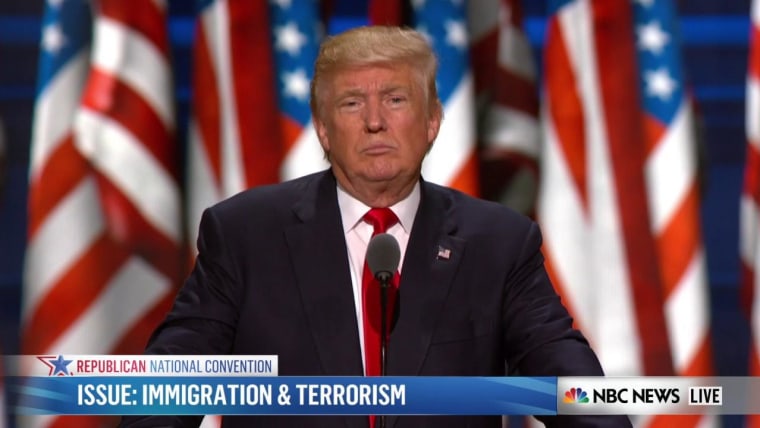

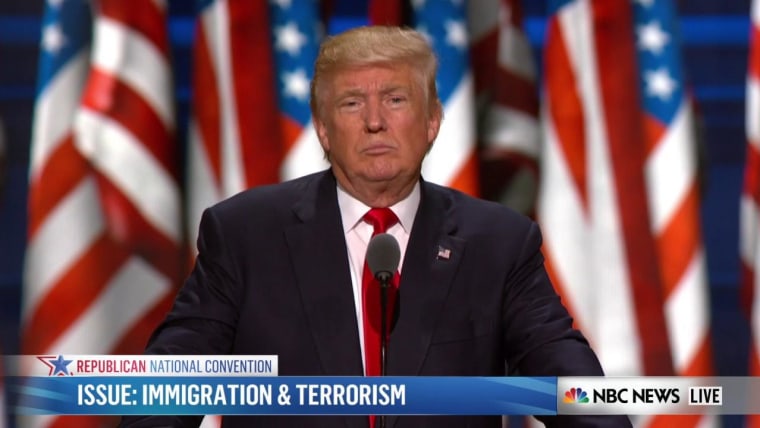

Trump's 100-Day Economic Plan: Bitcoin Price Impact And Predictions

Table of Contents

Key Elements of Trump's 100-Day Economic Plan and Their Potential Impact on Bitcoin

Trump's 100-Day Economic Plan encompassed several key areas with potentially significant ramifications for Bitcoin. Let's examine these elements and their possible effects on the cryptocurrency market.

Tax Cuts and Regulations

The plan included proposed tax cuts for corporations and individuals, alongside deregulation efforts across various sectors. These policies could impact investor sentiment towards Bitcoin in several ways. Increased capital gains taxes, for example, might reduce the attractiveness of Bitcoin investments for some, prompting a shift towards traditional assets. Conversely, decreased corporate taxes could free up capital for investment, potentially including cryptocurrency, depending on market conditions and perceived risk. Deregulation of financial markets might increase overall market volatility, which could either boost or negatively affect Bitcoin, depending on investor risk appetite. The impact on the USD is also crucial; a stronger dollar could decrease Bitcoin's price, while a weaker dollar could have the opposite effect.

- Increased capital gains taxes

- Decreased corporate taxes

- Deregulation of financial markets

Infrastructure Spending

The plan's focus on significant infrastructure investment could influence inflation and subsequently Bitcoin's price. Increased government spending often leads to increased inflation. If inflation rises, Bitcoin, often seen as a hedge against inflation, could see increased demand and a price surge. However, massive government borrowing to fund infrastructure projects could also increase overall government debt, which could negatively impact investor confidence in the long term, affecting Bitcoin's price in unpredictable ways. Moreover, the influx of capital into infrastructure projects might divert investment away from riskier assets like cryptocurrencies.

- Increased government debt

- Potential for inflation

- Job creation and economic growth

Trade Policies (Tariffs and Trade Wars)

Trump's trade policies, characterized by tariffs and trade disputes, notably with China, introduced a considerable amount of global economic uncertainty. This uncertainty often drives investors toward safer haven assets, and Bitcoin, in certain contexts, has been considered such an asset. Increased global uncertainty could thus push investors towards Bitcoin, increasing its price. However, trade wars negatively impacting the US dollar could create a downward pressure on Bitcoin’s price, while simultaneously increasing demand for it as a safe haven.

- Trade disputes with China

- Impact on global supply chains

- Increased market volatility

Historical Analysis: Bitcoin's Reaction to Past Economic Events

Understanding Bitcoin's behavior during past economic events is crucial for predicting its response to Trump's policies.

Previous Market Downturns and Bitcoin's Performance

Analyzing Bitcoin's price movements during previous market downturns reveals a complex relationship. While some downturns have seen Bitcoin's price decline, often mirroring traditional markets, other periods have shown Bitcoin to act as a relatively independent asset. The 2008 financial crisis, for example, saw Bitcoin's creation, partially as a response to the perceived instability of traditional financial systems. However, subsequent market corrections have demonstrated varied correlations, sometimes showcasing a negative correlation with traditional markets and other times mirroring broader market trends.

Impact of Other Presidential Policies on Bitcoin

Examining the impact of previous administrations' economic policies on Bitcoin provides a valuable comparison. While Bitcoin's existence predates many significant recent presidential policies, the overall market sentiment during periods of economic expansion or contraction has demonstrably impacted its price. Comparing the effects of previous administrations' fiscal and monetary policies on investor confidence and risk appetite provides context for predicting Bitcoin's potential response to Trump's 100-Day Plan.

Predictions and Scenarios for Bitcoin's Price under Trump's 100-Day Economic Plan

Predicting Bitcoin's price with certainty is impossible, but considering the factors above, we can outline potential scenarios.

Bullish Scenario

A bullish scenario assumes Trump's policies lead to significant economic growth, increased investor confidence, and a weaker dollar. This could drive investment into riskier assets, including Bitcoin, potentially leading to a substantial price increase. This scenario is more likely if the infrastructure spending stimulates economic activity without triggering runaway inflation.

Bearish Scenario

A bearish scenario envisions economic instability or increased market uncertainty due to trade wars or other unforeseen consequences of Trump's policies. This might lead investors to flock to safer assets, causing Bitcoin's price to decline as investors prioritize stability over risk.

Neutral Scenario

A neutral scenario suggests that Trump's policies have a limited or offsetting impact on Bitcoin's price. Positive effects from deregulation or increased investor confidence could be counterbalanced by negative effects from inflation or increased government debt. This would result in relatively stable Bitcoin pricing, largely unaffected by the 100-Day Plan's implementation.

Conclusion: Trump's 100-Day Economic Plan and the Future of Bitcoin

The potential impact of Trump's 100-Day Economic Plan on Bitcoin's price remains uncertain. The outlined scenarios – bullish, bearish, and neutral – highlight the complex interplay of economic factors. While a clear prediction is impossible, understanding the key elements of the plan and analyzing Bitcoin's historical responses to similar economic events provides a framework for informed speculation. To stay ahead of the curve, continue researching the topic, stay informed about economic developments and their potential impact on Bitcoin, and follow for further updates on Trump's 100-Day Economic Plan and its impact on Bitcoin.

Featured Posts

-

Counting Crows Snl Appearance A Pivotal Moment In Their Career

May 08, 2025

Counting Crows Snl Appearance A Pivotal Moment In Their Career

May 08, 2025 -

Arsenal Psg Maci Hangi Kanalda Saat Kacta Canli Izle

May 08, 2025

Arsenal Psg Maci Hangi Kanalda Saat Kacta Canli Izle

May 08, 2025 -

Affordable Rides Home From The United Center New Uber Shuttle Service For 5

May 08, 2025

Affordable Rides Home From The United Center New Uber Shuttle Service For 5

May 08, 2025 -

Uber Technologies Uber Investment Potential And Risks

May 08, 2025

Uber Technologies Uber Investment Potential And Risks

May 08, 2025 -

9 4000 2 360

May 08, 2025

9 4000 2 360

May 08, 2025