The Trump Tax Cut Bill: A Comprehensive Overview From House Republicans

Table of Contents

Individual Income Tax Rate Reductions

The Trump Tax Cut Bill drastically altered individual income tax brackets. House Republicans championed these changes, arguing they would stimulate economic growth by leaving more money in the hands of taxpayers. The bill lowered rates across the board, though the impact varied depending on income level.

- Reduced top individual income tax rate: The top individual income tax rate was slashed from 39.6% to 37%. This reduction was a central tenet of the Republican tax plan, intended to incentivize investment and entrepreneurship among high-income earners.

- Increased standard deduction: The standard deduction was significantly increased for both single filers and married couples. This simplification aimed to reduce the tax burden for many Americans, particularly those with lower incomes, by reducing the number of people required to itemize.

- Changes to itemized deductions: The bill introduced limitations on several itemized deductions, most notably the state and local tax (SALT) deduction. While this change generated considerable controversy, House Republicans argued it was necessary for broader tax reform and to promote greater tax fairness.

While the overall effect on different income levels is debated, House Republicans argued that the combination of rate reductions and increased standard deductions resulted in tax savings for a significant portion of the population. Further analysis, however, revealed that the benefits were disproportionately concentrated among higher-income taxpayers. Specific data on the distributional effects can be found in reports from the Tax Policy Center and the Congressional Budget Office.

Corporate Tax Rate Reduction

One of the most significant changes introduced by the Trump Tax Cut Bill was the reduction in the corporate tax rate. The bill lowered the rate from 35% to 21%, a move lauded by House Republicans as crucial for boosting American competitiveness and fostering economic growth.

The Republican rationale behind this drastic reduction rested on several key arguments:

- Attracting foreign investment: A lower corporate tax rate, they argued, would make the United States a more attractive destination for foreign investment, creating jobs and increasing economic activity.

- Boosting domestic business investment: The reduced tax burden on corporations, proponents believed, would encourage businesses to invest more in their operations, expanding their businesses and creating more employment opportunities.

- Creating higher-paying jobs: Increased business investment, in turn, would lead to the creation of higher-paying jobs, benefiting American workers across various sectors.

However, critics pointed out that the corporate tax cut primarily benefited large corporations and did not significantly translate into increased wages or job creation for the majority of workers. The long-term economic consequences of this dramatic rate reduction remain a subject of ongoing debate among economists.

Other Key Provisions of the Trump Tax Cut Bill

Beyond individual and corporate tax rate reductions, the Trump Tax Cut Bill contained several other notable provisions:

- Alternative Minimum Tax (AMT) changes: The AMT was modified to affect fewer taxpayers, reducing its impact on middle and upper-middle class families.

- Estate tax modifications: Changes were made to the estate tax, increasing the exemption amount.

- Pass-through business tax deductions: New deductions were introduced to benefit pass-through businesses, such as partnerships and sole proprietorships.

These provisions, while less prominent than the headline tax rate reductions, collectively contributed to the overall impact of the Trump Tax Cut Bill and formed a significant component of the Republican tax reform package.

Economic Impacts (Claimed by House Republicans)

House Republicans projected substantial economic benefits from the Trump Tax Cut Bill. They argued that the tax cuts would lead to:

- Significant GDP growth

- Increased job creation

- Higher wages for American workers

However, these claims were met with skepticism from many economists. While some studies did show short-term GDP growth following the tax cuts, others argued that the benefits were not evenly distributed and that the long-term fiscal impact could be negative due to increased national debt. A balanced assessment requires considering both the claims made by House Republicans and the counterarguments presented by independent economic analyses.

Conclusion: Assessing the Legacy of the Trump Tax Cut Bill

The Trump Tax Cut Bill, from the House Republican perspective, aimed to simplify the tax code, boost economic growth, and benefit American taxpayers. The key features, including significant individual and corporate tax rate reductions, coupled with changes to other provisions, represented a bold attempt to reshape the nation's tax system. While House Republicans pointed to potential economic benefits, critics highlighted concerns about income inequality and long-term fiscal sustainability. The legacy of this landmark legislation continues to be debated and assessed, with its long-term impacts remaining a subject of ongoing economic analysis. Learn more about the lasting impacts of the Trump Tax Cut Bill and its implications for the future of American taxation. Dive deeper into the details to understand the complexities of this landmark legislation.

Featured Posts

-

Tucows Announces 2024 Director Nominations And Honors Retiring Board Members

May 13, 2025

Tucows Announces 2024 Director Nominations And Honors Retiring Board Members

May 13, 2025 -

Local Deaths Recent Obituaries And Memorial Notices

May 13, 2025

Local Deaths Recent Obituaries And Memorial Notices

May 13, 2025 -

Madridskiy Turnir Sobolenko V Tsentre Skandala

May 13, 2025

Madridskiy Turnir Sobolenko V Tsentre Skandala

May 13, 2025 -

The New Workplace Reality Are Employees Truly Replaceable

May 13, 2025

The New Workplace Reality Are Employees Truly Replaceable

May 13, 2025 -

Olympus Has Fallen Examining The Films Impact And Legacy

May 13, 2025

Olympus Has Fallen Examining The Films Impact And Legacy

May 13, 2025

Latest Posts

-

Banned Candles In Canada Etsy Walmart Amazon Sales

May 14, 2025

Banned Candles In Canada Etsy Walmart Amazon Sales

May 14, 2025 -

Urgent Recall Walmart Pulls Electric Ride On Toys And Phone Chargers From Shelves

May 14, 2025

Urgent Recall Walmart Pulls Electric Ride On Toys And Phone Chargers From Shelves

May 14, 2025 -

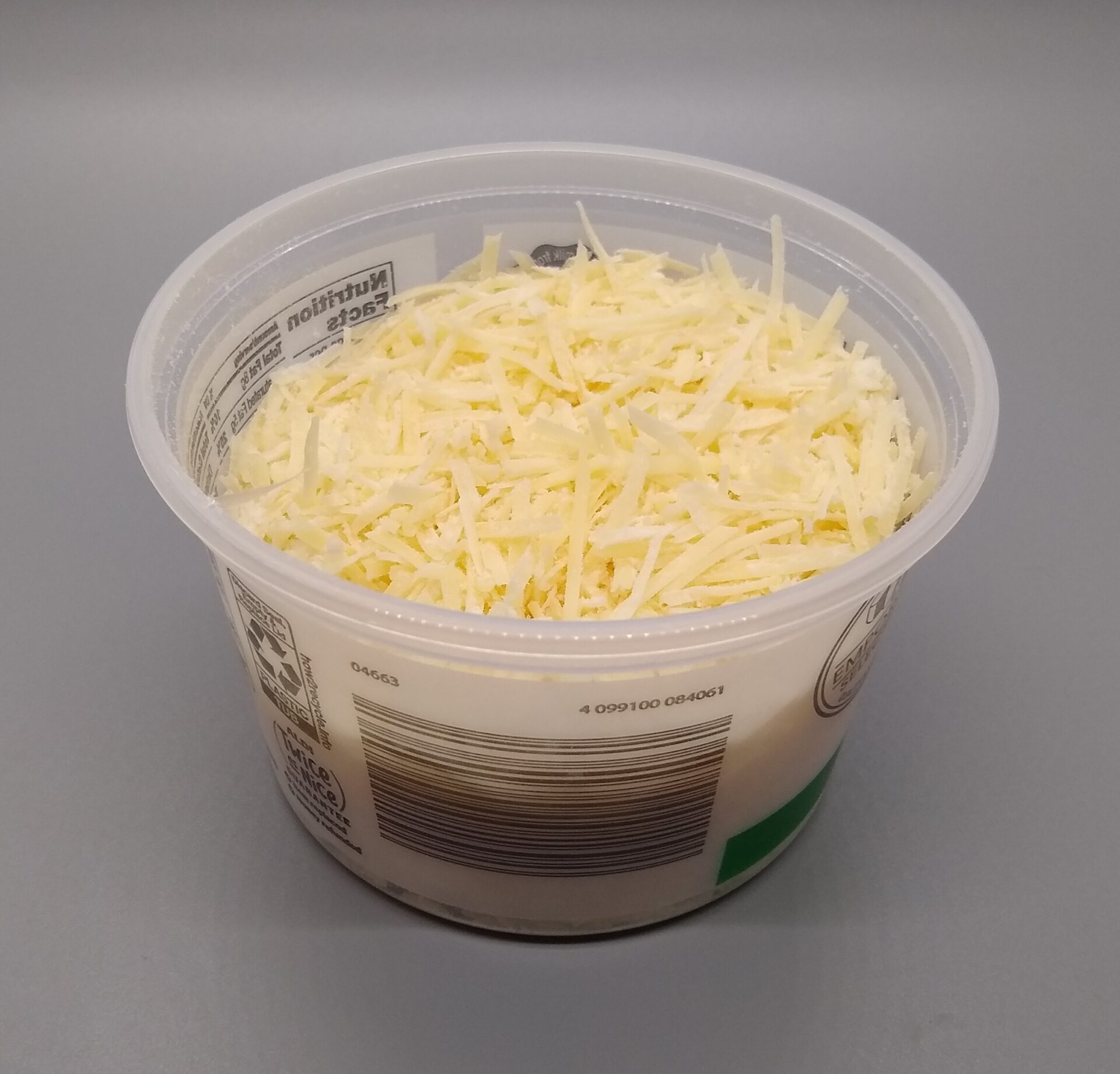

Aldi Cheese Recall Check Your Packets For Steel

May 14, 2025

Aldi Cheese Recall Check Your Packets For Steel

May 14, 2025 -

Aldi Issues Recall For Shredded Cheese Due To Steel Contamination Risk

May 14, 2025

Aldi Issues Recall For Shredded Cheese Due To Steel Contamination Risk

May 14, 2025 -

Aldi Recalls Shredded Cheese Possible Steel Fragments Found

May 14, 2025

Aldi Recalls Shredded Cheese Possible Steel Fragments Found

May 14, 2025