Tribal Loans Direct Lender: Navigating Bad Credit Loan Options

Table of Contents

Understanding Tribal Loans and Direct Lenders

What are Tribal Loans?

Tribal loans are short-term loans offered by lending institutions that are often affiliated with Native American tribes. These loans operate under the sovereignty of the tribes, which allows them to operate outside of some state regulations. It's important to understand that this doesn't necessarily mean they are unregulated; however, the regulatory landscape can be complex. Tribal loans are often marketed as an option for individuals with bad credit who may have difficulty securing financing through traditional channels, such as banks or credit unions. They are distinct from payday loans, although they share similarities in terms of their short repayment periods. Payday loans typically require repayment on the borrower's next payday, whereas tribal loans may offer slightly longer repayment terms, often structured as installment loans.

Advantages of Using a Direct Lender for Tribal Loans

Using a direct lender for tribal loans offers several key advantages:

- No Third-Party Fees: You deal directly with the lender, avoiding intermediary fees that can inflate the overall cost of the loan.

- Faster Processing: Direct lenders often have streamlined application processes, leading to quicker approvals and faster access to funds. This is particularly beneficial for emergency loans.

- Enhanced Privacy: Dealing directly with the lender can provide greater privacy and security for your personal and financial information.

- Improved Communication: Direct access to customer service simplifies communication and makes addressing any questions or concerns easier.

- Potentially Better Terms: While not always the case, direct lenders may sometimes offer more competitive interest rates and loan terms compared to those offered through brokers.

Disadvantages of Tribal Loans

While tribal loans offer convenience, it's crucial to acknowledge potential drawbacks:

- High Interest Rates: Interest rates on tribal loans can be significantly higher than those on traditional loans, so careful consideration of the total cost is essential.

- Strict Repayment Schedules: Missed payments can lead to significant penalties and further financial difficulties.

- Debt Trap Potential: The high interest rates and short repayment periods can create a cycle of debt if not managed carefully. Borrowers need to have a clear repayment plan in place.

- Legal and Regulatory Complexity: The regulatory landscape for tribal loans is complex and varies depending on tribal jurisdiction and state laws.

- Finding Reputable Lenders: Thorough research is necessary to identify legitimate and trustworthy lenders.

Finding Reputable Tribal Loan Direct Lenders

Due Diligence Before Applying

Before applying for a tribal loan, conduct thorough due diligence:

- Verify Licensing: Check if the lender is properly licensed and registered to operate in your state.

- Transparent Fees: Look for lenders with clear and transparent fee structures and interest rates, avoiding hidden charges.

- Customer Reviews: Read online reviews and testimonials to gauge the lender's reputation and customer service.

- Contact Information: Verify the lender's contact information, including a physical address if possible, to avoid scams.

- Avoid Guaranteed Approvals: Be wary of lenders promising guaranteed approval without a credit check. This is often a sign of a predatory lender.

Comparing Loan Offers

Once you've identified potential lenders, carefully compare their offers:

- Interest Rates: Compare APRs (Annual Percentage Rates) to find the lowest rate.

- Fees: Consider all fees, including origination fees, late payment penalties, and any other charges.

- Repayment Terms: Compare loan terms and repayment schedules to determine what fits your budget.

- Loan Amounts: Choose a loan amount that you can comfortably repay.

- Shop Around: Don't settle for the first offer you receive; shop around and compare multiple offers.

Applying for a Tribal Loan with a Direct Lender

Gather Necessary Documentation

To apply for a tribal loan, you'll need to provide the following documentation:

- Proof of Income: Pay stubs, bank statements, or tax returns demonstrating your income.

- Government-Issued ID: A valid driver's license or other form of government-issued photo identification.

- Bank Account Details: Information about your checking or savings account for direct deposit of funds.

- Employment Information: Details about your current employer, job title, and length of employment.

The Application Process

The application process for tribal loans is typically straightforward:

- Online Application: Most direct lenders offer online application forms that are quick and easy to complete.

- Required Information: You'll be asked to provide the necessary documentation and personal information.

- Approval Times: Approval times vary but are generally faster than traditional loans.

- Pre-Approval Options: Some lenders may offer pre-approval options to help you understand your eligibility before submitting a full application.

Responsible Borrowing and Repayment

Creating a Repayment Plan

Before accepting a loan, create a realistic repayment plan:

- Budgeting: Carefully budget to ensure you can comfortably afford the monthly payments.

- Automatic Payments: Set up automatic payments to avoid missed payments and late fees.

- Early Repayment: Explore options for early repayment to potentially save on interest.

- Consequences of Missed Payments: Understand the penalties for late or missed payments.

Seeking Help with Debt Management

If you're struggling to manage your debt, seek professional help:

- Credit Counseling: Contact a reputable credit counseling agency for guidance and support.

- Debt Consolidation: Explore debt consolidation options to simplify your payments and potentially lower your interest rates.

- Bankruptcy: Consider bankruptcy only as a last resort after exhausting other options.

Conclusion

Tribal loans from a direct lender can provide a viable solution for individuals facing bad credit situations needing emergency funds or short-term financial assistance. However, it is crucial to proceed with caution, conducting thorough research to find a reputable lender and understand the terms and conditions thoroughly. By carefully comparing offers and creating a solid repayment plan, you can navigate the process responsibly. Remember to always prioritize responsible borrowing and consider alternative financing options if necessary. Don't hesitate to explore your options with various tribal loans direct lender services to find the best fit for your individual needs. Remember to always borrow responsibly and only take out a loan you can afford to repay.

Featured Posts

-

Offre Speciale Samsung Galaxy S25 128 Go A 648 E

May 28, 2025

Offre Speciale Samsung Galaxy S25 128 Go A 648 E

May 28, 2025 -

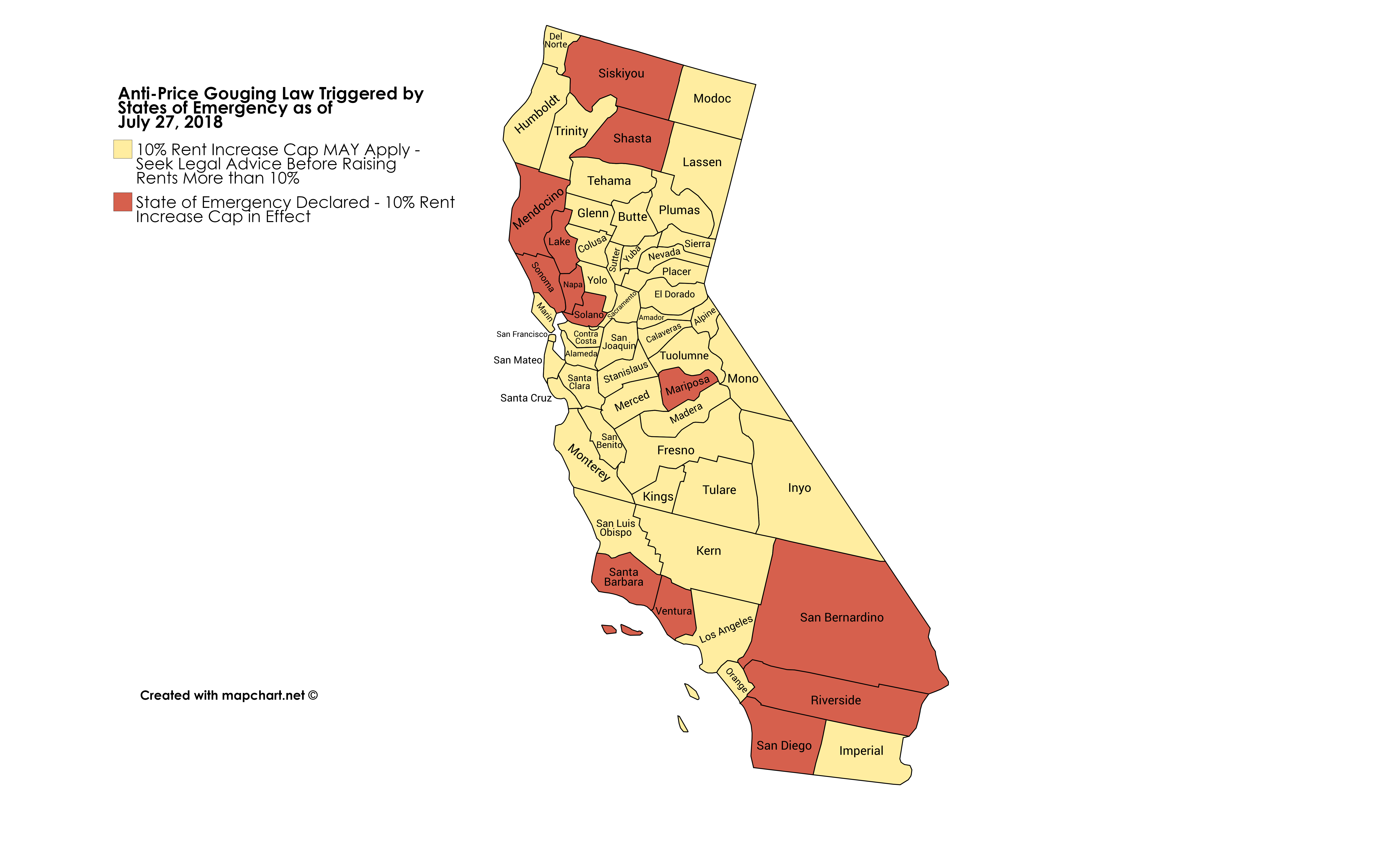

Increased Rent In La Price Gouging Following Devastating Fires

May 28, 2025

Increased Rent In La Price Gouging Following Devastating Fires

May 28, 2025 -

Kalvin Phillips Leeds United Return A Summer Transfer Possibility

May 28, 2025

Kalvin Phillips Leeds United Return A Summer Transfer Possibility

May 28, 2025 -

Leeds United Eyeing Kalvin Phillips Transfer Update

May 28, 2025

Leeds United Eyeing Kalvin Phillips Transfer Update

May 28, 2025 -

Eu Sanctions Loom For Shein Over Consumer Protection Failures

May 28, 2025

Eu Sanctions Loom For Shein Over Consumer Protection Failures

May 28, 2025