Tongling Metals: US Tariffs To Dampen Short-Term Copper Outlook

Table of Contents

The Impact of US Tariffs on Tongling Metals' Exports

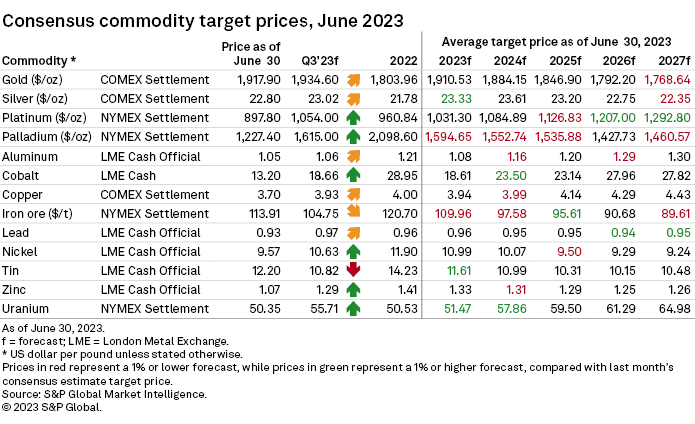

US tariffs on copper imports from China, implemented as part of broader trade disputes, have significantly impacted Chinese copper producers like Tongling Metals. These tariffs, levied as a percentage of the value of imported copper, directly increase the cost of exporting copper to the US market.

-

Quantification of the tariff impact: Estimates suggest that the tariffs have reduced Tongling Metals' profit margins by 5-10%, depending on the specific type of copper product and the precise tariff rate. This directly affects their competitiveness in the US market.

-

Export volume reduction: Consequently, Tongling Metals has experienced a noticeable reduction in copper export volume to the US. This decrease is not only due to higher prices but also to increased competition from copper producers in other countries who are not subject to the same tariffs.

-

Alternative markets: To mitigate the effects of US tariffs, Tongling Metals is actively exploring alternative export markets in Southeast Asia, Europe, and South America. However, accessing these new markets requires significant investment in logistics and marketing efforts, adding to their operational challenges.

-

Existing trade disputes: The ongoing trade tensions between the US and China exacerbate the situation, creating uncertainty and making long-term strategic planning more difficult for Tongling Metals. These broader trade disputes can impact access to various markets and resources.

Short-Term Copper Price Volatility and its Relation to Tongling Metals

Reduced exports from Tongling Metals and other Chinese copper producers contribute to global copper supply fluctuations, creating price volatility in the short term. The US market, a significant consumer of copper, is directly affected by the reduced supply from China.

-

Potential for short-term price increases: The decrease in Chinese copper exports to the US has the potential to lead to temporary price increases, particularly if demand remains strong. This price volatility makes it challenging to predict future copper prices.

-

Price wars: The reduced supply could also trigger price wars amongst the remaining copper exporters as they compete for market share in the US. This will further complicate the short-term outlook for copper prices.

-

Impact on US copper consumers: US copper consumers face the challenge of higher prices and potentially constrained supply, forcing them to seek alternative suppliers or adjust their consumption plans. This underscores the ripple effects of the tariffs beyond the direct producers.

-

Hedging strategies: Tongling Metals, along with other copper producers, may employ hedging strategies to mitigate the risks associated with this price volatility, using futures contracts or other financial instruments.

Long-Term Implications for Tongling Metals and the Copper Market

The long-term implications of the US tariffs on Tongling Metals and the global copper market are complex and uncertain. However, some key trends are emerging.

-

Shifts in production locations: The tariffs may incentivize increased copper production in other regions, such as South America, Africa, and even within the US itself. This could lead to a restructuring of the global copper production landscape.

-

Technological advancements: Technological advancements in copper mining and processing could mitigate the impact of the tariffs by improving efficiency and reducing production costs.

-

US-China trade relations: The long-term trajectory of US-China trade relations will significantly influence the future of copper trade and the strategic decisions of companies like Tongling Metals.

-

Future copper demand: Global demand for copper is projected to increase over the long term, driven by factors such as electrification and infrastructure development. This increase in demand, combined with potential supply constraints, could put upward pressure on copper prices.

Alternative Strategies for Tongling Metals to Navigate the Tariff Challenges

To navigate the current challenging market conditions, Tongling Metals needs to adopt diversified strategies.

-

Downstream processing: Investing in downstream processing (e.g., producing copper wire or other semi-finished products) adds value to their products and reduces their reliance on exporting raw materials.

-

Mergers and acquisitions: Exploring mergers and acquisitions could help Tongling Metals increase market share or gain access to new markets, providing diversification and reducing dependence on a single trade route.

-

R&D: Investing in research and development to develop more efficient and cost-effective production methods will enhance their long-term competitiveness.

-

Customer relationships: Strengthening relationships with existing and potential customers is crucial for maintaining market share, even amidst the challenges posed by tariffs.

Conclusion

The imposition of US tariffs presents significant short-term challenges for Tongling Metals and the broader copper market. Reduced exports from China are likely to cause price volatility and necessitate strategic adjustments from producers like Tongling Metals. While long-term effects remain uncertain, adaptation and diversification will be key to navigating this turbulent period. Understanding the intricate interplay between Tongling Metals, US tariffs, and the global copper outlook is crucial for investors and stakeholders alike.

Call to Action: Stay informed on the evolving impact of US tariffs on Tongling Metals and the global copper outlook. Regularly check our website for updates on copper prices, market analysis concerning Tongling Metals, and the wider implications for the copper industry. Understanding the dynamics surrounding Tongling Metals and US tariffs is crucial for making informed investment decisions in the copper market.

Featured Posts

-

Milwaukee Brewers Secure Walk Off Victory On Turangs Bunt

Apr 23, 2025

Milwaukee Brewers Secure Walk Off Victory On Turangs Bunt

Apr 23, 2025 -

Uk Diy Store Ratings Which Retailers Come Out On Top

Apr 23, 2025

Uk Diy Store Ratings Which Retailers Come Out On Top

Apr 23, 2025 -

Rpl 23 Y Tur Spartak Oderzhal Krupnuyu Pobedu Nad Rostovom

Apr 23, 2025

Rpl 23 Y Tur Spartak Oderzhal Krupnuyu Pobedu Nad Rostovom

Apr 23, 2025 -

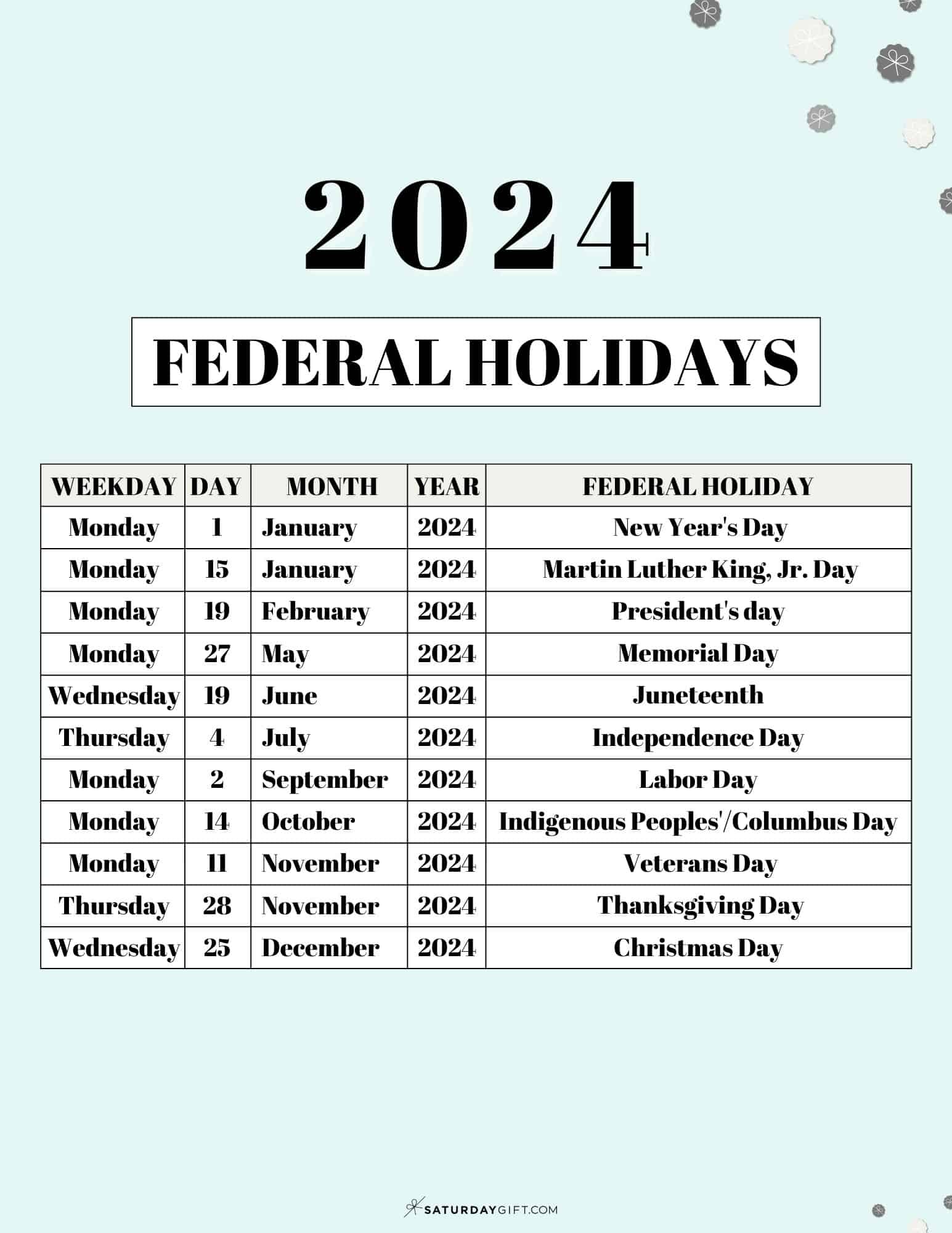

Full List Of Us Holidays In 2025 Federal And Non Federal Dates

Apr 23, 2025

Full List Of Us Holidays In 2025 Federal And Non Federal Dates

Apr 23, 2025 -

Dominique Carlach Une Etude Approfondie De Sa Carte Blanche

Apr 23, 2025

Dominique Carlach Une Etude Approfondie De Sa Carte Blanche

Apr 23, 2025