The Recent Market Dip: A Case Study In Investor Behavior

Table of Contents

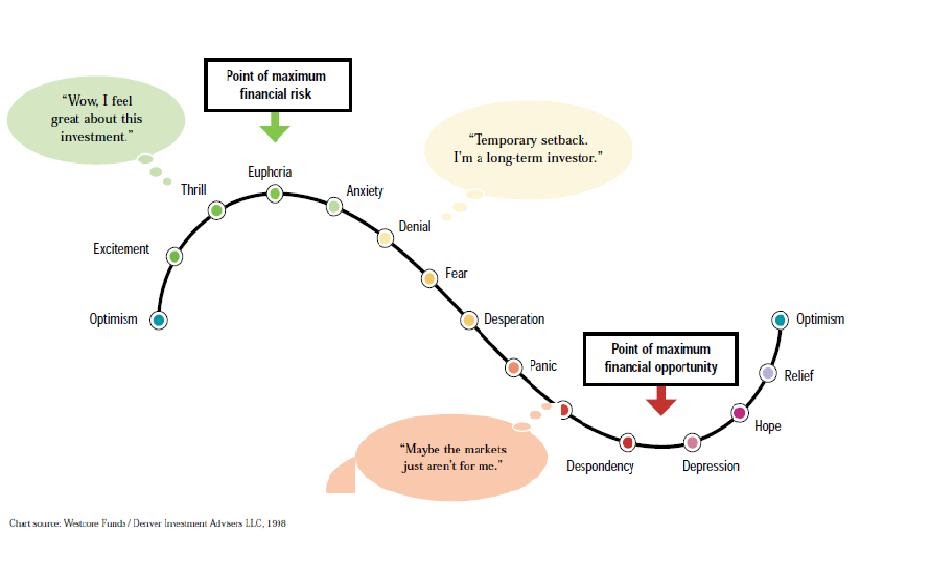

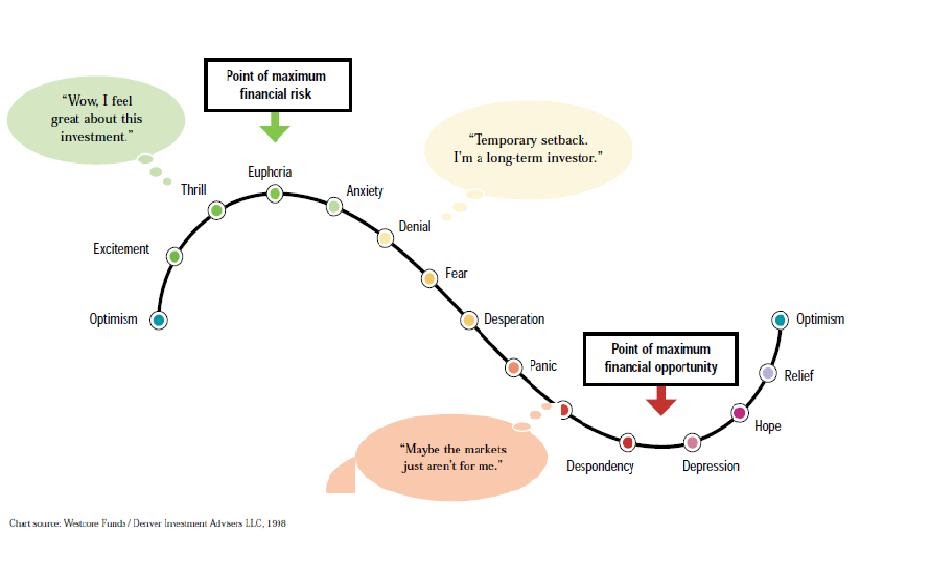

The Psychology of a Market Dip

This section explores the emotional responses of investors to market downturns. Understanding these psychological factors is crucial for making rational investment decisions, even during periods of significant market volatility and potential market corrections.

Fear and Panic Selling

The herd mentality plays a significant role during market dips. Fear, a powerful emotion, often overrides rational decision-making, leading to panic selling. This behavior exacerbates the market dip, creating a self-fulfilling prophecy of decline. We've seen this in historical market dips, such as the dot-com bubble burst and the 2008 financial crisis, where panic selling amplified the initial downturn.

- Increased trading volume: Panic selling leads to a surge in trading activity as investors rush to exit their positions.

- Sharp price declines: The sudden influx of sell orders overwhelms buy orders, causing prices to plummet rapidly.

- Loss aversion bias: Investors are often more sensitive to losses than gains, making them more likely to sell during a dip to avoid further losses, even if it's a temporary setback.

Greed and Overconfidence

Conversely, periods of market growth often breed overconfidence and greed. Investors may become overly optimistic, ignoring risk factors and chasing high returns. This behavior can lead to risky investments and amplified losses during a market dip. Many investors who experienced significant losses during the recent downturn were those who had become overly confident in the market's continued upward trajectory.

- Ignoring risk factors: Overconfidence leads to neglecting fundamental analysis and due diligence.

- Chasing high returns: The pursuit of quick profits without considering risk can result in substantial losses during a market correction.

- Ignoring market signals: Overconfident investors may dismiss warning signs and continue investing aggressively even when market indicators suggest a potential downturn.

Economic Factors Contributing to the Market Dip

Analyzing the underlying economic factors that trigger market downturns is equally important. These factors often interact in complex ways, creating a perfect storm for a significant market correction or a major market dip.

Inflation and Interest Rate Hikes

Rising inflation and subsequent interest rate hikes by central banks significantly impact market valuations. Higher interest rates increase borrowing costs for businesses and consumers, reducing spending and potentially leading to decreased corporate profits. This relationship between monetary policy and market dips is well-documented.

- Reduced consumer spending: Higher interest rates make borrowing more expensive, impacting consumer confidence and spending.

- Increased borrowing costs: Businesses face higher costs for expansion and operations, impacting profitability.

- Decreased corporate profits: Reduced consumer spending and higher borrowing costs can lead to lower corporate earnings, putting downward pressure on stock prices.

Geopolitical Uncertainty

Geopolitical events and instability play a crucial role in influencing market sentiment. Unexpected global events, such as wars, political upheavals, or major international crises, can trigger market dips by creating uncertainty and fear among investors.

- Supply chain disruptions: Geopolitical instability often leads to disruptions in global supply chains, impacting businesses and consumer prices.

- Trade wars: Trade disputes and tariffs can negatively impact international trade and economic growth, creating market volatility.

- Political instability: Uncertainty surrounding political leadership and policy changes can lead to investor caution and market declines.

Investor Strategies During a Market Dip

Navigating market downturns requires a well-defined investment strategy. A long-term perspective and disciplined approach can help investors mitigate risk and even capitalize on opportunities during a market dip.

Long-Term Investing and Dollar-Cost Averaging

A long-term investment horizon is crucial for weathering short-term volatility. Dollar-cost averaging, a strategy involving regular investments regardless of market fluctuations, can help mitigate risk during a market dip by averaging the purchase price over time.

- Diversification: Spreading investments across different asset classes reduces overall portfolio risk.

- Risk tolerance: Understanding your personal risk tolerance is essential for making informed investment decisions.

- Rebalancing portfolio: Regularly rebalancing your portfolio helps maintain your desired asset allocation and manage risk.

Analyzing Market Trends and Identifying Opportunities

Fundamental analysis, evaluating a company's intrinsic value, becomes particularly important during market corrections. Identifying undervalued assets can present significant investment opportunities during a market dip.

- Fundamental analysis: Thoroughly researching a company's financial health and future prospects.

- Technical analysis: Using charts and indicators to identify potential entry and exit points for investments.

- Value investing: Focusing on companies trading below their intrinsic value, offering potential for significant growth.

Conclusion

The recent market dip serves as a powerful reminder of the inherent volatility in financial markets and the importance of understanding investor behavior. By analyzing both the psychological and economic factors contributing to these downturns, investors can develop more robust strategies to navigate future market dips and even capitalize on potential opportunities. Remember, reacting rationally and with a long-term perspective is key to successfully weathering market fluctuations. Learn from this market dip and continue to educate yourself on effective investment strategies to prepare for future challenges. Don't let the fear of a market dip paralyze your investments; instead, use the knowledge gained to make informed decisions that align with your financial goals.

Featured Posts

-

Deportation Case Harvard Researchers Future Hangs In The Balance In Louisiana

Apr 28, 2025

Deportation Case Harvard Researchers Future Hangs In The Balance In Louisiana

Apr 28, 2025 -

Western Automakers In China Challenges And Opportunities Beyond Bmw And Porsche

Apr 28, 2025

Western Automakers In China Challenges And Opportunities Beyond Bmw And Porsche

Apr 28, 2025 -

The Growing Problem Of Truck Bloat In America Exploring Potential Antidotes

Apr 28, 2025

The Growing Problem Of Truck Bloat In America Exploring Potential Antidotes

Apr 28, 2025 -

75

Apr 28, 2025

75

Apr 28, 2025 -

Ftc Challenges Court Ruling On Microsoft Activision Merger

Apr 28, 2025

Ftc Challenges Court Ruling On Microsoft Activision Merger

Apr 28, 2025

Latest Posts

-

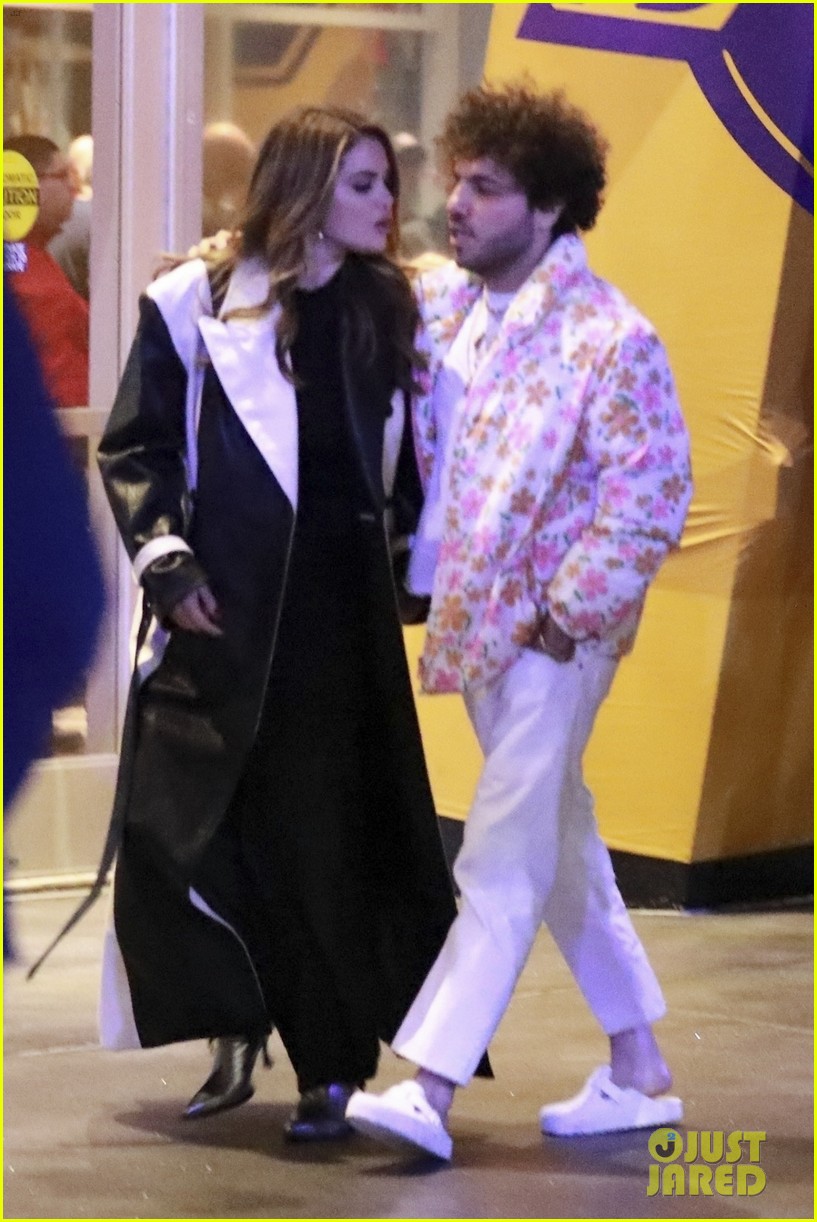

Selena Gomez And Benny Blanco Accidental Glimpse Into Their Private Life

May 12, 2025

Selena Gomez And Benny Blanco Accidental Glimpse Into Their Private Life

May 12, 2025 -

Selena Gomezs Edgy Leather Dress Get The Look

May 12, 2025

Selena Gomezs Edgy Leather Dress Get The Look

May 12, 2025 -

Selena Gomez And Benny Blancos Wedding Plans The First Dance Update

May 12, 2025

Selena Gomez And Benny Blancos Wedding Plans The First Dance Update

May 12, 2025 -

Selena Gomezs Black Boots And Leather Dress A Chic Look

May 12, 2025

Selena Gomezs Black Boots And Leather Dress A Chic Look

May 12, 2025 -

Selena Gomezs Benny Blanco Ring From 3000 To 12

May 12, 2025

Selena Gomezs Benny Blanco Ring From 3000 To 12

May 12, 2025