The Unfolding Bond Market Crisis: What Investors Need To Know

Table of Contents

Rising Interest Rates and Their Impact

The current bond market turmoil is largely driven by rising interest rates, a direct consequence of the Federal Reserve's (Fed) monetary policy tightening.

The Federal Reserve's Role:

The Fed's aggressive actions aim to curb persistent inflation. Their tools include:

- Quantitative Tightening (QT): The Fed is reducing its balance sheet by allowing bonds to mature without reinvestment, thus reducing the money supply.

- Interest Rate Hikes: The Fed has implemented several interest rate increases, making borrowing more expensive. This directly impacts bond yields.

- Effect on Bond Yields: Higher interest rates lead to higher bond yields, as new bonds offer more attractive returns. This causes existing bonds to lose value. The anticipation of further rate hikes further fuels this downward pressure on bond prices.

Inflation plays a critical role. The Fed's primary goal is to lower inflation to its 2% target. High inflation erodes the purchasing power of fixed-income investments, prompting the aggressive interest rate hikes. The potential for further rate increases depends heavily on the trajectory of inflation and remains a major source of uncertainty in the bond market.

Global Economic Uncertainty:

The bond market crisis is not solely a US phenomenon. Global economic factors significantly influence bond performance:

- Geopolitical Instability: The war in Ukraine, ongoing geopolitical tensions, and related sanctions create significant uncertainty in the global economy, affecting investor sentiment and bond markets.

- Supply Chain Disruptions: Ongoing disruptions continue to impact inflation, contributing to the need for higher interest rates.

- Energy Price Volatility: Fluctuations in energy prices, driven by geopolitical events and supply constraints, contribute to overall inflation and market uncertainty.

These global factors increase investor uncertainty, leading to capital flight from riskier assets, including some bonds, and increased demand for safer havens, creating volatility in bond yields and prices.

Increased Bond Yields and Their Implications

The sharp increase in bond yields has profound implications for investors.

Understanding Bond Yields:

A bond's yield represents the return an investor receives relative to its price. There’s an inverse relationship between bond prices and yields:

- Yield Curve Inversion: When short-term bond yields exceed long-term yields, it’s called a yield curve inversion, often seen as a recession indicator.

- Bond Types and Yields: Different types of bonds – government bonds (like Treasuries), corporate bonds, and municipal bonds – carry varying levels of risk and, therefore, different yields. Government bonds are generally considered safer, offering lower yields than corporate bonds, which offer higher yields to compensate for increased risk.

Impact on Investors' Portfolios:

Rising yields present challenges for investors:

- Fixed-Income Portfolios: Investors holding fixed-income portfolios face potential capital losses as bond prices decline.

- Losses for Bondholders: Bondholders who need to sell their bonds before maturity may incur significant losses.

- Diversification: Diversification across various asset classes is crucial to mitigate risk.

To mitigate risk, investors can consider strategies such as:

- Bond Laddering: Spreading investments across bonds with different maturities.

- Inflation-Protected Securities (TIPS): These bonds adjust their principal value based on inflation, offering protection against rising prices.

Navigating the Bond Market Crisis: Strategies for Investors

The current environment necessitates a proactive approach to investment management.

Diversification and Risk Management:

- Asset Allocation: Diversify your portfolio beyond bonds, including stocks, real estate, and commodities.

- Risk Tolerance: Assess your risk tolerance and adjust your investment strategy accordingly. Consider consulting a financial advisor to determine the appropriate risk level for your portfolio.

Seeking Professional Advice:

- Personalized Strategies: A financial advisor can offer personalized strategies based on your individual circumstances, risk profile, and financial goals.

- Expert Guidance: They provide valuable insights into navigating the complexities of the bond market crisis.

Conclusion

This unfolding bond market crisis, characterized by rising interest rates and increased bond yields, poses significant challenges for investors. Understanding the factors driving these changes – the Fed's monetary policy, global economic uncertainty, and the inverse relationship between bond prices and yields – is crucial for effective portfolio management. Diversification, risk management, and seeking professional advice are key strategies for navigating this turbulent period. Understanding the bond market crisis is crucial for making informed investment decisions. Don't wait; take control of your portfolio and navigate this challenging environment effectively. Learn more about managing your bond investments during a bond market crisis today! The future outlook remains uncertain, highlighting the need for continuous monitoring of market developments and adapting your investment strategy accordingly.

Featured Posts

-

Die Karl Weinbar Eroeffnet An Der Venloer Strasse

May 29, 2025

Die Karl Weinbar Eroeffnet An Der Venloer Strasse

May 29, 2025 -

Jozanne Van Der Velden Vvd Tijdperk Afgesloten Nieuwe Ambities

May 29, 2025

Jozanne Van Der Velden Vvd Tijdperk Afgesloten Nieuwe Ambities

May 29, 2025 -

Upcoming Louisiana Horror Film Sinners Theater Release Details

May 29, 2025

Upcoming Louisiana Horror Film Sinners Theater Release Details

May 29, 2025 -

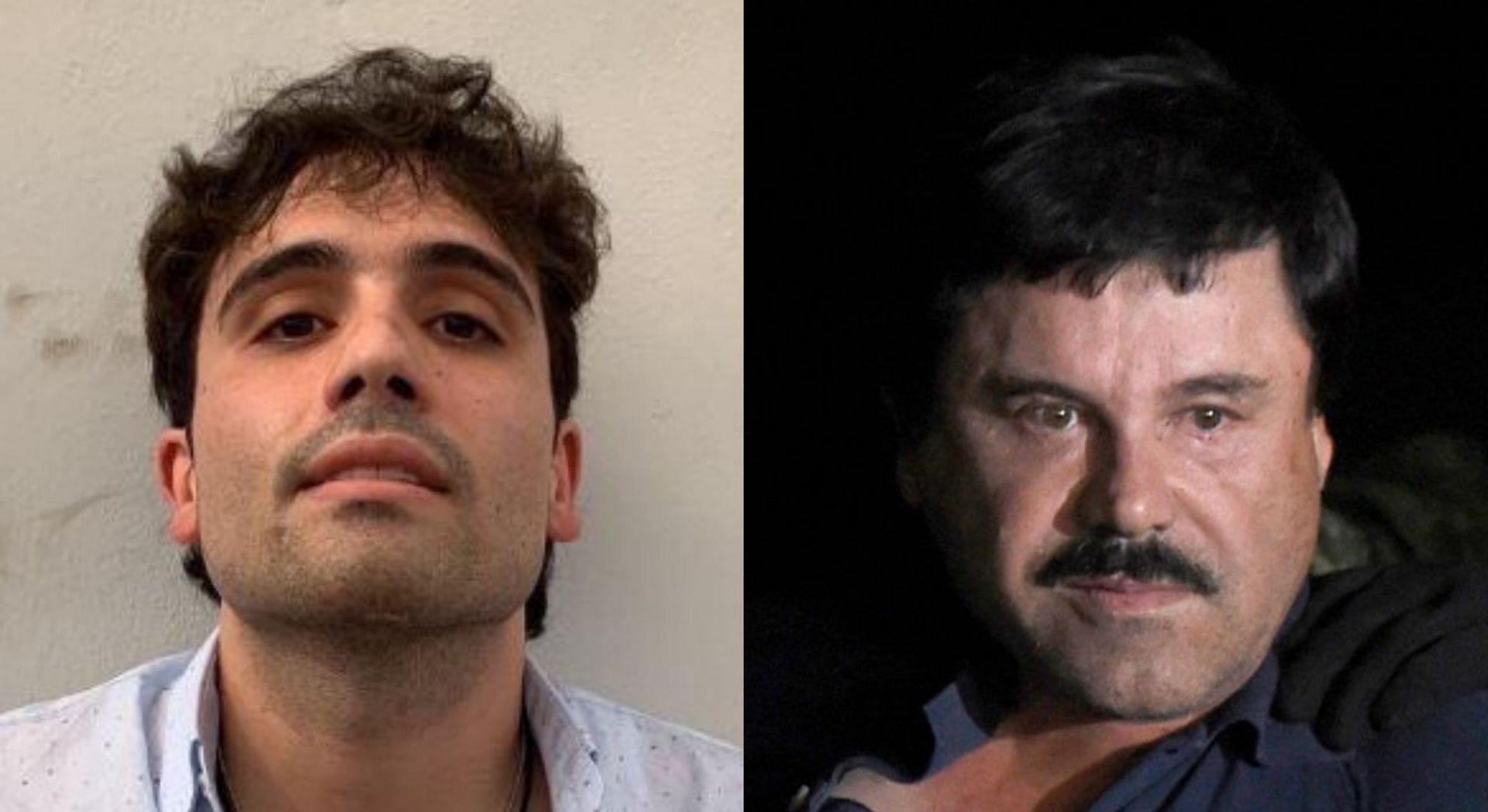

No Death Penalty For El Chapos Son Us Prosecutors Decision

May 29, 2025

No Death Penalty For El Chapos Son Us Prosecutors Decision

May 29, 2025 -

Netherlands Eurovision 2025 Analyzing C Est La Vie Claude And Winning Chances

May 29, 2025

Netherlands Eurovision 2025 Analyzing C Est La Vie Claude And Winning Chances

May 29, 2025