The Trump Tax Bill: Final Version Passes The House

Table of Contents

The highly anticipated Trump tax bill has officially passed the House, marking a significant legislative victory for the administration. This landmark legislation, which underwent considerable debate and revision, introduces sweeping changes to the US tax code. This article will break down the key elements of the final version, exploring its potential effects on individuals, businesses, and the overall economy. We'll delve into the details so you can understand the impact of this historic tax reform.

Key Provisions of the Passed Tax Bill

Individual Tax Changes

The Trump tax bill significantly altered individual income tax rates and deductions. Key changes included:

- Increased Standard Deduction: The standard deduction was substantially increased for both single filers and married couples, simplifying tax preparation for many Americans. This change benefited taxpayers who previously itemized deductions. For example, the standard deduction for single filers doubled.

- Modified Child Tax Credit: The child tax credit was expanded, increasing the maximum credit amount and making it partially refundable. This provided greater tax relief to families with children. The maximum credit was raised significantly, impacting millions of families.

- Changes to Itemized Deductions: Several itemized deductions were limited or eliminated. This included restrictions on state and local tax (SALT) deductions, impacting high-tax states disproportionately. The limitations on mortgage interest deductions also affected some homeowners.

These changes disproportionately affected different income levels. High-income earners saw a greater percentage reduction in their tax liability due to lower tax brackets, while the impact on middle and lower income individuals varied depending on their specific circumstances and deductions.

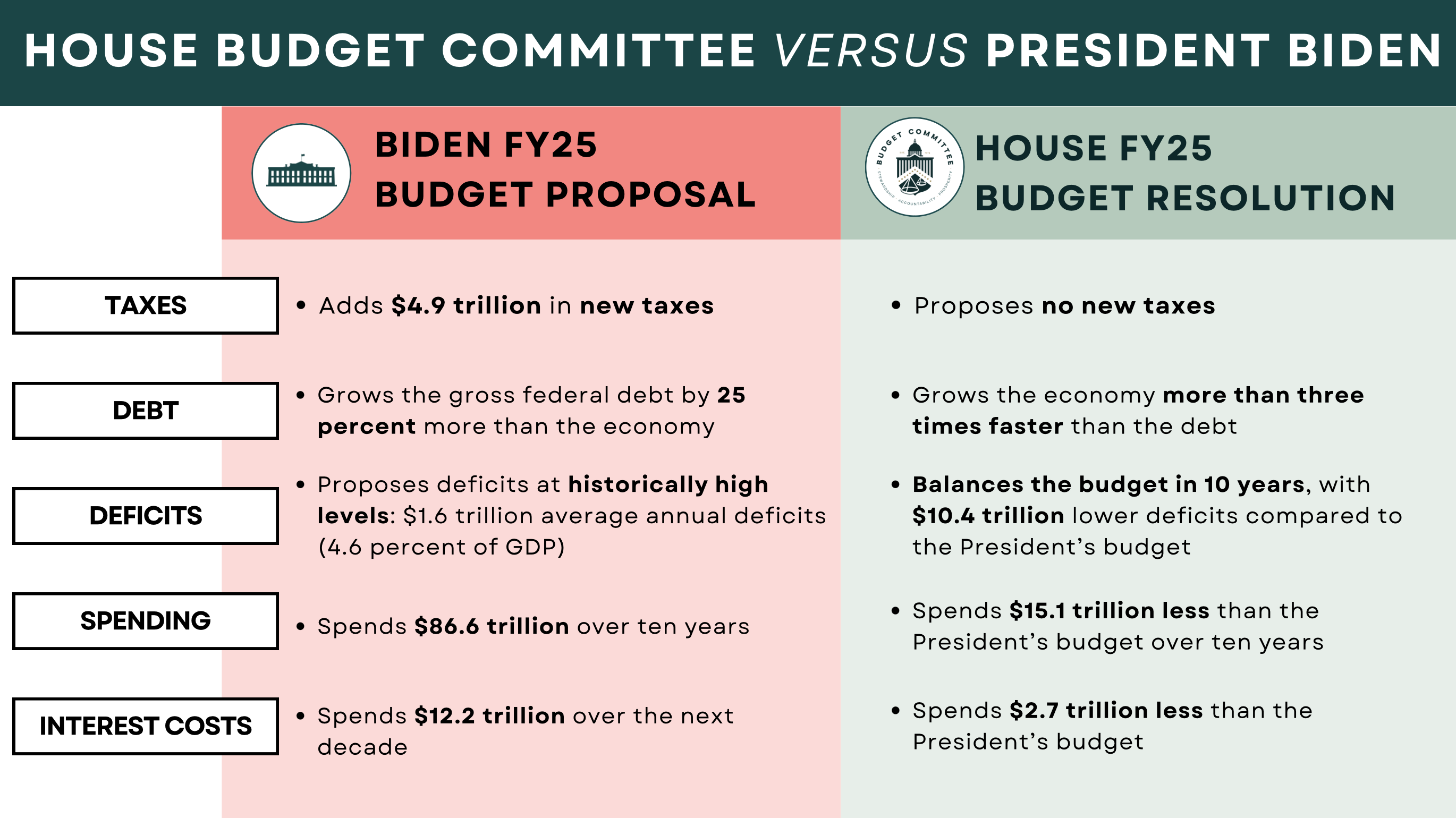

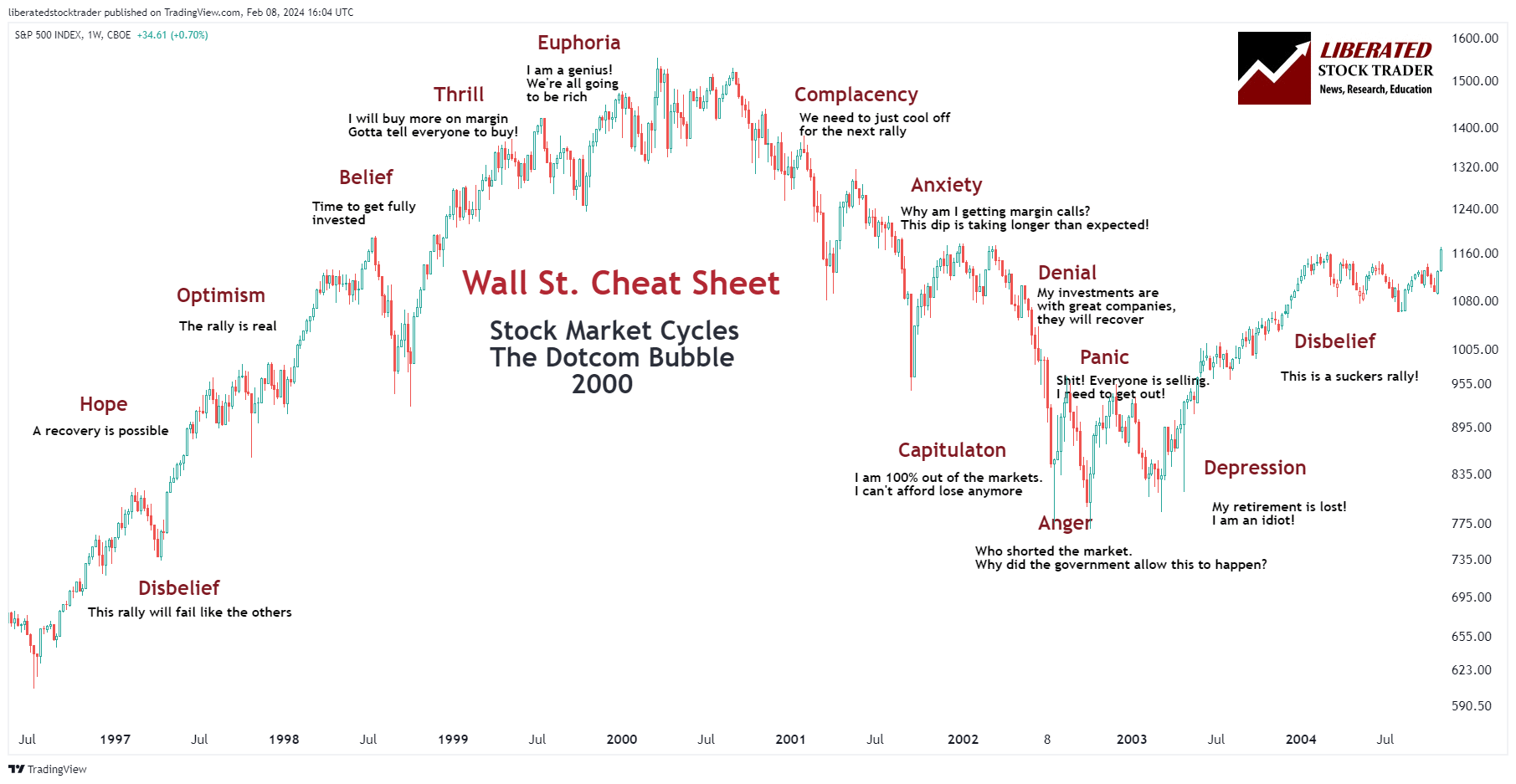

Corporate Tax Rate Reduction

A central feature of the Trump tax bill was the dramatic reduction in the corporate tax rate. The rate was slashed from 35% to 21%, a significant decrease intended to stimulate business investment and job growth.

- Arguments For: Supporters argued this reduction would boost corporate profits, leading to increased investment in capital goods, higher wages, and ultimately, faster economic growth.

- Arguments Against: Critics countered that the corporate tax cut would primarily benefit shareholders and executives, exacerbating income inequality and contributing to a larger national debt without a corresponding increase in jobs. Concerns were also raised about the potential for tax avoidance by multinational corporations.

- International Taxation: The bill included provisions aimed at reforming international taxation of corporations, seeking to prevent the shifting of profits to low-tax jurisdictions.

Changes to Pass-Through Entities

The bill also included provisions affecting pass-through entities, such as partnerships, LLCs, and sole proprietorships. These businesses don't pay corporate income tax; instead, their profits or losses are passed through to the owners' individual tax returns. The bill introduced new deductions and tax treatments designed to benefit these business owners, aiming to provide tax relief for small businesses and self-employed individuals. Specific changes varied depending on the type of pass-through entity and the owner's income.

Estate Tax Changes

The Trump tax bill significantly increased the estate tax exemption amount, effectively shielding a larger portion of inherited wealth from taxation. This change significantly reduced the number of estates subject to the estate tax, mainly benefiting wealthy families. The increased exemption amount meant that fewer estates would need to undergo complex estate planning to avoid the estate tax, streamlining the process for many.

Potential Economic Impacts of the Trump Tax Bill

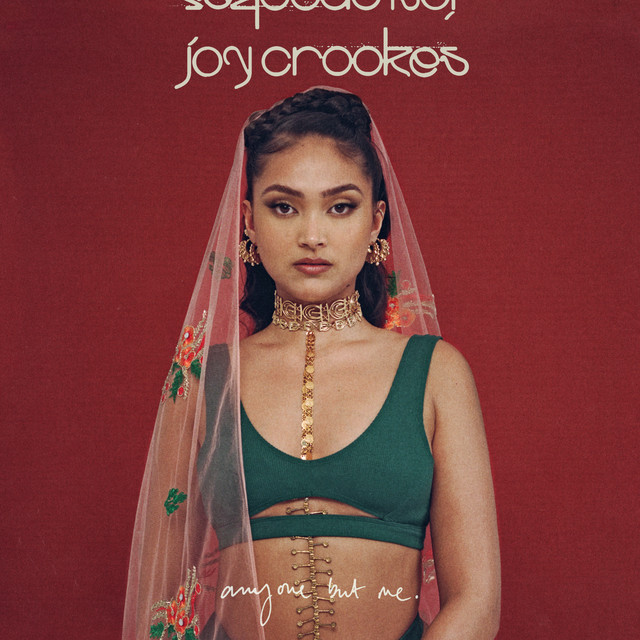

Impact on Economic Growth

The Trump administration projected significant economic growth following the passage of the tax bill. Forecasts varied widely among economists, with some predicting a noticeable increase in GDP growth and job creation, while others were more skeptical. The impact on inflation was also debated, with concerns raised about the potential for increased inflation due to increased consumer spending and business investment.

Impact on the National Debt

The tax cuts included in the Trump tax bill were expected to significantly increase the national debt. The reduction in tax revenue, coupled with increased government spending, created a larger budget deficit. The long-term fiscal consequences of these tax cuts were a major point of contention, with concerns expressed about the sustainability of the nation's debt level.

Impact on Income Inequality

The impact on income inequality was a hotly debated topic. Critics argued that the disproportionate benefit to high-income earners and corporations would worsen income inequality. Supporters countered that the overall economic growth spurred by the tax cuts would benefit all segments of the population, ultimately reducing income inequality. Empirical data on the long-term effects on income inequality were expected to emerge over time.

Reactions and Criticisms of the Trump Tax Bill

Political Responses

The Trump tax bill faced significant partisan division. Republicans largely lauded the bill as a vital step towards economic growth and job creation, while Democrats heavily criticized it for its regressive nature and its impact on the national debt.

Public Opinion

Public opinion on the bill was divided, with polls showing varying levels of support and opposition depending on the respondent's political affiliation and economic circumstances. Public perception shifted over time as the potential impacts of the bill became clearer.

Expert Analysis

Economists and tax experts offered diverse analyses of the bill's effectiveness and potential downsides. Some experts argued that the tax cuts would stimulate economic growth, while others raised concerns about their long-term fiscal sustainability and their impact on income inequality.

Conclusion

The Trump tax bill's passage represents a major shift in US tax policy. This article summarized the key provisions, including changes to individual and corporate tax rates, deductions, and credits. We explored the potential economic implications, both positive and negative, along with the various reactions and criticisms the bill has received.

Call to Action: Understanding the intricacies of the new Trump Tax Bill is crucial for individuals and businesses alike. Stay informed about potential implications by following our continued coverage on the Trump Tax Bill and its unfolding effects. Further research into your specific tax situation is recommended.

Featured Posts

-

Savannah Guthries Mid Week Today Show Co Host Swap

May 24, 2025

Savannah Guthries Mid Week Today Show Co Host Swap

May 24, 2025 -

Yevrobachennya 2025 Konchita Vurst Nazvala Chotirokh Potentsiynikh Peremozhtsiv

May 24, 2025

Yevrobachennya 2025 Konchita Vurst Nazvala Chotirokh Potentsiynikh Peremozhtsiv

May 24, 2025 -

Joy Crookes Carmen A New Single To Hear

May 24, 2025

Joy Crookes Carmen A New Single To Hear

May 24, 2025 -

Reduced Game Budgets Impact On Accessibility Features

May 24, 2025

Reduced Game Budgets Impact On Accessibility Features

May 24, 2025 -

Onrust Op Wall Street Positief Sentiment Voor De Aex

May 24, 2025

Onrust Op Wall Street Positief Sentiment Voor De Aex

May 24, 2025

Latest Posts

-

Lea Michele Daniel Radcliffe And More Support Jonathan Groffs Broadway Debut

May 24, 2025

Lea Michele Daniel Radcliffe And More Support Jonathan Groffs Broadway Debut

May 24, 2025 -

Could Jonathan Groffs Just In Time Performance Make Tony History

May 24, 2025

Could Jonathan Groffs Just In Time Performance Make Tony History

May 24, 2025 -

The Jonas Brothers Joe Jonass Response To Relationship Drama

May 24, 2025

The Jonas Brothers Joe Jonass Response To Relationship Drama

May 24, 2025 -

Just In Time And Jonathan Groff A Look At The Tony Potential

May 24, 2025

Just In Time And Jonathan Groff A Look At The Tony Potential

May 24, 2025 -

Jonathan Groffs Just In Time Opening Lea Michele Daniel Radcliffe And More Celebrate

May 24, 2025

Jonathan Groffs Just In Time Opening Lea Michele Daniel Radcliffe And More Celebrate

May 24, 2025