Trade Wars And Tech IPOs: A Cautious Market Response

Table of Contents

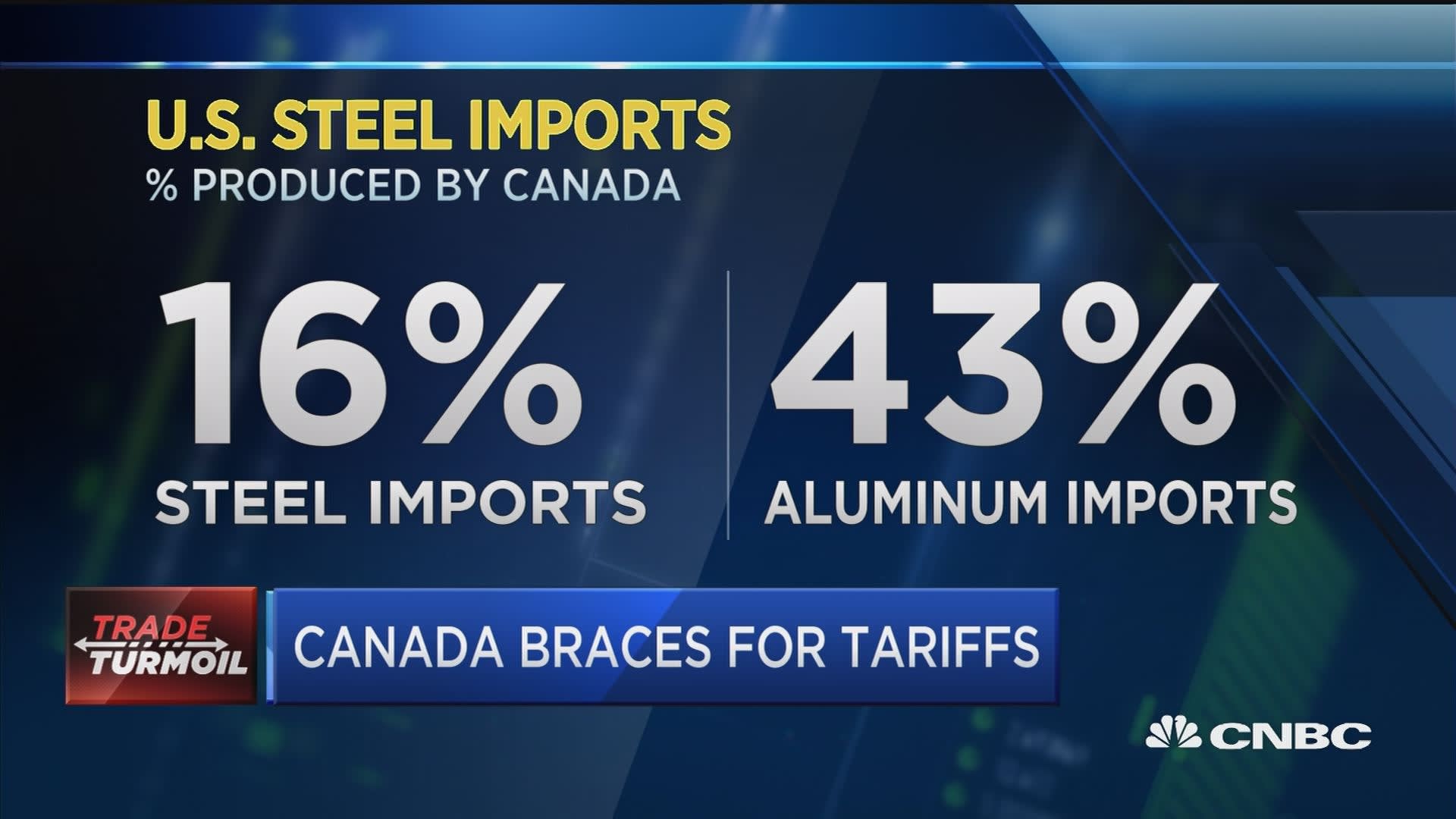

The Impact of Trade Wars on Global Economic Growth

Trade wars undermine global economic health, directly impacting the success of tech IPOs. This impact manifests in two key areas: reduced investor confidence and increased market volatility.

Reduced Investor Confidence

Trade wars erode investor confidence by creating uncertainty about future profits and market stability. This directly affects the appetite for riskier investments like tech IPOs. The uncertainty discourages both individual and institutional investors.

- Decreased consumer spending due to tariffs: Higher prices on imported goods reduce consumer spending power, impacting the revenue streams of many tech companies.

- Supply chain disruptions leading to higher production costs: Tariffs and trade restrictions disrupt global supply chains, increasing production costs for technology companies and reducing profit margins.

- Reduced foreign direct investment: Uncertainty surrounding trade policies deters foreign investment, limiting capital available for tech companies and impacting their growth potential.

Increased Market Volatility

The unpredictable nature of trade disputes leads to significant swings in stock market indices, making it harder to accurately price tech IPOs. This volatility makes long-term investment planning challenging.

- Increased market volatility impacts pricing valuations: Fluctuating market conditions make it difficult to determine a fair and accurate valuation for tech IPOs.

- Short-term trading becomes more prominent, reducing long-term investment: Investors may engage in short-term trading strategies due to heightened volatility, neglecting long-term growth potential.

- Uncertainty impacts future earnings projections for tech companies: The unpredictable nature of trade wars makes it difficult for companies to accurately predict future earnings, impacting investor confidence and valuations.

How Trade Wars Affect Tech IPO Valuations

Trade wars significantly influence the valuations of tech IPOs through reduced demand and the disruption of global supply chains.

Reduced Demand for Tech IPOs

In times of economic uncertainty fueled by trade wars, investors often seek safer havens, reducing demand for riskier assets such as newly issued tech stocks. This lower demand can impact the IPO’s success and long-term performance.

- Fewer institutional investors participate in IPOs: Institutional investors are more risk-averse during trade wars, leading to lower participation in tech IPOs.

- Lower initial pricing and reduced trading volume on debut: Reduced demand can result in lower initial pricing and reduced trading volume, negatively impacting returns for early investors.

- Increased difficulty securing favorable valuations: Companies may struggle to secure favorable valuations during times of market uncertainty, potentially limiting their fundraising potential.

Impact on Global Supply Chains

Many tech companies rely on global supply chains, making them vulnerable to disruptions caused by tariffs and trade restrictions. This vulnerability directly impacts profitability and valuation.

- Increased costs associated with sourcing components: Tariffs increase the cost of imported components, impacting the profitability of tech companies.

- Potential delays in product launches due to supply chain bottlenecks: Trade restrictions can create bottlenecks in supply chains, delaying product launches and impacting revenue.

- Negative impact on projected revenue and earnings: Supply chain disruptions and increased costs negatively impact projected revenue and earnings, reducing investor confidence and valuations.

Strategies for Navigating the Current Market

Navigating the current market requires a strategic approach that incorporates diversification, thorough due diligence, and a long-term perspective.

Diversification

Diversifying investment portfolios across various asset classes can mitigate the risk associated with tech IPOs during trade wars. Don't put all your eggs in one basket.

- Consider investing in established, less volatile companies: Diversify your portfolio by including established companies with a proven track record.

- Explore opportunities in sectors less sensitive to global trade: Invest in sectors less susceptible to the effects of trade wars.

- Allocate funds across different geographic markets: Diversify geographically to reduce dependence on any single region affected by trade disputes.

Thorough Due Diligence

Conduct extensive research on the financial health and future prospects of tech companies before investing in their IPOs. Thorough research is essential for making informed decisions.

- Analyze the company's business model and competitive landscape: Assess the company's strengths, weaknesses, opportunities, and threats within the market.

- Evaluate the company's dependence on global supply chains: Understand the company's vulnerability to supply chain disruptions.

- Review the company's management team and track record: Assess the experience and capabilities of the management team.

Long-Term Perspective

Maintaining a long-term investment strategy is crucial, allowing investors to weather short-term market fluctuations caused by trade wars. Focus on the long-term growth potential.

- Focus on companies with strong fundamentals and sustainable growth potential: Invest in companies with a solid foundation and the potential for long-term growth.

- Avoid impulsive trading based on short-term market reactions: Resist the urge to make hasty decisions based on short-term market fluctuations.

- Reassess investment strategies periodically based on market conditions: Regularly review your investment strategies and adapt them to changing market conditions.

Conclusion

The ongoing trade wars have created a challenging environment for tech IPOs, impacting investor confidence, valuations, and market performance. Understanding the complex interplay between global trade and the tech sector is crucial for investors to make informed decisions. By employing a diversified investment strategy, conducting thorough due diligence, and maintaining a long-term perspective, investors can navigate this uncertain landscape and potentially capitalize on opportunities presented by promising tech companies. Remember to carefully assess the risks associated with tech IPOs and the broader impact of trade wars before making any investment decisions. Stay informed about developments in global trade and adjust your investment strategy accordingly to mitigate risks and maximize potential returns in this dynamic market.

Featured Posts

-

40 000 E Eurojackpot Voitto Suomalainen Onnen Onnellinen

May 14, 2025

40 000 E Eurojackpot Voitto Suomalainen Onnen Onnellinen

May 14, 2025 -

2025 Outlook Serbia Denmark Germany Episode 58

May 14, 2025

2025 Outlook Serbia Denmark Germany Episode 58

May 14, 2025 -

Federer Povratak Na Terene Nedosta U Mi Navi Achi I Puni Stadioni

May 14, 2025

Federer Povratak Na Terene Nedosta U Mi Navi Achi I Puni Stadioni

May 14, 2025 -

Moose Jaw Hopes Tariffs Will Attract Canadian And American Businesses

May 14, 2025

Moose Jaw Hopes Tariffs Will Attract Canadian And American Businesses

May 14, 2025 -

Neljae Laehes Puolen Miljoonan Euron Eurojackpot Voittoa Katso Voittopaikat

May 14, 2025

Neljae Laehes Puolen Miljoonan Euron Eurojackpot Voittoa Katso Voittopaikat

May 14, 2025