Trump Wants To Ban Congressional Stock Trading: Key Takeaways From Time Interview

Table of Contents

Trump's Stance on Banning Congressional Stock Trading

In his Time interview, Donald Trump forcefully advocated for a complete ban on congressional stock trading. He argued that the current system allows for inherent conflicts of interest and creates an uneven playing field between lawmakers and ordinary citizens. His key concerns, repeatedly emphasized throughout the interview, included:

-

Perception of conflict of interest: Trump highlighted the inherent appearance of impropriety when lawmakers profit from market movements potentially influenced by their legislative actions. He argued that even the perception of a conflict of interest erodes public trust.

-

Potential for insider trading: Trump expressed deep concern about the potential for members of Congress to use non-public information gained through their positions to make profitable stock trades. This, he argued, is a serious abuse of power and a betrayal of public trust.

-

Erosion of public trust: Trump repeatedly linked congressional stock trading to a decline in public trust in government. He argued that a ban would be a significant step towards restoring faith in the integrity of elected officials.

-

Need for stronger ethics regulations: Trump framed the call for a ban as part of a broader need for stronger ethics regulations across the government. He emphasized that a ban on stock trading would send a strong message that lawmakers are prioritizing public service over personal gain.

Arguments For and Against a Ban on Congressional Stock Trading

The debate surrounding a ban on congressional stock trading is complex, with compelling arguments on both sides.

Arguments in Favor:

Proponents of a ban argue it would:

-

Enhance public trust and transparency in government: A ban would significantly increase transparency and reduce the perception of corruption. This would lead to increased public trust in the legislative process.

-

Reduce potential for corruption and insider trading: Eliminating the opportunity for insider trading would remove a major source of potential corruption in government.

-

Improve public perception of Congress: A ban could help improve the largely negative public perception of Congress, which has been plagued by accusations of ethical lapses.

-

Level the playing field for ordinary citizens: A ban would ensure that lawmakers are not benefiting from privileged access to information unavailable to the general public.

Potential legislative approaches to a ban could include outright prohibitions, stricter disclosure requirements, and blind trusts.

Arguments Against:

Opponents of a ban raise concerns about:

-

Infringement on members' financial freedoms: Some argue that a ban would unfairly restrict the financial freedoms of members of Congress.

-

Potential for unintended consequences: A ban could inadvertently discourage qualified individuals from seeking public office, if they are unwilling or unable to divest from their financial holdings.

-

Difficulty in enforcing such a ban effectively: Enforcing a ban could prove challenging, requiring robust oversight mechanisms and potentially leading to costly investigations.

-

Concerns about the practicality and implementation of a ban: Critics argue that a ban might be overly broad and difficult to implement fairly and effectively. What constitutes "insider trading" in this context could be particularly difficult to define and prosecute.

The Current Landscape of Congressional Stock Trading Regulations

Currently, Congress operates under the Stop Trading on Congressional Knowledge (STOCK) Act, which aims to prevent insider trading and promote transparency. However, the STOCK Act has weaknesses, including loopholes and limited enforcement. Moreover, existing disclosure requirements are often insufficient to reveal the full extent of lawmakers' financial interests. Recent high-profile cases involving congressional stock trading have further fueled calls for stronger regulations and contributed to the public’s skepticism. The effectiveness of current ethics rules in preventing conflicts of interest remains questionable, prompting this ongoing debate about stricter measures.

Potential Impact and Future Implications of a Ban

The potential impact of a ban on congressional stock trading on the political landscape is significant. While its feasibility remains a subject of discussion, the debate alone suggests a growing demand for ethical reforms. Alternative solutions, such as enhanced transparency measures and stricter conflict-of-interest rules, might also be explored. However, the likelihood of a complete ban becoming a reality depends largely on political will and the ability to overcome the significant hurdles associated with its implementation.

- Long-term implications of a ban could include: Increased public trust, reduced potential for corruption, and a reshaping of the relationship between lawmakers and the financial markets. However, it also could lead to unforeseen consequences, affecting the pool of candidates running for office and potentially altering the political landscape in unexpected ways.

Ultimately, the success of a ban hinges on careful consideration of its implementation, robust enforcement mechanisms, and a broader commitment to ethical conduct in government.

Conclusion

Donald Trump's call to ban congressional stock trading, as highlighted in his recent Time interview, underscores the ongoing debate about ethics and transparency in American politics. While arguments exist both for and against such a ban, the interview emphasizes the urgent need for stronger regulations to address public concerns about potential conflicts of interest and insider trading. The future of congressional stock trading remains uncertain, but the conversation initiated by Trump is a crucial step towards greater accountability and public trust.

Call to Action: Learn more about the ongoing debate surrounding a ban on congressional stock trading and engage in the discussion to help shape the future of ethics in government. Stay informed on the latest developments related to congressional stock trading bans and advocate for policies that promote transparency and integrity in Washington.

Featured Posts

-

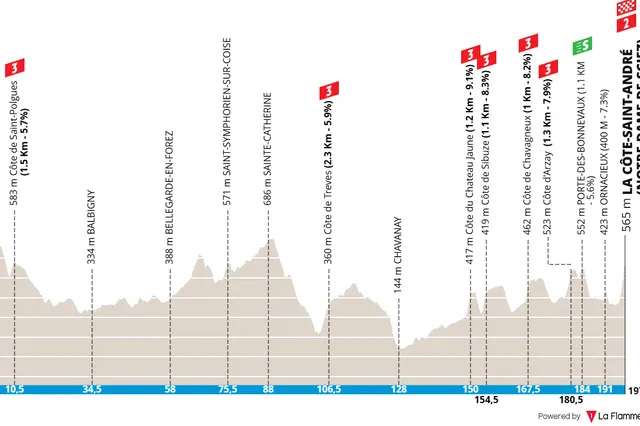

Jasper Merlier Speed And Success At Paris Nice

Apr 26, 2025

Jasper Merlier Speed And Success At Paris Nice

Apr 26, 2025 -

Trumps Stance On Ukraines Nato Membership A Critical Analysis

Apr 26, 2025

Trumps Stance On Ukraines Nato Membership A Critical Analysis

Apr 26, 2025 -

Saab Ceo Reports Shorter Lead Times For Defense Orders

Apr 26, 2025

Saab Ceo Reports Shorter Lead Times For Defense Orders

Apr 26, 2025 -

Ajax 125th Anniversary Evaluating Dam Safety Risks

Apr 26, 2025

Ajax 125th Anniversary Evaluating Dam Safety Risks

Apr 26, 2025 -

Hollywood Shutdown Actors And Writers On Strike Impacting Film And Tv

Apr 26, 2025

Hollywood Shutdown Actors And Writers On Strike Impacting Film And Tv

Apr 26, 2025

Latest Posts

-

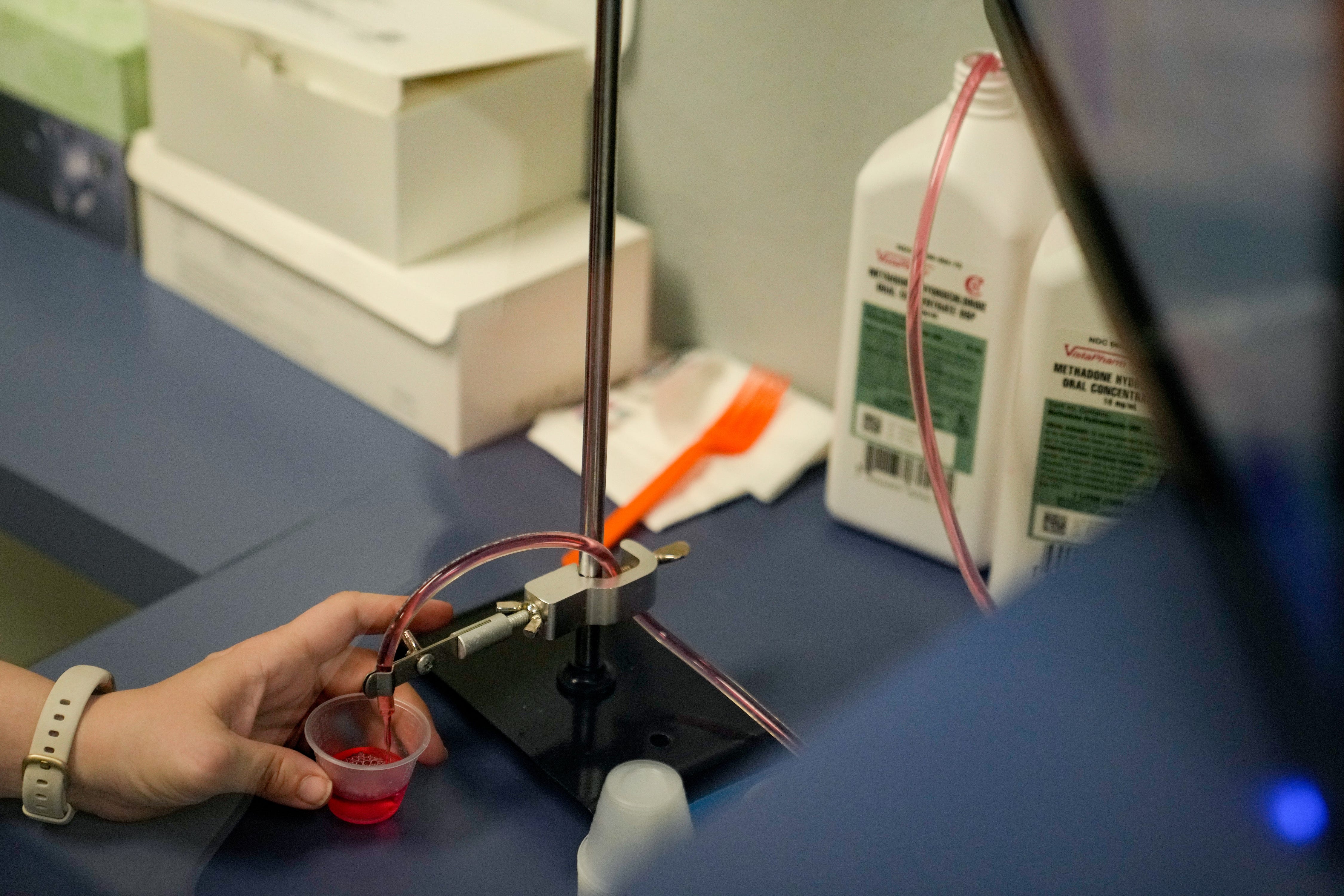

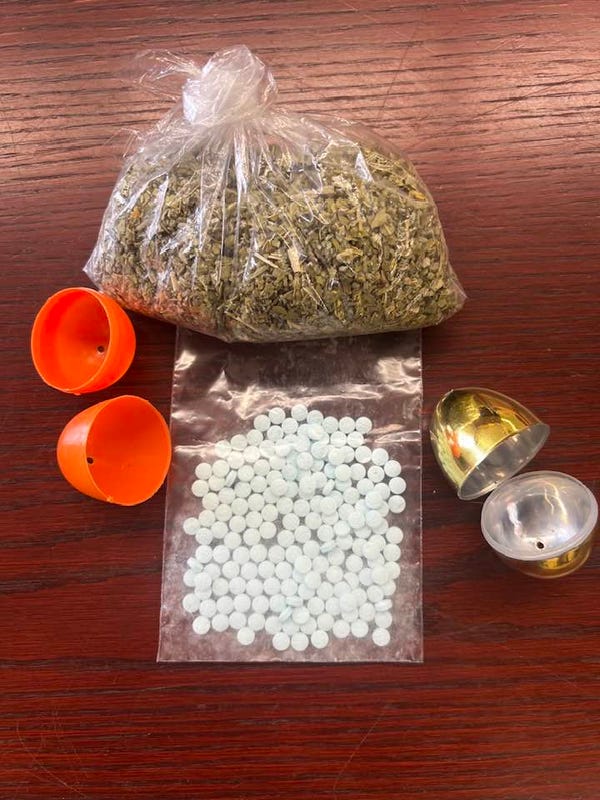

Attorney General Uses Prop Fentanyl To Illustrate Drug Crisis

May 10, 2025

Attorney General Uses Prop Fentanyl To Illustrate Drug Crisis

May 10, 2025 -

The Jeffrey Epstein Files Should We Vote On Their Release A Look At Pam Bondis Actions

May 10, 2025

The Jeffrey Epstein Files Should We Vote On Their Release A Look At Pam Bondis Actions

May 10, 2025 -

Fake Fentanyl Demonstration By Attorney General Sparks Debate

May 10, 2025

Fake Fentanyl Demonstration By Attorney General Sparks Debate

May 10, 2025 -

Ag Pam Bondi And The Epstein Files A Call For Public Vote

May 10, 2025

Ag Pam Bondi And The Epstein Files A Call For Public Vote

May 10, 2025 -

Attorney General Highlights Fake Fentanyl Threat

May 10, 2025

Attorney General Highlights Fake Fentanyl Threat

May 10, 2025