The Trade War And Crypto: A Single Coin's Potential For Growth

Table of Contents

The Impact of Trade Wars on Traditional Markets

Trade wars, characterized by tariffs, sanctions, and retaliatory measures, inject significant uncertainty into traditional markets. This uncertainty leads to volatility in stocks, bonds, and commodities, impacting investor confidence. The imposition of tariffs, for instance, disrupts supply chains, increases prices for consumers, and reduces overall economic growth. This creates a ripple effect, impacting various sectors and leading to decreased investor confidence.

- Increased market volatility: Tariffs and sanctions create unpredictable market conditions.

- Decreased investor confidence: Uncertainty regarding future trade policies discourages investment.

- Potential for capital flight: Investors seek safer havens for their assets.

Cryptocurrency as a Hedge Against Trade War Uncertainty

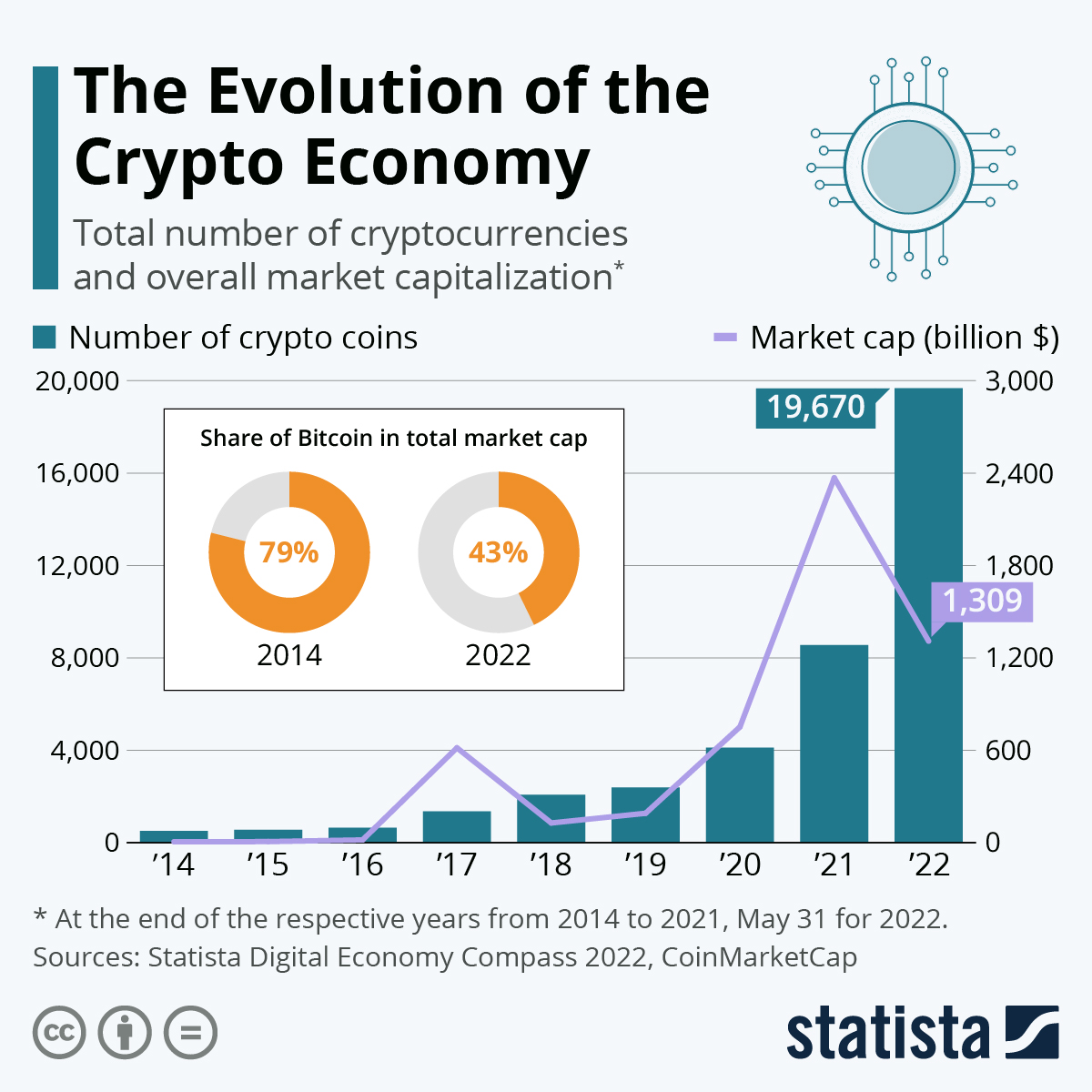

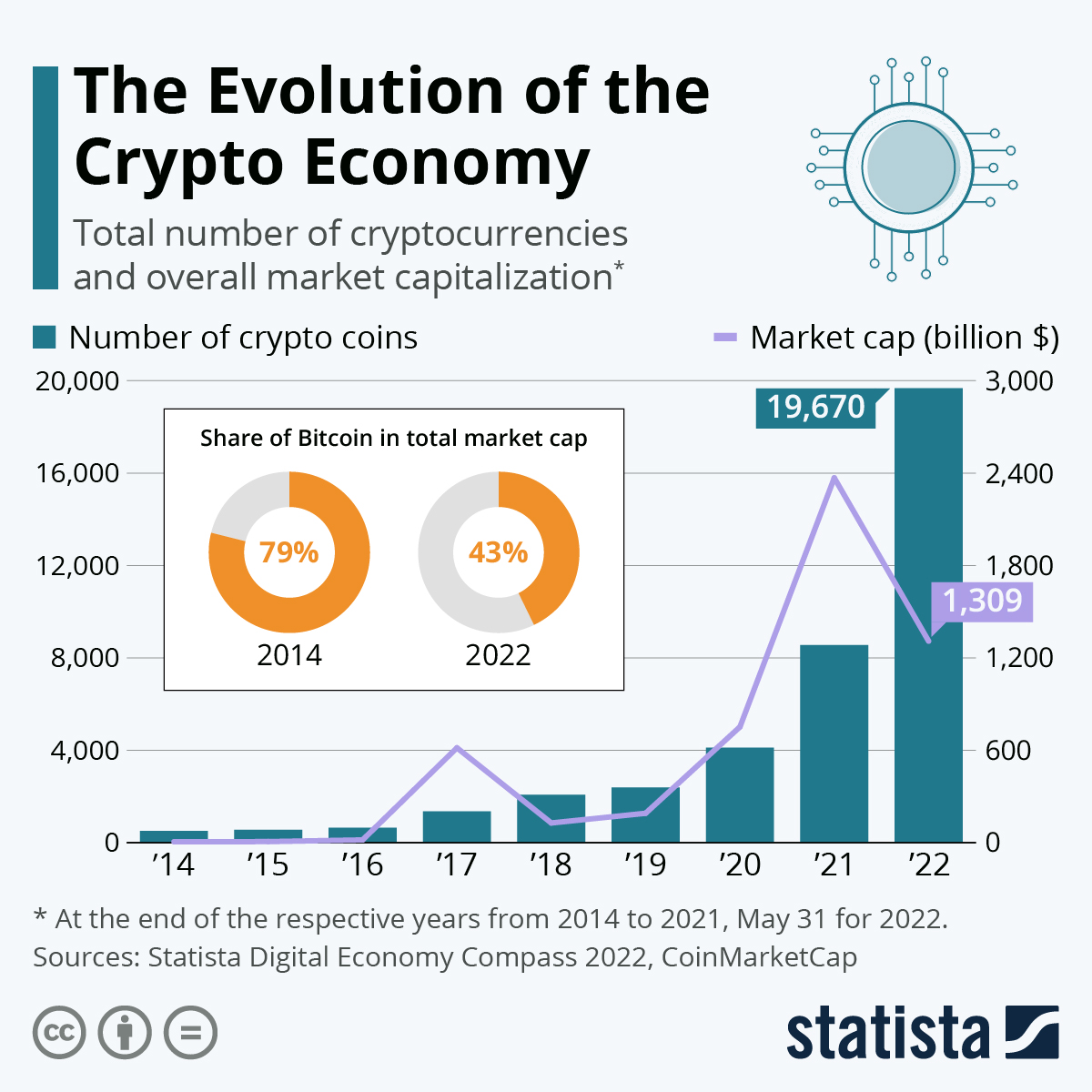

Cryptocurrencies, with their decentralized nature, offer a potential alternative to traditional assets during times of geopolitical instability. Unlike traditional assets tied to specific nations or economies, cryptocurrencies operate on a global, decentralized network, reducing their susceptibility to individual country policies.

- Decentralization: Reduces reliance on government policies and regulations.

- Faster transactions: Bypasses traditional financial institutions, potentially streamlining processes.

- Increased liquidity: Compared to some illiquid assets, cryptocurrencies often offer relatively easy buying and selling.

Bitcoin – A Case Study

Bitcoin, the original and most established cryptocurrency, presents a compelling case study. Its decentralized nature, robust technology, and widespread adoption make it a strong contender for growth in the face of trade war uncertainty.

- Technological advancements: Bitcoin's underlying blockchain technology continues to evolve, enhancing its security and efficiency.

- Strong community support: A large and active community ensures continued development and adoption.

- Real-world use cases: Bitcoin is increasingly being accepted by businesses and individuals as a form of payment and a store of value.

- Competitive advantages: Its first-mover advantage and established brand recognition set it apart from many newer cryptocurrencies.

Analyzing Bitcoin's Growth Potential

Bitcoin's growth potential, in the context of the ongoing trade war, is significant. While predicting the future price of any cryptocurrency is inherently speculative, several factors point towards potential growth.

- Price predictions: While market analysis offers diverse predictions, the overall trend suggests a potential for growth based on increased adoption and scarcity.

- Technological roadmap: Continued development of the Bitcoin network enhances its scalability and security.

- Potential adoption by businesses and institutions: Growing institutional interest in Bitcoin suggests further market maturation.

- Risk assessment: While Bitcoin offers potential benefits, it's crucial to acknowledge the inherent risks associated with cryptocurrency investments, including volatility and potential regulatory changes.

Conclusion

In conclusion, the impact of the trade war on traditional markets has created a climate of uncertainty, pushing investors to seek alternative assets. Bitcoin, with its decentralized structure, robust technology, and growing adoption, presents a compelling case for continued growth in this volatile environment. The unique characteristics of Bitcoin, discussed above, position it as a potential hedge against the negative effects of global trade tensions. Therefore, the trade war and crypto, specifically Bitcoin, are intricately connected, opening up new opportunities for investors. Learn more about Bitcoin and its potential in the face of the trade war, but always remember to conduct thorough due diligence and understand the inherent risks before investing in cryptocurrencies. This information is not financial advice.

Featured Posts

-

Elizabeth City Police Search For Vehicle Break In Suspect

May 09, 2025

Elizabeth City Police Search For Vehicle Break In Suspect

May 09, 2025 -

Palantir Stock In 2025 40 Growth Potential And Investment Decision

May 09, 2025

Palantir Stock In 2025 40 Growth Potential And Investment Decision

May 09, 2025 -

New Threats Prompt Police Investigation Into Madeleine Mc Cann Parents Safety

May 09, 2025

New Threats Prompt Police Investigation Into Madeleine Mc Cann Parents Safety

May 09, 2025 -

Addressing The Nursing Shortage Community Colleges Receive 56 Million

May 09, 2025

Addressing The Nursing Shortage Community Colleges Receive 56 Million

May 09, 2025 -

Revealed Franco Colapintos Exclusive Alpine Test At Monza

May 09, 2025

Revealed Franco Colapintos Exclusive Alpine Test At Monza

May 09, 2025