Tracking The Net Asset Value (NAV) Of Amundi MSCI All Country World UCITS ETF USD Acc

Table of Contents

Understanding the Amundi MSCI All Country World UCITS ETF USD Acc

The Amundi MSCI All Country World UCITS ETF USD Acc offers investors exposure to a broad range of global equities. Its investment strategy focuses on tracking the MSCI All Country World Index, providing a diversified portfolio weighted by market capitalization. This means the ETF holds a proportionate share of the world's largest companies, offering significant diversification across various sectors and geographies.

The ETF's expense ratio (insert expense ratio here), represents the annual cost of managing the fund, and it’s an important factor to consider as it impacts your overall returns. A lower expense ratio generally translates to a higher net return. You can easily identify this ETF using its ISIN (insert ISIN here) and ticker symbol (insert ticker symbol here).

Investing in a globally diversified ETF like the Amundi MSCI All Country World UCITS ETF USD Acc provides several key benefits:

- Global Market Exposure: Gain access to a wide range of international companies.

- Diversification: Reduce portfolio risk by spreading investments across multiple markets and sectors.

- Cost-Effectiveness: Generally lower expense ratios compared to actively managed mutual funds.

- Liquidity: Relatively easy to buy and sell on major exchanges.

- Transparency: The underlying holdings and performance are readily available.

Key Features:

- Investment objective: Global market exposure

- Underlying index: MSCI All Country World Index

- Currency: USD

- Expense ratio: [Insert expense ratio]

Sources for Tracking the Amundi MSCI All Country World UCITS ETF USD Acc NAV

Accurately tracking the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc requires accessing reliable data sources. Several options provide real-time and historical NAV information:

- Amundi Website: The official source for the most accurate NAV data. Check their investor relations section.

- Bloomberg Terminal: A professional-grade financial data platform offering detailed ETF information.

- Reuters Eikon: Similar to Bloomberg, providing comprehensive real-time data and analytics.

- Major Brokerage Platforms (e.g., Interactive Brokers, TD Ameritrade): Most brokerage accounts display real-time NAV for held ETFs.

It's crucial to understand that discrepancies might exist between different sources. Minor variations are common due to reporting delays or different calculation methods. Always prioritize official sources like the Amundi website to minimize the risk of misinformation and ensure you have the most accurate NAV data.

Factors Affecting the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc

Several factors influence the daily fluctuations of the Amundi MSCI All Country World UCITS ETF USD Acc NAV:

- Global Market Performance: The performance of the underlying assets within the MSCI All Country World Index directly impacts the NAV. Positive market movements generally lead to a higher NAV, and vice versa.

- Currency Fluctuations (USD): Since the ETF is denominated in USD, changes in exchange rates against other currencies can affect the NAV, especially for holdings in non-USD denominated companies.

- Dividend Payouts and Reinvestment: Dividend payments from underlying companies are usually reinvested back into the fund, impacting the NAV.

- Management Fees (Expense Ratio): The expense ratio gradually deducts from the fund's assets over time, subtly affecting the NAV.

Interpreting and Utilizing NAV Data for Investment Decisions

Understanding how to interpret NAV data is essential for making informed investment decisions. You can utilize NAV data in the following ways:

- Calculating Total Return: Compare the current NAV to your initial purchase price to determine your overall return on investment.

- Comparing Performance Against Benchmarks: Assess the ETF's performance relative to its benchmark index (MSCI All Country World Index) to gauge its effectiveness.

- Identifying Potential Entry/Exit Points: While not a sole indicator, observing NAV trends can inform potential buying or selling opportunities. Consider this in conjunction with other market analysis.

- Understanding Market Price vs. NAV: The market price of an ETF can deviate slightly from its NAV, particularly for actively traded ETFs. This difference is usually minimal and often reflects market supply and demand.

Remember that NAV is just one piece of the puzzle. Combine NAV analysis with a broader understanding of market trends, economic factors, and your overall investment strategy for optimal decision-making.

Conclusion: Stay Informed About Your Amundi MSCI All Country World UCITS ETF USD Acc NAV

Regularly tracking the Net Asset Value (NAV) of your Amundi MSCI All Country World UCITS ETF USD Acc investments is vital. By utilizing reliable sources like the Amundi website, Bloomberg, Reuters, and your brokerage platform, you can minimize the risk of misinformation and make informed decisions about your portfolio. Remember to consistently monitor the NAV in conjunction with a comprehensive investment strategy to maximize your returns. Continue your education on ETF investing and related topics to become a more sophisticated investor. Actively track your Amundi MSCI All Country World UCITS ETF USD Acc NAV today!

Featured Posts

-

Kyle Walkers Night Out Explaining The Photos With Mystery Women Amidst Annie Kilner Split

May 24, 2025

Kyle Walkers Night Out Explaining The Photos With Mystery Women Amidst Annie Kilner Split

May 24, 2025 -

Is Kyle Walker Peters Headed To West Ham Examining The Transfer Offer

May 24, 2025

Is Kyle Walker Peters Headed To West Ham Examining The Transfer Offer

May 24, 2025 -

Tuleeko Tuukka Taponen F1 Kuljettajaksi Taenae Vuonna

May 24, 2025

Tuleeko Tuukka Taponen F1 Kuljettajaksi Taenae Vuonna

May 24, 2025 -

Memorial Day 2025 Air Travel When To Book For The Best Prices And Avoid Crowds

May 24, 2025

Memorial Day 2025 Air Travel When To Book For The Best Prices And Avoid Crowds

May 24, 2025 -

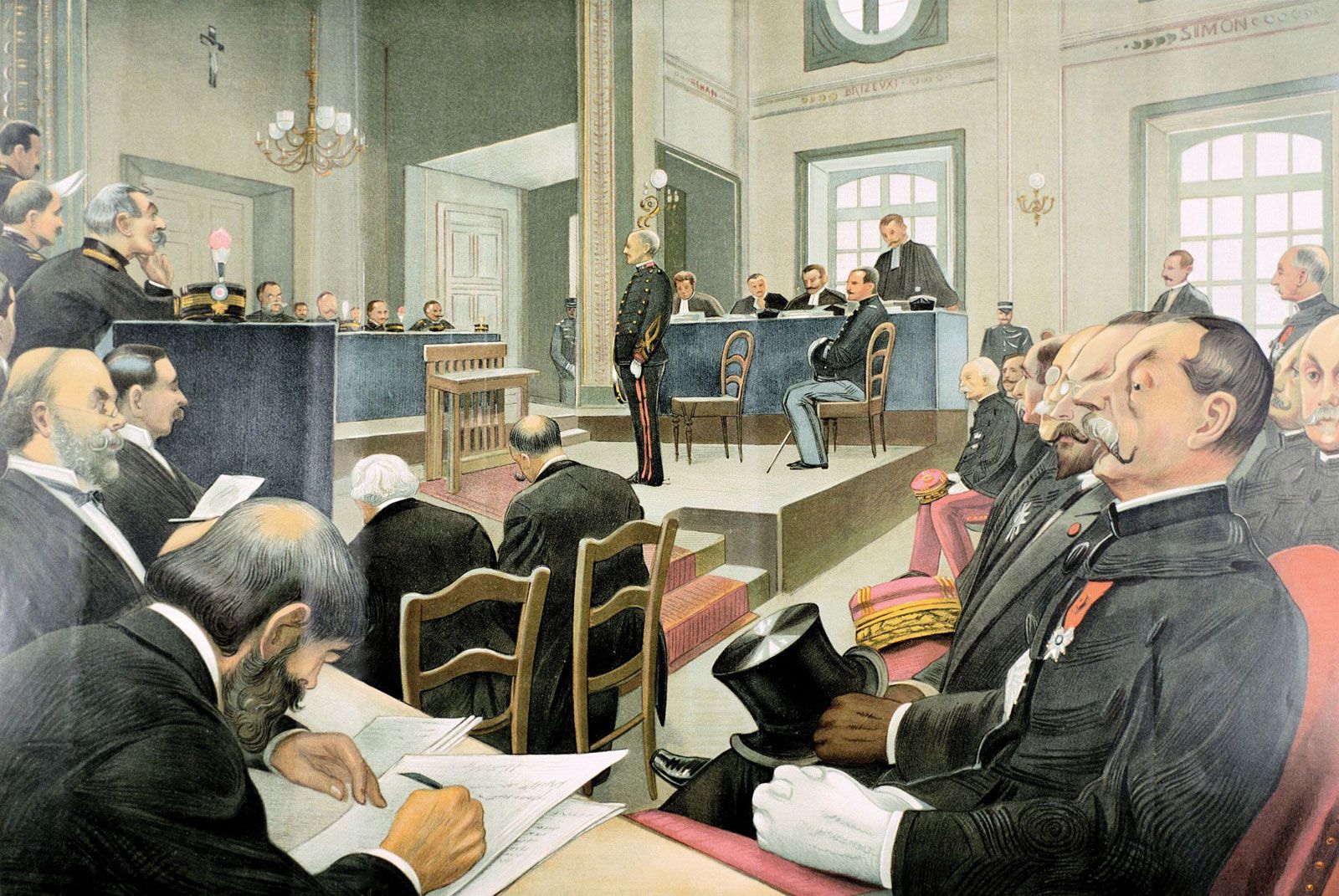

Posthumous Honor For Alfred Dreyfus French Parliament Debates Symbolic Act Of Rehabilitation

May 24, 2025

Posthumous Honor For Alfred Dreyfus French Parliament Debates Symbolic Act Of Rehabilitation

May 24, 2025

Latest Posts

-

Ex French Prime Minister Critiques Macrons Policies

May 24, 2025

Ex French Prime Minister Critiques Macrons Policies

May 24, 2025 -

French Lawmakers Push For Dreyfus Promotion A Century After The Scandal

May 24, 2025

French Lawmakers Push For Dreyfus Promotion A Century After The Scandal

May 24, 2025 -

Couple Goals Lady Gaga And Michael Polansky At Snl Afterparty

May 24, 2025

Couple Goals Lady Gaga And Michael Polansky At Snl Afterparty

May 24, 2025 -

Zimmermann Showcases Amira Al Zuhair At Paris Fashion Week

May 24, 2025

Zimmermann Showcases Amira Al Zuhair At Paris Fashion Week

May 24, 2025 -

Lady Gaga And Fiance Arrive At Snl Afterparty Photos

May 24, 2025

Lady Gaga And Fiance Arrive At Snl Afterparty Photos

May 24, 2025