Trump Demands Powell's Removal: A Critical Analysis Of The Fed Chair Dispute

Table of Contents

The Roots of the Trump-Powell Conflict

The Trump-Powell clash stemmed from a fundamental disagreement over economic policy and the appropriate role of the Federal Reserve.

Trump's Economic Agenda and the Fed's Actions

Trump's economic platform prioritized rapid economic growth, fueled by substantial tax cuts and deregulation. He consistently advocated for low interest rates to stimulate borrowing and investment. However, Powell, tasked with maintaining price stability and full employment, pursued a different course.

- Tax Cuts and Deregulation: Trump's 2017 tax cuts significantly reduced corporate and individual income taxes, aiming to boost economic activity. Simultaneously, his administration pursued deregulation across various sectors.

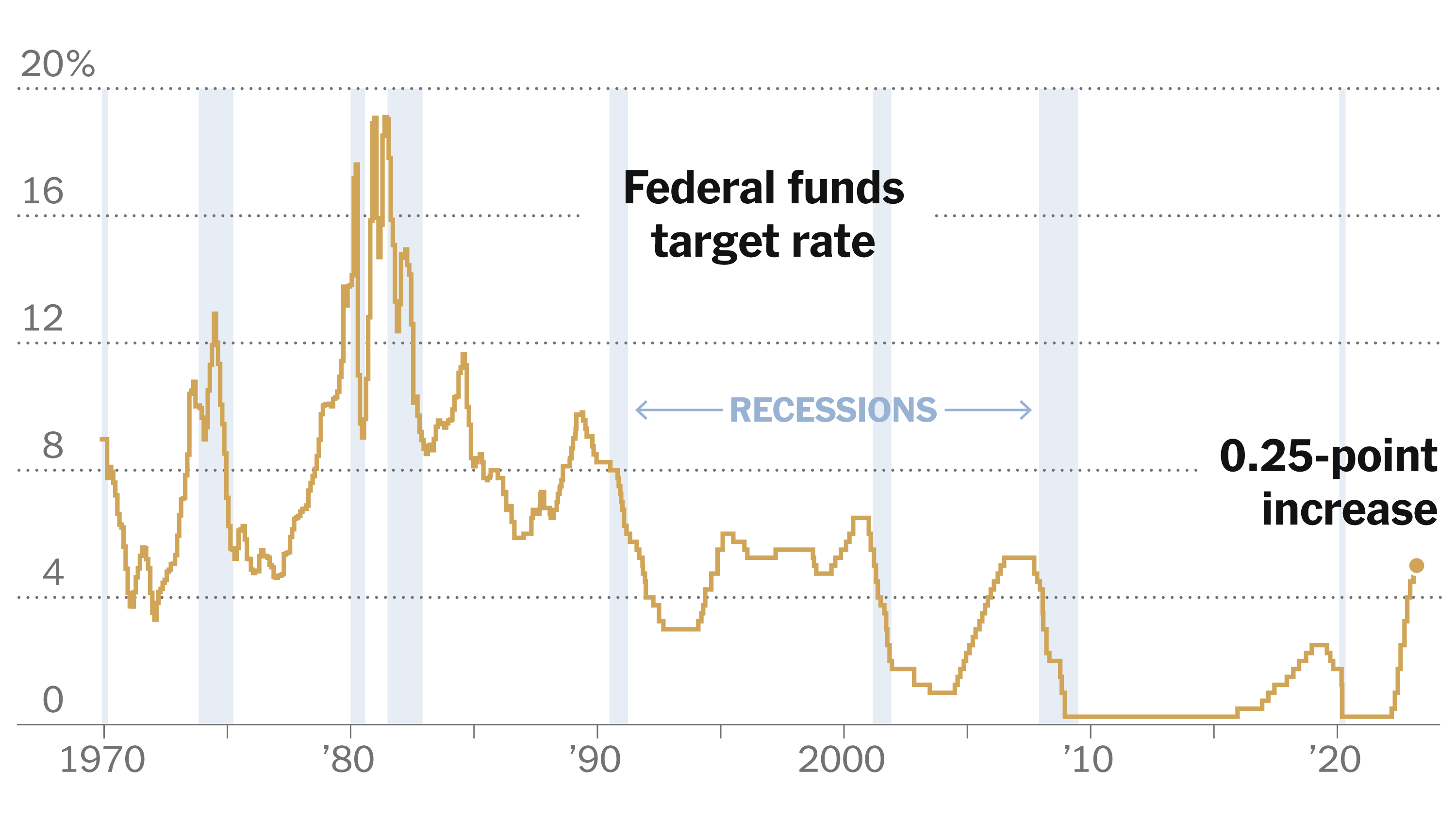

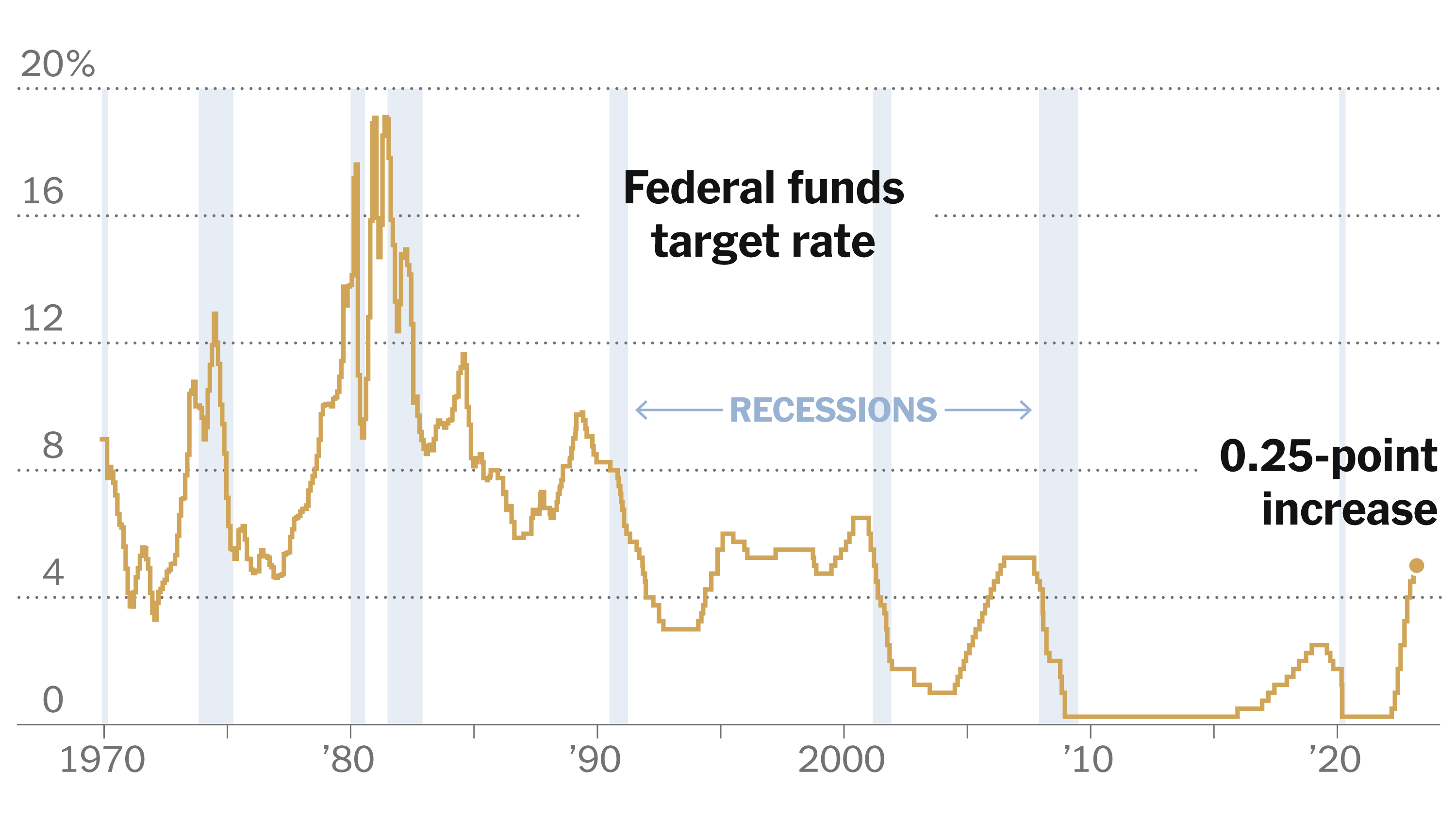

- Contrasting Monetary Policy: The Fed, under Powell's leadership, responded to a strengthening economy by gradually raising interest rates to combat potential inflation. This tightening monetary policy directly countered Trump's calls for persistently low rates.

- Inflation and Interest Rate Hikes: Throughout 2018, the Fed implemented several interest rate hikes. While inflation remained relatively low, Trump viewed these increases as a threat to his economic growth goals, frequently expressing his displeasure publicly. For example, inflation in 2018 averaged around 2.4%, a level the Fed considered manageable, but Trump deemed it too high, given his desired economic trajectory.

Political Pressure and Presidential Influence

Trump's frustration with Powell extended beyond mere policy disagreements. His public criticism escalated into a sustained campaign of pressure, utilizing social media and public statements to express his dissatisfaction. This unprecedented level of pressure raised serious concerns about the independence of the Federal Reserve.

- Public Criticisms and Tweets: Trump repeatedly attacked Powell via Twitter and in public speeches, labeling him as an enemy and even suggesting his dismissal.

- Threats of Removal: While Trump lacked the legal authority to directly remove Powell without cause, his actions created a climate of uncertainty and potential political interference.

- Historical Context: While Presidents have historically influenced the Fed, Trump's actions marked a departure from the norms of subtle persuasion, representing a more overt and aggressive attempt to control monetary policy. The potential impact on the Fed's ability to make unbiased decisions based purely on economic data was a major concern for economists and policymakers.

Economic Consequences of the Dispute

The public nature of the Trump-Powell conflict had significant repercussions for the US economy and global markets.

Market Volatility and Uncertainty

Trump's attacks on Powell created substantial uncertainty in financial markets, leading to increased volatility.

- Market Reactions: Stock markets often reacted negatively to Trump's statements about Powell and the Fed's policy decisions, reflecting investor concerns about political interference.

- Dollar Volatility: The value of the US dollar fluctuated in response to the uncertainty surrounding the Fed's independence and the potential for erratic monetary policy decisions. The increased uncertainty negatively impacted business investment and consumer confidence.

Impact on Monetary Policy Effectiveness

The political pressure likely impacted the Fed's ability to effectively manage the economy.

- Delayed Responses: The constant barrage of criticism may have influenced the Fed's decision-making process, potentially leading to delayed or less decisive responses to economic challenges.

- Policy Uncertainty: The uncertainty surrounding the Fed's independence contributed to a more volatile economic environment, making it more difficult to forecast and manage economic activity. This ambiguity hindered the Fed's ability to pursue its mandate effectively.

Long-Term Implications and Lessons Learned

The Trump-Powell Dispute underscores the critical importance of central bank independence and the need for safeguards against political interference.

The Importance of Central Bank Independence

A politically independent central bank is essential for maintaining price stability and long-term economic growth.

- Credibility and Effectiveness: An independent Fed can make objective decisions based solely on economic data, without political considerations. This fosters public trust and enhances the effectiveness of monetary policy.

- Historical Examples: Numerous historical examples demonstrate the detrimental effects of politicized central banks. Countries with politically influenced monetary policies often experience higher inflation, greater economic volatility, and slower economic growth.

The Future of the Relationship Between the Presidency and the Fed

The Trump-Powell dispute highlights the need for clearer guidelines and mechanisms to protect the Fed's independence.

- Legislative Reforms: Discussions on strengthening legal protections for the Fed's independence and limiting presidential influence are crucial.

- Increased Transparency: Greater transparency about the Fed's decision-making process can help build public trust and mitigate political interference.

- Strengthening Institutional Norms: Fostering a stronger culture of respect for the Fed's independence within the executive branch is paramount for long-term stability.

Conclusion

The "Trump Powell Dispute" serves as a stark reminder of the delicate balance between political pressure and the indispensable independence of the Federal Reserve. While Trump's actions aimed to manipulate monetary policy for short-term political gains, the consequences underscored the significant risks of politicizing the central bank. Maintaining the Fed's independence is vital for long-term economic stability and preserving the credibility of US monetary policy. Understanding the complexities of the Trump Powell Dispute offers invaluable insights for navigating similar challenges in the future. To explore this crucial issue further, continue your research on the Trump Powell Dispute and its ongoing ramifications for economic policy.

Featured Posts

-

Kecocokan Jodoh Weton Senin Legi Dan Rabu Pon Panduan Primbon Jawa

Apr 23, 2025

Kecocokan Jodoh Weton Senin Legi Dan Rabu Pon Panduan Primbon Jawa

Apr 23, 2025 -

Milwaukee Brewers Evaluating The Contribution Of William Contreras

Apr 23, 2025

Milwaukee Brewers Evaluating The Contribution Of William Contreras

Apr 23, 2025 -

The Poilievre Phenomenon Rise Fall And Lessons From A Lost Election

Apr 23, 2025

The Poilievre Phenomenon Rise Fall And Lessons From A Lost Election

Apr 23, 2025 -

Pope Francis Ring Understanding The Ritual Of Destruction After Death

Apr 23, 2025

Pope Francis Ring Understanding The Ritual Of Destruction After Death

Apr 23, 2025 -

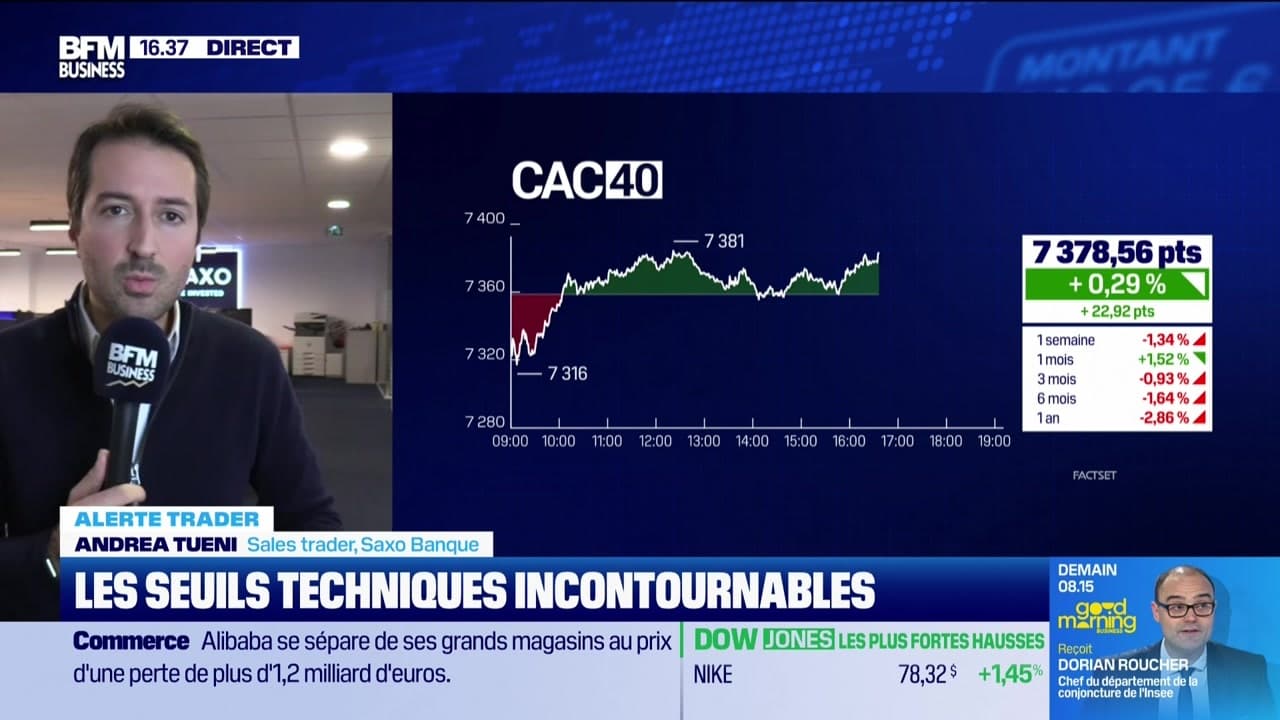

Seuils Techniques Votre Guide Complet Pour L Alerte Trader

Apr 23, 2025

Seuils Techniques Votre Guide Complet Pour L Alerte Trader

Apr 23, 2025