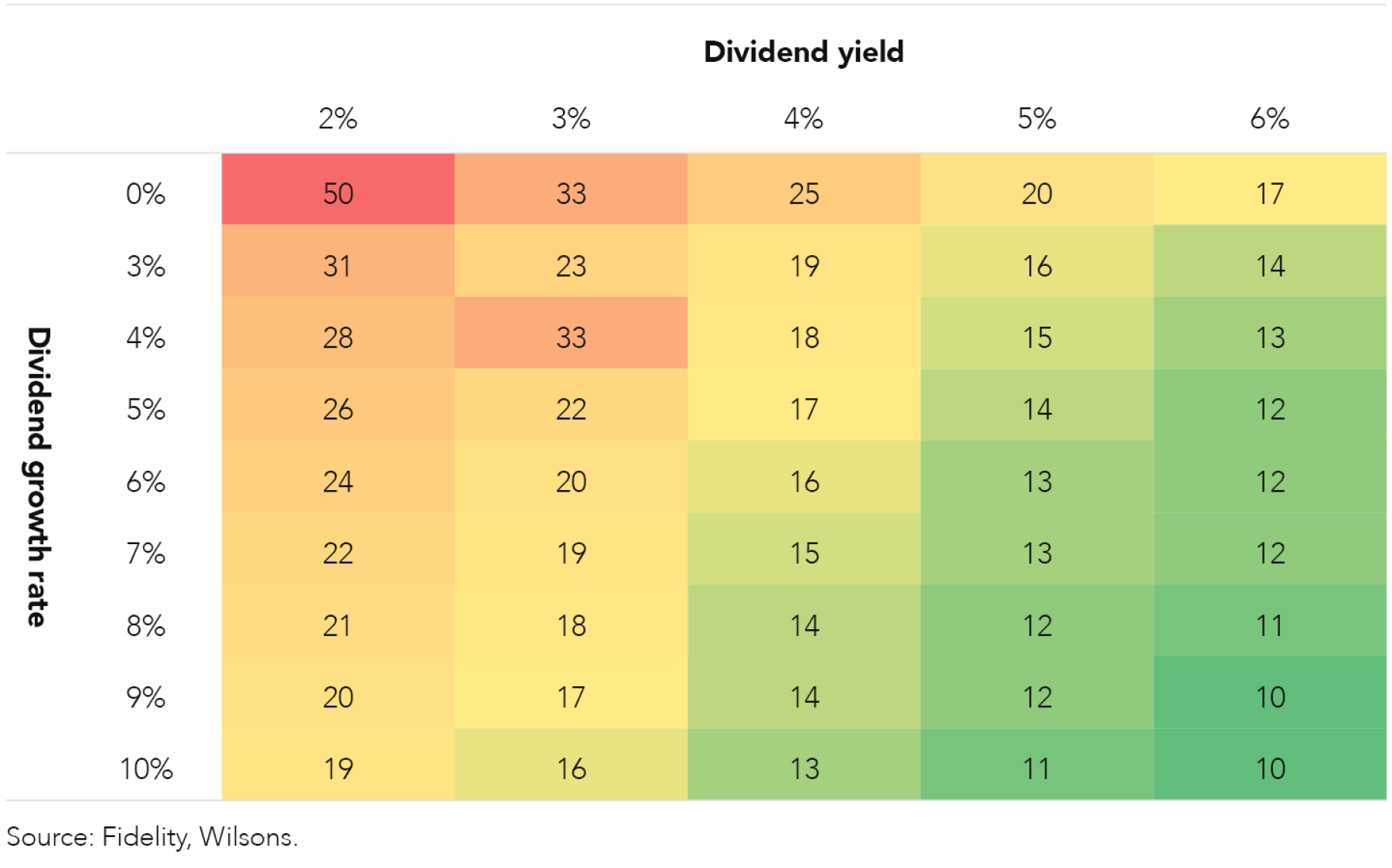

What constitutes a "high-yield" dividend? It's generally considered a dividend yield significantly above the average market yield. However, simply chasing the highest yield is a risky strategy. It's crucial to understand the difference between dividend yield and dividend payout ratio, and to assess the sustainability of those dividends.

- Dividend Yield: This is the annual dividend per share divided by the stock price. A higher yield suggests a potentially larger return on your investment.

- Dividend Payout Ratio: This represents the percentage of a company's earnings paid out as dividends. A high payout ratio (e.g., above 70%) might signal potential future dividend cuts if the company's earnings decline.

Chasing extremely high yields without proper due diligence can be dangerous. Always analyze a company's financial health before investing. Look at factors like:

- Debt levels: High debt can strain a company's ability to pay dividends consistently.

- Earnings growth: Consistent earnings growth is essential for sustainable dividend payouts.

- Free cash flow: This indicates the company's ability to generate cash after covering operating expenses and capital expenditures. A healthy free cash flow is vital for dividend sustainability.

Identifying Reliable High-Yield Dividend Stocks

Finding reliable high-yield dividend stocks requires a strategic approach. You can use online stock screeners to filter for stocks meeting your criteria. Look for:

- High dividend yield: Set a minimum yield threshold based on your investment goals.

- Low payout ratio: This indicates a greater margin of safety for future dividend payments.

- Strong financial health: Use metrics like debt-to-equity ratio, return on equity (ROE), and free cash flow to assess financial strength.

Diversification is key! Don't put all your eggs in one basket. Spread your investments across different sectors to mitigate risk. Sectors known for high dividend yields include:

- Real Estate Investment Trusts (REITs): These companies own and operate income-producing real estate.

- Utilities: These companies provide essential services like electricity and water, often paying consistent dividends.

- Consumer Staples: Companies that provide everyday necessities tend to have stable dividends.

Building a Simple, Diversified Portfolio

The Power of Diversification

Diversification is crucial for minimizing risk in your high-yield dividend portfolio. It protects you from significant losses if one investment performs poorly.

- Diversify across sectors: Don't concentrate your investments in just one industry.

- Diversify by market cap: Include a mix of large-cap, mid-cap, and small-cap stocks.

- Diversify geographically: Consider international stocks to further reduce risk.

A well-diversified portfolio might contain 10-20 different stocks, depending on your risk tolerance and investment goals.

Dollar-Cost Averaging (DCA) for Consistent Growth

Dollar-cost averaging (DCA) is a simple yet effective strategy. It involves investing a fixed amount of money at regular intervals, regardless of the market price.

- Reduces market volatility impact: By investing consistently, you avoid the risk of investing a large sum right before a market downturn.

- Smooths out your average cost per share: This helps maximize returns over the long term.

Consider a monthly or quarterly investment schedule to maintain consistency.

Monitoring and Rebalancing Your High-Yield Dividend Portfolio

Regular Portfolio Reviews

Regularly reviewing your portfolio is essential. This helps you identify:

- Underperforming stocks: These may need to be replaced with better-performing alternatives.

- Changing market conditions: Adjust your strategy accordingly.

- Company-specific news: Stay informed about any significant events impacting your holdings.

Aim for at least an annual review, but more frequent checks are beneficial.

Rebalancing for Optimal Allocation

Rebalancing involves adjusting your portfolio to maintain your target asset allocation. This helps you manage risk and capitalize on market opportunities.

- Sell over-performing assets: Take profits from stocks that have significantly outperformed their targets.

- Buy under-performing assets: Reinvest those profits in stocks that are lagging behind.

Maintaining a disciplined rebalancing strategy ensures your portfolio stays aligned with your risk tolerance and investment goals.

Conclusion

Building a successful high-yield dividend strategy hinges on simplicity, diversification, consistent investment, and regular monitoring. A well-structured high-yield dividend portfolio can provide a reliable stream of passive income and contribute significantly to long-term wealth creation. Remember, a simple, well-managed approach is often the most effective.

Ready to unlock the power of simplicity and build your own high-yield dividend strategy? Start researching reliable high-yield dividend stocks today and begin building your path to financial freedom! Learn more about effective high-yield dividend investing techniques and start building your passive income stream.

Featured Posts

-

Nba Sixth Man Of The Year Payton Pritchards Triumph

May 11, 2025

Nba Sixth Man Of The Year Payton Pritchards Triumph

May 11, 2025 -

Upcoming Championships Stadium Track To Be Resurfaced

May 11, 2025

Upcoming Championships Stadium Track To Be Resurfaced

May 11, 2025 -

Medieval Illustrations Merlin And Arthurs Book Cover Depiction

May 11, 2025

Medieval Illustrations Merlin And Arthurs Book Cover Depiction

May 11, 2025 -

Houston Astros Foundation College Classic Top College Baseball Teams Face Off

May 11, 2025

Houston Astros Foundation College Classic Top College Baseball Teams Face Off

May 11, 2025 -

Lily Collins Calvin Klein Campaign A Look At The Images

May 11, 2025

Lily Collins Calvin Klein Campaign A Look At The Images

May 11, 2025