Trump Tariffs And Their Detrimental Impact On Fintech IPOs: The Case Of Affirm Holdings (AFRM)

Table of Contents

The Macroeconomic Impact of Trump Tariffs

The Trump-era tariffs created a climate of uncertainty that extended far beyond simple import/export dynamics. This uncertainty directly impacted investor sentiment and the availability of investment capital, creating a headwind for companies considering an IPO, especially those in the rapidly growing Fintech sector.

Global Trade Uncertainty and Investor Sentiment

- Increased uncertainty discouraged investment. The unpredictable nature of the tariffs made it difficult for businesses to plan long-term strategies and accurately forecast future earnings.

- Tariffs led to higher input costs for many businesses. Increased costs for raw materials and components, due to tariffs, squeezed profit margins and reduced overall profitability.

- Negative news cycles surrounding the trade war negatively impacted investor confidence. Constant headlines about escalating trade tensions created a sense of instability, making investors hesitant to commit capital to new ventures.

- Supply chain disruptions created volatility. The imposition of tariffs led to significant disruptions in global supply chains, increasing uncertainty and unpredictability for businesses reliant on international trade.

The unpredictability caused by tariffs significantly hampered businesses' ability to forecast future earnings. For investors, predictable earnings are crucial when evaluating the potential of an IPO. The uncertainty created by the trade war made it difficult for companies like Affirm to present a clear picture of their future financial performance, thus impacting investor confidence and potentially leading to lower valuations.

Rising Interest Rates and Reduced Investment Capital

- The Federal Reserve's response to trade war inflation included raising interest rates. To combat inflation fueled, in part, by tariff-related price increases, the Federal Reserve raised interest rates.

- Higher interest rates increased borrowing costs for businesses. This made it more expensive for companies to secure funding for expansion and operations, including preparing for and undertaking an IPO.

- Reduced investment capital availability made IPOs riskier propositions. With higher borrowing costs and increased uncertainty, investors became more risk-averse, reducing the overall pool of capital available for IPOs.

The higher interest rates directly impacted Affirm's cost of capital. Securing funding for growth and expansion became more challenging and expensive, potentially impacting the company's valuation and the timing of its IPO. The increased cost of capital forced many Fintech companies to re-evaluate their growth strategies and potentially delay IPO plans.

The Specific Impact on Affirm Holdings (AFRM) IPO

Affirm Holdings, a Buy Now, Pay Later (BNPL) company, felt the impact of the Trump tariffs directly and indirectly. The economic uncertainty and increased costs created by the trade war significantly impacted the company's IPO and subsequent performance.

Increased Costs and Reduced Profit Margins

- Tariffs increased the cost of goods and services used by Affirm or its customers. While Affirm's direct exposure might have been limited, its customers, many of whom were retailers, faced higher input costs due to tariffs. This indirectly impacted Affirm's operations and profitability.

- This impacted Affirm's operational costs. Higher input costs for retailers could lead to decreased consumer spending, thus reducing Affirm's transaction volume and revenue.

- Reduced profit margins made the company less attractive to investors. Lower profit margins create increased financial risk and make a company less appealing to investors considering an IPO.

For example, if Affirm's merchant partners relied on imported technology or components for their operations, the tariffs increased their operational costs, potentially leading to higher prices for consumers and a decrease in demand for their products. This, in turn, would reduce the transaction volume processed by Affirm, resulting in lower revenues and tighter profit margins.

Delayed IPO and Lower Valuation

- The overall economic uncertainty potentially led to a delay in Affirm's IPO plans. The company might have chosen to postpone its IPO to wait for a more favorable economic climate.

- Investor hesitancy resulted in a lower valuation than might have been achieved in a more stable economic environment. The uncertainty surrounding the trade war and its impact on the broader economy discouraged investors, leading to a lower valuation for Affirm's IPO.

- The initial public offering price was potentially impacted. The lower valuation likely translated into a lower IPO price, limiting the capital Affirm could raise.

The prevailing market conditions during the period surrounding Affirm's IPO were significantly influenced by the trade war and its related uncertainties. A comparison of Affirm's performance with other Fintech companies that went public around the same time, controlling for company-specific factors, would provide further insight into the extent of the tariffs’ impact.

Alternative Explanations and Counterarguments

While the Trump tariffs played a significant role in shaping the economic landscape and negatively impacting Fintech IPOs, it's crucial to acknowledge other contributing factors.

Other Factors Contributing to Market Conditions

- Discuss other potential economic factors that influenced Fintech IPO performance aside from tariffs. Factors such as independent interest rate hikes, overall market volatility (separate from the trade war), and company-specific performance issues should all be considered.

- Mention factors such as interest rate hikes unrelated to the trade war, overall market volatility, and company-specific performance issues. These factors also influence investor sentiment and market conditions.

It's important to note that the economic environment surrounding Affirm's IPO was complex. While the Trump tariffs certainly played a role, attributing the entire impact solely to tariffs would be an oversimplification. A holistic analysis requires considering other economic and market factors influencing the performance of Fintech IPOs during this period.

Conclusion

The Trump administration's tariffs created a climate of uncertainty and negatively impacted Fintech IPOs, as exemplified by the case of Affirm Holdings (AFRM). Increased costs, reduced investor confidence, and higher interest rates all played a role in the challenges faced by Affirm and similar companies. While other factors contributed to market conditions, the impact of the tariffs should not be underestimated.

Understanding the detrimental effects of protectionist trade policies, like the Trump tariffs, is crucial for investors and businesses operating in the Fintech sector. Further research into the long-term impact of Trump tariffs on Fintech IPOs is essential to prepare for similar future economic challenges. Learn more about the impact of global trade on financial markets and protect your investments by staying informed about future trade policies.

Featured Posts

-

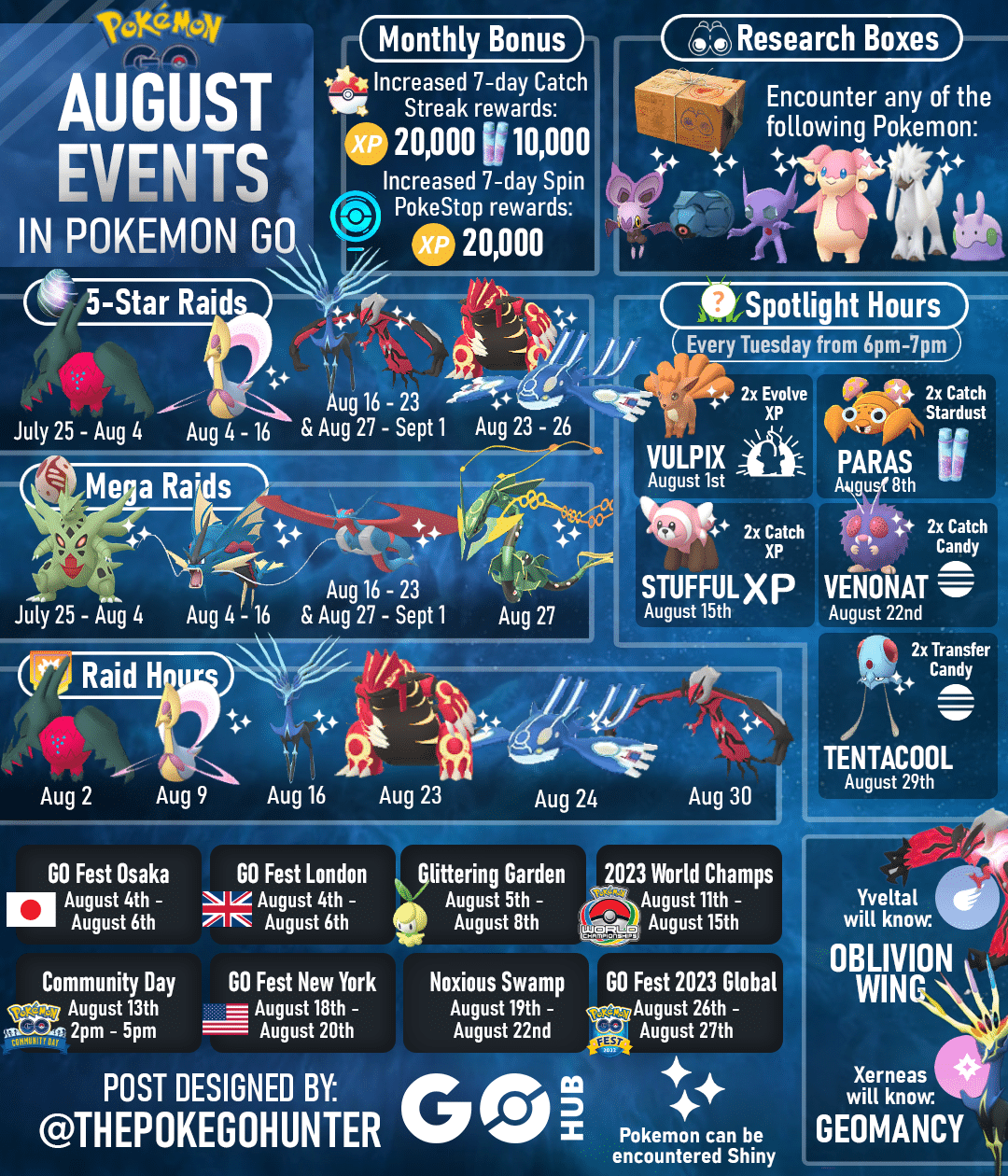

Plan Your May Pokemon Go Events 2025

May 14, 2025

Plan Your May Pokemon Go Events 2025

May 14, 2025 -

Find The 1 Most Unique Restaurant In Upstate New York Or Adapt For Specific Region

May 14, 2025

Find The 1 Most Unique Restaurant In Upstate New York Or Adapt For Specific Region

May 14, 2025 -

Federerov Povratak Zvanichna Iz Ava Zhelja Za Publikom

May 14, 2025

Federerov Povratak Zvanichna Iz Ava Zhelja Za Publikom

May 14, 2025 -

Sanremo 2024 La Rai Diffida Il Comune Ecco Cosa Sta Accadendo

May 14, 2025

Sanremo 2024 La Rai Diffida Il Comune Ecco Cosa Sta Accadendo

May 14, 2025 -

Dean Huijsen Transfer Chelsea Aim For June 14th Deadline

May 14, 2025

Dean Huijsen Transfer Chelsea Aim For June 14th Deadline

May 14, 2025