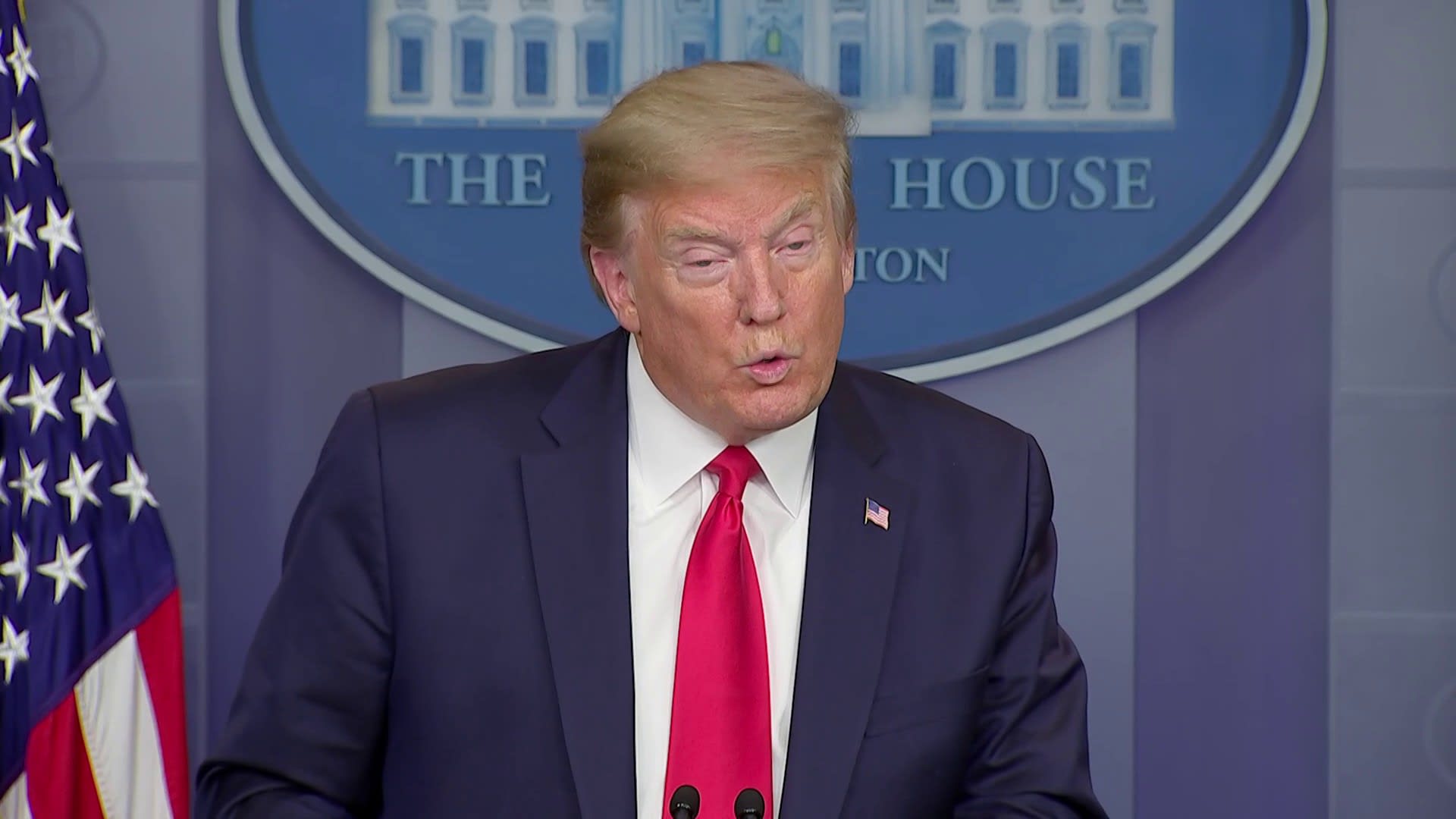

Trump's Aggressive Trade Tactics: Risks To America's Global Financial Dominance

Table of Contents

Escalation of Trade Wars and Their Economic Consequences

Trump's "America First" trade agenda prioritized protectionist measures, leading to a significant escalation of trade wars. This section delves into the mechanics of these conflicts and their devastating economic consequences.

Increased Tariffs and Retaliation

The hallmark of Trump's trade policy was the imposition of hefty tariffs on various goods. The tariffs on steel and aluminum, for example, sparked immediate retaliation from key trading partners like China and the European Union. These retaliatory tariffs, in turn, impacted American businesses and consumers.

- Tariffs imposed: Steel and aluminum (25% and 10%, respectively), goods from China (ranging from 10% to 25%), various other goods from different countries.

- Retaliatory measures: Tariffs on American agricultural products, automobiles, and other goods.

- Economic impact: Increased prices for consumers (inflation), job losses in sectors reliant on global trade, reduced competitiveness of American businesses in global markets. Studies from organizations like the Peterson Institute for International Economics have estimated significant job losses and economic damage due to these trade wars.

Disruption of Global Supply Chains

The aggressive trade actions disrupted established global supply chains, leading to increased costs, production delays, and, in some cases, forced relocation of manufacturing facilities.

- Affected businesses: Numerous industries, particularly those heavily reliant on imported components or those exporting significant portions of their production, faced disruption.

- Increased costs: Tariffs and trade restrictions increased input costs for businesses, squeezing profit margins and hindering economic growth.

- Relocation of manufacturing: Some companies relocated their production facilities to countries outside the affected trade zones to avoid tariffs and maintain competitiveness. This represents a loss of American jobs and a potential weakening of the US manufacturing base.

Damage to International Relations and Alliances

Trump's aggressive trade tactics significantly strained relationships with key American trading partners and undermined the stability of global trade governance.

Strained Relationships with Trading Partners

The constant threat of tariffs and unpredictable trade actions created immense uncertainty and damaged trust amongst nations. This uncertainty hampered international cooperation on various economic and diplomatic fronts.

- China: The trade war with China was particularly damaging, resulting in heightened tensions and accusations of unfair trade practices.

- European Union: The EU, a major trading partner of the US, also faced significant economic repercussions due to retaliatory tariffs, leading to strained diplomatic relations.

- Canada and Mexico: Even close allies like Canada and Mexico experienced friction due to disagreements over trade policies.

Erosion of Multilateral Trade Organizations

Trump's administration frequently criticized and undermined the World Trade Organization (WTO), a crucial institution for maintaining a stable global trading system.

- Challenges to WTO rulings: The US frequently disregarded or challenged WTO rulings that went against its interests, weakening the organization's authority.

- Withdrawal threats: Trump's administration repeatedly threatened to withdraw from the WTO, further destabilizing the global trade architecture.

- Impact on trade negotiations: The uncertainty surrounding the WTO's future hampered progress on new trade agreements and made existing agreements less effective.

Long-Term Risks to US Financial Dominance

The aggressive trade policies employed during the Trump administration pose significant long-term risks to America's financial standing on the world stage.

Loss of Global Market Share

Protectionist policies can stifle innovation and competitiveness, potentially leading to a decline in American market share in various sectors.

- Reduced competitiveness: Tariffs and trade barriers made American goods less competitive in global markets, allowing other countries to gain market share.

- Impact on specific industries: Industries reliant on exports, such as agriculture and manufacturing, were particularly affected by the loss of market access.

- Long-term economic consequences: A sustained loss of market share can hinder economic growth and diminish the overall influence of the US economy.

Decreased Foreign Investment

The uncertainty created by aggressive trade policies can deter foreign investment in the US.

- Uncertainty and risk aversion: Frequent changes in trade policy and the threat of new tariffs created an unstable investment climate, driving away foreign investors seeking predictable and reliable returns.

- Capital flight: Some foreign investors might redirect their investments to countries with more stable and predictable economic policies.

- Impact on economic growth: Reduced foreign investment can slow economic growth and limit opportunities for innovation and job creation.

Weakening of the US Dollar

Trade imbalances and currency fluctuations are intricately linked. Aggressive trade policies can negatively impact the value of the US dollar.

- Trade deficits: Trade wars can exacerbate trade deficits, potentially putting downward pressure on the value of the dollar.

- Currency wars: Retaliatory trade measures often involve currency manipulation, leading to competitive devaluations and potentially destabilizing global currency markets.

- Impact on global financial stability: A weakening dollar can negatively impact global financial stability and reduce the influence of the US economy.

Conclusion: Navigating the Future of American Trade Policy

Trump's aggressive trade tactics presented significant risks to America's global financial dominance, leading to increased trade tensions, damaged international relationships, and potential long-term economic harm. The disruption of global supply chains, the erosion of multilateral trade organizations, and the potential weakening of the US dollar all highlight the need for a more nuanced and strategic approach to international trade. Understanding Trump's trade legacy is crucial for mitigating risks to American financial dominance and rethinking America's approach to global trade. We must move towards policies that promote cooperation, stability, and mutually beneficial trade relationships. Engaging in informed discussions about the future of American trade policy is vital for ensuring a strong and prosperous future for the US economy.

Featured Posts

-

Nintendos Action Forces Ryujinx Emulator Development To Cease

Apr 22, 2025

Nintendos Action Forces Ryujinx Emulator Development To Cease

Apr 22, 2025 -

Anchor Brewing Company Closing After 127 Years The End Of An Era

Apr 22, 2025

Anchor Brewing Company Closing After 127 Years The End Of An Era

Apr 22, 2025 -

Conclave 2023 How Will It Shape Pope Franciss Legacy

Apr 22, 2025

Conclave 2023 How Will It Shape Pope Franciss Legacy

Apr 22, 2025 -

A Combined Approach Examining The Military Assets Of Sweden And Finland In A Pan Nordic Context

Apr 22, 2025

A Combined Approach Examining The Military Assets Of Sweden And Finland In A Pan Nordic Context

Apr 22, 2025 -

Harvard Faces 1 Billion Funding Cut Under Trump Administration

Apr 22, 2025

Harvard Faces 1 Billion Funding Cut Under Trump Administration

Apr 22, 2025