The Truth About Elon Musk's Dogecoin Investments

Table of Contents

Elon Musk's Public Statements and Their Impact on Dogecoin

Elon Musk's pronouncements on Dogecoin have consistently sent shockwaves through the cryptocurrency market. His social media activity, particularly on Twitter, has proven to be a powerful, albeit unpredictable, force driving Dogecoin's price fluctuations.

Analyzing Musk's Tweets and Social Media Activity

Musk's tweets frequently mention Dogecoin, often using hashtags like #Dogecoin and #Doge. These seemingly casual mentions have a disproportionate effect on the coin's price. For example, a single positive tweet can trigger a significant price surge, while a negative comment can lead to a sharp drop.

- Example 1: A tweet from Musk in [insert date] mentioning Dogecoin led to a [percentage]% increase in price within [timeframe].

- Example 2: Conversely, a tweet expressing skepticism about Dogecoin in [insert date] resulted in a [percentage]% decrease in price.

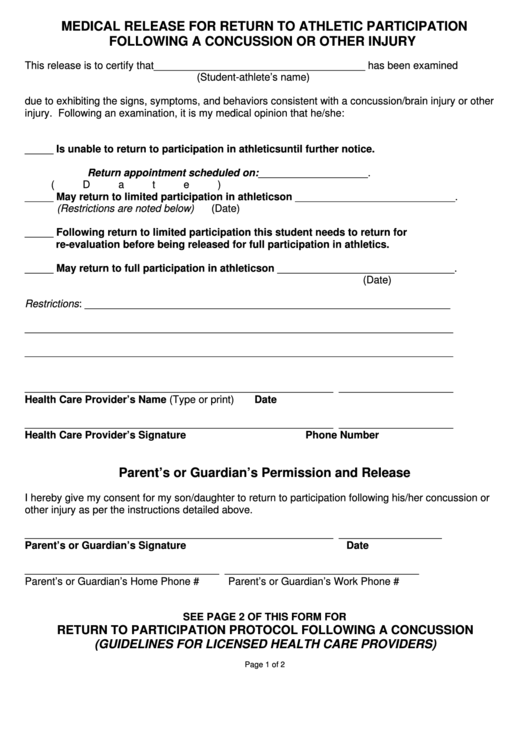

[Insert chart/graph visually depicting Dogecoin price fluctuations correlated with specific Musk tweets]. These visuals clearly demonstrate the direct correlation between Musk's social media activity and Dogecoin price volatility. This level of influence raises questions about market manipulation and the ethical responsibilities of influential figures in the crypto space.

The Role of Media Coverage in Amplifying Musk's Influence

Mainstream media outlets frequently report on Musk's Dogecoin-related activities, further amplifying his influence on investor sentiment. News articles, television segments, and online discussions all contribute to a cycle of hype and speculation surrounding the cryptocurrency. This media attention creates a feedback loop: Musk's tweets generate news coverage, which, in turn, influences investor decisions and subsequently affects Dogecoin's price.

- Correlation: A strong correlation exists between significant news cycles focusing on Musk's Dogecoin pronouncements and subsequent sharp increases or decreases in the Dogecoin price. This emphasizes the importance of media influence in shaping public perception and driving market behavior.

The Financial Implications of Elon Musk's Potential Dogecoin Holdings

While the exact extent of Elon Musk's Dogecoin holdings remains undisclosed, speculation abounds regarding the size of his potential investment. This lack of transparency adds to the complexity of analyzing the situation.

Speculation vs. Confirmed Investments

The absence of definitive information on Musk's Dogecoin holdings fuels speculation and contributes to the cryptocurrency's volatility. While various reports and estimations exist, none can be definitively confirmed. This opacity raises ethical concerns about the potential for insider trading or market manipulation based on privileged information.

- Ethical Concerns: The lack of transparency raises concerns about the potential for influencing a volatile asset based on potentially undisclosed holdings. This underscores the need for greater regulation and transparency in the cryptocurrency market.

The Risks Associated with Meme-Based Cryptocurrencies

Dogecoin, as a meme-based cryptocurrency, is inherently volatile and susceptible to manipulation. Unlike established cryptocurrencies with established use cases and technology, Dogecoin's value is largely driven by speculation and social media trends.

- Volatility: Investing in Dogecoin carries significantly higher risk compared to more established cryptocurrencies due to its susceptibility to rapid price swings.

- Pump and Dump Schemes: The decentralized nature of Dogecoin makes it vulnerable to pump-and-dump schemes, where coordinated efforts artificially inflate the price before a coordinated sell-off, leaving many investors with losses.

- Due Diligence: Investors must exercise extreme caution and conduct thorough due diligence before investing in Dogecoin or any other meme-based cryptocurrency. Understanding and managing risk is crucial.

The Broader Impact of Musk's Involvement on the Cryptocurrency Market

Elon Musk's involvement with Dogecoin has had a far-reaching impact on the broader cryptocurrency market, influencing both its popularity and regulatory scrutiny.

Dogecoin's Rise in Popularity and Market Capitalization

Musk's endorsement has significantly boosted Dogecoin's popularity and market capitalization. While initially a meme coin, Dogecoin has gained considerable attention and attracted a large investor base, largely due to Musk's influence. This increased popularity has raised questions about the long-term viability of meme-based currencies and their role in the evolving cryptocurrency landscape.

- Market Performance: Compare Dogecoin's performance against other cryptocurrencies to illustrate its unique volatility and growth trajectory.

The Future of Dogecoin and Musk's Role

The long-term prospects of Dogecoin remain uncertain. While Musk's continued engagement could maintain its popularity, the cryptocurrency’s future success depends on factors beyond his influence, including broader cryptocurrency adoption and regulatory developments. Increased regulatory scrutiny is likely given the volatility linked to Musk's pronouncements.

- Regulatory Scrutiny: The influence exerted by a single individual on a cryptocurrency's price raises significant regulatory concerns about market manipulation and investor protection. Future regulation may seek to mitigate these risks.

Conclusion

Elon Musk's involvement with Dogecoin has undeniably had a profound impact on the cryptocurrency market. His influence has driven significant price volatility and increased the coin's popularity, yet it also highlights the inherent risks associated with meme-based cryptocurrencies and the importance of informed decision-making for investors. The lack of transparency around his personal holdings adds another layer of complexity. Before investing in Dogecoin or any other cryptocurrency, conduct thorough research, understand the risks involved, and assess your risk tolerance. Make informed choices regarding your Dogecoin investments.

Featured Posts

-

Soaring Us China Trade Implications Of The Approaching Trade Truce

May 26, 2025

Soaring Us China Trade Implications Of The Approaching Trade Truce

May 26, 2025 -

Agam Berger And Daniel Weiss A March Of The Living Participation Following Their Release

May 26, 2025

Agam Berger And Daniel Weiss A March Of The Living Participation Following Their Release

May 26, 2025 -

Ahtjajat Mtwaslt Btl Abyb Mtalb Balifraj En Alasra

May 26, 2025

Ahtjajat Mtwaslt Btl Abyb Mtalb Balifraj En Alasra

May 26, 2025 -

Monaco Grand Prix 2025 Betting Predictions And Best Odds

May 26, 2025

Monaco Grand Prix 2025 Betting Predictions And Best Odds

May 26, 2025 -

Naomi Kempbell U 55 Stil Krasa Ta Vpliv Na Svit Modi

May 26, 2025

Naomi Kempbell U 55 Stil Krasa Ta Vpliv Na Svit Modi

May 26, 2025