The Trade War's Impact On Crypto: One Cryptocurrency That Could Thrive

Table of Contents

H2: The Trade War and Global Economic Instability

Trade wars, characterized by escalating tariffs and trade restrictions, significantly disrupt global markets. The resulting uncertainty creates a ripple effect, impacting investor confidence and fueling market volatility. This instability stems from several factors:

- Increased market volatility and investor uncertainty: The unpredictable nature of trade policies leads to unpredictable market movements, making it difficult for investors to plan and execute strategies.

- Reduced global trade and economic slowdown: Tariffs and trade barriers stifle international commerce, leading to slower economic growth and potentially even recession in affected sectors.

- Impact on traditional financial markets (stocks, bonds): The uncertainty spills over into traditional markets, causing fluctuations in stock prices and bond yields as investors reassess risk.

- Flight to safety among investors: As investors seek to protect their capital, they often move towards perceived "safe haven" assets, such as gold or government bonds. However, the cryptocurrency market presents an alternative "safe haven" for some investors.

These factors contribute to a climate of global economic instability, creating an environment where alternative assets, such as certain cryptocurrencies, might find increased appeal.

H2: Cryptocurrencies as a Hedge Against Economic Uncertainty

Cryptocurrencies, particularly decentralized ones like Bitcoin, are increasingly viewed as a potential hedge against traditional market instability. Several factors contribute to this perception:

- Decentralized nature of cryptocurrencies makes them less susceptible to geopolitical events: Unlike traditional financial systems, which are often influenced by government policies and geopolitical events, cryptocurrencies operate on a decentralized network, making them less vulnerable to such influences.

- Potential for price appreciation during periods of uncertainty: As investors seek alternatives, the demand for certain cryptocurrencies can increase, potentially leading to price appreciation.

- Use of cryptocurrencies to bypass traditional financial systems: Cryptocurrencies offer a way to transact and store value outside traditional banking systems, which can be advantageous during periods of economic instability or currency devaluation.

- Increased adoption during times of economic crisis: Historically, periods of economic instability have often led to increased adoption of alternative assets, and cryptocurrencies are no exception.

The inherent characteristics of cryptocurrencies make them an attractive option for investors seeking to diversify their portfolios and mitigate risk during times of global uncertainty.

H3: Specific Cryptocurrency Analysis: Bitcoin

Bitcoin, the first and most well-known cryptocurrency, stands out as a potential beneficiary of the trade war's impact. Several reasons support this assertion:

- Bitcoin's history as a store of value during periods of economic turmoil: Bitcoin has demonstrated resilience in past periods of economic uncertainty, often experiencing price increases amidst market downturns.

- Limited supply of Bitcoin as a factor influencing its price: Bitcoin's fixed supply of 21 million coins creates scarcity, potentially driving up its value as demand increases.

- Increasing institutional adoption of Bitcoin: Major financial institutions are increasingly incorporating Bitcoin into their investment strategies, lending credibility and further driving demand.

- Bitcoin's decentralized and secure nature: Its decentralized architecture and robust cryptographic security offer a compelling alternative to traditional financial systems.

These factors position Bitcoin as a potentially resilient cryptocurrency during a period of heightened economic instability.

H2: Risks and Considerations

While cryptocurrencies like Bitcoin offer potential advantages, investing in them during times of trade war uncertainty also carries risks:

- Volatility of cryptocurrency markets: Cryptocurrency markets are known for their price volatility, meaning significant price fluctuations can occur in short periods.

- Regulatory uncertainty surrounding cryptocurrencies: The regulatory landscape for cryptocurrencies is still evolving, creating uncertainty for investors.

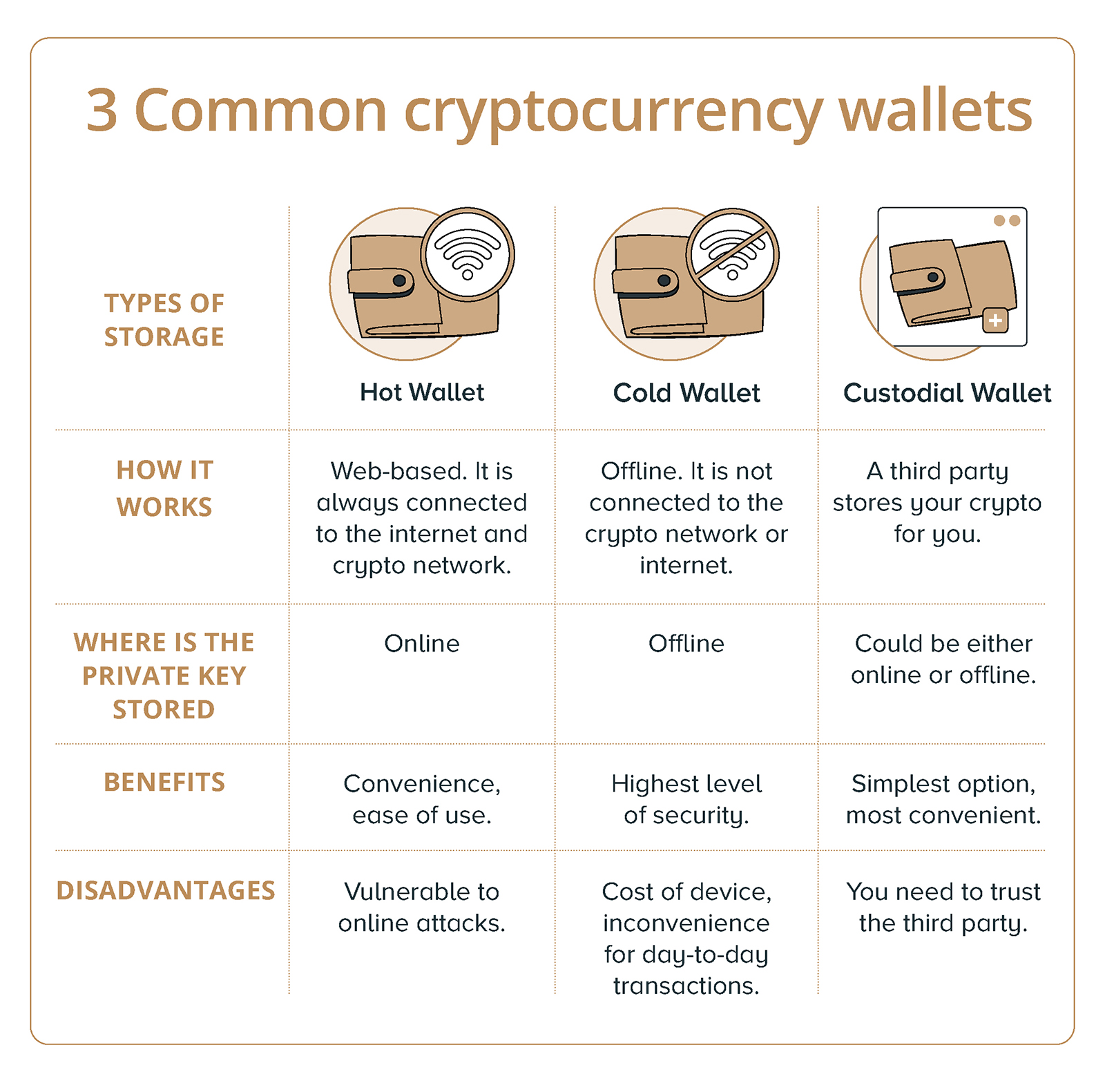

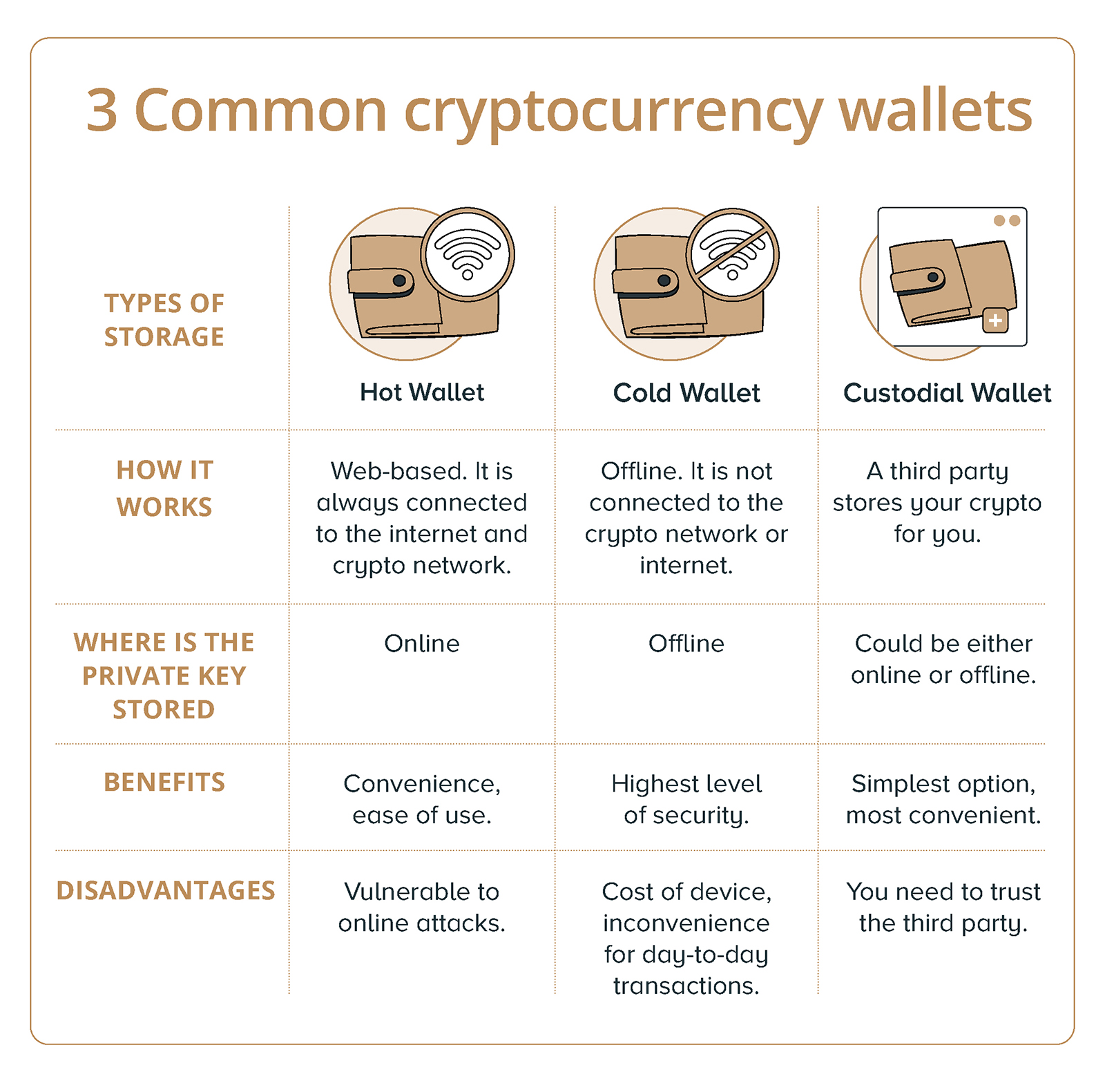

- Security risks associated with holding cryptocurrencies: Investors need to take precautions to safeguard their private keys and protect their cryptocurrency holdings from theft or loss.

- Potential for scams and fraudulent activity: The cryptocurrency market is susceptible to scams and fraudulent activities, requiring investors to exercise due diligence.

It's crucial to acknowledge these risks and to engage in informed investing practices.

3. Conclusion

The trade war's impact on the global economy creates uncertainty, prompting investors to seek resilient assets. Cryptocurrencies, particularly Bitcoin, with their decentralized nature and potential for price appreciation, present a compelling alternative. Bitcoin’s limited supply, growing institutional adoption, and historical performance during economic turmoil contribute to its potential to thrive during this period. However, it is vital to remember the inherent volatility and risks associated with cryptocurrency investment. Thorough research and understanding of the market are essential before investing in any cryptocurrency. Learn more about how to navigate the impact of the trade war on your cryptocurrency investments and explore potential opportunities in this evolving market. Consider diversifying your portfolio with resilient cryptocurrencies like Bitcoin, but always remember to conduct thorough due diligence.

Featured Posts

-

Air Traffic Controller Safety Warnings Preceded Newark System Failure

May 09, 2025

Air Traffic Controller Safety Warnings Preceded Newark System Failure

May 09, 2025 -

Edmonton Nordic Spa Project Rezoning Hurdle Cleared

May 09, 2025

Edmonton Nordic Spa Project Rezoning Hurdle Cleared

May 09, 2025 -

Prognozirovanie Snegopadov V Mae Pochemu Sinoptiki Oshibayutsya

May 09, 2025

Prognozirovanie Snegopadov V Mae Pochemu Sinoptiki Oshibayutsya

May 09, 2025 -

Silnye Snegopady Preduprezhdenie Dlya Zhiteley Yaroslavskoy Oblasti

May 09, 2025

Silnye Snegopady Preduprezhdenie Dlya Zhiteley Yaroslavskoy Oblasti

May 09, 2025 -

Beyonces Cowboy Carter Doubled Streams Post Tour Debut

May 09, 2025

Beyonces Cowboy Carter Doubled Streams Post Tour Debut

May 09, 2025