Thursday's CoreWeave (CRWV) Stock Plunge: A Deep Dive Into The Causes

Table of Contents

The Impact of the Broader Market Downturn on CRWV

The CoreWeave (CRWV) stock plunge didn't occur in isolation. Thursday saw a considerable downturn across broader markets, particularly impacting the technology sector. This general market negativity played a significant role in CRWV's decline.

- Market Index Performance: The Nasdaq Composite and the S&P 500 both experienced notable drops on Thursday, indicating a wider market sell-off. This negative sentiment spilled over into the cloud computing sector, affecting even strong performers like CoreWeave.

- Tech Sector News: Negative news concerning interest rates or other macroeconomic factors impacting the tech sector likely contributed to the overall bearish sentiment. Any announcements regarding regulatory changes or potential economic slowdowns would have amplified the downward pressure on tech stocks, including CRWV.

- Market Sentiment: The prevailing market sentiment on Thursday was undeniably bearish. This negative outlook, fueled by broader economic anxieties and tech sector uncertainty, significantly impacted investor confidence in growth stocks, such as CoreWeave. Fear of further losses likely led to widespread selling.

Analysis of CoreWeave's Specific Financial Performance

While the broader market downturn played a significant role, it's crucial to examine if any CoreWeave-specific factors exacerbated the stock's fall. Unfortunately, without specific details about any negative news releases or financial reports released close to the drop, a definitive answer is difficult to provide. However, several potential internal factors warrant investigation.

- Earnings Reports and Announcements: The absence of any negative news concerning CoreWeave's earnings reports or announcements before the stock plunge suggests the decline was primarily market-driven. However, a thorough review of any released financial information is necessary.

- Guidance Revisions: Any downward revisions to CoreWeave's future performance guidance could have triggered a sell-off, even if the overall numbers were still positive. Investors often react strongly to signs of potential slowing growth.

- Analyst Downgrades: Analyst downgrades, reflecting a change in outlook on CoreWeave's prospects, could also have contributed to the stock price decline. These opinions heavily influence investor decisions.

The Role of Investor Sentiment and Speculation

Investor sentiment and speculation often play a crucial, and sometimes unpredictable, role in stock price movements. In the case of CoreWeave's stock plunge, it's important to consider:

- Unusual Trading Activity: Analysis of trading volume and unusual trading patterns could reveal insights into potential short-selling or other speculative activities that contributed to the drop. A surge in short-selling, for instance, would exert significant downward pressure on the stock price.

- Social Media Sentiment: Examining social media chatter around CoreWeave on Thursday could highlight any negative narratives or rumors that influenced investor sentiment. Negative social media trends can quickly spread fear and uncertainty, leading to sell-offs.

- Investor Confidence: A shift in investor confidence regarding CoreWeave's long-term prospects, perhaps stemming from concerns about the AI/cloud computing market's future, could have triggered the selloff. Uncertainty about future growth can quickly erode investor trust.

Competition and the Cloud Computing Landscape

The competitive landscape of the cloud computing market is intensely dynamic. CoreWeave's performance is intrinsically linked to its position within this competitive arena.

- Key Competitors: Analyzing the activities of CoreWeave's major competitors, such as AWS, Microsoft Azure, and Google Cloud, can provide context. Any significant announcements or market share shifts from these competitors could indirectly affect CoreWeave's stock price.

- Competitive Pressures: Increased competition, pricing pressures, or new technological advancements from rivals could have negatively impacted investor perception of CoreWeave's long-term potential. This increased competitive pressure can lead to decreased investor confidence.

- Market Positioning and Vulnerabilities: A reassessment of CoreWeave's market positioning and any perceived vulnerabilities could have contributed to the stock decline. Investors will always be looking for signs of weakness in a competitive environment.

Conclusion: Understanding and Navigating Future CoreWeave (CRWV) Stock Fluctuations

The CoreWeave (CRWV) stock plunge on Thursday resulted from a confluence of factors, including a broader market downturn, potentially exacerbated by investor sentiment and speculation within the competitive cloud computing landscape. While no specific CoreWeave-related negative news was immediately apparent, the overall market negativity and uncertainties within the sector played a major role. Understanding these market forces and monitoring CoreWeave's performance, financial reports, and the broader cloud computing industry is crucial for effective investment decision-making. Stay informed about future CoreWeave (CRWV) stock movements by following our updates and analyses. Understanding the factors influencing CRWV's price is crucial for making informed investment decisions.

Featured Posts

-

Within The Sound Perimeter Music As A Universal Language

May 22, 2025

Within The Sound Perimeter Music As A Universal Language

May 22, 2025 -

Hout Bay Fcs Success The Klopp Connection

May 22, 2025

Hout Bay Fcs Success The Klopp Connection

May 22, 2025 -

Cau Ma Da Du An Trong Diem Ket Noi Dong Nai

May 22, 2025

Cau Ma Da Du An Trong Diem Ket Noi Dong Nai

May 22, 2025 -

Irish Actor Barry Ward An Interview On Roles And Perceptions

May 22, 2025

Irish Actor Barry Ward An Interview On Roles And Perceptions

May 22, 2025 -

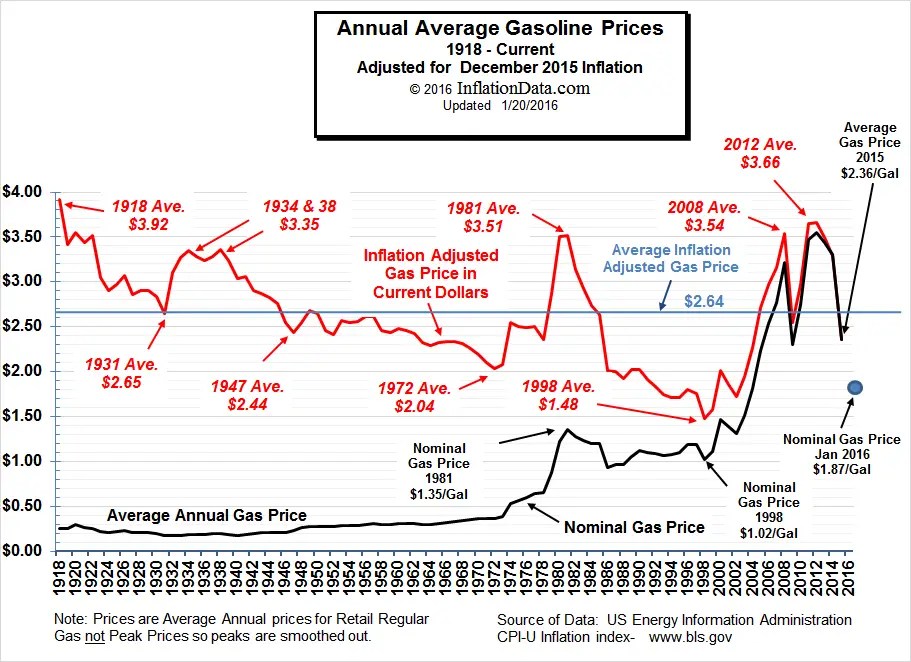

Virginia Gasoline Prices A Week Over Week Decrease

May 22, 2025

Virginia Gasoline Prices A Week Over Week Decrease

May 22, 2025