Today's Stock Market: Key Developments – Trump's Tariffs And UK Trade Deal

Table of Contents

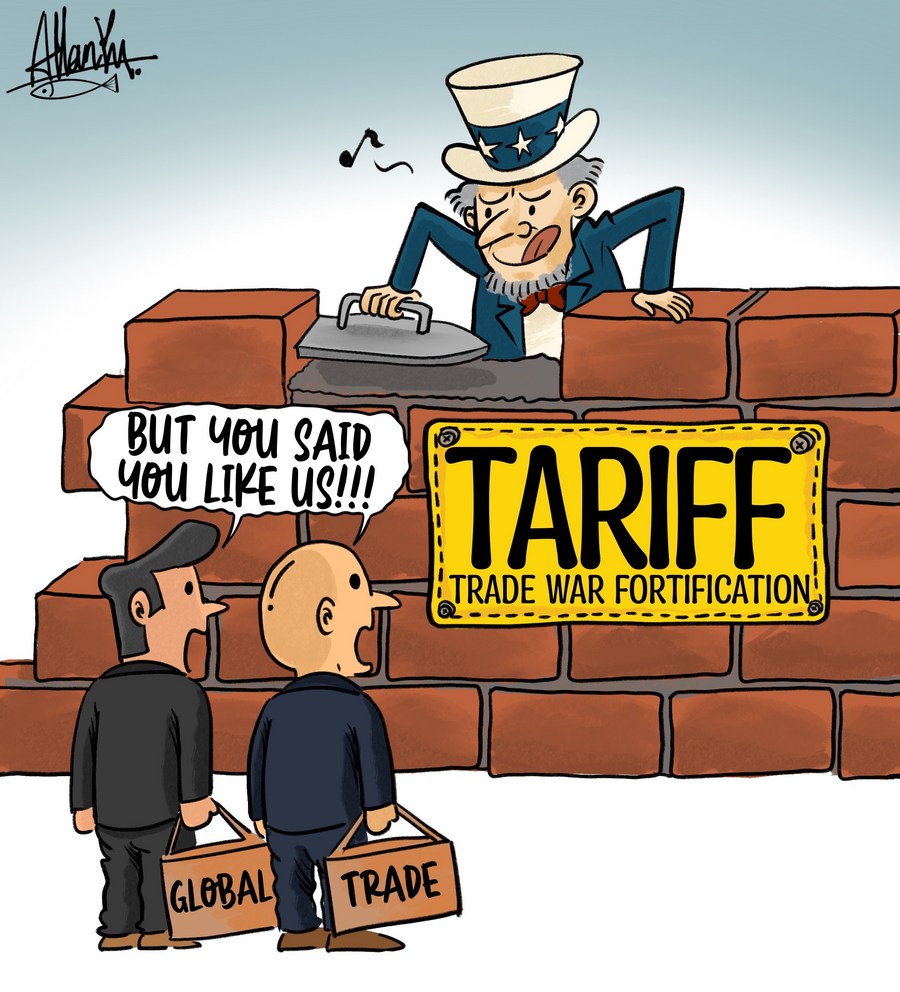

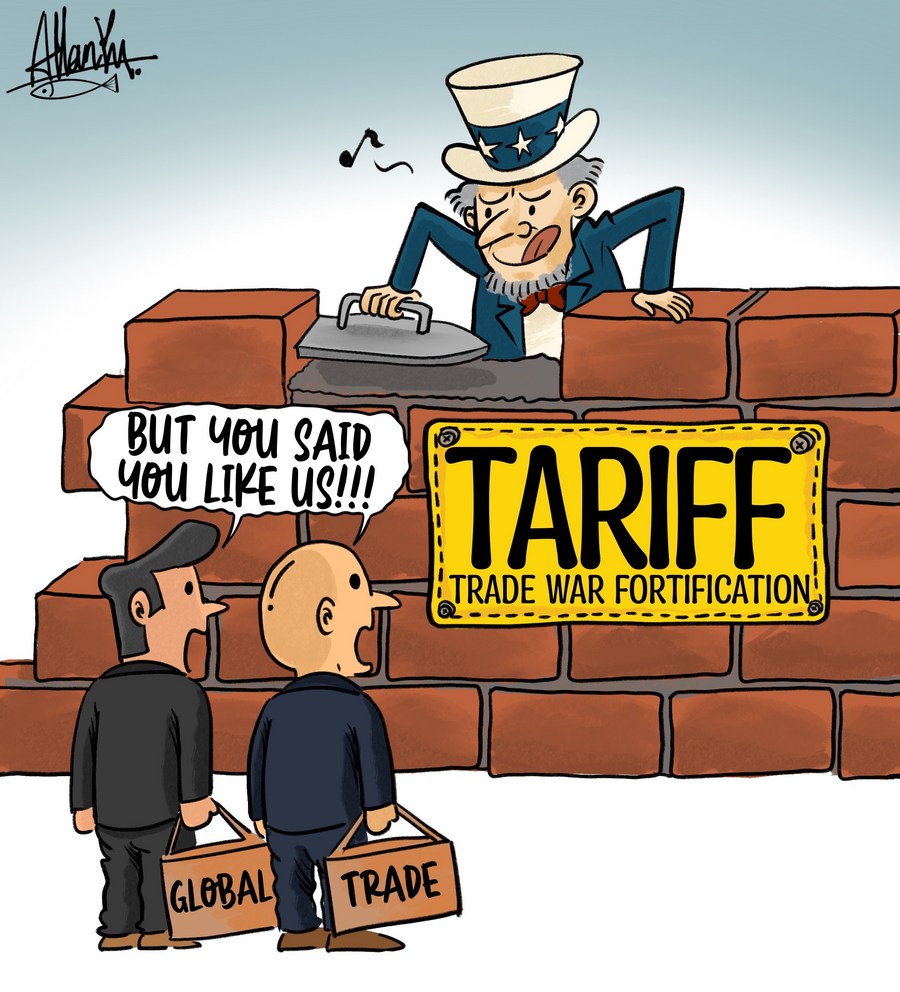

Trump's Tariffs: A Lingering Impact on Global Trade and Stock Market Performance

Trump's tariffs, implemented between 2018 and 2020, significantly impacted global trade and left a lasting mark on today's stock market. Their ripple effects continue to be felt, highlighting the interconnectedness of the global economy.

Sectoral Impact of Tariffs

Certain sectors were disproportionately affected by these tariffs. The manufacturing and agricultural sectors, in particular, experienced significant disruptions.

- Manufacturing: Companies reliant on imported materials faced increased costs, impacting profitability and share prices. For example, the steel and aluminum tariffs led to higher prices for manufacturers using these materials, squeezing profit margins.

- Agriculture: The trade war with China heavily impacted agricultural exports, leading to lower prices for farmers and impacting the stocks of agricultural companies.

- Technology: While not as directly targeted, the tech sector faced indirect consequences through supply chain disruptions and increased uncertainty in the global market.

The long-term effects of supply chain disruptions caused by the tariffs are still being felt. Companies are now reevaluating their global sourcing strategies, leading to increased diversification and potentially higher costs.

The Ripple Effect on Investor Sentiment

The uncertainty created by Trump's tariffs significantly impacted investor sentiment. The unpredictable nature of the trade disputes led to increased market volatility.

- Shift in Investment Strategies: Investors became more cautious, shifting towards defensive investments like government bonds and away from riskier assets.

- Correlation between Tariff Announcements and Market Volatility: Market reactions to tariff announcements were often dramatic, with sharp increases or decreases in stock prices depending on the specifics of the announcement. This volatility created an unpredictable investment environment.

The UK Trade Deal: Opportunities and Challenges for the Stock Market

The UK's post-Brexit trade deal with the EU, while aiming to minimize disruption, introduced new complexities for the stock market.

Post-Brexit Trade Dynamics

The new trade agreement brought both opportunities and challenges for UK-based companies.

- Potential Benefits: Increased access to certain markets outside the EU was a potential benefit. However, the realization of these opportunities depends heavily on successfully navigating new trade regulations.

- Potential Drawbacks: New regulatory hurdles, increased customs procedures, and the potential for increased costs significantly impacted many businesses. This resulted in fluctuations in the share prices of companies heavily reliant on EU trade.

Global Implications of the UK Trade Deal

The UK trade deal had broader global implications, influencing international trade and investor sentiment.

- Impact on Global Supply Chains: The deal's impact on supply chains, especially those involving the UK, resulted in adjustments and increased uncertainty for businesses across the globe.

- Influence on Other International Trade Agreements: The UK's approach to trade negotiations set a precedent that influenced how other countries approached similar negotiations, either inspiring similar policies or prompting countermeasures.

Interplay between Trump's Tariffs and the UK Trade Deal

The impacts of Trump's tariffs and the UK trade deal were not isolated events. There were significant overlaps and compounding effects.

Synergistic Effects

The two events created a climate of uncertainty that affected investor confidence globally. Companies dealing with both tariff increases and post-Brexit trade adjustments faced even greater challenges.

- For example, a UK manufacturer relying on imported materials subject to Trump's tariffs faced additional challenges navigating new post-Brexit customs regulations. This compounded the negative impact on profitability and share price.

Predicting Future Market Trends

These past events provide valuable lessons for predicting future market trends. The increasing interconnectedness of the global economy highlights the vulnerability of markets to geopolitical events.

- Potential Risks: Future trade disputes or unforeseen geopolitical events could trigger similar market reactions. Investors need to be prepared for unexpected volatility.

- Potential Opportunities: Companies that successfully navigate these challenges and adapt to changing global trade dynamics may offer significant investment opportunities.

Conclusion: Understanding Today's Stock Market in a Post-Tariff and Post-Brexit World

Trump's tariffs and the UK trade deal significantly impacted today's stock market, highlighting the importance of understanding global trade dynamics for successful investing. The volatility and uncertainty stemming from these events underscore the need for diversified investment strategies and a keen awareness of global political and economic developments.

Stay informed about Today's Stock Market and its key drivers by following reputable financial news sources. Understanding global trade dynamics is essential for navigating the complexities of today's investment landscape. Continue researching "Today's Stock Market" to make well-informed investment decisions and consider consulting a financial advisor for personalized guidance.

Featured Posts

-

Russias Military Might On Display Putins Victory Day Parade

May 11, 2025

Russias Military Might On Display Putins Victory Day Parade

May 11, 2025 -

Ufc 315 Fiorot Faces Shevchenkos Retirement Test

May 11, 2025

Ufc 315 Fiorot Faces Shevchenkos Retirement Test

May 11, 2025 -

Fremonts Wolf River Firefighter Honored During National Fallen Firefighters Memorial

May 11, 2025

Fremonts Wolf River Firefighter Honored During National Fallen Firefighters Memorial

May 11, 2025 -

Is Next Week The Launch Date For Ryan Reynolds Mntn Ipo

May 11, 2025

Is Next Week The Launch Date For Ryan Reynolds Mntn Ipo

May 11, 2025 -

Ufc 315 Belal Muhammad Vs Jack Della Maddalena Full Main Card Announced

May 11, 2025

Ufc 315 Belal Muhammad Vs Jack Della Maddalena Full Main Card Announced

May 11, 2025