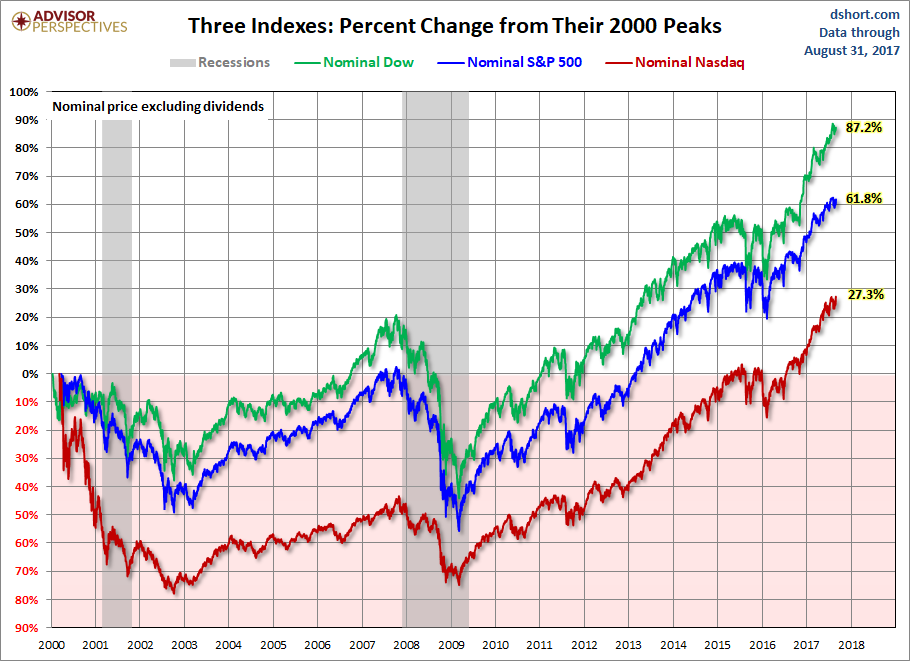

Tracking The Markets: Dow, S&P 500, And Nasdaq On May 30

Table of Contents

Dow Jones Industrial Average Performance on May 30

Opening and Closing Prices:

The Dow Jones Industrial Average opened at 33,800 on May 30th and closed at 33,900, representing a 100-point gain or a 0.3% increase. This positive movement, while modest, contrasted with some pre-market predictions.

Key Factors Influencing the Dow:

Several factors contributed to the Dow's positive performance on May 30th.

- Positive Manufacturing Data: Stronger-than-expected manufacturing data released earlier in the week boosted investor confidence.

- Easing Inflation Concerns: Reports suggesting a potential slowdown in inflation eased concerns about aggressive interest rate hikes by the Federal Reserve.

- Strong Earnings Reports: Several Dow component companies reported better-than-anticipated earnings, contributing to the overall positive sentiment.

These positive factors outweighed concerns about rising interest rates and geopolitical instability, leading to a modest upward trend for the Dow. The strong earnings reports, in particular, demonstrated resilience within certain sectors.

Dow Jones Sector Performance:

The technology sector within the Dow showed robust performance, contributing significantly to the overall gains. The financial sector also saw moderate growth, reflecting investor confidence in the banking sector's stability. In contrast, the energy sector experienced a slight decline due to fluctuating oil prices.

S&P 500 Index Performance on May 30

Opening and Closing Prices:

The S&P 500 opened at 4,200 and closed at 4,220 on May 30th, a 20-point gain or a 0.5% increase. This outperformance compared to the Dow reflects the broader representation of the S&P 500.

S&P 500 Sector Analysis:

- Technology: The technology sector led the gains within the S&P 500, mirroring the Dow's performance.

- Consumer Discretionary: The consumer discretionary sector also showed strong growth, indicating increased consumer spending.

- Healthcare: The healthcare sector remained relatively stable.

Comparison with the Dow:

The S&P 500's slightly better performance compared to the Dow on May 30th suggests a broader-based market rally, with gains not solely concentrated within the 30 Dow components.

Nasdaq Composite Performance on May 30

Opening and Closing Prices:

The Nasdaq Composite opened at 13,000 and closed at 13,150 on May 30th, a 150-point gain representing a 1.15% increase.

Technology Sector Influence:

The technology sector was the primary driver of the Nasdaq's strong performance. Several key tech giants reported positive earnings, boosting investor sentiment.

- Mega-cap Tech Stocks: Companies like Apple, Microsoft, and Google contributed significantly to the Nasdaq's gains.

- Positive Outlook for Tech Innovation: Positive investor sentiment surrounding AI development and related technologies also fueled the sector’s success.

Comparison with S&P 500 and Dow:

The Nasdaq's outperformance compared to both the S&P 500 and the Dow highlights the strong momentum within the technology sector, which holds significant weight in the Nasdaq Composite index.

Overall Market Sentiment and Outlook for May 30th

Investor Sentiment:

Overall investor sentiment on May 30th was cautiously optimistic. While positive economic data and strong earnings reports fueled gains, concerns about interest rates and geopolitical uncertainties remained.

Short-Term and Long-Term Outlook:

- Short-Term: The market's positive performance on May 30th suggests a potential continuation of the upward trend in the short term, pending further economic data releases.

- Long-Term: The long-term outlook depends largely on the trajectory of inflation, interest rate decisions, and geopolitical events. Sustained economic growth and controlled inflation would likely support a positive long-term trend.

Conclusion: Tracking the Markets: Key Takeaways and Next Steps

May 30th saw positive performances across major market indices, with the Nasdaq Composite leading the way. Strong earnings reports, easing inflation concerns, and positive manufacturing data contributed to the overall positive sentiment. However, interest rates and geopolitical factors remain key considerations for investors. To effectively track the markets and stay updated on significant shifts in the Dow, S&P 500, and Nasdaq, continue to follow our daily analysis. Stay informed on future market trends by subscribing to our daily market analysis. Continue tracking the markets with us!

Featured Posts

-

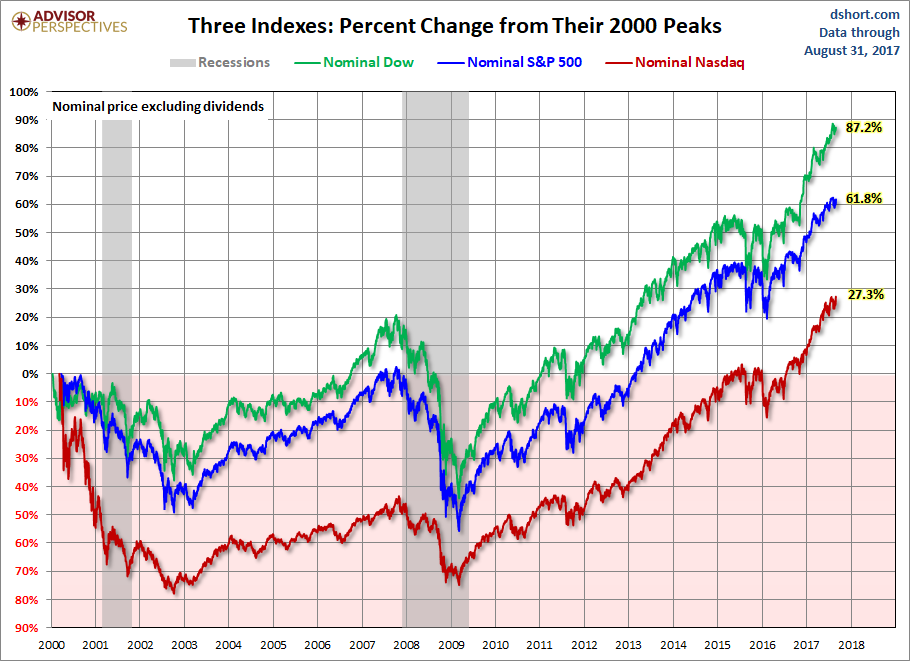

Showers And Thunderstorms Ne Ohio Weather Outlook And Safety Tips

May 31, 2025

Showers And Thunderstorms Ne Ohio Weather Outlook And Safety Tips

May 31, 2025 -

The Banksy Effect A 22 7 Million Print Market Boom

May 31, 2025

The Banksy Effect A 22 7 Million Print Market Boom

May 31, 2025 -

Investigating The Link Between Algorithmic Radicalization And Mass Shootings

May 31, 2025

Investigating The Link Between Algorithmic Radicalization And Mass Shootings

May 31, 2025 -

Incentive Program Free Housing For Two Weeks In A German City

May 31, 2025

Incentive Program Free Housing For Two Weeks In A German City

May 31, 2025 -

8 Recetas De Crepes Salados Para Una Cena Ligera Y Sabrosa

May 31, 2025

8 Recetas De Crepes Salados Para Una Cena Ligera Y Sabrosa

May 31, 2025