Thousands Owe HMRC: Unclaimed Savings And Refunds

Table of Contents

Common Reasons for Unclaimed HMRC Refunds

Several factors contribute to people leaving unclaimed money with HMRC. Understanding these reasons is the first step in reclaiming what's yours.

Overpaid Income Tax

Overpaying income tax is surprisingly common. This can happen due to various reasons:

- Incorrect tax code: A wrong tax code provided by your employer can lead to overpayment throughout the year.

- Changes in circumstances not reported: Life changes like marriage, having children, or starting a new job affect your tax liability. Failing to inform HMRC can lead to overpayment.

- Self-assessment errors: Mistakes on your self-assessment tax return can result in overpayment.

Check your tax code online via the HMRC website [link to HMRC tax code checker] and ensure all your circumstances are accurately reflected on your tax return. For self-assessment queries, refer to the official HMRC guidance [link to HMRC self-assessment guidance].

Unclaimed Child Benefit

Many families are unaware of or have missed out on Child Benefit payments. This can occur due to:

- Changes in family circumstances: Changes in your income, the number of children, or their ages can impact your eligibility.

- Missed payments: If you haven't received payments you believe you're entitled to, check your payment history.

- Eligibility changes: HMRC's eligibility criteria change, so ensure you're still eligible for the current benefit levels.

Visit the HMRC website for more details on Child Benefit and how to claim [link to HMRC child benefit page].

National Insurance Contributions

Overpayments in National Insurance contributions (NICs) can also occur. This can happen due to:

- Errors in employment records: Incorrect information recorded by your employer can lead to overpayment.

- Multiple jobs: If you hold multiple jobs, the NICs calculations might be incorrect if not reported properly.

- Self-employment: Inaccuracies in your self-employment NICs declarations could result in overpayment.

The HMRC website provides guidance on National Insurance contributions and how to check for potential overpayments [link to HMRC National Insurance guidance].

Savings and Investments

Forgotten or lost savings represent a substantial amount of unclaimed money. This might involve:

- Lost bank statements: It's easy to lose track of old bank accounts or investments.

- Forgotten investments: Investments in dormant accounts or forgotten pension plans might hold significant unclaimed value.

- Deceased relatives' accounts: Inheritance funds or savings belonging to deceased relatives may remain unclaimed.

Services like [link to a reputable lost savings finder service] can help you trace lost savings and investments.

How to Check if You Have Unclaimed HMRC Money

Several methods allow you to check for unclaimed HMRC money.

Using the HMRC Online Portal

The HMRC online portal is the primary method for checking for unclaimed funds. [Include screenshots or visual aids here, showing step-by-step instructions on how to navigate the portal to find unclaimed funds]. You'll need your Government Gateway user ID and password to access your account.

Contacting HMRC Directly

If you can't find the information you need online, contact HMRC directly via:

- Phone: [HMRC phone number]

- Email: [HMRC email address – if available]

- Post: [HMRC postal address]

Be prepared to provide personal information, including your National Insurance number, to verify your identity.

Using Third-Party Services (with caution)

Numerous third-party services claim to help you find unclaimed money. While some are legitimate, approach these services with caution. Always independently verify any information they provide before taking any action. Never share your banking or personal information unless you are certain of the legitimacy of the organization.

Claiming Your Unclaimed HMRC Refunds

Once you've identified unclaimed money, you'll need to follow HMRC's claim process.

The Claim Process

[Include a step-by-step guide here, including examples of necessary documentation. This could include forms to fill out, specific information required, and evidence to support your claim].

Timeframes for Processing

HMRC aims to process claims within [insert typical processing time] but processing times can vary depending on the complexity of your claim.

Appealing a Rejected Claim

If your claim is rejected, you have the right to appeal. [Include details on how to appeal, including deadlines and procedures].

Conclusion

Thousands of people are missing out on significant amounts of unclaimed savings and refunds from HMRC. By understanding the common reasons for unclaimed money and utilizing the resources outlined above, you can increase your chances of reclaiming what's rightfully yours. Don't miss out! Check your eligibility for unclaimed HMRC savings and refunds today! Start by visiting the HMRC website [link to HMRC website] or using the online portal to check your account. Don't delay – your unclaimed money could be waiting!

Featured Posts

-

Man Utd In 62 5m Transfer Pursuit Arsenal And Chelsea Target Contacted

May 20, 2025

Man Utd In 62 5m Transfer Pursuit Arsenal And Chelsea Target Contacted

May 20, 2025 -

Gop Tax Plan Does It Really Cut The Deficit A Mathematical Look

May 20, 2025

Gop Tax Plan Does It Really Cut The Deficit A Mathematical Look

May 20, 2025 -

Amazon Spring Sale 2025 His And Hers Hugo Boss Perfumes Discounted

May 20, 2025

Amazon Spring Sale 2025 His And Hers Hugo Boss Perfumes Discounted

May 20, 2025 -

Fing A Look At David Walliams Fantasy Film Approved By Stan

May 20, 2025

Fing A Look At David Walliams Fantasy Film Approved By Stan

May 20, 2025 -

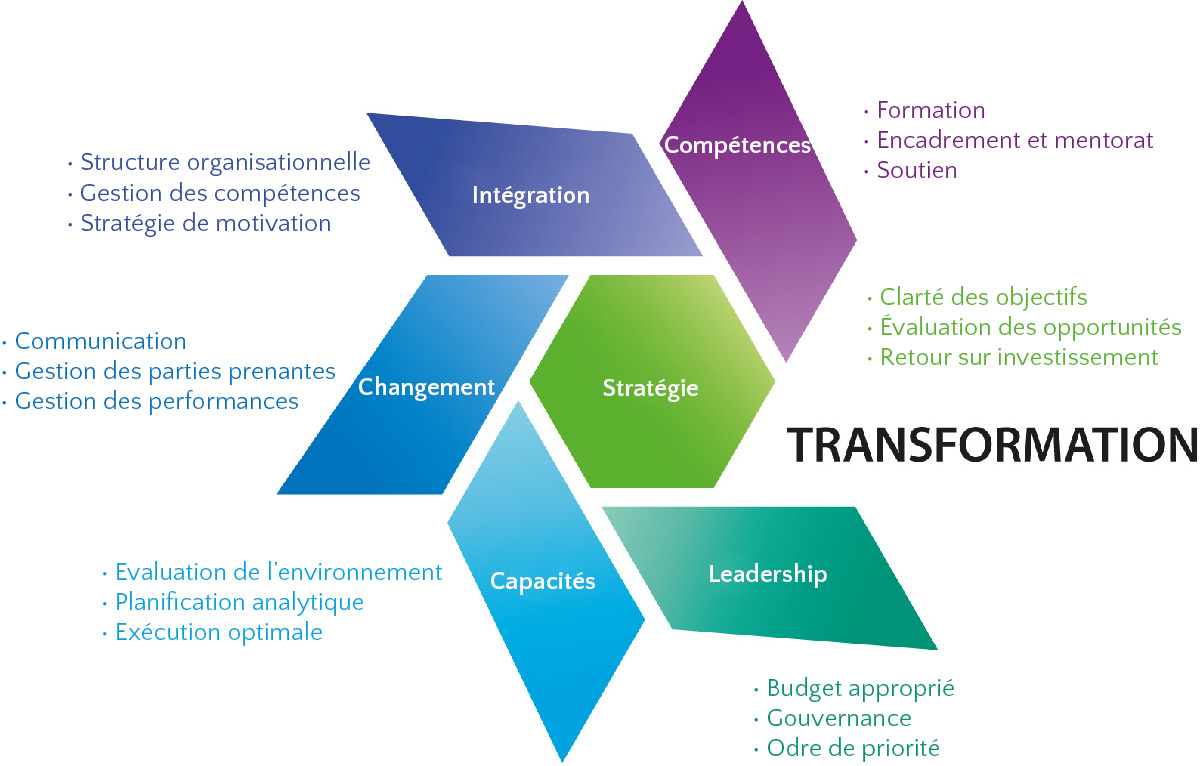

Abidjan 2025 Ivoire Tech Forum Et La Transformation Digitale

May 20, 2025

Abidjan 2025 Ivoire Tech Forum Et La Transformation Digitale

May 20, 2025