Trump Tariffs And Disinflation: An ECB Perspective (Holzmann)

Table of Contents

Holzmann's Central Argument: The Transmission Mechanism of Tariffs to Prices

Holzmann's core argument centers on the transmission mechanism through which Trump's tariffs impacted inflation in the Eurozone. He posited a multi-faceted effect, extending beyond the direct impact on import prices. His analysis highlights how these tariffs, despite being primarily targeted at the US, created considerable indirect pressure leading to disinflation within the Eurozone.

- Impact on import prices (direct effect): While not directly hit by the tariffs, the Eurozone experienced indirect effects. Increased prices for US goods and services impacted global supply chains, leading to higher input costs for Eurozone businesses.

- Impact on supply chains and production costs (indirect effect): Disruptions to global supply chains, caused by retaliatory tariffs and trade uncertainties, led to increased production costs for European firms. This pressure reduced the ability of businesses to raise prices, dampening inflation.

- Potential for second-round effects on wages and consumer prices: The increased production costs, coupled with reduced business confidence, limited wage growth. This suppressed consumer spending and further contributed to disinflationary pressures.

- Role of global trade dynamics: Holzmann emphasized the interconnectedness of global trade. The Trump administration's protectionist policies fostered uncertainty, impacting investment decisions and hindering overall economic growth in the Eurozone, further contributing to disinflationary pressures.

ECB Policy Response to Disinflationary Pressures from Trump Tariffs

The ECB responded to the potential disinflationary pressures stemming from Trump's trade policies with a range of measures. Understanding these responses is crucial to fully grasping the complexities of the situation.

- Monetary policy adjustments (e.g., interest rates, quantitative easing): The ECB implemented measures such as keeping interest rates low and continuing quantitative easing programs (QE) to stimulate economic activity and combat disinflation.

- Communication strategies employed by the ECB: The ECB employed clear communication strategies to manage market expectations and maintain confidence amidst the economic uncertainty.

- Evaluation of the effectiveness of ECB policies: The effectiveness of these policies remains a subject of ongoing debate, with some arguing that they were insufficient to fully counter the disinflationary pressures.

- Potential unintended consequences of ECB actions: The prolonged period of low interest rates and QE may have created unintended consequences, such as asset bubbles and increased financial risks.

Alternative Perspectives and Criticisms of Holzmann's Analysis

While Holzmann's analysis provides valuable insights, several alternative perspectives and criticisms exist. A balanced understanding requires considering these counterarguments.

- Critique of Holzmann's methodology: Some economists criticized his methodology, questioning the direct causal link he established between Trump tariffs and Eurozone disinflation.

- Discussion of alternative causal factors for disinflation: Other factors, such as slowing global growth and technological advancements, may have played a more significant role in the disinflation observed in the Eurozone.

- Counterarguments to Holzmann's conclusions: Some argue that the impact of Trump tariffs on Eurozone inflation was minimal compared to other macroeconomic factors.

- Importance of considering broader economic factors: Holzmann's analysis, while insightful, might have overlooked the broader global economic context and other influential variables contributing to disinflation.

Data and Evidence Supporting (or Contradicting) Holzmann's Claims

Empirical evidence is essential for evaluating Holzmann's claims. Analyzing relevant data can offer further insights.

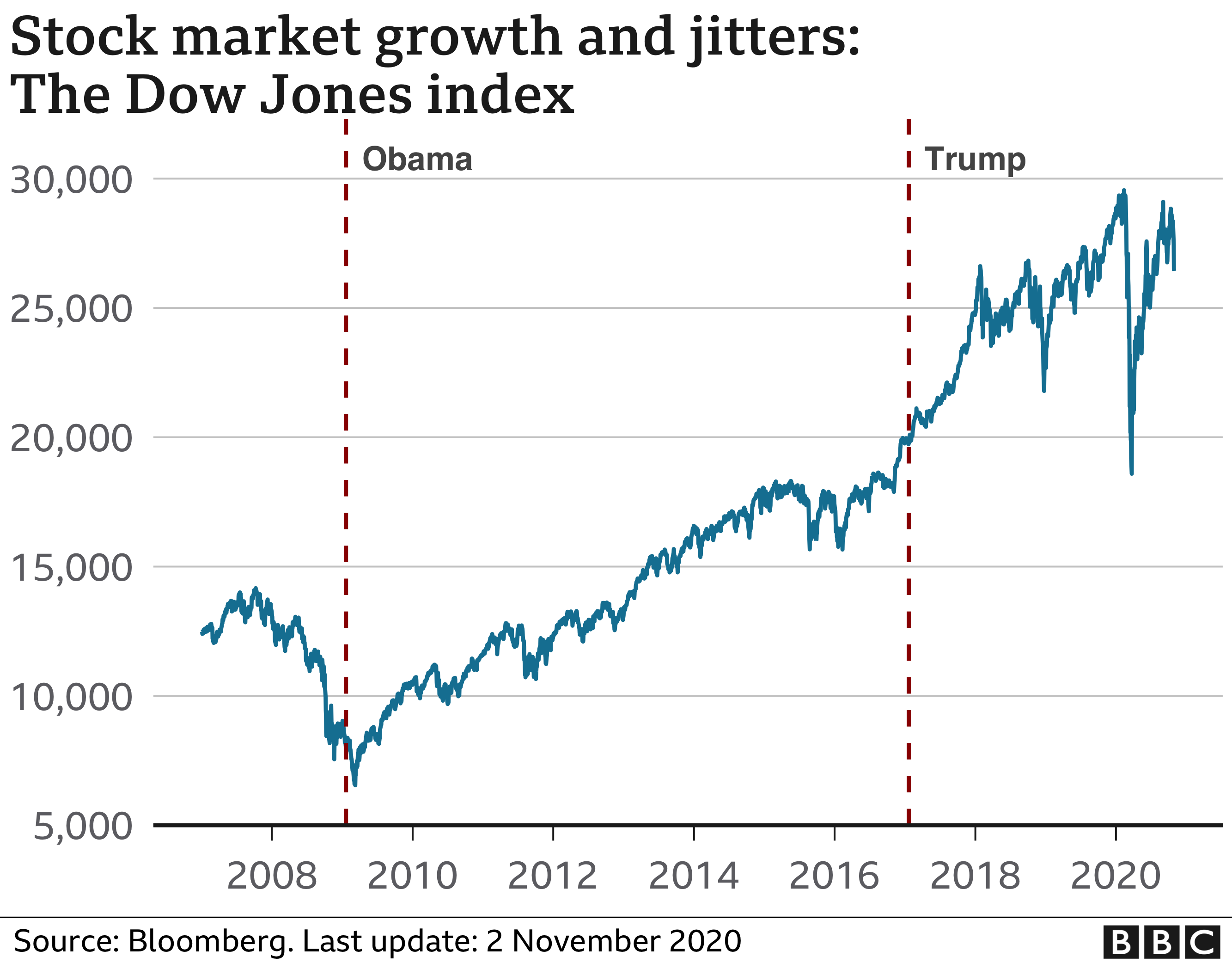

- Inflation data from the Eurozone during the relevant period: Eurozone inflation figures during the period of Trump's tariffs show a period of low inflation, lending some support to Holzmann's analysis. However, isolating the specific impact of the tariffs is complex.

- Trade data illustrating the impact of tariffs: Analyzing trade data between the Eurozone and the US during this period can help assess the extent of trade disruptions and their potential contribution to disinflation.

- Analysis of supply chain disruptions and their cost implications: Studying supply chain disruptions caused by the tariffs and their resulting impact on production costs within the Eurozone can provide more quantitative evidence.

- Economic modeling results (if any): Econometric models simulating the effects of the tariffs on Eurozone inflation could offer a more robust assessment of the impact.

Conclusion: Synthesizing the Impact of Trump Tariffs on Disinflation – Key Takeaways from the ECB Perspective

Holzmann's analysis offers a valuable perspective on the complex relationship between Trump tariffs and disinflation within the Eurozone. While the direct impact of the tariffs on the Eurozone was limited, his analysis effectively highlights the indirect effects through global supply chain disruptions and reduced business confidence, impacting production costs and ultimately contributing to disinflationary pressures. The ECB's policy response, although intended to counteract these pressures, also faced challenges and potential unintended consequences. Further research is needed to definitively quantify the impact of Trump’s tariffs, isolating their effects from other macroeconomic factors. Understanding this relationship is crucial for future economic policy decisions, particularly concerning global trade and the management of inflation. We encourage further exploration into the intricacies of "Trump Tariffs and Disinflation," particularly examining the ECB’s role and considering related concepts like "trade wars," "global inflation," and "monetary policy effectiveness." Let's continue the discussion on the long-term implications of this significant period in global economic history.

Featured Posts

-

Invest With The Elite Gaining Access To Elon Musks Private Company Investments

Apr 26, 2025

Invest With The Elite Gaining Access To Elon Musks Private Company Investments

Apr 26, 2025 -

New Restrictions On Federal Disaster Assistance Under Trump Administration

Apr 26, 2025

New Restrictions On Federal Disaster Assistance Under Trump Administration

Apr 26, 2025 -

Newsoms Podcast A Gamble For His Political Career Charlie Kirks Perspective

Apr 26, 2025

Newsoms Podcast A Gamble For His Political Career Charlie Kirks Perspective

Apr 26, 2025 -

Benson Boone I Heart Radio Music Awards 2025 Photo 5137815

Apr 26, 2025

Benson Boone I Heart Radio Music Awards 2025 Photo 5137815

Apr 26, 2025 -

Photographies De Pierre Terrasson A La Galerie Le Labo Du 8

Apr 26, 2025

Photographies De Pierre Terrasson A La Galerie Le Labo Du 8

Apr 26, 2025

Latest Posts

-

100 Days Of Trump How Did It Affect Elon Musks Net Worth

May 10, 2025

100 Days Of Trump How Did It Affect Elon Musks Net Worth

May 10, 2025 -

The Impact Of Trumps First 100 Days On Elon Musks Financial Status

May 10, 2025

The Impact Of Trumps First 100 Days On Elon Musks Financial Status

May 10, 2025 -

The Tesla Dogecoin Connection Examining The Influence Of Elon Musk And Market Volatility

May 10, 2025

The Tesla Dogecoin Connection Examining The Influence Of Elon Musk And Market Volatility

May 10, 2025 -

Analyzing The Change In Elon Musks Net Worth The Trump Presidencys First 100 Days

May 10, 2025

Analyzing The Change In Elon Musks Net Worth The Trump Presidencys First 100 Days

May 10, 2025 -

Analyzing The Impact Of Teslas Stock Performance On Dogecoins Value The Elon Musk Factor

May 10, 2025

Analyzing The Impact Of Teslas Stock Performance On Dogecoins Value The Elon Musk Factor

May 10, 2025