To Buy Or Not To Buy Palantir Stock Before May 5th: A Practical Guide

Table of Contents

Palantir's Recent Performance and Future Outlook

Analyzing Q4 2023 Earnings and Revenue Growth

Palantir's recent financial performance is crucial in evaluating its current valuation and future potential. Analyzing Q4 2023 earnings reports is essential for understanding the company's trajectory. Key metrics to examine include:

- Revenue Growth: A consistent upward trend in revenue suggests strong market demand for Palantir's products and services. Look for year-over-year growth percentages and assess their sustainability.

- Profitability: Examine metrics like net income, operating margin, and free cash flow to determine Palantir's profitability and its ability to generate sustainable profits.

- Customer Acquisition: Analyze the growth in the number of customers, particularly in the government and commercial sectors. This indicates the effectiveness of Palantir's sales and marketing efforts.

Analyst predictions and ratings for Palantir stock provide valuable external perspectives. While these should be considered alongside your own research, they offer a consensus view on the company's prospects. Further bolstering an analysis of Palantir stock should be a review of any significant partnerships or contract wins announced recently. These partnerships can signal future growth and revenue streams.

Assessing Palantir's Long-Term Growth Potential

Palantir operates in a rapidly growing market for big data analytics and AI-powered solutions. The increasing demand from both government and commercial sectors presents significant opportunities for long-term growth.

- Government Sector: Palantir's solutions are increasingly sought after by government agencies for intelligence analysis, cybersecurity, and other critical applications.

- Commercial Sector: Palantir is expanding its presence in the commercial sector, offering its platform to businesses across various industries to improve operational efficiency and decision-making.

Palantir possesses several competitive advantages, including its proprietary technology, strong customer relationships, and a talented team. However, potential risks and challenges exist, such as intense competition, dependence on large contracts, and the need for continuous innovation to maintain a technological edge.

Evaluating the Risks Associated with Investing in Palantir Stock Before May 5th

Market Volatility and its Impact on Palantir

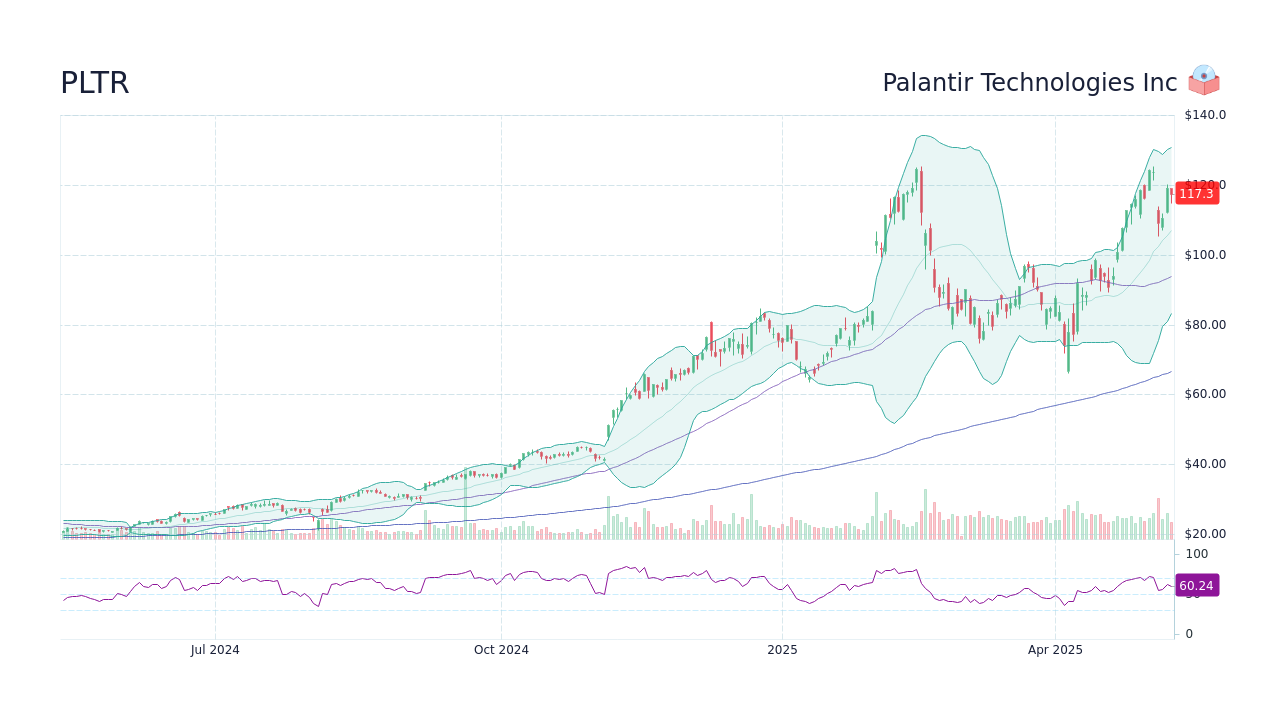

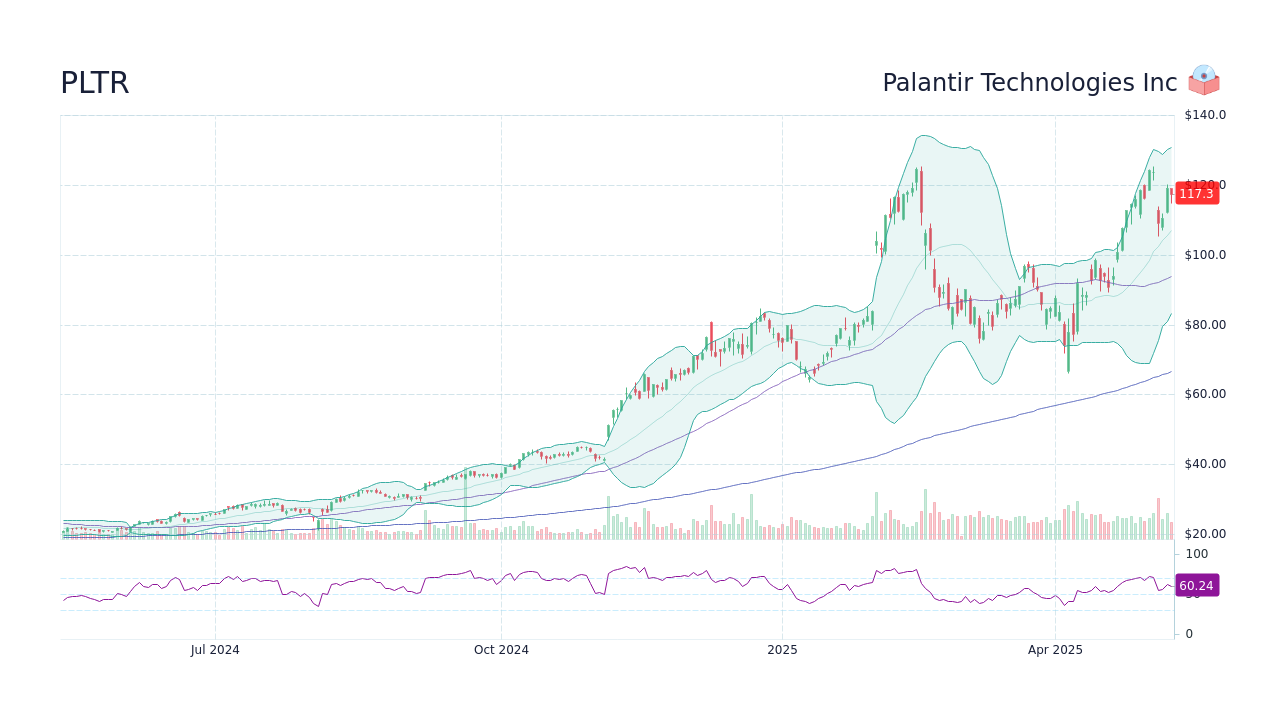

The overall market environment significantly impacts Palantir's stock price. Geopolitical events, economic downturns, and changes in investor sentiment can lead to considerable volatility. It's crucial to consider these factors when assessing the risk associated with investing in Palantir stock. Analyzing the historical volatility of Palantir's stock price provides insights into its past behavior and can offer clues about potential future fluctuations.

Potential Downsides and Risks of Investing Before May 5th

Investing in Palantir stock before May 5th carries inherent risks, including:

- Earnings Disappointments: If Palantir's Q1 2024 earnings fall short of expectations, the stock price could experience a significant drop.

- Unexpected News: Negative news related to the company's operations, legal issues, or competitive landscape could negatively impact the stock price.

- Short-Term Losses: The stock market is inherently unpredictable, and investing before a significant event like an earnings announcement always carries the risk of short-term losses.

Thorough due diligence is paramount. This includes reviewing financial statements, understanding the company's business model, and assessing its competitive landscape.

Developing a Sound Investment Strategy for Palantir Stock

Diversification and Risk Management

Diversification is crucial to mitigating risk. Don't put all your eggs in one basket. Investing in Palantir stock should be part of a broader investment portfolio that includes other assets to reduce overall risk exposure. Consider different investment strategies, such as dollar-cost averaging (DCA) to mitigate the impact of market volatility.

- Dollar-Cost Averaging: Investing a fixed amount of money at regular intervals, regardless of price fluctuations.

- Long-Term Investing: Holding the investment for an extended period to allow time for growth and to weather short-term market fluctuations.

Setting realistic investment goals and time horizons is crucial. Align your investment strategy with your risk tolerance and long-term financial goals.

Determining Your Investment Tolerance and Risk Appetite

Before investing in Palantir stock, honestly assess your risk tolerance.

- Conservative Investors: May prefer to avoid high-risk investments like Palantir stock, opting for safer alternatives.

- Aggressive Investors: Might be comfortable with higher risk in pursuit of potentially higher returns.

If you're unsure about your risk tolerance or how to develop an appropriate investment strategy, seek professional financial advice from a qualified advisor.

Conclusion

Investing in Palantir stock presents both exciting opportunities and significant risks. The company operates in a high-growth market but faces competition and market volatility. Whether or not to buy Palantir stock before May 5th depends heavily on your individual risk tolerance, investment horizon, and the results of your own thorough due diligence. While the potential for high returns exists, the possibility of short-term losses is equally real. A wait-and-see approach, pending the release of further information, might be prudent for some investors. However, for those with a high-risk tolerance and a longer-term outlook, Palantir could be a worthwhile addition to a diversified portfolio. Make informed decisions about your Palantir stock investments before May 5th.

Featured Posts

-

Harry Styles Snl Impression A Disappointing Take

May 09, 2025

Harry Styles Snl Impression A Disappointing Take

May 09, 2025 -

Exploring Elizabeth Hurleys Revealing Style Notable Cleavage Moments

May 09, 2025

Exploring Elizabeth Hurleys Revealing Style Notable Cleavage Moments

May 09, 2025 -

Inters Stunning Champions League Victory Over Bayern Munich

May 09, 2025

Inters Stunning Champions League Victory Over Bayern Munich

May 09, 2025 -

February 23 Nyt Strands Solutions Game 357 Hints And Answers Guide

May 09, 2025

February 23 Nyt Strands Solutions Game 357 Hints And Answers Guide

May 09, 2025 -

Lisa Rays Air India Complaint Airline Responds Calls Allegations Unfounded

May 09, 2025

Lisa Rays Air India Complaint Airline Responds Calls Allegations Unfounded

May 09, 2025