Traders Reduce BOE Rate Cut Bets As Pound Rises Post-Inflation Data

Table of Contents

Inflation Data Surprises Markets

The latest UK inflation figures released [insert date] significantly deviated from market forecasts, triggering a ripple effect across the financial landscape. This deviation holds immense significance for BOE policy, as it suggests a potentially stronger-than-anticipated economic recovery.

- CPI (Consumer Price Index): Year-on-year inflation came in at [insert percentage], lower than the predicted [insert percentage]. Month-on-month inflation showed a [insert percentage] change, also defying expectations.

- Core Inflation: Excluding volatile energy and food prices, core inflation stood at [insert percentage], indicating underlying price pressures are [increasing/decreasing/stable].

- Comparison with Previous Months and Analyst Predictions: This represents a [increase/decrease] compared to the previous month's [insert percentage] and significantly undercuts the average analyst prediction of [insert percentage].

These unexpectedly positive numbers indicate a cooling inflation rate, reducing the pressure on the BOE to implement further rate cuts to stimulate the economy. The lower-than-expected UK inflation rate directly impacts the BOE's monetary policy considerations.

Pound Sterling Strengthens on Positive Inflation News

The positive inflation data immediately sparked a rally in the Pound Sterling (GBP). The improved economic outlook boosted investor confidence, leading to increased demand for the GBP against other major currencies. This strengthening reflects a renewed faith in the UK economy's resilience.

- GBP/USD: The pound appreciated against the US dollar, reaching [insert exchange rate].

- GBP/EUR: Similarly, the GBP strengthened against the Euro, trading at [insert exchange rate].

This positive movement in the GBP/USD and GBP/EUR exchange rates directly impacts forex trading strategies, influencing currency traders and investors to adjust their positions based on the new market dynamics. The strengthening pound reflects the market's reassessment of the UK's economic prospects.

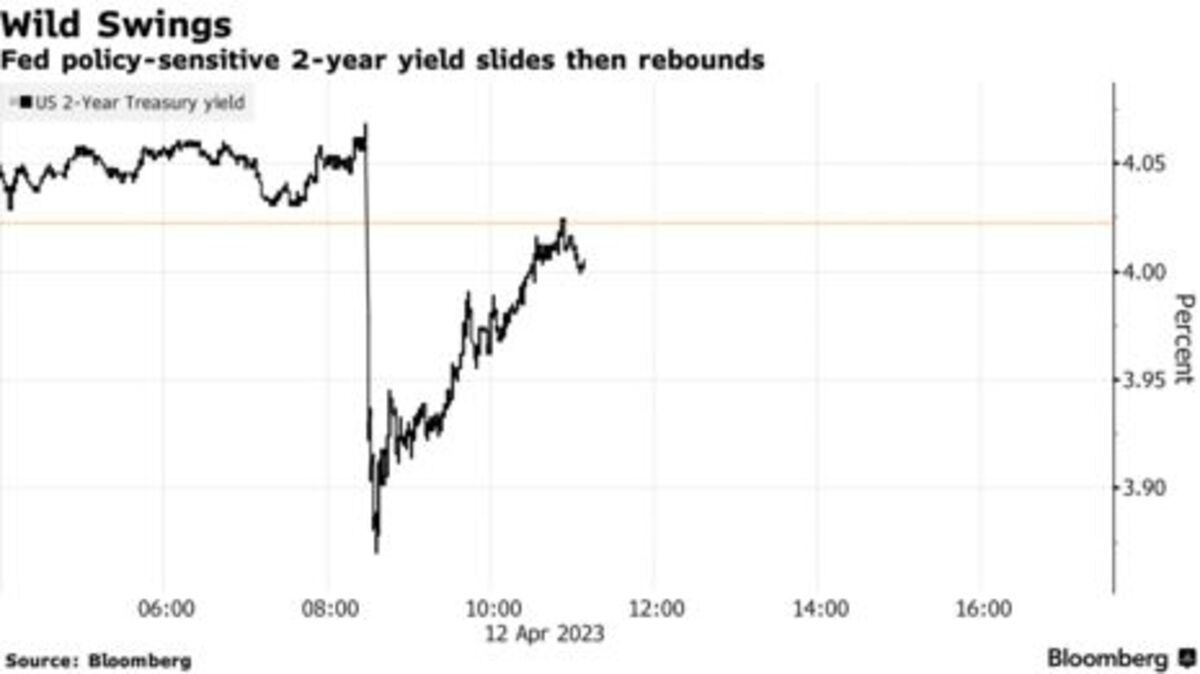

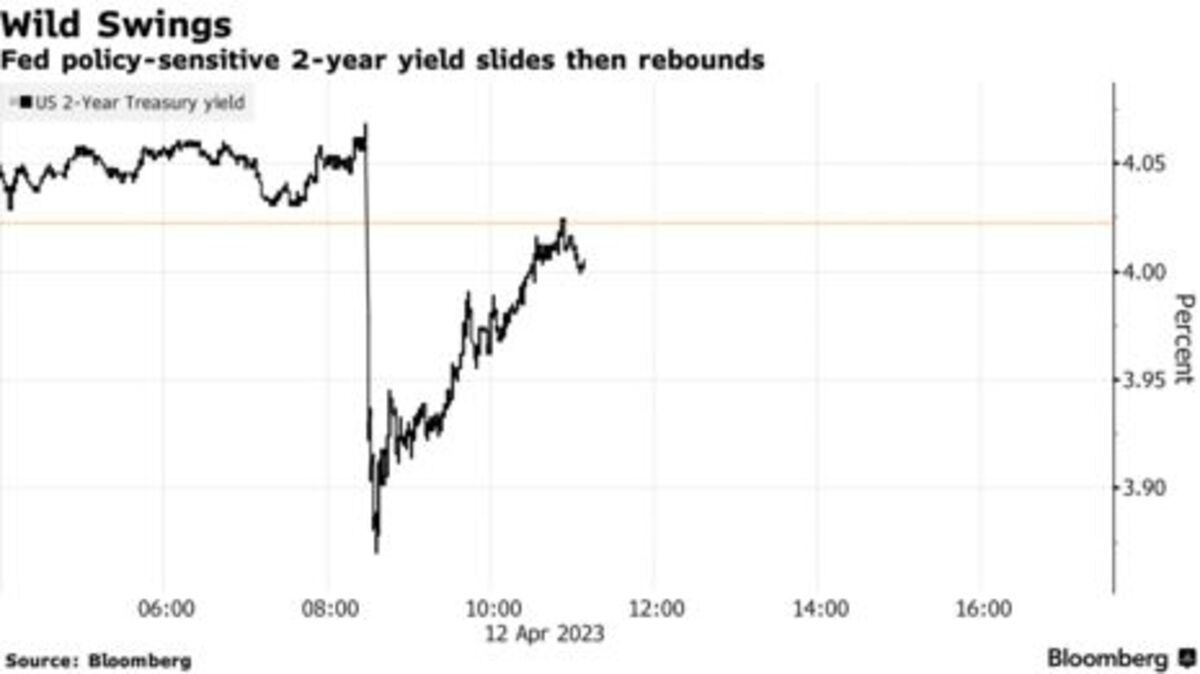

Reduced Bets on BOE Rate Cuts

The improved inflation data has significantly decreased the probability of a near-term BOE rate cut. The market's previous expectation of a rate cut to stimulate economic growth has diminished considerably, thanks to the positive inflation surprise. This shift reflects a change in the perceived necessity for further monetary easing.

- Interest Rate Futures Contracts: The pricing of interest rate futures contracts indicates a [insert percentage] probability of a rate cut in the next [insert timeframe], down from [insert percentage] before the inflation data release.

This reduction in the likelihood of a BOE rate cut impacts borrowing costs for businesses and individuals, affecting investment decisions and overall economic activity. A less accommodative monetary policy stance might lead to slightly higher borrowing costs but also signals greater stability and confidence in the UK economy.

Analysis of Trader Sentiment

Following the release of the positive inflation data, market sentiment shifted decisively towards optimism. The improved economic outlook boosted investor confidence, leading to a higher risk appetite among traders. This positive shift in sentiment is evident in increased trading activity and a more bullish outlook for the UK economy. Many trading strategies have been adjusted to reflect this improved outlook, with many investors now favoring assets perceived as more risky.

Conclusion: The Impact of Inflation Data on BOE Rate Cut Bets

In summary, the unexpectedly positive UK inflation data has had a significant impact on market expectations. The stronger-than-anticipated figures resulted in a strengthening Pound Sterling and a considerable reduction in bets on a future BOE rate cut. The improved economic outlook suggests a more stable and resilient UK economy. Monitoring inflation data and its subsequent effect on interest rate decisions remains crucial for all investors and traders. Staying informed about upcoming BOE announcements and other key economic indicators is vital for making informed decisions regarding BOE interest rate forecasts and GBP trading. For the latest information on BOE monetary policy decisions, regularly consult the Bank of England website and reputable financial news sources.

Featured Posts

-

The Hells Angels From Outlaw Motorcycle Club To Global Phenomenon

May 26, 2025

The Hells Angels From Outlaw Motorcycle Club To Global Phenomenon

May 26, 2025 -

Bayerns Neuer Faces Extended Absence Due To Injury

May 26, 2025

Bayerns Neuer Faces Extended Absence Due To Injury

May 26, 2025 -

Experience D C Pride A Comprehensive Guide To 2024 Events

May 26, 2025

Experience D C Pride A Comprehensive Guide To 2024 Events

May 26, 2025 -

Andalusian Farmstay Escape Your Peaceful Country Retreat

May 26, 2025

Andalusian Farmstay Escape Your Peaceful Country Retreat

May 26, 2025 -

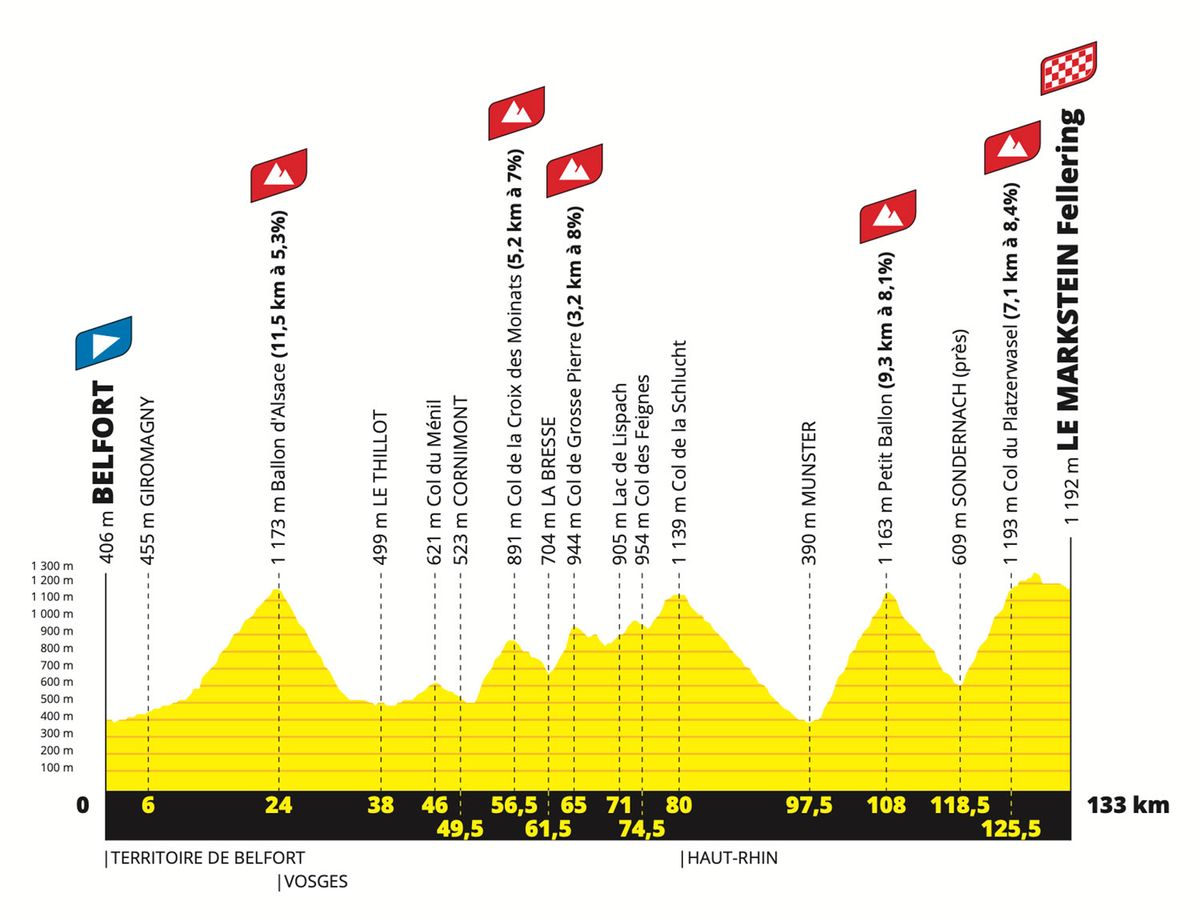

Jeu De Management Cycliste Rtbf Preparez Vous Pour Le Tour De France

May 26, 2025

Jeu De Management Cycliste Rtbf Preparez Vous Pour Le Tour De France

May 26, 2025