Trump And Oil Prices: Goldman Sachs' Analysis Of Public Statements

Table of Contents

Trump's Rhetoric and its Immediate Impact on Oil Futures

Trump's pronouncements frequently triggered immediate and measurable changes in oil futures. His outspoken communication style, often amplified by social media, created an environment of heightened uncertainty and speculation. This, in turn, directly influenced short-term oil price movements.

- Examples of market reactions: Threats of sanctions against Iran, for example, often led to a spike in oil prices as markets anticipated potential supply disruptions. Conversely, positive comments about OPEC cooperation could temporarily dampen prices. His comments on the strategic petroleum reserve also influenced market sentiment and trading activity.

- Market sentiment and speculation: The unpredictable nature of Trump's statements fueled speculation and amplified the impact on oil futures. Traders and investors reacted swiftly to every utterance, leading to significant price swings, sometimes irrespective of underlying supply and demand fundamentals.

- Technical analysis and news analysis: Technical analysts often integrated news analysis concerning Trump's pronouncements into their trading strategies, using both to predict short-term price movements. The interplay between fundamental and technical analysis became particularly crucial during periods of heightened uncertainty driven by presidential rhetoric.

Goldman Sachs' Methodology in Assessing the Impact

To assess the impact of Trump's statements on oil prices, Goldman Sachs likely employed a multifaceted approach:

- Sentiment analysis: They probably used sophisticated algorithms to analyze the sentiment expressed in Trump's public statements, identifying keywords and phrases associated with positive or negative market reactions.

- Correlation studies: Statistical analysis would have been used to establish correlations between specific statements and subsequent changes in oil prices, determining the strength and direction of these relationships.

- Econometric modeling: More advanced econometric models might have been employed to isolate the impact of Trump's statements from other factors influencing oil prices, providing a more nuanced understanding of the causal relationships.

However, it's crucial to acknowledge the limitations of such analyses. These models are subject to inherent biases and might not fully capture the complex interplay of factors impacting oil prices. Furthermore, attributing price movements solely to presidential rhetoric would be an oversimplification. While Goldman Sachs has not publicly released a single, comprehensive report solely dedicated to this topic, their numerous market commentaries and energy sector analyses implicitly incorporated these factors.

Long-Term Effects of Trump's Energy Policies on Oil Prices

Beyond the immediate market reactions, Trump's broader energy policies had lasting consequences on the long-term trajectory of oil prices.

- Increased domestic oil production: His administration's focus on deregulation and increased domestic energy production led to a significant rise in US oil output, impacting global supply and potentially exerting downward pressure on prices.

- Geopolitical shifts: Changes in US relationships with OPEC nations and other key oil-producing countries influenced the global supply landscape and contributed to oil price volatility. The withdrawal from the Iran nuclear deal, for instance, had far-reaching consequences.

- Unfolding consequences: Some long-term effects of Trump's policies, like the lasting impact of deregulation on environmental regulations and energy investment, are still unfolding and require further analysis.

Goldman Sachs' Predictions and Assessments

While specific long-term projections from Goldman Sachs directly attributable to Trump's policies might not be readily available as a single publication, their general oil price forecasts throughout his presidency undoubtedly incorporated considerations of these policy impacts. Any discrepancies between short-term market reactions and longer-term trends highlight the complex relationship between immediate rhetoric and enduring policy effects. Assessing the accuracy of Goldman Sachs' predictions requires an in-depth evaluation of their reports across the period.

Comparing Trump's Impact to Other Presidents

Comparing Trump's influence on oil prices to previous administrations reveals interesting insights into the relationship between presidential communication and market behavior.

- Communication styles: Trump's unconventional and often provocative communication style stands in stark contrast to his predecessors. This difference greatly influenced market reactions to presidential statements.

- Long-term policy impact: Analyzing the long-term effects of energy policies under different presidents reveals varying degrees of impact on the oil market trajectory.

- Comparative studies: While not a direct focus of many analyses, the impact of presidential statements on market volatility across different administrations allows for valuable comparative studies.

Goldman Sachs' Comparative Analysis (if available)

While Goldman Sachs might not have explicitly compared Trump's impact to other presidents in a single, dedicated report, their broader market analysis implicitly factored in historical precedents. Any such comparative analysis would likely highlight the unique aspects of Trump's influence, emphasizing the role of his communication style in shaping market expectations and causing volatility.

Conclusion

Goldman Sachs' analysis, while perhaps not explicitly compiled into a single report on "Trump and Oil Prices," implicitly addressed the significant impact of the former president's statements and policies on global oil markets. His unpredictable rhetoric frequently caused short-term price fluctuations, while his broader energy policies contributed to long-term shifts in supply and demand. Understanding this intricate interplay between presidential actions and global oil markets is crucial for investors and policymakers alike. Learn more about the influence of Trump and Oil Prices by delving into Goldman Sachs' extensive market reports and analyses. Understand the impact of presidential statements on oil markets and analyze Goldman Sachs' perspective on Trump and Oil Prices to gain a deeper understanding of this complex dynamic.

Featured Posts

-

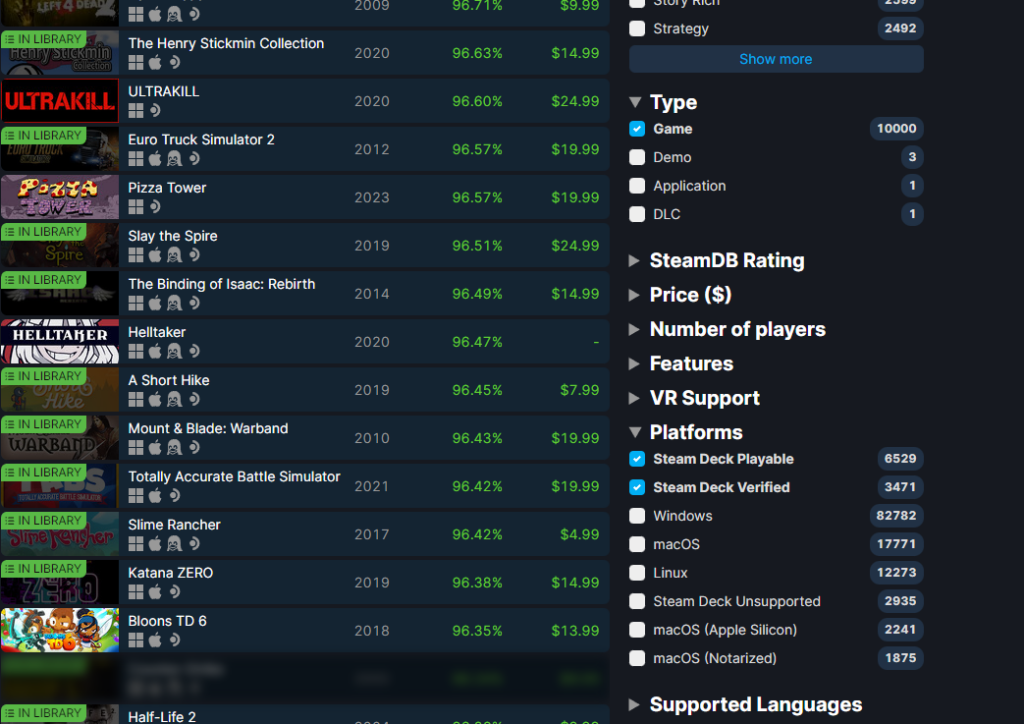

Steam Deck Verified Games Your New Ps 1 Portable

May 16, 2025

Steam Deck Verified Games Your New Ps 1 Portable

May 16, 2025 -

From Scatological Data To Engaging Podcast An Ai Powered Solution

May 16, 2025

From Scatological Data To Engaging Podcast An Ai Powered Solution

May 16, 2025 -

La Wildfires Gambling And The Growing Commodification Of Disaster

May 16, 2025

La Wildfires Gambling And The Growing Commodification Of Disaster

May 16, 2025 -

Draisaitl Hellebuyck And Kucherov 2023 Nhl Hart Trophy Finalists

May 16, 2025

Draisaitl Hellebuyck And Kucherov 2023 Nhl Hart Trophy Finalists

May 16, 2025 -

Potential Permanent Gas Tax Cut In Ontario Highway 407 East Tolls In Focus

May 16, 2025

Potential Permanent Gas Tax Cut In Ontario Highway 407 East Tolls In Focus

May 16, 2025