The Return Of Angry Elon: What It Means For Tesla Investors

Table of Contents

Market Volatility and Tesla Stock Performance

The correlation between Elon Musk's actions and Tesla's stock price fluctuations is undeniable. His pronouncements, whether on Twitter or in official statements, often trigger significant swings in the market. This "Tesla stock volatility" is a major concern for investors.

- Examples: Musk's tweets about taking Tesla private in 2018, his comments on Bitcoin, and his recent actions regarding Twitter have all resulted in dramatic shifts in Tesla's share price. These events showcase the significant impact of his pronouncements on investor sentiment.

- Data Points: Comparing Tesla's stock performance to other major automotive companies reveals a significantly higher degree of volatility. Tesla's stock price often experiences far more dramatic daily and weekly swings than its competitors, directly linked to investor perception of Musk's actions and pronouncements. This "Elon Musk's impact on Tesla" is a key factor contributing to this higher risk profile.

- Short-term vs. Long-term: While short-term gains and losses are dramatic, the long-term impact on investor confidence remains a critical question. Short-term traders might capitalize on the volatility, but long-term investors need to assess whether Musk's behavior poses a systemic risk to the company's long-term value and sustainability. Understanding these "Tesla investment risks" is crucial.

The Impact on Investor Sentiment and Confidence

Elon Musk's behavior significantly impacts investor sentiment and confidence. Periods of controversy often see a decline in investor confidence, leading to sell-offs and price drops.

- Investor Confidence Levels: Analyzing investor confidence surveys and market sentiment indicators reveals a clear correlation between negative news about Musk and a decrease in positive sentiment toward Tesla. Conversely, periods of positive news and stable leadership often translate to increased investor optimism.

- News and Public Opinion: News articles and social media discussions often reflect the prevailing investor sentiment. Monitoring these sources provides crucial insights into the overall market perception of Tesla and the impact of "Elon Musk's reputation" on its value.

- Brand Damage: While Tesla's innovative technology and market position are undeniably strong, the potential for long-term damage to the brand image due to Musk's erratic behavior cannot be discounted. This "Tesla investor sentiment" is a key factor determining the company’s long-term sustainability.

Analyzing the Long-Term Implications for Tesla

The long-term consequences of Elon Musk's actions on Tesla are far-reaching and require careful consideration. The unpredictability surrounding his leadership presents both opportunities and challenges.

- Growth and Expansion: Musk's actions can influence Tesla's ability to attract investment, secure crucial partnerships, and execute its ambitious growth plans. This impacts the long-term "Tesla's future" and its ability to maintain its market leadership.

- Talent Acquisition and Retention: The uncertainty surrounding Musk's leadership could make it difficult for Tesla to attract and retain top talent, hindering its ability to innovate and compete effectively. A negative perception of "Elon Musk's leadership" can affect employee morale and productivity.

- Partnerships and Collaborations: Potential partners might hesitate to collaborate with Tesla due to the risks associated with Musk's unpredictable behavior. This potential impact on partnerships could affect Tesla's ability to grow and innovate. This is crucial for Tesla's "sustainability."

Strategies for Tesla Investors

Navigating the complexities of Tesla investment requires a strategic approach. Investors need to consider several factors to mitigate risks and potentially capitalize on opportunities.

- Diversification: Diversifying your investment portfolio is crucial to mitigate the risks associated with Tesla's volatility. Don't put all your eggs in one basket.

- Long-term vs. Short-term: Long-term investors with a strong belief in Tesla's technology and future might be less affected by short-term fluctuations. Short-term investors, however, need to be prepared for significant price swings.

- Monitoring News and Trends: Staying informed about market trends, news related to Tesla, and Elon Musk's actions is crucial for making informed investment decisions. This "Tesla investment strategy" is key to success. Understanding how to "manage Tesla investment risk" is paramount.

Conclusion: Navigating the Unpredictability of "Angry Elon" and Tesla Investments

The impact of Elon Musk's behavior on Tesla investors is undeniable. The volatility of Tesla's stock price highlights the need for a careful and informed investment strategy. Understanding the potential for both significant gains and losses is crucial. The key takeaways include the direct correlation between Musk's actions and market fluctuations, the impact on investor sentiment, and the potential long-term implications for Tesla's growth and sustainability.

To successfully navigate the challenges of investing in Tesla in the age of "Angry Elon," conduct thorough research, actively monitor market trends and news, and develop a robust investment strategy that aligns with your risk tolerance. By understanding the impact of Angry Elon on Tesla's stock price and developing a smart "Tesla investment strategy," you can better "manage your Tesla investments wisely" and "assess the risks of Angry Elon on your Tesla portfolio."

Featured Posts

-

The Schumacher Phenomenon Exploring His Image And Reputation Among Competitors

May 25, 2025

The Schumacher Phenomenon Exploring His Image And Reputation Among Competitors

May 25, 2025 -

Den Yparxei Endiaferon Tis Mercedes Gia Ton Ferstapen

May 25, 2025

Den Yparxei Endiaferon Tis Mercedes Gia Ton Ferstapen

May 25, 2025 -

The Ultimate Guide To Escaping To The Country

May 25, 2025

The Ultimate Guide To Escaping To The Country

May 25, 2025 -

Hawaii Keiki Showcase Artistic Talents Sew A Lei For Memorial Day Poster Contest

May 25, 2025

Hawaii Keiki Showcase Artistic Talents Sew A Lei For Memorial Day Poster Contest

May 25, 2025 -

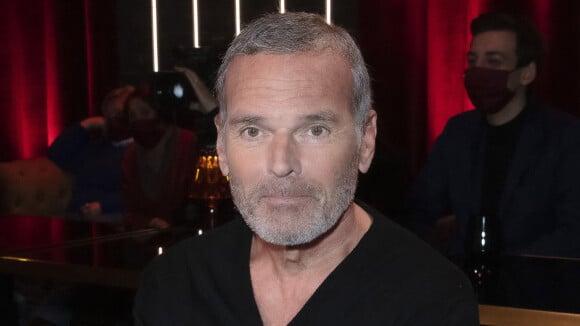

La Replique Cinglante De Thierry Ardisson A Laurent Baffie Essaie De Parler Pour Toi

May 25, 2025

La Replique Cinglante De Thierry Ardisson A Laurent Baffie Essaie De Parler Pour Toi

May 25, 2025