Trade War And Crypto: A Winning Strategy For Investors

Table of Contents

Understanding the Impact of Trade Wars on Traditional Markets

Trade wars introduce considerable uncertainty, significantly impacting various traditional investment sectors. This uncertainty ripples through stock markets, commodities markets, and foreign exchange markets.

Increased Volatility and Uncertainty

Trade wars fundamentally increase market volatility. The imposition of tariffs on imported goods, for example, directly leads to price increases for consumers and can stifle economic growth by decreasing consumer spending. Furthermore, the geopolitical tensions inherent in trade disputes frequently cause market instability, leading to rapid and unpredictable price swings.

- Example: Tariffs on steel imports can increase the cost of construction, impacting real estate values and potentially slowing down the construction sector.

- Example: A trade dispute between major economies can lead to decreased international trade and negatively impact businesses reliant on global supply chains, resulting in stock price drops.

Diversification as a Protective Measure: Limitations in Trade Wars

While diversification is typically a cornerstone of risk management, traditional diversification strategies may prove insufficient during periods of trade war.

- Bullet Point: Holding assets across multiple sectors can reduce risk, but trade wars can impact entire sectors simultaneously. For instance, a trade war focused on technology could negatively affect multiple technology companies regardless of their specific niche.

- Bullet Point: International diversification becomes significantly more complex and risky during trade disputes. Tariffs and sanctions can disrupt established international trade routes and investment flows.

Cryptocurrencies as a Hedge Against Trade War Uncertainty

Cryptocurrencies offer a compelling alternative to traditional assets, especially during times of trade war uncertainty. Their inherent characteristics offer a unique form of protection.

Decentralized and Borderless Nature

The decentralized and borderless nature of cryptocurrencies makes them relatively less susceptible to the direct impacts of trade policies.

- Bullet Point: Crypto transactions are generally not subject to national tariffs or trade restrictions, offering a way to bypass these limitations.

- Bullet Point: The global nature of crypto markets allows for diversification across jurisdictions, mitigating the risk associated with any single national economy being negatively affected by trade disputes.

Safe Haven Asset Potential

During economic uncertainty, investors often seek alternative assets perceived as "safe havens."

- Bullet Point: Cryptocurrencies, much like gold, are increasingly viewed as a potential store of value during periods of instability. Their finite supply (in many cases) can make them attractive during times of inflation.

- Bullet Point: Demand for cryptocurrencies may increase as investors seek to preserve capital and diversify away from traditional assets affected by trade disputes.

Developing a Crypto Investment Strategy During Trade Wars

Navigating the crypto market during a trade war requires a strategic approach. Success depends heavily on careful planning and execution.

Due Diligence and Research

Thorough research is paramount. Understand the fundamentals of the specific cryptocurrencies you are considering.

- Bullet Point: Analyze market capitalization, underlying technology, and the level of adoption by businesses and individuals.

- Bullet Point: Research the team behind the project and their expertise, assessing their long-term vision and the project's overall viability.

Risk Management and Portfolio Diversification

Diversification remains critical, even within the cryptocurrency market.

- Bullet Point: Consider a diversified portfolio across different asset classes, including both established cryptocurrencies (like Bitcoin and Ethereum) and promising new projects with strong fundamentals.

- Bullet Point: Utilize risk management tools like stop-loss orders to limit potential losses, particularly crucial in a volatile market.

Long-Term Perspective

The cryptocurrency market is inherently volatile. A long-term investment strategy is crucial for success.

- Bullet Point: Avoid impulsive decisions driven by short-term market fluctuations. Focus on the long-term potential of the cryptocurrencies you've chosen.

- Bullet Point: Focus on the underlying technology and the potential for long-term growth of the broader cryptocurrency market.

Conclusion

Trade wars introduce significant uncertainty and risk into traditional markets. However, the decentralized nature and global reach of cryptocurrencies offer investors a compelling opportunity to mitigate these risks and potentially capitalize on market volatility. By carefully considering the factors outlined above and developing a well-researched and diversified Trade War and Crypto Investment Strategy, you can navigate these challenging economic times and potentially achieve substantial returns. Don't miss out – start building your resilient crypto portfolio today!

Featured Posts

-

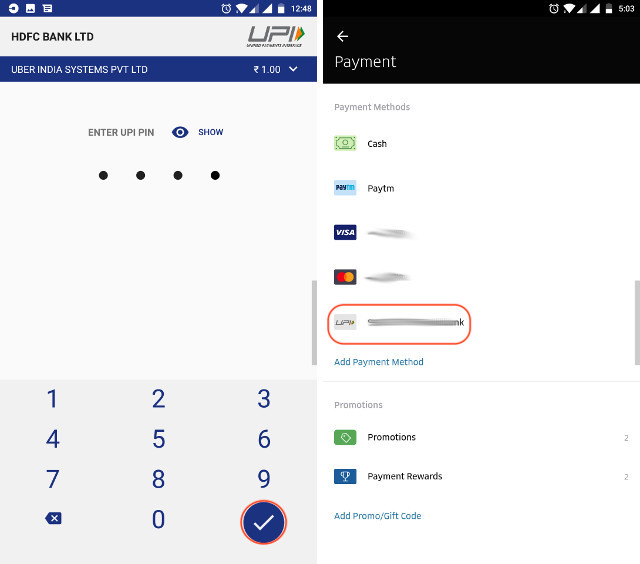

Is Upi Payment Still Available For Uber Auto Rides

May 08, 2025

Is Upi Payment Still Available For Uber Auto Rides

May 08, 2025 -

Celtics Game 1 Loss Colin Cowherds Scathing Assessment Of Jayson Tatum

May 08, 2025

Celtics Game 1 Loss Colin Cowherds Scathing Assessment Of Jayson Tatum

May 08, 2025 -

Hkd Usd Plummets Hong Kong Dollar Interest Rates Sharpest Fall Since 2008

May 08, 2025

Hkd Usd Plummets Hong Kong Dollar Interest Rates Sharpest Fall Since 2008

May 08, 2025 -

Open Ai Unveils New Tools For Voice Assistant Development

May 08, 2025

Open Ai Unveils New Tools For Voice Assistant Development

May 08, 2025 -

El Emotivo Gesto De Erick Pulgar Hacia Los Aficionados Del Flamengo

May 08, 2025

El Emotivo Gesto De Erick Pulgar Hacia Los Aficionados Del Flamengo

May 08, 2025