Trump Tariffs: The Untold Story Of Small Business Hardship

Table of Contents

The Direct Impact of Increased Import Costs

The most immediate effect of Trump tariffs was a significant increase in the cost of imported goods and raw materials. This directly impacted countless small businesses reliant on global supply chains.

Rising Prices for Raw Materials and Goods

Tariffs, essentially taxes on imported goods, directly increased the price of essential inputs for many small businesses. This surge in costs wasn't easily absorbed, especially considering the already slim profit margins typical of small enterprises.

- Manufacturing: Companies using imported steel, aluminum, or components faced drastically higher production costs.

- Retail: Businesses selling imported goods saw their inventory costs skyrocket, forcing them to raise prices or reduce profit margins.

- Agriculture: Farmers relying on imported fertilizers or machinery experienced increased operating expenses, impacting their ability to compete.

Statistics from [cite relevant source, e.g., Bureau of Economic Analysis] revealed a [specific percentage]% increase in the cost of [specific imported goods] following the implementation of Trump tariffs. This directly translated to decreased profitability and, in some cases, business closures for small businesses lacking the financial reserves to absorb these shocks.

Reduced Competitiveness in the Global Marketplace

Higher prices due to Trump tariffs rendered many American small businesses less competitive internationally. This loss of competitiveness impacted both domestic sales and export opportunities.

- Loss of Market Share: American small businesses found themselves struggling to compete with foreign rivals whose production costs weren't inflated by tariffs.

- Impact on Export-Oriented Businesses: Businesses that exported goods faced decreased demand as their products became more expensive in global markets.

- Ripple Effect: The reduced competitiveness of small businesses also impacted their suppliers and customers, creating a wider economic ripple effect.

Indirect Consequences and Economic Ripple Effects

Beyond the immediate impact on import costs, Trump tariffs triggered a series of indirect consequences that further strained small businesses.

Supply Chain Disruptions and Delays

The tariffs contributed to significant disruptions and delays in global supply chains. Businesses faced unpredictable lead times and stock shortages, impacting production and sales.

- Stock Shortages: Many small businesses struggled to maintain adequate inventory levels due to delays in receiving imported goods.

- Production Delays: Manufacturing businesses experienced production halts due to shortages of necessary components.

- Impact on Customer Satisfaction: Delays and shortages led to decreased customer satisfaction and potential loss of revenue.

Increased Financing Costs and Reduced Investment

The increased uncertainty and higher input costs associated with Trump tariffs made it harder for small businesses to secure financing and investment.

- Reduced Access to Credit: Lenders became more risk-averse, making it more difficult for small businesses to obtain loans.

- Impact on Expansion Plans: Businesses postponed or cancelled expansion projects due to financial constraints.

- Reduced Hiring: Many businesses were forced to limit or postpone hiring due to financial uncertainty.

The Burden of Compliance and Administrative Costs

Navigating the complex tariff regulations and paperwork placed a significant administrative burden on small businesses.

- Increased Time and Resources: Businesses spent considerable time and resources complying with new regulations.

- Potential for Errors and Penalties: Errors in compliance could lead to costly penalties, further straining already limited resources.

Case Studies: Real-Life Examples of Small Business Struggles

[Insert 2-3 case studies of small businesses severely impacted by Trump tariffs. Include quotes from business owners about their experiences, highlighting job losses, business closures, and financial hardship. Ensure diversity in industries represented.]

Conclusion

Trump tariffs inflicted significant negative consequences on small businesses across various sectors. The direct increase in import costs, combined with the indirect impacts on supply chains, financing, and administrative burdens, created an unsustainable environment for many small enterprises. The case studies highlight the human cost of these policies, demonstrating the devastating effects on livelihoods and local economies. Understanding the full impact of Trump tariffs on small businesses is crucial for policymakers and future trade negotiations. Further research into the long-term effects of these policies is needed to avoid repeating past mistakes and to better support small businesses. Let’s work together to prevent similar situations impacting small businesses by advocating for responsible and sustainable trade policies. (Main Keyword variations: Trump Tariffs, Tariffs and Small Businesses, Impact of Tariffs)

Featured Posts

-

Shevchenko Open To Zhang Weili Superfight A Potential Mma Showdown

May 12, 2025

Shevchenko Open To Zhang Weili Superfight A Potential Mma Showdown

May 12, 2025 -

Stellantis Ceo Decision Imminent American Executive In The Running

May 12, 2025

Stellantis Ceo Decision Imminent American Executive In The Running

May 12, 2025 -

Rahals Plan To Launch A Young Driver Scholarship Fund

May 12, 2025

Rahals Plan To Launch A Young Driver Scholarship Fund

May 12, 2025 -

Bundesliga Absteiger 2023 24 Bochum Und Holstein Kiel Leipzig Entgeht Cl

May 12, 2025

Bundesliga Absteiger 2023 24 Bochum Und Holstein Kiel Leipzig Entgeht Cl

May 12, 2025 -

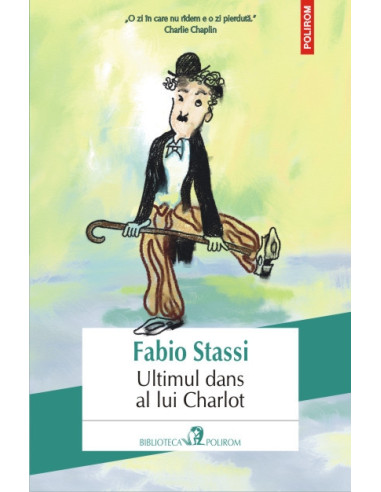

Ultimul Dans Al Lui Thomas Mueller La Bayern Munchen

May 12, 2025

Ultimul Dans Al Lui Thomas Mueller La Bayern Munchen

May 12, 2025