Tracking The Net Asset Value Of The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

Defining Net Asset Value (NAV) and the Amundi Dow Jones Industrial Average UCITS ETF

Net Asset Value (NAV) represents the total value of an ETF's underlying assets minus its liabilities, divided by the number of outstanding shares. Essentially, it's the net worth of the ETF per share. The NAV is a crucial indicator of the ETF's intrinsic value and is closely related to its market price, though they may differ slightly. The Amundi Dow Jones Industrial Average UCITS ETF, as its name suggests, tracks the performance of the Dow Jones Industrial Average, one of the most widely followed stock market indices globally. This ETF offers investors exposure to 30 of the largest and most influential companies in the US economy, providing a diversified investment in a well-established index. This article aims to clearly explain how to effectively track the NAV of this specific, widely held ETF.

Understanding the Factors Affecting the Amundi Dow Jones Industrial Average UCITS ETF NAV

Several factors influence the daily fluctuations in the Amundi Dow Jones Industrial Average UCITS ETF's NAV. Understanding these factors is crucial for interpreting NAV changes and making sound investment decisions.

-

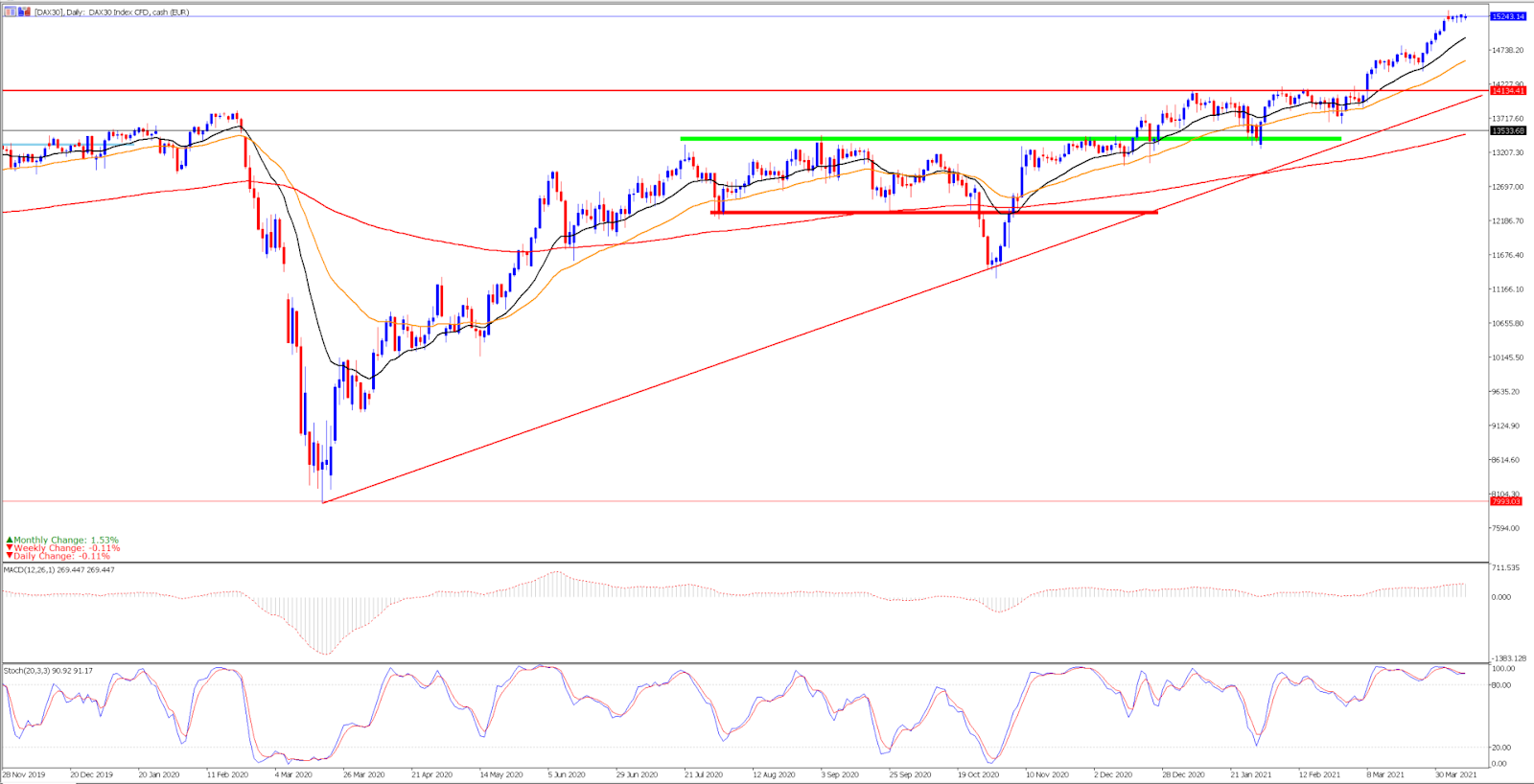

Performance of the Dow Jones Industrial Average: The primary driver of the ETF's NAV is the performance of the underlying Dow Jones Industrial Average index. Positive movements in the index generally lead to an increase in the ETF's NAV, while negative movements result in a decrease. This direct correlation is a key feature of index-tracking ETFs.

-

Currency Fluctuations: Because this is a UCITS ETF, currency fluctuations between the Euro (or other currency depending on the share class) and the US dollar could impact the NAV. If the dollar strengthens against the Euro, the NAV (expressed in Euro) might decrease, even if the underlying assets in USD perform well.

-

Management Expense Ratio (MER): The ETF's management fees, known as the MER, are deducted from the fund's assets and indirectly affect the NAV. While the MER's impact on the NAV is typically small on a daily basis, it's essential to consider it over the long term.

-

Other factors affecting NAV:

- Daily market movements of the Dow Jones 30 components. Individual stock price changes directly impact the overall index and subsequently, the ETF's NAV.

- Currency exchange rate fluctuations (if applicable). Changes in exchange rates between the ETF's base currency and the currency of the underlying assets can significantly affect the NAV.

- Impact of the ETF's management fees (MER). These fees reduce the overall value of the fund's assets and thus the NAV.

- Dividend distributions. When the underlying companies pay dividends, the ETF receives these distributions, which are then typically passed on to investors. This will affect the NAV.

Where to Find the Amundi Dow Jones Industrial Average UCITS ETF NAV

Reliable sources for obtaining the Amundi Dow Jones Industrial Average UCITS ETF's NAV are essential for effective tracking. Here are several options:

-

Amundi's Official Website: The ETF provider, Amundi, is the most reliable source for the official NAV. Their website usually provides end-of-day NAV data, and often real-time data as well.

-

Major Financial News Sources: Reputable financial news websites like Bloomberg, Yahoo Finance, Google Finance, and others often list real-time or end-of-day NAVs for various ETFs, including the Amundi Dow Jones Industrial Average UCITS ETF.

-

Your Brokerage Account: Most brokerage platforms provide real-time pricing and NAV information for the ETFs held in your portfolio. This is often the most convenient method for tracking your investment.

-

Dedicated ETF Data Providers: Several specialized financial data providers offer comprehensive ETF information, including NAV data. These often require a subscription but provide in-depth analytics and tools.

Interpreting the Amundi Dow Jones Industrial Average UCITS ETF NAV and its Implications for Investors

Understanding how to interpret the NAV and its relationship to the ETF's market price is vital.

-

NAV vs. Market Price: The NAV and the market price of an ETF are generally close, but they might differ slightly due to supply and demand dynamics in the market. A premium (market price > NAV) or discount (market price < NAV) can arise.

-

Arbitrage Opportunities: Significant differences between the NAV and market price can present potential arbitrage opportunities for sophisticated investors. However, these opportunities are often short-lived and require quick execution.

-

Tracking Investment Performance: Monitoring the NAV over time enables investors to accurately track the performance of their investment in the Amundi Dow Jones Industrial Average UCITS ETF. By comparing the changes in the NAV to your initial investment, you can calculate your returns.

-

Benchmarking: Comparing the NAV of the Amundi Dow Jones Industrial Average UCITS ETF to the actual Dow Jones Industrial Average allows you to assess the ETF's tracking efficiency.

Tools and Techniques for Efficiently Tracking the Amundi Dow Jones Industrial Average UCITS ETF NAV

Efficiently tracking the NAV requires the right tools and techniques.

-

Spreadsheets (Excel, Google Sheets): These tools allow you to easily record the NAV over time, calculate returns, and create charts to visualize the ETF's performance.

-

Portfolio Tracking Apps/Websites: Many apps and websites provide comprehensive portfolio tracking features, allowing you to monitor the NAV of multiple ETFs and other investments in one place.

-

Price Alerts: Setting up price alerts through your brokerage account or a financial news website can notify you of significant NAV changes, enabling you to react promptly to market movements.

Mastering the Amundi Dow Jones Industrial Average UCITS ETF NAV for Informed Investment Decisions

Effectively tracking the NAV of the Amundi Dow Jones Industrial Average UCITS ETF involves utilizing multiple reliable sources, such as Amundi's website, reputable financial news outlets, and your brokerage platform. Regularly monitoring the NAV, understanding its relationship to the market price, and utilizing tools like spreadsheets or portfolio tracking apps are key to making well-informed investment decisions. Remember to consider factors like the performance of the Dow Jones Industrial Average, currency fluctuations, and the MER when interpreting NAV changes. By actively tracking your Amundi Dow Jones Industrial Average UCITS ETF NAV and other relevant metrics, you can effectively manage your investment and potentially optimize your returns. To start tracking your investment today, visit the Amundi website [link to Amundi website].

Featured Posts

-

Hl Ystmr Sewd Daks 30 Thlyl Ladae Almwshr Alalmany

May 24, 2025

Hl Ystmr Sewd Daks 30 Thlyl Ladae Almwshr Alalmany

May 24, 2025 -

Kharkovschina Svadebniy Sezon Rekordnye 600 Brakov Za Mesyats

May 24, 2025

Kharkovschina Svadebniy Sezon Rekordnye 600 Brakov Za Mesyats

May 24, 2025 -

Fatal Shop Stabbing Leads To Rearrest Of Previously Released Teen

May 24, 2025

Fatal Shop Stabbing Leads To Rearrest Of Previously Released Teen

May 24, 2025 -

Financing Your Escape To The Country Practical Tips

May 24, 2025

Financing Your Escape To The Country Practical Tips

May 24, 2025 -

Profun A Fyrstu 100 Rafutgafu Porsche Macan

May 24, 2025

Profun A Fyrstu 100 Rafutgafu Porsche Macan

May 24, 2025

Latest Posts

-

Relx Succes Ondanks Economische Tegenwind De Rol Van Ai In De Groei

May 24, 2025

Relx Succes Ondanks Economische Tegenwind De Rol Van Ai In De Groei

May 24, 2025 -

Stijgende Kapitaalmarktrentes Euro Boven 1 08

May 24, 2025

Stijgende Kapitaalmarktrentes Euro Boven 1 08

May 24, 2025 -

Ai Stuwt Relx Groei Ondanks Zwakke Economie Voorspellingen Tot 2025

May 24, 2025

Ai Stuwt Relx Groei Ondanks Zwakke Economie Voorspellingen Tot 2025

May 24, 2025 -

Amsterdam Stock Market Aex Index Hits 1 Year Low After 4 Fall

May 24, 2025

Amsterdam Stock Market Aex Index Hits 1 Year Low After 4 Fall

May 24, 2025 -

Relx Sterke Financiele Resultaten Ondanks Economische Uitdagingen Dankzij Ai

May 24, 2025

Relx Sterke Financiele Resultaten Ondanks Economische Uitdagingen Dankzij Ai

May 24, 2025