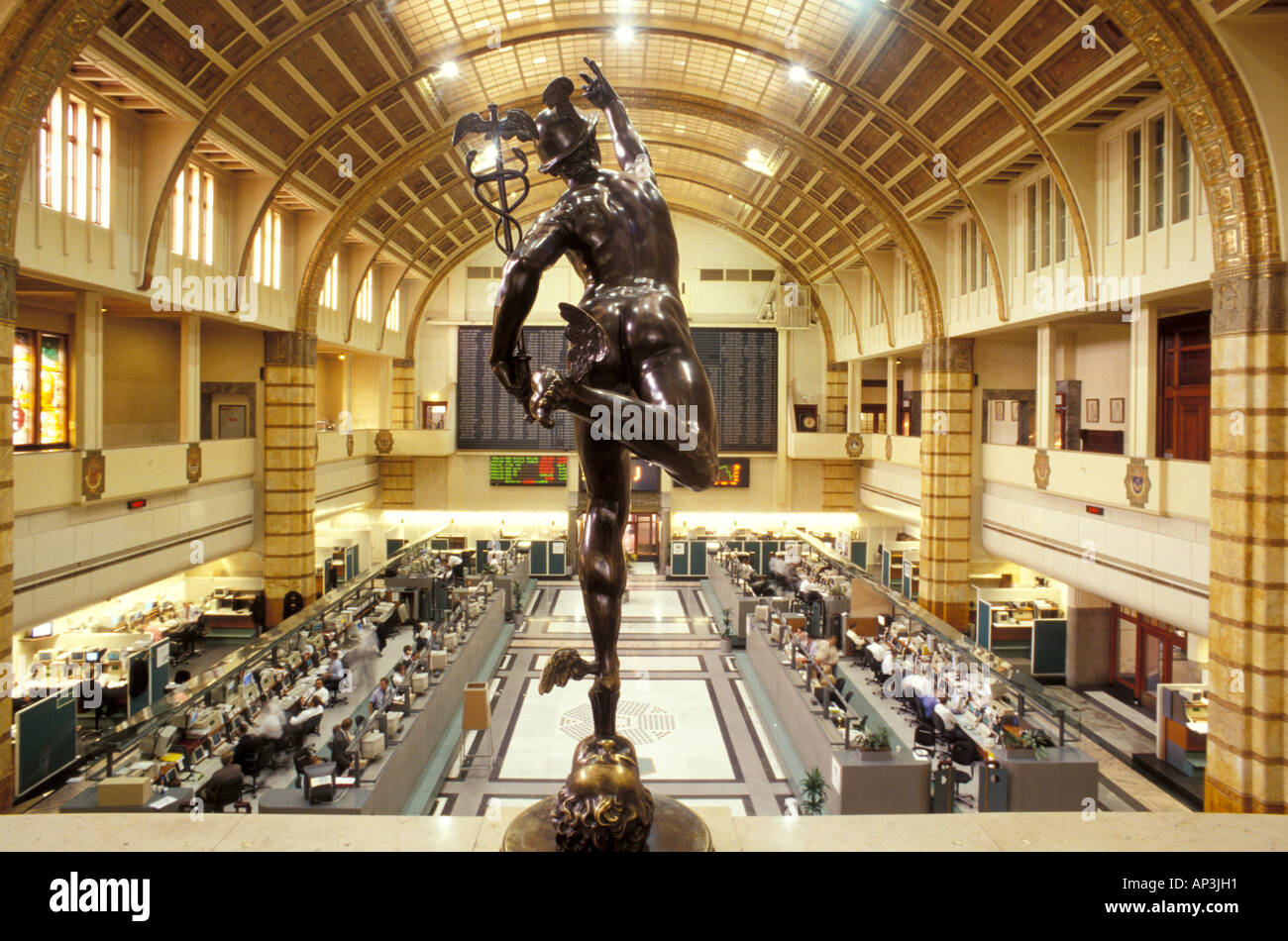

Three-Day Slide: Amsterdam Stock Exchange Down 11%

Table of Contents

Causes of the Amsterdam Stock Exchange's Three-Day Slide

Several interconnected factors contributed to the AEX's sharp decline. Understanding these causes is crucial for navigating the current market volatility and predicting future trends.

Global Economic Uncertainty

Rising interest rates globally have significantly impacted investor sentiment. Central banks worldwide are aggressively combating inflation, leading to increased borrowing costs for businesses and dampening economic growth prospects. This uncertainty creates a risk-averse environment, prompting investors to withdraw from riskier assets like stocks.

- Increased energy prices impacting Dutch businesses: The ongoing energy crisis, exacerbated by the war in Ukraine, has significantly increased energy costs for Dutch companies, impacting profitability and investor confidence.

- Global recession fears dampen investor confidence: Concerns about a potential global recession are fueling market anxiety, leading to a sell-off in various asset classes, including the AEX.

- Geopolitical instability: The ongoing war in Ukraine continues to create uncertainty in global markets, impacting supply chains, energy prices, and investor sentiment. This instability directly impacts the AEX, as many Dutch companies have international operations and supply chains affected by the conflict.

Sector-Specific Downturns

The three-day slide wasn't uniform across all sectors. Certain industries experienced disproportionately large declines, highlighting specific vulnerabilities within the Dutch economy.

- Energy sector: Falling gas prices after a period of high volatility led to significant losses in energy-related stocks. The price fluctuation itself, rather than simply the fall, contributed to investor unease.

- Tech sector: Concerns over slowing growth and increased competition in the global tech market triggered a sell-off in technology stocks listed on the AEX. This mirrors trends seen in other major tech-heavy indices.

- Finance sector: Increased regulatory scrutiny and concerns about potential loan defaults in a slowing economy negatively impacted financial institutions listed on the AEX.

Impact of International Market Trends

The AEX's performance is closely linked to global market trends. The sharp decline wasn't isolated; it mirrored similar downturns in other major stock exchanges.

- Correlation with Wall Street and FTSE 100: A strong negative correlation was observed between the AEX and major indices like the Wall Street Dow Jones Industrial Average and the FTSE 100 during the three-day period, indicating a shared response to global economic pressures. (Note: Ideally, a chart illustrating this correlation would be included here.)

- Contagion effect: The sell-off in other markets created a contagion effect, influencing investor behavior and contributing to the AEX's sharp decline. Investors, witnessing downturns elsewhere, acted to protect their portfolios by liquidating assets listed on the AEX.

Consequences of the 11% Drop on the Amsterdam Stock Exchange

The 11% drop has significant consequences for investors, the Dutch economy, and the long-term outlook for the AEX.

Impact on Investor Confidence

The sharp market decline has undeniably eroded investor confidence. The three-day slide has increased risk aversion and could trigger further sell-offs or increased market volatility.

- Increased risk aversion among investors: Investors are likely to adopt a more cautious approach, favoring safer investments over riskier equities.

- Potential for capital flight from the Dutch market: Some investors may choose to move their investments to other markets perceived as less volatile.

- Impact on retirement funds and individual portfolios: Many individual investors and pension funds experienced significant losses due to the sudden market downturn.

Economic Implications for the Netherlands

The AEX's performance is a key indicator of the Dutch economy's health. The 11% drop has potential negative economic ramifications.

- Reduced economic growth projections: The market decline could lead to lower economic growth forecasts for the Netherlands as investor confidence decreases and business investments are delayed.

- Potential job losses in affected sectors: Companies in struggling sectors might be forced to cut jobs to reduce costs and improve their bottom line.

- Government response: The Dutch government may need to implement economic stimulus packages or other measures to mitigate the negative economic fallout.

Long-Term Outlook for the AEX

While the short-term outlook remains uncertain, several factors could influence the AEX's recovery.

- Factors influencing market recovery: A stabilization of global interest rates, easing geopolitical tensions, and improved corporate earnings could contribute to a market rebound.

- Potential investment strategies: Investors may consider diversifying their portfolios and focusing on companies with strong fundamentals and growth potential. (Note: This is not financial advice.)

- Expert opinions: (Space for including expert opinions or predictions on the AEX's future performance.)

Conclusion: Navigating the Amsterdam Stock Exchange After its Three-Day Slide

The 11% drop in the Amsterdam Stock Exchange over three days represents a significant market event with far-reaching consequences. The "three-day slide" resulted from a confluence of global economic uncertainty, sector-specific weaknesses, and the influence of international market trends. The consequences include eroded investor confidence, potential economic repercussions for the Netherlands, and uncertainty regarding the long-term outlook for the AEX. Staying informed about market trends and consulting financial advisors before making investment decisions is crucial during this period. Return to this site for further updates on the AEX and its recovery from this recent sharp decline.

Featured Posts

-

Carolina Country Music Fest 2025 Officially Sold Out

May 25, 2025

Carolina Country Music Fest 2025 Officially Sold Out

May 25, 2025 -

Europese Aandelen Vs Wall Street Doorzetting Van De Recente Marktdraai

May 25, 2025

Europese Aandelen Vs Wall Street Doorzetting Van De Recente Marktdraai

May 25, 2025 -

Oleg Basilashvili Test Na Znanie Ego Roley

May 25, 2025

Oleg Basilashvili Test Na Znanie Ego Roley

May 25, 2025 -

Hells Angels Pay Tribute South Shields Biker Remembered

May 25, 2025

Hells Angels Pay Tribute South Shields Biker Remembered

May 25, 2025 -

Annie Kilners Social Media Activity After Kyle Walker Incident

May 25, 2025

Annie Kilners Social Media Activity After Kyle Walker Incident

May 25, 2025