Trump Tariffs: CEO Concerns Over Economic Uncertainty And Consumer Confidence

Table of Contents

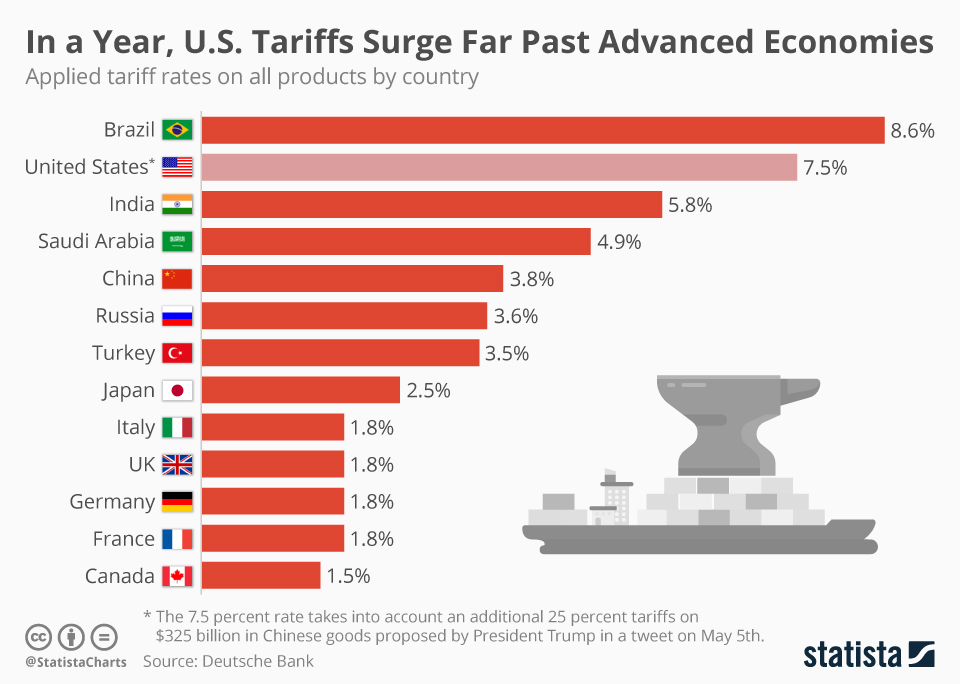

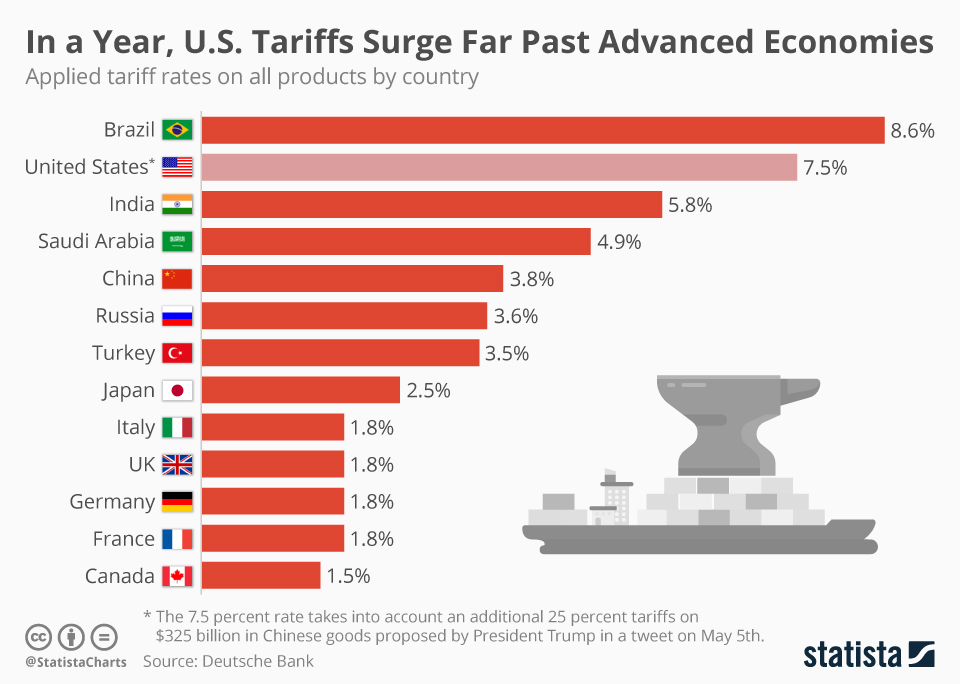

The Direct Impact of Trump Tariffs on Businesses

The most immediate consequence of Trump Tariffs was a direct increase in the cost of doing business for many American companies.

Increased Production Costs

Tariffs directly increased the cost of imported goods, significantly impacting manufacturers, retailers, and countless other sectors reliant on global supply chains.

- Steel and Aluminum: The tariffs on steel and aluminum, for example, led to substantial price increases for manufacturers relying on these raw materials, forcing them to absorb the costs or pass them on to consumers.

- Consumer Electronics: The impact rippled through various industries. The consumer electronics sector faced higher costs for imported components, resulting in increased prices for finished products.

- Raw Materials & Finished Goods: Across the board, businesses experienced increased prices for both raw materials and finished goods, squeezing profit margins and impacting competitiveness. Estimates suggest that some industries saw cost increases of 10-20%, depending on their reliance on imported goods.

Supply Chain Disruptions

The complex web of global supply chains proved highly vulnerable to the disruptive effects of Trump Tariffs.

- Finding Alternative Suppliers: Businesses faced challenges in locating alternative suppliers, often leading to increased lead times and logistical complications. This added significant costs and time delays.

- Increased Shipping Costs: The search for alternative suppliers often meant longer shipping routes and thus, significantly higher transportation costs.

- Production Delays: The ripple effect of supply chain disruptions led to production delays, impacting delivery schedules and potentially causing lost sales. The complexity of global supply chains meant disruptions in one area often impacted other unrelated industries.

Reduced Competitiveness

Trump Tariffs significantly reduced the competitiveness of US businesses, both domestically and in international markets.

- Impact on Exports: Retaliatory tariffs imposed by other countries on US exports diminished the competitiveness of American goods in global markets.

- Loss of Market Share: Higher production costs, coupled with retaliatory tariffs, led to a loss of market share for many US companies, particularly those heavily reliant on international trade.

- Difficulty Competing: American businesses found themselves struggling to compete with businesses in countries that didn't face similar tariff burdens, leading to a shift in global market dynamics.

CEO Concerns and Investment Decisions

The economic uncertainty created by Trump Tariffs profoundly impacted CEO decision-making, leading to significant shifts in investment and business strategies.

Decreased Investment and Hiring

The uncertainty surrounding the trade war caused many CEOs to postpone or cancel investments and reduce hiring.

- Delayed Expansion Plans: Numerous companies delayed expansion plans, opting for a wait-and-see approach amidst the uncertainty.

- Reduced Capital Expenditures: Capital expenditures, crucial for long-term growth and innovation, were significantly reduced in many sectors as businesses prioritized financial stability.

- Hiring Freezes: Numerous companies implemented hiring freezes, demonstrating a cautious approach to employment given the uncertain economic climate. Data from the Bureau of Labor Statistics showed a noticeable slowdown in job growth during this period.

Shifting Business Strategies

To mitigate the impact of Trump Tariffs, companies were forced to adapt their business strategies.

- Relocating Production: Some businesses relocated production facilities to countries with lower tariffs, a costly and complex process with long-term implications.

- Alternative Sourcing: Companies actively sought alternative sourcing for raw materials and components, a process that often involved increased costs and logistical challenges.

- Price Increases: Many companies increased prices to offset the increased costs of imported goods, impacting consumer affordability and potentially harming consumer confidence.

Stock Market Volatility

The announcements of new tariffs and the ongoing trade war were directly correlated with significant fluctuations in the stock market.

- Market Reactions: The stock market reacted negatively to tariff announcements, reflecting investor concerns about the economic consequences of the trade war.

- Impact on Investor Confidence: Uncertainty about the future created a climate of fear, significantly impacting investor confidence and leading to overall market volatility. Data shows a clear correlation between tariff-related news and drops in market indices.

The Impact on Consumer Confidence and Spending

Trump Tariffs ultimately led to increased prices for consumers, impacting their purchasing power and overall consumer confidence.

Increased Prices for Consumers

The increased costs faced by businesses were inevitably passed on to consumers in the form of higher prices for a wide range of goods.

- Examples of Price Increases: Consumers faced higher prices for everything from clothing and electronics to automobiles and building materials, directly impacting their disposable income.

- Inflation and Consumer Price Indices: Data on inflation and consumer price indices showed a clear upward trend during the period of increased tariffs, confirming the impact on consumer costs.

Reduced Consumer Spending

The reduction in purchasing power, coupled with growing economic uncertainty, led to a decrease in consumer spending.

- Consumer Confidence: Consumer confidence indices showed a clear decline, reflecting consumer concerns about the future economic outlook.

- Spending Habits: Consumers reduced spending on discretionary items, opting for more essential purchases, negatively impacting economic growth. Retail sales figures showed a slowdown during this period.

Long-Term Economic Implications

The decreased consumer confidence and spending stemming from Trump Tariffs had significant long-term implications for the US economy.

- Slower Economic Growth: The reduction in consumer spending and business investment contributed to slower economic growth.

- Reduced Job Creation: The decrease in investment and business activity ultimately led to reduced job creation across various sectors.

- Negative Impacts on Other Economic Sectors: The ripple effects of reduced consumer spending and investment impacted various economic sectors, creating a more challenging economic environment.

Conclusion

Trump Tariffs had a significant and multifaceted impact on the US economy. The direct increase in production costs, coupled with supply chain disruptions, led to reduced competitiveness for American businesses. These challenges, coupled with increased prices for consumers, resulted in decreased investment, hiring freezes, and reduced consumer spending. The resulting economic uncertainty significantly impacted CEO confidence and fueled stock market volatility. Understanding the long-term consequences of these trade policies remains crucial for navigating future economic challenges. What are your thoughts on the lasting impact of Trump-era tariffs on the American economy? Further research into the effects of trade policies on various economic sectors is essential to inform future strategies and mitigate similar risks.

Featured Posts

-

The Countrys Evolving Business Landscape Mapping Key Growth Areas

Apr 26, 2025

The Countrys Evolving Business Landscape Mapping Key Growth Areas

Apr 26, 2025 -

The Trump Administration And The Future Of Ai Regulation In Europe

Apr 26, 2025

The Trump Administration And The Future Of Ai Regulation In Europe

Apr 26, 2025 -

Auto Carrier Reports 70 Million Loss Projection Due To Us Port Fees

Apr 26, 2025

Auto Carrier Reports 70 Million Loss Projection Due To Us Port Fees

Apr 26, 2025 -

Velikonocni Rozpocet Planovani Nakupu V Dobe Ekonomicke Nejistoty

Apr 26, 2025

Velikonocni Rozpocet Planovani Nakupu V Dobe Ekonomicke Nejistoty

Apr 26, 2025 -

Invest With The Elite Gaining Access To Elon Musks Private Company Investments

Apr 26, 2025

Invest With The Elite Gaining Access To Elon Musks Private Company Investments

Apr 26, 2025

Latest Posts

-

Section 230 And The Sale Of Banned Chemicals On E Bay A Legal Ruling

May 10, 2025

Section 230 And The Sale Of Banned Chemicals On E Bay A Legal Ruling

May 10, 2025 -

Resistance Grows Car Dealerships Challenge Ev Mandate

May 10, 2025

Resistance Grows Car Dealerships Challenge Ev Mandate

May 10, 2025 -

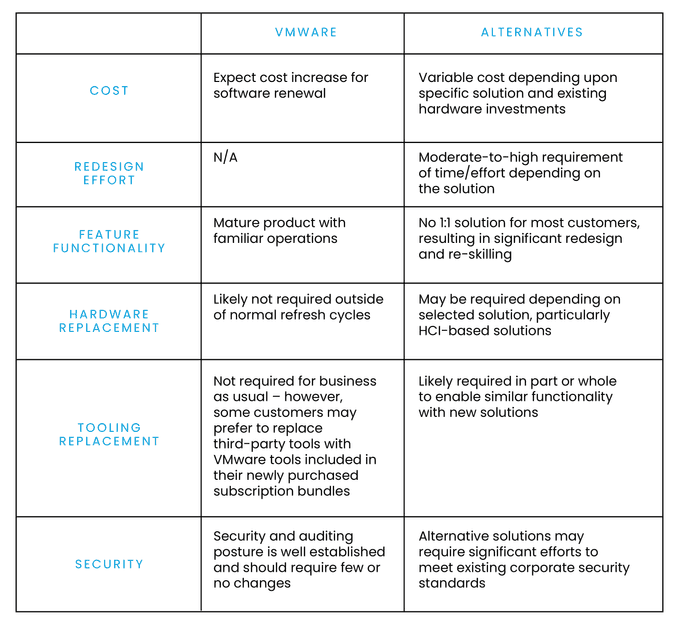

Broadcoms V Mware Acquisition At And T Exposes A 1 050 Price Increase

May 10, 2025

Broadcoms V Mware Acquisition At And T Exposes A 1 050 Price Increase

May 10, 2025 -

1 050 V Mware Price Hike At And T Highlights Broadcoms Extreme Pricing Proposal

May 10, 2025

1 050 V Mware Price Hike At And T Highlights Broadcoms Extreme Pricing Proposal

May 10, 2025 -

Ohio Derailment Investigation Into Lingering Toxic Chemicals In Buildings

May 10, 2025

Ohio Derailment Investigation Into Lingering Toxic Chemicals In Buildings

May 10, 2025