Trump Tax Cuts: What The House Republican Bill Means For You

Table of Contents

Individual Income Tax Rate Changes

The House Republican bill significantly altered individual income tax rates, aiming to simplify the tax code and boost economic activity.

Lower Tax Brackets: A Closer Look

The bill lowered individual income tax rates across several brackets. This resulted in substantial tax savings for many Americans, particularly those in the lower and middle-income ranges.

- Pre-Reform Brackets (simplified): The pre-reform system had a more complex structure with higher rates for higher earners.

- Post-Reform Brackets (simplified): The Trump tax cuts reduced the number of brackets and lowered the rates within them. For example, the highest bracket was significantly lowered.

- Example: A family earning $75,000 annually saw a noticeable reduction in their tax liability compared to the previous system. The exact amount varied depending on deductions and other factors.

- Limitations: While the lower rates provided tax relief for many, the benefits were not evenly distributed. Critics argued the cuts disproportionately benefited high-income earners.

Standard Deduction Increases: A Boon for Many Taxpayers

Another key change was the substantial increase in standard deduction amounts. This simplified tax filing for many, and increased the number of taxpayers who could utilize the standard deduction rather than itemizing.

- Changes in Standard Deduction Amounts: The standard deduction was raised significantly for single, married filing jointly, and head-of-household filers.

- Impact on Itemizing: The increase in the standard deduction led to a decrease in the number of taxpayers who chose to itemize deductions, as itemizing only becomes beneficial when deductions exceed the standard deduction amount.

- Impact on Charitable Giving: The increase in standard deduction could potentially reduce charitable giving, as some taxpayers may no longer itemize and claim charitable donations.

Corporate Tax Rate Reduction: A Focus on Business

The most dramatic change in the House Republican bill was the slashing of the corporate tax rate. The rate plummeted from 35% to 21%, a significant reduction intended to stimulate business investment and economic growth.

Impact on Businesses and the Economy: Analyzing the Results

The lower corporate tax rate was projected to boost business investment, job creation, and overall economic growth. However, the actual impact remains a subject of ongoing debate.

- Arguments for Effectiveness: Proponents argued the lower rate would incentivize businesses to invest more, leading to higher employment and wages.

- Arguments Against Effectiveness: Critics countered that much of the tax savings went to stock buybacks and shareholder payouts rather than investments in the business.

- Data on Investment and Job Growth: While some studies suggest a positive correlation between the tax cut and increased business investment, it's difficult to isolate the impact from other economic factors.

- Unintended Consequences: The lower corporate tax rate might have inadvertently contributed to increased national debt.

Potential for Increased Corporate Profits & Shareholder Returns: A Closer Look at Outcomes

One of the main outcomes of the corporate tax rate reduction was a notable increase in corporate profits and shareholder returns.

- Utilization of Tax Savings: Many corporations used their tax savings for stock buybacks, boosting share prices and benefiting shareholders. Others invested in expansion or research and development.

- Correlation with Stock Market Performance: The period following the tax cuts saw a surge in the stock market. However, determining the extent to which this was directly caused by the tax cuts remains complex.

Changes to Itemized Deductions: Significant Alterations

The Trump tax cuts also brought about notable changes to itemized deductions, with perhaps the most controversial being the limitation on the state and local tax (SALT) deduction.

SALT Deduction Limitations: A Significant Change

The $10,000 cap on state and local tax (SALT) deductions disproportionately impacted taxpayers in high-tax states, essentially negating a significant tax benefit for many residents of those states.

- Political and Economic Consequences: The SALT deduction limitation sparked considerable political debate, with some arguing it unfairly penalized residents of high-tax states.

- Mitigation Strategies: Taxpayers in high-tax states explored various strategies to mitigate the impact of the SALT cap, including adjustments to their tax planning.

Changes to Other Itemized Deductions: Ripple Effects

Changes were also made to other itemized deductions, altering the tax implications for various taxpayers.

- Mortgage Interest Deduction: While the mortgage interest deduction remained, the rules regarding its applicability were not fundamentally altered by the tax cuts.

- Charitable Contribution Deduction: The charitable contribution deduction limits were not significantly altered by the Trump tax cuts.

Long-Term Effects and Economic Implications of the Trump Tax Cuts: An Ongoing Discussion

The long-term economic consequences of the Trump tax cuts remain a subject of ongoing debate and analysis.

National Debt Increase: A Major Concern

A significant concern surrounding the tax cuts is their contribution to the national debt. The reduced tax revenue necessitates increased government borrowing to fund existing programs.

Economic Growth Projections: Analyzing the Results

The projected and actual economic growth following the tax cuts have been the subject of intense scrutiny. Different economic models and reports provide varying assessments, making definitive conclusions challenging. The interplay between economic growth and the tax cuts’ direct impact needs further examination.

Conclusion: Understanding the Impact of Trump Tax Cuts

The Trump tax cuts, primarily structured by the House Republican bill, significantly altered the US tax code. Understanding the implications of these changes—from lower individual income tax rates and increased standard deductions to the corporate tax rate reduction and limitations on itemized deductions—is essential for effective financial planning. While the long-term economic ramifications continue to be debated, analyzing how these tax cuts impact your individual financial situation is paramount. To fully grasp how the Trump tax cuts affect your personal circumstances, we strongly recommend consulting a qualified tax professional. Continue your research on Trump tax cuts, tax reform, and tax planning strategies to stay abreast of evolving tax laws and optimize your financial position.

Featured Posts

-

Electric Vehicle Revolution In Brazil Byds Growing Presence And Fords Retreat

May 13, 2025

Electric Vehicle Revolution In Brazil Byds Growing Presence And Fords Retreat

May 13, 2025 -

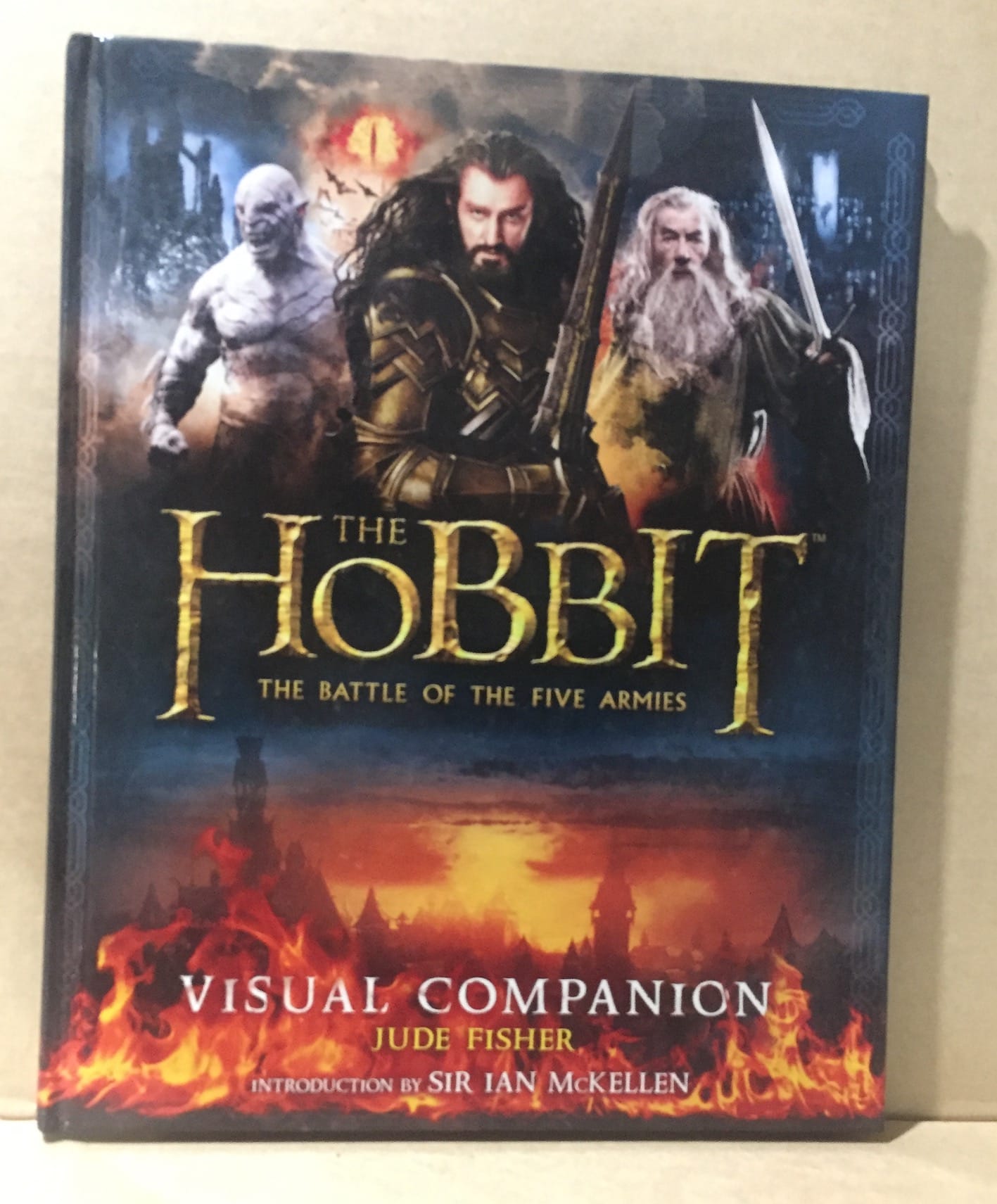

Exploring The Hobbit The Battle Of The Five Armies Visual Effects And Cinematography

May 13, 2025

Exploring The Hobbit The Battle Of The Five Armies Visual Effects And Cinematography

May 13, 2025 -

Dodgers Defeat Cubs 3 0 Yamamotos 6 Inning Masterclass And Edmans Key Homer

May 13, 2025

Dodgers Defeat Cubs 3 0 Yamamotos 6 Inning Masterclass And Edmans Key Homer

May 13, 2025 -

Snimkata Na Dzherard Btlr Za Blgariya Emotsionalna Istoriya

May 13, 2025

Snimkata Na Dzherard Btlr Za Blgariya Emotsionalna Istoriya

May 13, 2025 -

I Skarlet Gioxanson Epivevaionei Telos Stin Black Widow

May 13, 2025

I Skarlet Gioxanson Epivevaionei Telos Stin Black Widow

May 13, 2025