TikTok's "Just Contact Us" Tariff Workarounds: A CNN Investigation

Table of Contents

How the "Just Contact Us" Method Works

Sellers use vague contact information to sidestep declaring accurate product origins and paying the associated tariffs. This circumvention of import regulations relies on obfuscation and a lack of transparency.

- Lack of clear product details on listings: Products are often described vaguely, omitting crucial details about their origin and composition. This makes it difficult for Customs and Border Protection (CBP) to assess the correct tariff.

- Reliance on private messaging for pricing and shipping information: Instead of openly displaying prices and shipping details, sellers direct buyers to contact them privately. This allows them to manipulate pricing and avoid proper documentation.

- Misleading product descriptions to evade tariff classifications: Sellers might misclassify products to lower or avoid tariffs altogether. For example, a product might be labeled differently than its true classification to escape higher duties.

- Use of unofficial import channels: This often involves smaller, less regulated shipping methods that make tracking and verification more difficult, facilitating the avoidance of customs inspections.

The CNN investigation highlighted specific examples. One seller offered high-value electronics with unclear origins, directing inquiries to a private message system where pricing and shipping details were negotiated, effectively bypassing standard import procedures. This tactic violates Section 301 of the Trade Act of 1974, which addresses unfair trade practices. Other examples included clothing items and consumer electronics with ambiguous descriptions that could potentially mask their country of origin, thus allowing for tariff evasion.

The Scale of the Problem: How Widespread is Tariff Evasion on TikTok?

The CNN investigation suggests the problem is significant, though quantifying the exact scale is challenging due to the secretive nature of the practice.

- Statistics on the number of sellers using this tactic: While precise numbers weren't released in the investigation, anecdotal evidence points to a surprisingly large number of sellers employing this method across various product categories.

- Percentage of TikTok products potentially affected: It’s difficult to estimate the percentage, but the sheer volume of products sold on TikTok suggests a considerable portion could be involved in some form of tariff avoidance.

- Examples of high-value items involved in tariff avoidance: High-value electronics, luxury goods, and designer clothing were found to be among the items involved in tariff avoidance schemes.

- Geographic locations of sellers most frequently using this method: While not explicitly stated, the investigation implied a geographically diverse range of sellers are engaged in this practice, further highlighting the complexity of the problem.

The potential financial impact is substantial. The loss of tariff revenue directly affects the US government's budget and funding for various programs. This widespread avoidance of import duties undermines fair competition and the integrity of the import process.

The Consequences of TikTok's "Just Contact Us" Tariff Workarounds

The implications of these TikTok tariff workarounds extend to various stakeholders:

- Unfair competition for legitimate businesses paying tariffs: Legitimate businesses complying with import regulations face unfair competition from those evading tariffs, potentially leading to business closures and job losses.

- Loss of revenue for the US government: The revenue lost due to tariff evasion directly impacts government funding and public services.

- Potential safety concerns related to unregulated imports: Products imported through unofficial channels might not meet safety standards, posing risks to consumers.

- Damage to consumer trust: The prevalence of tariff evasion erodes consumer trust in online marketplaces and the authenticity of products.

The economic impact is considerable, affecting domestic industries reliant on fair trade practices. The risks to consumers are also significant, as products bypassing standard import checks may be counterfeit, substandard, or even dangerous. Sellers involved in such practices face potential legal repercussions, including fines and prosecution.

Potential Solutions to Combat TikTok Tariff Workarounds

Addressing this issue requires a multi-pronged approach:

- Increased scrutiny and monitoring of TikTok listings: TikTok needs to enhance its monitoring system to detect suspicious listings and sellers.

- Collaboration between TikTok, US Customs and Border Protection, and other relevant agencies: Closer cooperation between platforms, government agencies, and law enforcement is crucial for effective enforcement.

- Enhanced transparency requirements for sellers: Stricter rules on product descriptions, pricing, and shipping information would make it more difficult for sellers to hide their activities.

- Stronger enforcement of existing import regulations: Increased penalties and investigations are needed to deter tariff evasion.

- Consumer education on identifying and avoiding suspicious sellers: Educating consumers about the warning signs of suspicious sellers can help reduce demand for products involved in tariff avoidance.

Implementing these solutions requires commitment from all stakeholders. International cooperation is also vital given the global nature of e-commerce. Consumer awareness is key to combatting this issue; informed consumers can help create a more level playing field.

Conclusion

The CNN investigation into TikTok's "just contact us" tariff workarounds reveals a significant loophole that facilitates widespread tariff evasion. This practice leads to substantial financial losses for the US government, creates an unfair advantage for unscrupulous sellers, and risks consumers' safety. Understanding these TikTok tariff workarounds is crucial for protecting the integrity of the import process and ensuring fair competition. Stay informed about the ongoing developments and support policies that encourage transparency and accountability within online marketplaces to effectively combat these practices and promote fair trade.

Featured Posts

-

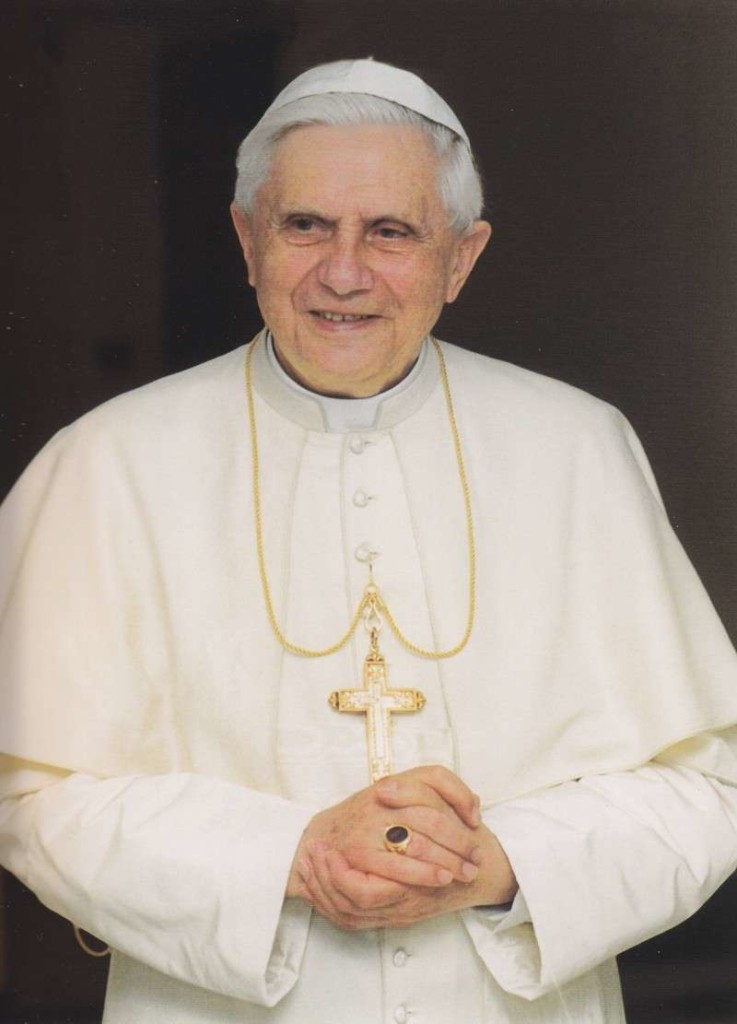

A Compassionate Pope Remembering The Life And Legacy Of Francis

Apr 22, 2025

A Compassionate Pope Remembering The Life And Legacy Of Francis

Apr 22, 2025 -

Repetitive Documents Let Ai Create A Profound Poop Podcast

Apr 22, 2025

Repetitive Documents Let Ai Create A Profound Poop Podcast

Apr 22, 2025 -

5 Dos And Don Ts For Landing A Private Credit Job

Apr 22, 2025

5 Dos And Don Ts For Landing A Private Credit Job

Apr 22, 2025 -

The Selection Of A New Pope A Deep Dive Into Papal Conclaves And Their Traditions

Apr 22, 2025

The Selection Of A New Pope A Deep Dive Into Papal Conclaves And Their Traditions

Apr 22, 2025 -

Razer Blade 16 2025 Review Ultra Settings On A Thin Laptop

Apr 22, 2025

Razer Blade 16 2025 Review Ultra Settings On A Thin Laptop

Apr 22, 2025