Toronto Real Estate Market Update: Sales Down 23%, Prices Dip 4%

Table of Contents

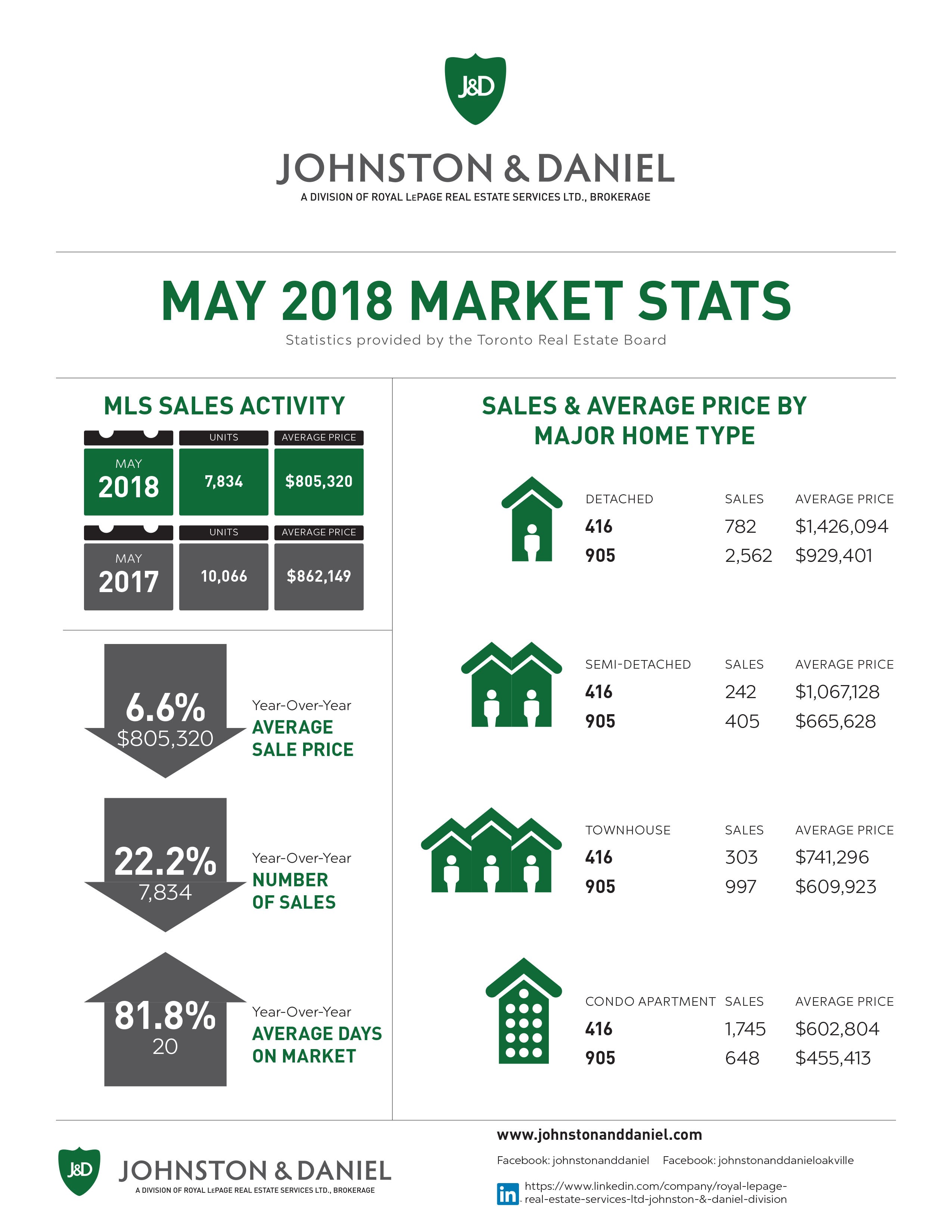

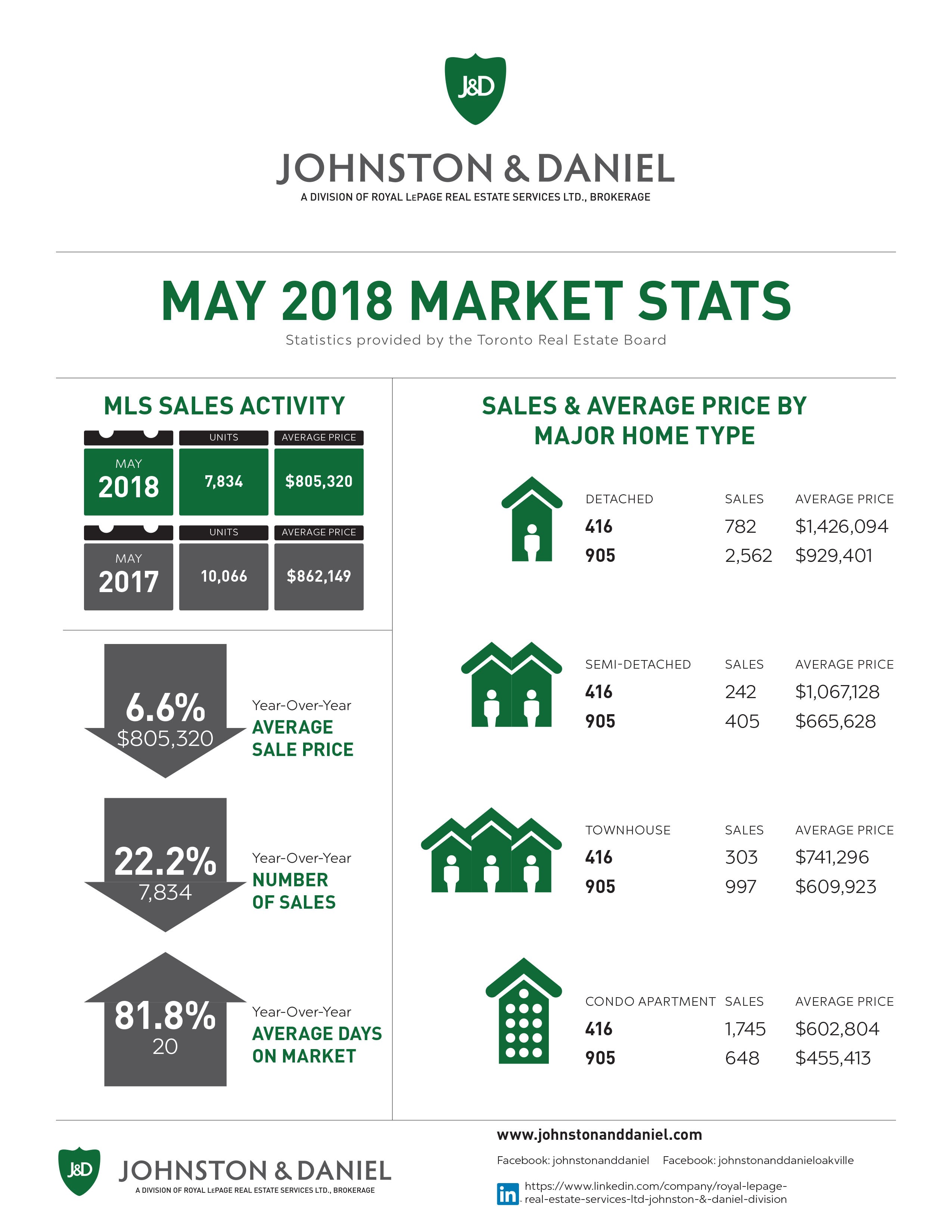

Significant Drop in Toronto Home Sales

The 23% decrease in Toronto home sales compared to the same period last year is undeniable. This dramatic fall reflects a significant cooling in buyer activity across various property segments. The impact is felt across the board, although some areas are experiencing sharper declines than others.

- Downtown Core: Sales of condos in the downtown core have dropped by approximately 28%, highlighting the impact of reduced commuter traffic and a shift in work-from-home patterns.

- Suburban Areas: While suburban areas haven't seen as drastic a drop, sales of detached homes are down approximately 20%, indicating a broader market correction.

- Townhouses: The townhouse market, often a popular middle ground, shows a decline of around 25%, suggesting affordability concerns are affecting a wide range of buyers.

This slowdown contrasts sharply with the frenzied market activity seen in previous years. The dramatic shift underscores the changing dynamics within the Toronto real estate market. The significant drop in home sales points to a market correction, and understanding these trends is crucial for both buyers and sellers.

Price Corrections in the Toronto Real Estate Market

Alongside the sales slump, average prices in the Toronto real estate market have fallen by approximately 4%. While this might seem significant, it's important to contextualize this within the larger picture. After years of substantial price growth, this could be viewed as a market correction rather than a catastrophic crash.

- Downtown Condos: Average prices for downtown condos have seen a more pronounced decline, falling by around 6%, reflecting the oversupply in certain segments.

- Detached Homes in the Suburbs: Detached homes in the suburbs have experienced a more moderate price decrease of around 3%, indicating more resilience in this segment.

- Areas Bucking the Trend: Certain niche markets and highly desirable neighborhoods are still experiencing relatively stable or even slightly increasing prices, showcasing the localized nature of this correction.

This price correction signals a shift toward a more balanced market. However, it’s important to note that price changes vary significantly across different property types and neighborhoods within Toronto. Careful analysis of specific areas is crucial for both buyers and sellers seeking to navigate the current landscape.

Factors Contributing to the Toronto Real Estate Market Slowdown

Several interconnected factors contribute to the slowdown in the Toronto real estate market. The most significant is the impact of rising interest rates.

- Rising Interest Rates: The Bank of Canada's interest rate hikes have significantly increased borrowing costs, making mortgages more expensive and reducing buyer affordability. This directly impacts purchasing power and dampens demand.

- Economic Uncertainty and Inflation: Economic uncertainty and persistent inflation further erode consumer confidence, making potential buyers hesitant to commit to large financial investments like purchasing a home.

- Government Policies: While not a direct driver, government policies related to housing affordability and speculation can indirectly influence market activity.

The interplay of these factors creates a complex situation, impacting both buyer behavior and overall market activity. Understanding these interconnected forces is vital for making informed decisions within the current Toronto housing market.

Outlook for the Toronto Real Estate Market

Predicting the future of the Toronto real estate market with complete accuracy is impossible. However, considering current trends and factors, we can propose potential scenarios.

- Short-Term Forecast (Next 6-12 Months): We anticipate a continuation of the current slowdown, with sales remaining relatively subdued and prices potentially experiencing further, albeit moderate, corrections.

- Long-Term Outlook (Next 2-5 Years): Over the long term, the market is expected to stabilize. However, the pace of recovery will depend on factors such as interest rate changes, economic growth, and government policy. A gradual return to more sustainable growth is a likely scenario.

- Potential Catalysts for Market Recovery: A reduction in interest rates, improved economic conditions, and increased buyer confidence could act as catalysts for a market rebound.

While uncertainty remains, a careful assessment of the current factors suggests a period of adjustment before a potential return to stronger growth in the Toronto real estate market.

Conclusion: Navigating the Changing Toronto Real Estate Landscape

In summary, the Toronto real estate market is experiencing a significant correction, marked by a 23% decrease in sales and a 4% dip in prices. Rising interest rates, economic uncertainty, and inflation are the primary drivers of this slowdown. While the short-term outlook suggests continued moderation, the long-term forecast points toward stabilization and eventual recovery.

Buyers and sellers navigating this changing Toronto real estate market should seek professional advice. Understanding the current dynamics of the Toronto housing market is crucial for making informed decisions. Stay informed about the Toronto real estate market and consult with experienced real estate professionals to tailor your strategy to the current conditions. Learn more about navigating the current Toronto housing market by connecting with a local expert today.

Featured Posts

-

Rusya Merkez Bankasi Ndan Kripto Para Uyarisi Yatirimcilar Icin Riskler

May 08, 2025

Rusya Merkez Bankasi Ndan Kripto Para Uyarisi Yatirimcilar Icin Riskler

May 08, 2025 -

El Regreso De Neymar Brasil Vs Argentina En El Monumental

May 08, 2025

El Regreso De Neymar Brasil Vs Argentina En El Monumental

May 08, 2025 -

Lyon Psg Macin Canli Yayini Nereden Izlenir

May 08, 2025

Lyon Psg Macin Canli Yayini Nereden Izlenir

May 08, 2025 -

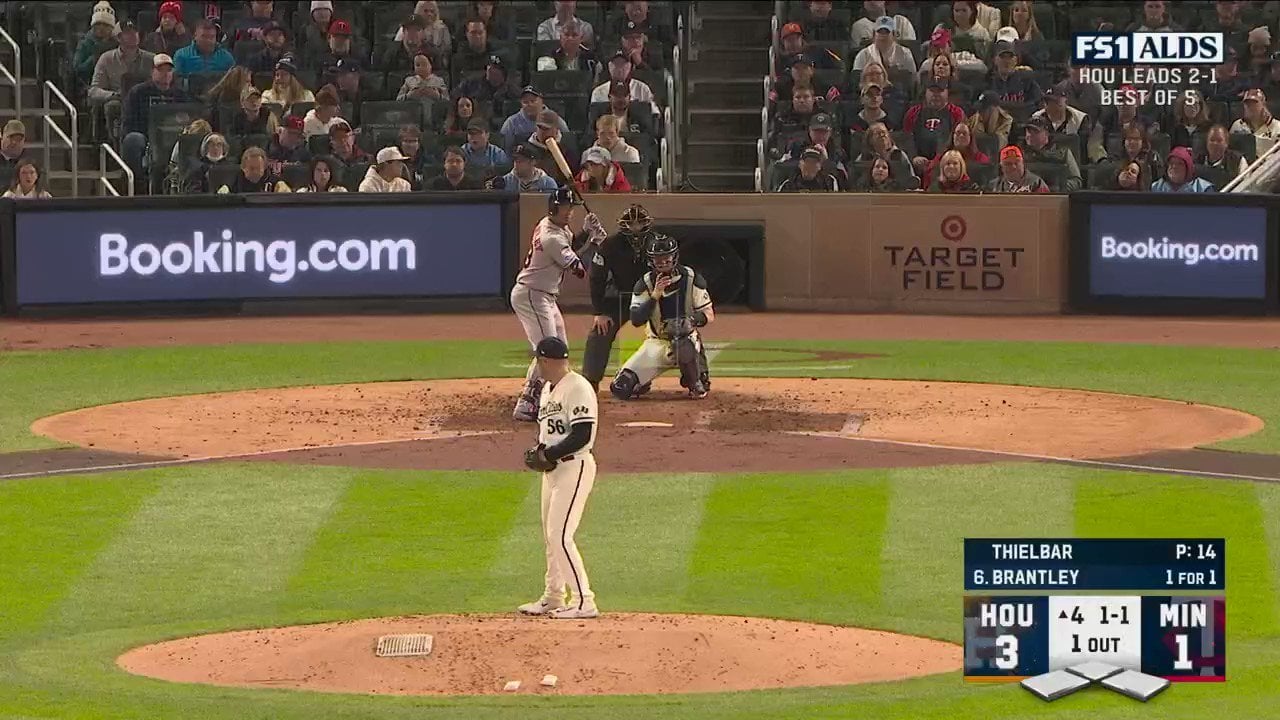

Minnesota Twins Dominate Angels Hitters Record 13 More Strikeouts

May 08, 2025

Minnesota Twins Dominate Angels Hitters Record 13 More Strikeouts

May 08, 2025 -

One Cryptocurrency To Watch Amidst The Trade Wars Crypto Crash

May 08, 2025

One Cryptocurrency To Watch Amidst The Trade Wars Crypto Crash

May 08, 2025