Trump Tax Bill Passes House After Late-Night Negotiations

Table of Contents

Key Provisions of the Passed House Tax Bill

The House Tax Bill dramatically reshapes the US tax system. Key changes affect individual income tax rates, corporate taxes, and provisions for pass-through businesses.

Individual Income Tax Changes:

- Tax Brackets: The bill simplifies the individual income tax brackets, reducing the number of brackets and adjusting the rates. For example, the highest tax bracket may be lowered, while some lower brackets might be slightly increased or remain the same. This will affect taxpayers differently depending on their income level. Specific changes require careful review of the bill's final text.

- Standard Deduction: The standard deduction is significantly increased, potentially benefiting many middle- and lower-income taxpayers. This means more people may not itemize deductions, simplifying their tax filings.

- Itemized Deductions: Changes to itemized deductions are significant. The bill limits or eliminates certain deductions, such as state and local tax (SALT) deductions, potentially impacting taxpayers in high-tax states. The mortgage interest deduction remains, but with potential limitations. These changes will have varying effects on taxpayers, depending on their individual circumstances and the deductions they currently utilize.

Corporate Tax Rate Changes:

- Lower Corporate Tax Rate: The bill reduces the corporate tax rate from 35% to 20%. This substantial cut is intended to boost business investment and job creation. However, the long-term economic impact remains a subject of ongoing debate among economists.

- Repatriation of Overseas Profits: The bill includes provisions designed to encourage US companies to repatriate profits held overseas. This could lead to increased investment and economic activity within the United States. However, it also raises questions about fairness and potential tax avoidance loopholes.

Pass-Through Business Provisions:

- Impact on Small Businesses: The bill introduces changes to how pass-through businesses (sole proprietorships, partnerships, LLCs) are taxed. The exact implications for these businesses are complex and depend on various factors, including business structure and income level.

- Benefits and Drawbacks: While the intended effect is to provide tax relief for small business owners, the actual benefits and drawbacks will vary significantly depending on the individual business's circumstances. Careful consideration and professional tax advice are strongly recommended for these business owners.

The Late-Night Negotiations and Political Fallout

Passing the Trump Tax Bill was far from easy. Intense late-night negotiations highlighted significant challenges:

- Internal Republican Disagreements: The bill faced considerable pushback from within the Republican party itself, with disagreements over various provisions leading to protracted debates and compromises.

- Lobbying Efforts: Intense lobbying efforts from various interest groups exerted considerable influence on the final shape of the legislation, further complicating the negotiation process.

- Key Figures: Key figures such as House Speaker Paul Ryan played crucial roles in navigating the complex negotiations and securing the necessary votes for passage.

- Political Compromises: Significant compromises were made to secure enough votes, potentially diluting the bill's original goals and creating new points of contention.

- Political Implications: The bill's passage has significant political implications, potentially impacting the 2018 midterm elections and shaping the future of the Republican agenda.

Public Reaction and Expert Opinions

Public reaction to the House Tax Bill has been divided, with strong opinions on both sides:

- Positive Reactions: Supporters lauded the potential for economic growth, job creation, and tax relief for individuals and businesses.

- Negative Reactions: Critics raised concerns about the bill's impact on the national debt, its potential to exacerbate income inequality, and the elimination or reduction of key tax deductions.

- Expert Opinions: Economists offer differing forecasts on the bill’s long-term effects. Some predict increased economic growth, while others warn of potential inflationary pressures and a rise in the national debt. These forecasts are based on different modeling methodologies and assumptions, leading to a wide range of predictions.

Conclusion

The Trump tax bill's passage through the House represents a significant overhaul of the US tax code, achieved after intense late-night negotiations. The bill includes substantial changes to individual and corporate tax rates, as well as provisions impacting pass-through businesses. The long-term economic consequences and political fallout remain to be seen, but the bill will undoubtedly reshape the American tax landscape. Understanding the implications of this House Tax Bill and the Trump Tax Bill is crucial for responsible financial planning.

Call to Action: Stay informed about the ongoing developments surrounding the Trump tax bill and its implementation. Learn more about how the new tax law affects you by researching available resources and consulting a tax professional to understand the implications of the House Tax Bill for your personal financial situation. Understanding the implications of the Trump Tax Bill is crucial for responsible financial planning.

Featured Posts

-

Joe Jonass Response To A Public Argument Involving Him

May 24, 2025

Joe Jonass Response To A Public Argument Involving Him

May 24, 2025 -

700 000 Profit Nicki Chapmans Escape To The Country Investment Strategy Revealed

May 24, 2025

700 000 Profit Nicki Chapmans Escape To The Country Investment Strategy Revealed

May 24, 2025 -

Frank Sinatras Marital History Details On His Four Wives And Relationships

May 24, 2025

Frank Sinatras Marital History Details On His Four Wives And Relationships

May 24, 2025 -

Savannah Guthries Mid Week Today Show Co Host Swap

May 24, 2025

Savannah Guthries Mid Week Today Show Co Host Swap

May 24, 2025 -

Aex Rally Na Trump Uitstel Analyse Van De Winnaars

May 24, 2025

Aex Rally Na Trump Uitstel Analyse Van De Winnaars

May 24, 2025

Latest Posts

-

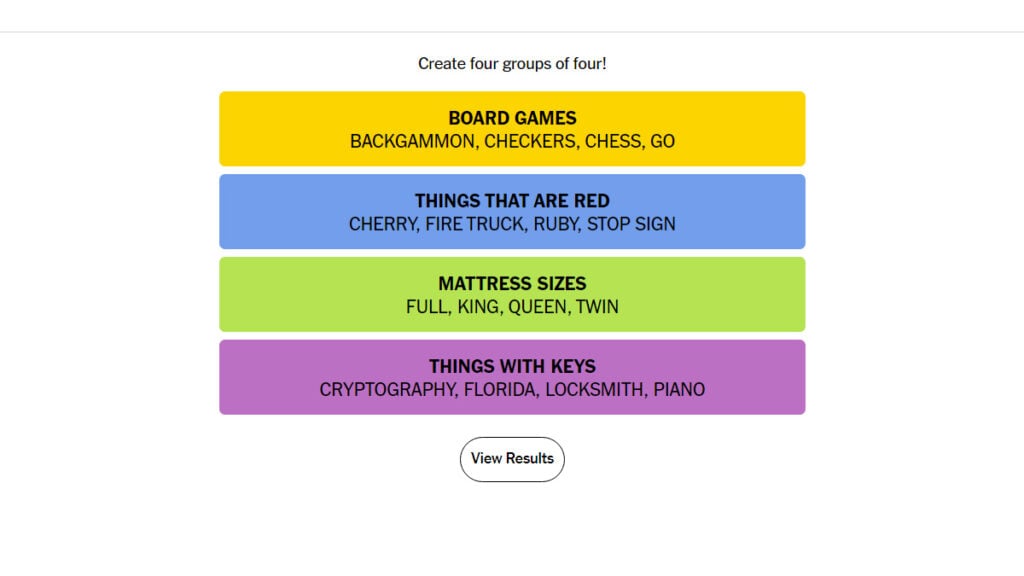

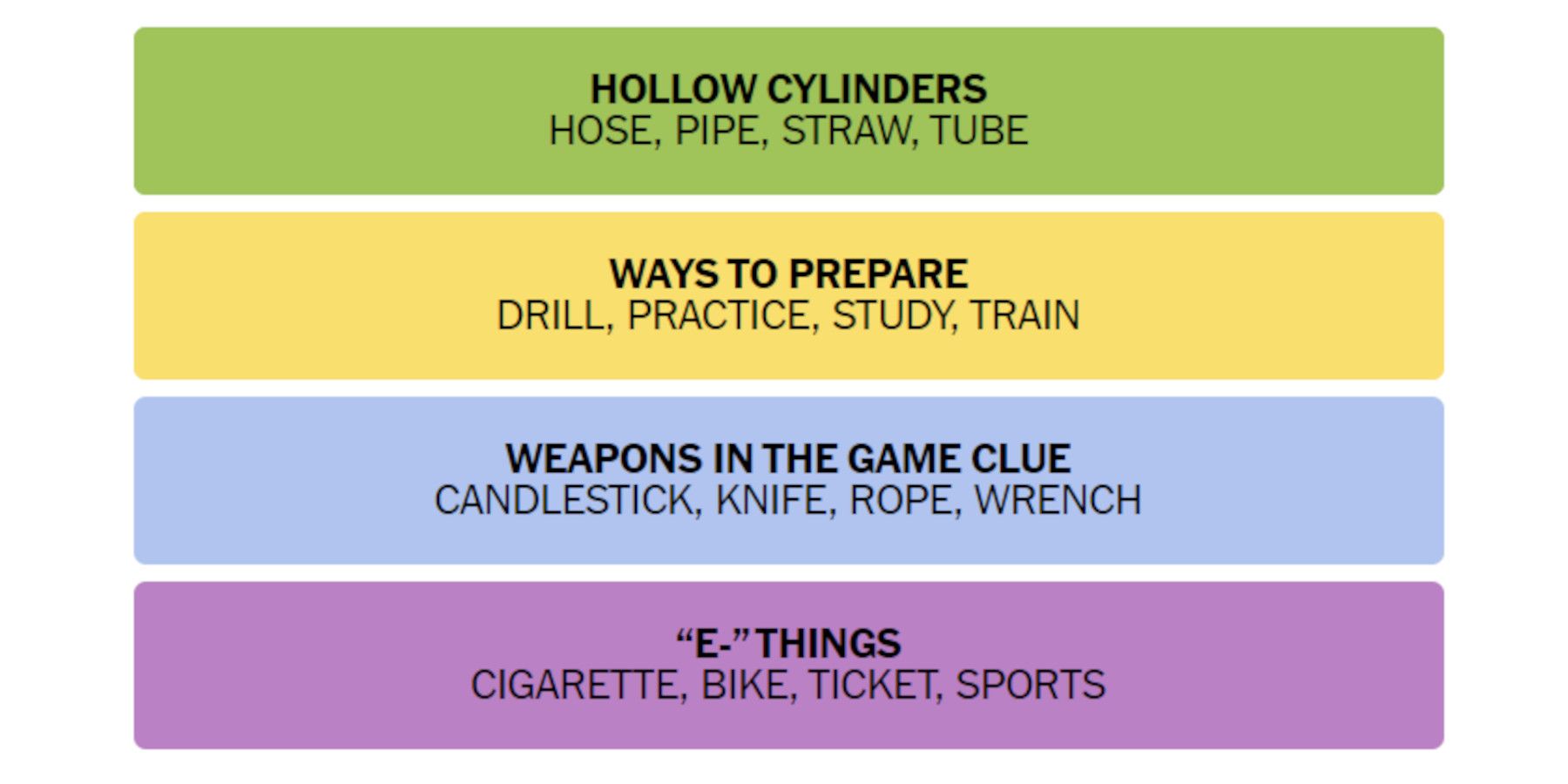

Solutions To New York Times Connections Puzzle 646 March 18 2025

May 25, 2025

Solutions To New York Times Connections Puzzle 646 March 18 2025

May 25, 2025 -

Nyt Connections Game Hints And Answers For March 18 2025 Puzzle 646

May 25, 2025

Nyt Connections Game Hints And Answers For March 18 2025 Puzzle 646

May 25, 2025 -

Experience The Ferrari Difference Bengalurus New Service Centre

May 25, 2025

Experience The Ferrari Difference Bengalurus New Service Centre

May 25, 2025 -

Fatal Stabbing Previously Bailed Teen Arrested Again

May 25, 2025

Fatal Stabbing Previously Bailed Teen Arrested Again

May 25, 2025 -

New York Times Connections Puzzle 646 Solutions March 18 2025

May 25, 2025

New York Times Connections Puzzle 646 Solutions March 18 2025

May 25, 2025