Trump Tariffs Hit Infineon (IFX): Sales Guidance Below Expectations

Table of Contents

The Impact of Trump Tariffs on Infineon's Operations

The Trump administration's tariffs, imposed as part of its trade war with China and other nations, significantly impacted Infineon's operations. These tariffs affected both imported components crucial for Infineon's manufacturing processes and the company's exported goods. For example, tariffs on imported materials like certain metals and chemicals increased the cost of production. Simultaneously, tariffs imposed on Infineon's exports to key markets reduced its competitiveness and decreased demand.

The financial consequences were substantial:

- Increased Costs: Tariffs directly increased the cost of raw materials and components, squeezing profit margins. Estimates suggest a percentage increase in costs (insert percentage if available, otherwise remove this line and replace with general description).

- Reduced Profitability: The higher production costs translated into lower profit margins, impacting Infineon's overall financial performance. This is reflected in (cite specific financial reports or data if available).

- Decreased Competitiveness: Increased prices due to tariffs made Infineon's products less competitive in the global market, leading to a potential loss of market share to companies based in countries not subject to the same tariffs.

Infineon's Revised Sales Guidance and Market Reaction

Infineon's lowered sales guidance reflects the harsh reality of the tariff-induced challenges. The company attributed the revision primarily to (cite specific reasons given by Infineon in their official statements). This announcement sparked a significant market reaction:

- Stock Price Fluctuations: Infineon's stock price experienced (describe the nature of stock price fluctuation – e.g., a sharp decline, moderate dip, etc.) following the announcement, indicating investor concern about the company's future prospects.

- Investor Sentiment: Investor sentiment turned (describe sentiment – e.g., negative, cautious, etc.), reflecting anxieties surrounding the long-term impact of the tariffs and the company's ability to navigate these headwinds. Analysts expressed (cite analyst opinions if available).

Infineon's Strategies to Mitigate Tariff Impacts

Faced with these substantial challenges, Infineon has implemented various strategies to mitigate the negative impacts of the tariffs:

- Supply Chain Diversification: The company is actively diversifying its supply chain to reduce reliance on tariff-affected regions. This involves sourcing components from alternative locations and establishing new manufacturing partnerships.

- Cost Reduction Measures: Infineon is implementing internal cost-reduction initiatives to offset the increased input costs imposed by the tariffs. This could involve streamlining operations, improving efficiency, and negotiating better deals with suppliers.

- Price Adjustments: While potentially impacting market share, Infineon may have adjusted its pricing strategies to absorb some of the increased costs while maintaining profitability.

- Lobbying Efforts: Infineon, like other affected companies, likely engaged in lobbying efforts to advocate for tariff reductions or exemptions. The effectiveness of these efforts remains to be seen.

Long-Term Implications for Infineon and the Semiconductor Industry

The long-term implications of the Trump tariffs extend beyond Infineon's immediate financial performance. The impact on its market position and financial stability is significant, and the broader implications for the semiconductor industry are equally concerning.

- Global Trade Uncertainty: The instability caused by trade wars creates uncertainty, making long-term planning and investment decisions more challenging for companies like Infineon.

- Restructuring of Global Supply Chains: The tariffs are accelerating the restructuring of global supply chains, forcing companies to re-evaluate their sourcing strategies and potentially leading to regionalization of production.

- Impact on Innovation: The increased costs and reduced competitiveness caused by tariffs could potentially stifle innovation within the semiconductor industry, as companies may prioritize cost-cutting measures over research and development.

Conclusion: Trump Tariffs and Infineon's Future

The Trump-era tariffs have demonstrably impacted Infineon's sales guidance and financial performance. While Infineon is employing various strategies to mitigate the negative effects, the long-term consequences remain uncertain. The broader implications for the semiconductor industry and global trade are significant, highlighting the need for a stable and predictable international trade environment. To stay informed about Infineon's progress in navigating these challenges and the evolving impact of trade policies on the semiconductor industry, follow updates on Infineon (IFX) and related news regarding the effects of Trump tariffs. Understanding how global trade affects businesses is crucial in today's interconnected world.

Featured Posts

-

32

May 09, 2025

32

May 09, 2025 -

Le Conseil Metropolitain De Dijon Valide La Concertation Sur Le Tramway Ligne 3

May 09, 2025

Le Conseil Metropolitain De Dijon Valide La Concertation Sur Le Tramway Ligne 3

May 09, 2025 -

Soyuzniki Ukrainy Kto Priedet V Kiev 9 Maya

May 09, 2025

Soyuzniki Ukrainy Kto Priedet V Kiev 9 Maya

May 09, 2025 -

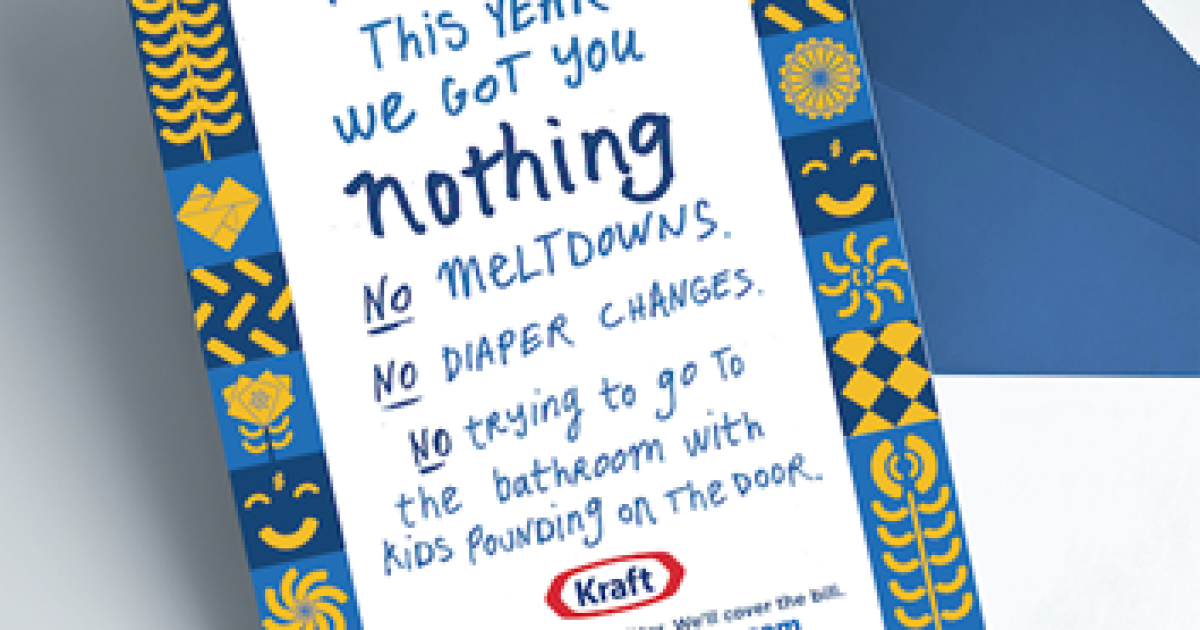

Mans 3 K Babysitting Bill Leads To 3 6 K Daycare Costs A Costly Lesson

May 09, 2025

Mans 3 K Babysitting Bill Leads To 3 6 K Daycare Costs A Costly Lesson

May 09, 2025 -

Update Pam Bondi And The Impending Release Of Epstein Files

May 09, 2025

Update Pam Bondi And The Impending Release Of Epstein Files

May 09, 2025