Toronto Housing Market Report: Sales Down 23%, Prices Down 4%

Table of Contents

Declining Sales Volume in the Toronto Housing Market

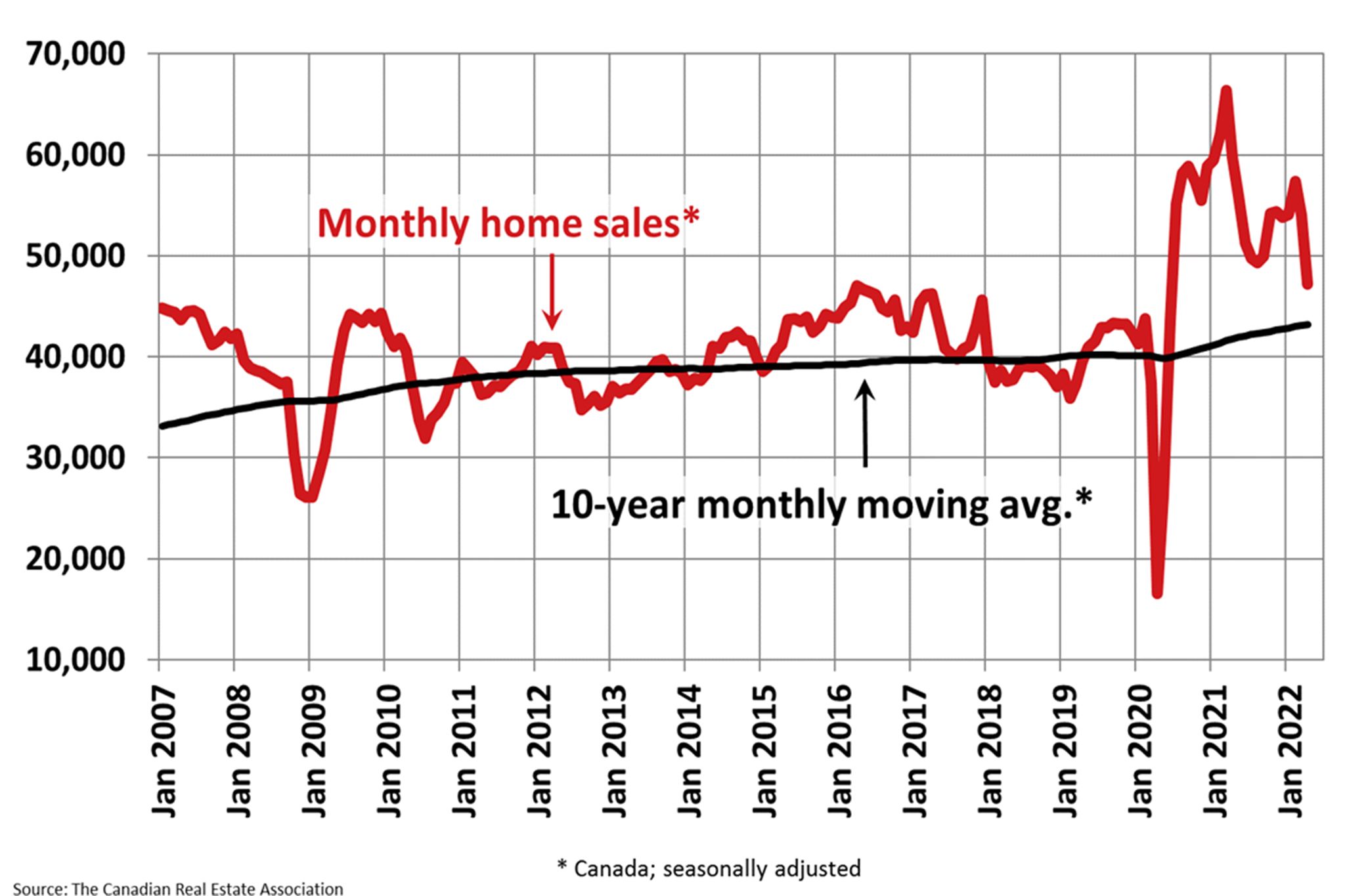

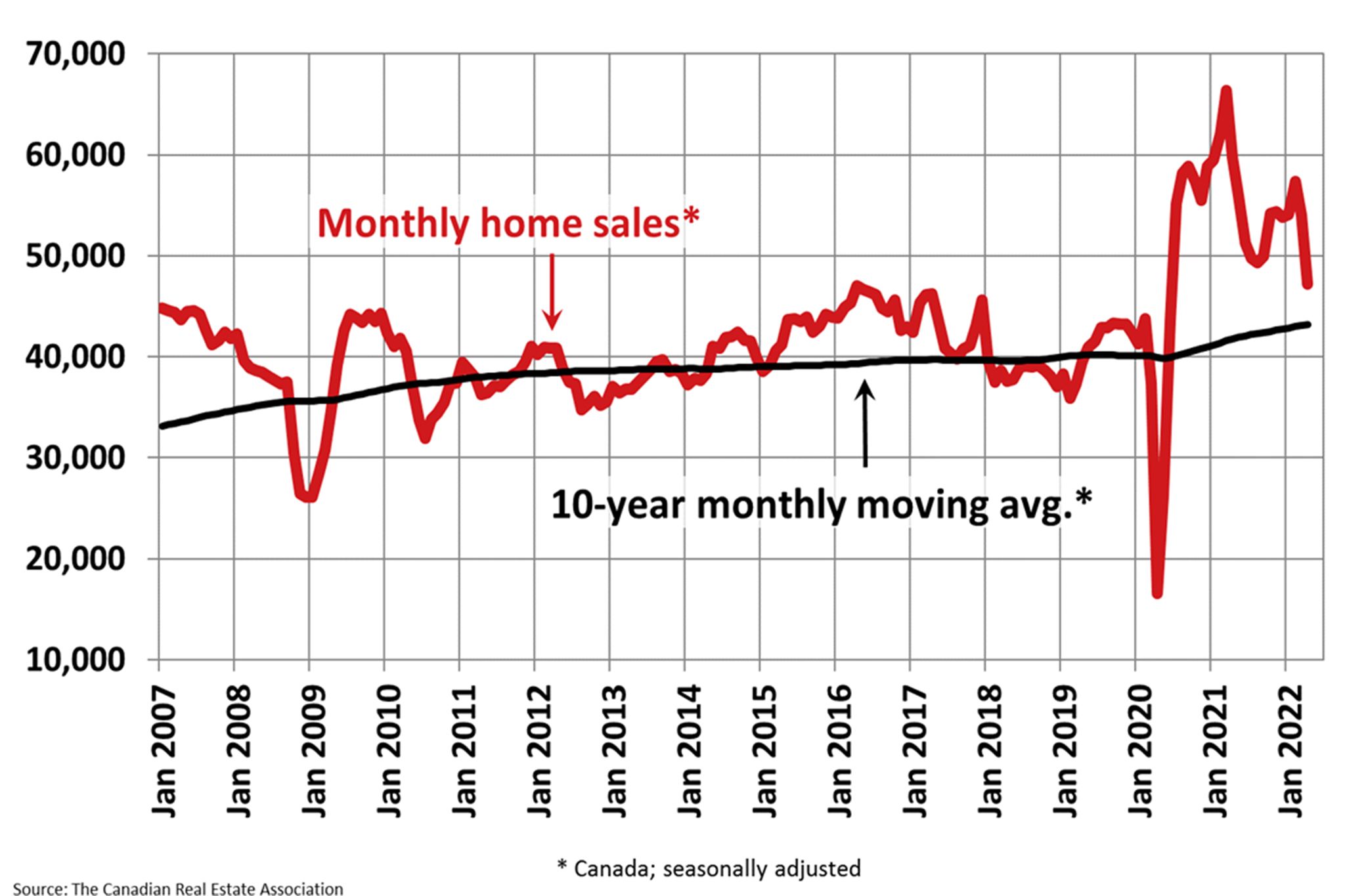

The 23% year-over-year decrease in Toronto real estate sales is a dramatic indicator of a cooling market. Compared to the frenzied pace of the previous few years, the current numbers paint a picture of significantly reduced activity. This decline isn't uniform across the board; month-over-month fluctuations also reveal a consistent downward trend. Several factors contribute to this substantial drop in sales volume.

-

Impact of rising interest rates on buyer affordability: Increased interest rates have drastically reduced borrowing power, making it more expensive for potential buyers to secure mortgages. This has effectively priced many out of the market, especially first-time homebuyers. Higher monthly payments significantly impact affordability, leading to fewer offers and ultimately, fewer sales.

-

Reduced investor activity due to market uncertainty: The uncertainty surrounding the future of the Toronto housing market has led to a decrease in investor activity. Investors, often sensitive to market shifts, are adopting a wait-and-see approach, contributing to the decline in overall sales volume.

-

Effects of economic slowdown on consumer confidence: A general economic slowdown and concerns about inflation have dampened consumer confidence, impacting purchasing decisions across the board, including the significant investment of buying a home. This cautious approach further contributes to the lower sales numbers.

-

Comparison of sales figures across different Toronto neighborhoods: The impact of the slowdown isn't uniform across all Toronto neighbourhoods. While some areas, particularly the downtown core, might be experiencing a more pronounced dip, others in the suburbs may show less significant declines. Further granular analysis is necessary to understand these variations.

-

Analysis of sales data for various property types (condos, detached homes, townhouses): The decline in sales is affecting various property types differently. Detached homes, traditionally the most expensive segment, are likely experiencing a more pronounced impact than condos, which may offer more affordable entry points.

Price Corrections in the Toronto Real Estate Market

The 4% decrease in Toronto house prices represents a notable correction in a market that had seen years of almost uninterrupted price growth. This isn't necessarily a market crash, but rather a significant adjustment. However, the implications for buyers and sellers are considerable.

-

Average price drops for different property types (condos, detached homes, townhouses): While the overall average price drop is 4%, the impact varies across different property types. Detached homes, having experienced the most dramatic price increases in recent years, are likely seeing larger percentage decreases compared to condos or townhouses.

-

Price changes across various Toronto neighbourhoods (e.g., downtown core vs. suburbs): Similar to sales volume, price changes aren't uniform across neighbourhoods. The downtown core, often a more volatile market segment, might be experiencing steeper price corrections than more stable suburban areas.

-

Comparison of price changes with other major Canadian cities: Comparing Toronto's price adjustments to those in other major Canadian cities provides valuable context. Are similar trends observable elsewhere, suggesting a broader national phenomenon, or is Toronto experiencing a unique correction?

-

Analysis of the impact of inventory levels on pricing: Increased inventory levels contribute to price reductions as a larger supply of homes creates more competition among sellers and subsequently lowers prices.

Factors Influencing the Toronto Housing Market Slowdown

Beyond interest rates, several other factors contribute to the Toronto housing market slowdown. Understanding these interwoven elements is crucial to comprehending the current market dynamics.

-

Increased borrowing costs and mortgage stress tests: Stricter mortgage stress tests and increased borrowing costs significantly impact buyer affordability, limiting the pool of eligible purchasers.

-

Impacts of inflation and economic uncertainty on purchasing power: Inflation erodes purchasing power, making it harder for potential buyers to afford homes, even if interest rates remained constant. Economic uncertainty further exacerbates this issue, discouraging investment in real estate.

-

Changes in government policies affecting the real estate market: Government policies, both federal and provincial, can influence the real estate market. Changes to tax policies, land transfer taxes, or other regulations can impact affordability and investment decisions.

-

Shifts in buyer preferences and demand: Changing buyer preferences and evolving demand can influence the market. For example, a shift towards smaller, more sustainable homes can affect sales of larger, detached properties.

-

Potential impact of new housing developments on supply: An increase in the supply of new homes through new developments can also impact prices and sales volume, creating more competition and potentially moderating price increases.

The Role of Interest Rates

Interest rates are arguably the most significant factor driving the current Toronto housing market slowdown. The Bank of Canada's interest rate hikes have directly increased borrowing costs, making mortgages more expensive and significantly reducing the affordability for many potential buyers. This reduction in purchasing power is a key contributor to both the lower sales volume and the price correction. The impact is felt most severely by first-time homebuyers with limited savings and those reliant on higher loan-to-value mortgages.

Conclusion

The Toronto housing market is experiencing a significant correction, with sales down 23% and prices down 4%. This downturn is primarily attributed to rising interest rates, economic uncertainty, and reduced buyer confidence. While the market shows signs of cooling, it remains crucial to monitor these trends closely. Different segments within the Toronto housing market are experiencing varying levels of impact. Further analysis is needed to determine if this represents a temporary adjustment or a more sustained shift in the long-term trajectory of the Toronto real estate sector.

Call to Action: Stay informed about the evolving Toronto housing market. Subscribe to our newsletter for regular updates and expert analysis on Toronto real estate trends. Understanding the latest shifts in the Toronto housing market is key to making informed decisions.

Featured Posts

-

Shkelje E Rregullores Se Uefa S Arsenali Nen Hetim Pas Ndeshjes Me Psg

May 08, 2025

Shkelje E Rregullores Se Uefa S Arsenali Nen Hetim Pas Ndeshjes Me Psg

May 08, 2025 -

Psg Vs Arsenal Gary Nevilles Prediction And Match Analysis

May 08, 2025

Psg Vs Arsenal Gary Nevilles Prediction And Match Analysis

May 08, 2025 -

Canadas Carney Rejects Trumps Overtures A White House Showdown

May 08, 2025

Canadas Carney Rejects Trumps Overtures A White House Showdown

May 08, 2025 -

The European Digital Identity Wallet A Closer Look

May 08, 2025

The European Digital Identity Wallet A Closer Look

May 08, 2025 -

Micro Strategy Vs Bitcoin Which Is The Better Investment In 2025

May 08, 2025

Micro Strategy Vs Bitcoin Which Is The Better Investment In 2025

May 08, 2025